Teleperformance: First-quarter 2023 Revenue

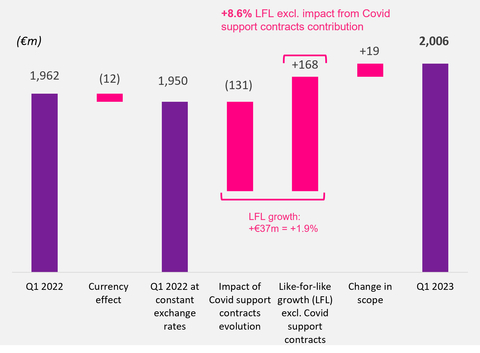

Teleperformance reported first-quarter 2023 revenue of €2,006 million, reflecting a year-on-year increase of +1.9% like-for-like and +2.2% as reported. Excluding the impact of Covid contracts, like-for-like growth was +8.6%. The company anticipates sustained growth for the year, revising targets upward without affecting net value creation. Growth is driven by strong momentum in financial services, social media, travel sectors, and government agencies. The EBITA margin target has been raised to around 16%. Despite external uncertainties, the firm sees positive effects from China's reopening and diversifying offshore operations.

- Like-for-like growth excluding Covid contracts: +8.6%

- Revised EBITA margin target raised to around 16% from 15.7%

- Sustained growth outlook for 2023 with adjusted revenue targets: +8% to +10% excluding Covid contracts

- Revenue impact of -€131 million from the end of Covid contracts

- Core Services revenue declined by -0.4% year-on-year

-

Like-for-like growth excluding Covid contracts*: +

8.6% -

Like-for-like growth** (including the -

€131m impact of the end of the Covid contracts): +1.9% -

Total growth: +

2.2% - Sustained growth outlook for 2023

- Revised full-year 2023 targets, with no impact on net value creation

Analysis of first-quarter 2023 revenue growth (Graphic: Teleperformance)

Teleperformance (Paris:TEP), a global leader in digital business services, today released its quarterly revenue figures for the three months ended

First-quarter 2023 revenue

-

€2,006 million -

up +

8.6% like-for-like excluding Covid contracts* -

up +

1.9% like-for-like** -

up +

2.2% as reported

Solid, diversified growth

- Strong momentum in Core Services activities in the social media, financial services and travel sectors and with government agencies (excluding Covid contracts)

- Sustained expansion of offshore activities serving the North American market, which lowered the level of like-for-like growth (price effect of around -0.6 points) but conversely had a positive impact on margins

- Positive impact of China’s reopening on both Core Services and Specialized Services (TLScontact)

-

Expected impact over the quarter of the end of the contribution from Covid contracts (-

€131 million )

Strong growth outlook for 2023 and revised targets

-

Like-for-like revenue growth target, excluding Covid contracts, of between +

8% and +10% -

Like-for-like revenue growth target, including Covid contracts, of around +

7% -

EBITA margin target raised to around

16% , a record high, versus15.7% previously - Further targeted acquisitions capable of creating value

* At constant scope of consolidation and exchange rates, excluding the impact of lower revenue from Covid support contracts (“Covid contracts”)

** At constant scope of consolidation and exchange rates

Commenting on this performance, Teleperformance Chairman and Chief Executive Officer

We’ve enjoyed robust sales momentum in a variety of client sectors, including social media, financial services, travel and government agencies, as well as in many countries, particularly in

The Group's 2023 growth outlook is strong. Given the changing internal dynamics of the business, we are adjusting our initial targets for the year, with no impact on net value creation. We remain more committed than ever to pursuing targeted acquisitions capable of creating value, leveraging our efficient TP Cube development model.”

------------------------

Consolidated revenue

€ millions |

2023 |

2022 |

% change |

|||

Like-for-like

|

Like-for-like |

Reported |

||||

Average exchange rate |

|

|

|

|

|

|

First quarter |

2,006 |

1,962 |

+ |

+ |

+ |

|

* Excluding the impact of lower revenue from Covid support contracts (“Covid contracts”)

Consolidated revenue came in at

The expected non-recurring impact of a decline in the contribution from Covid support contracts in 2023 compared with 2022 (-

This sustained performance, delivered against a backdrop of continued economic and geopolitical uncertainty, attests to the resilience and diversity of the Group's client portfolio, as well as the validity of its “TP Cube” growth strategy. Teleperformance has positioned itself as the digital transformation partner of choice for its clients by deploying its expertise in digital solutions by client sector and by country. During the first quarter, the success of this strategy was demonstrated by rapid business growth in the financial services and travel sectors, as well as with government agencies (excluding Covid contracts) and in Trust & Safety content moderation.

The fast-developing offshore solutions to serve the North American market, particularly in

Specialized Services also expanded at a sustained pace, led by the continued recovery of TLScontact’s visa application management business, which benefited from China’s reopening in particular, and the steady development of LanguageLine Solutions' online interpretation business.

Revenue by activity

|

Q1 2023 |

Q1 2022 |

% change |

||

€ millions |

|

|

Like-for-like |

Like-for-like excluding

|

Reported |

CORE SERVICES & D.I.B.S.* |

1,685 |

1,711 |

- |

+ |

- |

|

646 |

628 |

+ |

+ |

+ |

LATAM |

396 |

382 |

+ |

+ |

+ |

|

643 |

701 |

- |

+ |

- |

SPECIALIZED SERVICES |

321 |

251 |

+ |

+ |

+ |

TOTAL |

2,006 |

1,962 |

+ |

+ |

+ |

* Digital Integrated Business Services

** Excluding the impact of lower revenue from Covid support contracts (“Covid contracts”)

- Core Services & Digital Integrated Business Services (D.I.B.S.)

Core Services & D.I.B.S. revenue amounted to

Excluding the impact of the decline in revenue from Covid support contracts, Core Services & D.I.B.S. activities delivered like-for-like growth of +

-

North America &Asia-Pacific

Regional revenue came to

Like-for-like growth was limited in the first quarter due in particular to the continued acceleration of growth in offshore activities in

- LATAM

First-quarter 2023 revenue for the LATAM region amounted to

In first-quarter 2023, the Group's businesses enjoyed particularly robust growth in the social media, online entertainment and financial services sectors. Travel sector activities also continued to expand at a satisfactory pace.

Business growth was particularly strong in

-

Europe & MEA (EMEA)

Revenue in the EMEA region amounted to

Multilingual activities, which are the primary contributors to the region’s revenue stream and mainly serve the large global leaders in the digital economy, reported sustained growth for the quarter, in

Operations in the

Lastly, business was robust in

- Specialized Services

Revenue from Specialized Services stood at

The first quarter also saw the continued recovery of TLScontact's business, supported by the recent reopening of

LanguageLine Solutions, the main contributor to Specialized Services revenue, continued in the first quarter to see the sustained growth observed from second-half 2022. The continued swift ramp-up of video interpreting solutions and growth in global solutions are supporting this positive trend.

Outlook

In a still uncertain environment, the Group's growth outlook remains strong in 2023.

The Group should continue to benefit from healthy sales momentum in the financial services, travel and content moderation sectors.

Given the changing internal dynamics of the business, Teleperformance has adjusted its targets for 2023:

-

Like-for-like revenue growth excluding Covid contracts: between +

8% and +10% ; -

Like-for-like revenue growth including Covid contracts: around +

7% ; -

EBITA margin target raised to around

16% , a record high, versus a margin target of15.7% previously.

This dual adjustment to the initial objectives, both upwards and downwards, has no impact on net value creation.

-----------------

Disclaimer

All forward-looking statements are based on Teleperformance management’s present expectations of future events and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. For a detailed description of these factors and uncertainties, please refer to the “Risk Factors” section of our Universal Registration Document, available at www.teleperformance.com. Teleperformance undertakes no obligation to publicly update or revise any of these forward-looking statements.

Conference call with analysts and investors

A replay of the conference call will be available for subsequent listening on Teleperformance’s website, along with the relevant documentation, in the Investor Relations section under

https://www.teleperformance.com/en-us/investors/publications-and-events/financial-publications/

Indicative investor calendar

First-half 2023 results:

Third-quarter 2023 revenue:

About

Teleperformance (TEP – ISIN: FR0000051807 – Reuters: TEPRF.PA - Bloomberg: TEP FP), a global leader in digital business services, serves as a strategic partner to the world’s largest companies in many industries. It offers a One Office support services model including end-to-end digital solutions, which guarantee successful customer interaction and optimized business processes, anchored in a unique, comprehensive high touch, high tech approach. More than 410,000 employees, based in 91 countries, support billions of connections every year in over 300 languages and 170 markets, in a shared commitment to excellence as part of the “Simpler, Faster, Safer” process. This mission is supported by the use of reliable, flexible, intelligent technological solutions and compliance with the industry’s highest security and quality standards, based on Corporate Social Responsibility excellence. In 2022, Teleperformance reported consolidated revenue of

Teleperformance shares are traded on the Euronext Paris market, Compartment A, and are eligible for the deferred settlement service. They are included in the following indices: CAC 40, STOXX 600,

For more information: www.teleperformance.com Follow us on Twitter: @teleperformance

Appendix

Glossary - Alternative Performance Measures

Change in like-for-like revenue:

Change in revenue at constant exchange rates and scope of consolidation = [current year revenue - last year revenue at current year rates - revenue from acquisitions at current year rates] / last year revenue at current year rates.

EBITDA before non‑recurring items or current EBITDA (Earnings before Interest, Taxes, Depreciation and Amortization):

Operating profit before depreciation & amortization, amortization of intangible assets acquired as part of a business combination, goodwill impairment charges and non-recurring items.

EBITA before non‑recurring items or current EBITA (Earnings before Interest, Taxes and Amortization):

Operating profit before amortization of intangible assets acquired as part of a business combination, goodwill impairment charges and non-recurring items.

Non‑recurring items:

Principally comprises restructuring costs, incentive share award plan expense, costs of closure of subsidiary companies, transaction costs for the acquisition of companies, and all other expenses that are unusual by reason of their nature or amount.

Net free cash flow:

Cash flow generated by the business - acquisitions of intangible assets and property, plant and equipment net of disposals - financial income/expenses.

Net debt:

Current and non-current financial liabilities - cash and cash equivalents

Diluted earnings per share (net profit attributable to shareholders divided by the number of diluted shares and adjusted):

Diluted earnings per share is determined by adjusting the net profit attributable to ordinary shareholders and the weighted average number of ordinary shares outstanding by the effects of all potentially diluting ordinary shares. These include convertible bonds, stock options and incentive share awards granted to employees when the required performance conditions have been met at the end of the financial year.

-------

NB: The alternative performance measures (APMs) are defined in the Appendix

View source version on businesswire.com: https://www.businesswire.com/news/home/20230425005729/en/

FINANCIAL ANALYSTS AND INVESTORS

Investor relations and financial

communication department

TELEPERFORMANCE

Tel: +33 1 53 83 59 15

investor@teleperformance.com

PRESS RELATIONS

Karine Allouis –

IMAGE7

Tel: +33 1 53 70 74 70

teleperformance@image7.fr

PRESS RELATIONS

TELEPERFORMANCE

Tel: + 1 629-899-0675

nicole.miller@teleperformance.com

Source: Teleperformance

FAQ

What are the first-quarter 2023 revenue figures for Teleperformance?

What is Teleperformance's growth outlook for 2023?

How has Teleperformance adjusted its EBITA margin target for 2023?