Oak View Bankshares, Inc. Announces Record Earnings for 2022 and Doubles Dividend

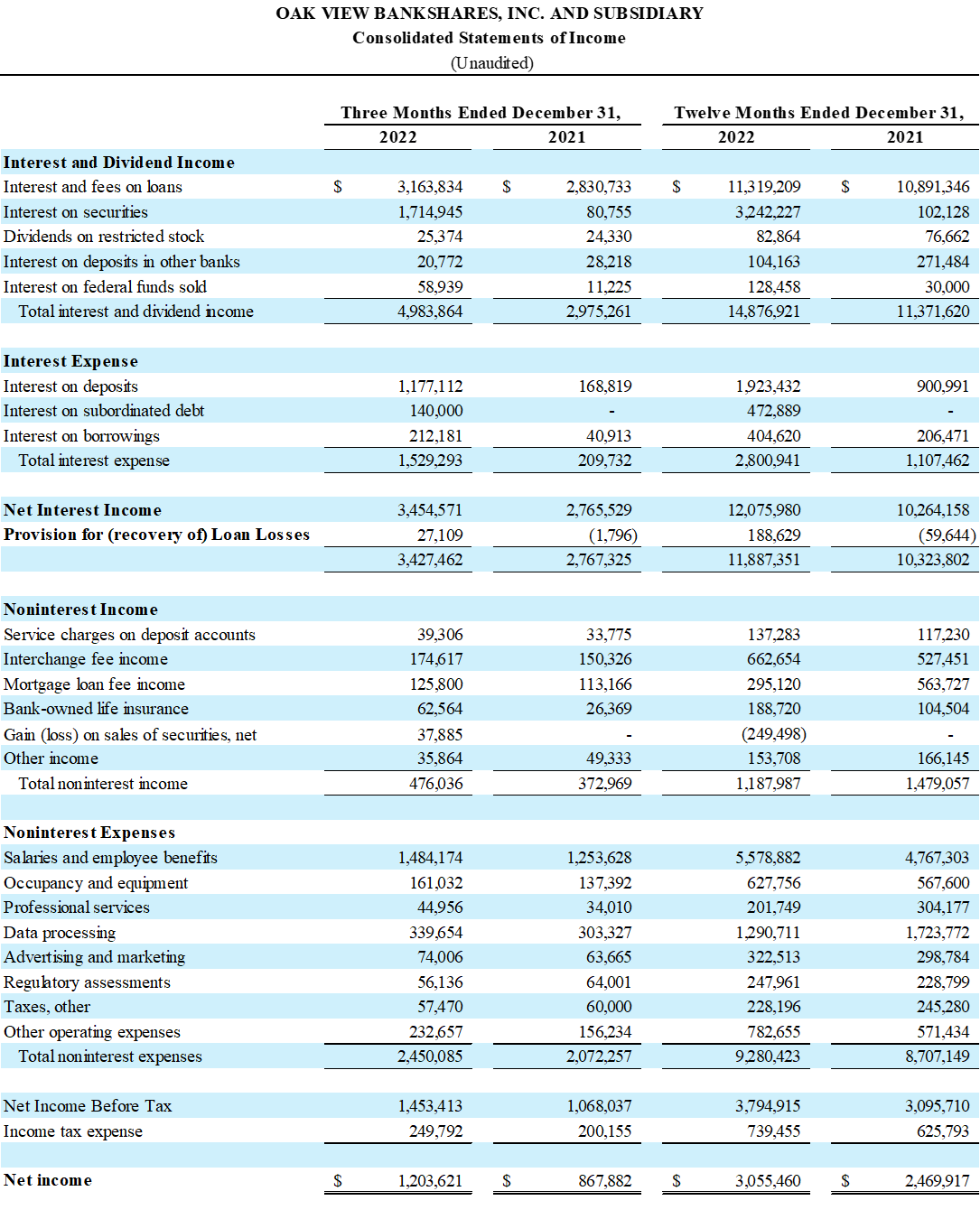

Oak View Bankshares, Inc. (OTC Pink:OAKV) reported strong financial results for the fourth quarter and year ended December 31, 2022. Net income surged 38.68% to $1.20 million, translating to earnings per share of $0.41, up from $0.29 year-over-year. For the full year, net income reached $3.06 million, a 23.71% increase, with earnings per share rising to $1.03 from $0.84. Total assets expanded to $497.89 million with total loans at $273.87 million. The company declared a $0.10 dividend per share, doubling the previous year’s payout. Return on average assets improved to 1.02%, while credit quality remained strong with no nonperforming loans. However, net interest margin declined slightly to 3.10%.

- Net income increased by 38.68% in Q4 2022 to $1.20 million.

- Full-year net income rose 23.71% to $3.06 million.

- Earnings per share increased to $0.41 for Q4 2022 and $1.03 for the full year.

- Total assets grew to $497.89 million.

- Total loans increased to $273.87 million.

- Annual dividend of $0.10 per share was declared, doubling from the previous year.

- Return on average assets improved to 1.02%.

- No nonperforming loans reported.

- Net interest margin decreased to 3.10%, down from 3.35% in Q4 2021.

- Total noninterest expense rose to $2.45 million in Q4 2022.

Insights

Analyzing...

WARRENTON, VA / ACCESSWIRE / January 25, 2023 / Oak View Bankshares, Inc. (the "Company") (OTC Pink:OAKV), parent company of Oak View National Bank (the "Bank"), reported net income of

Net income for the twelve months ended December 31, 2022, was

On January 19, 2023, the Board of Directors of the Company declared an annual dividend of

Selected Highlights:

- Return on average assets was

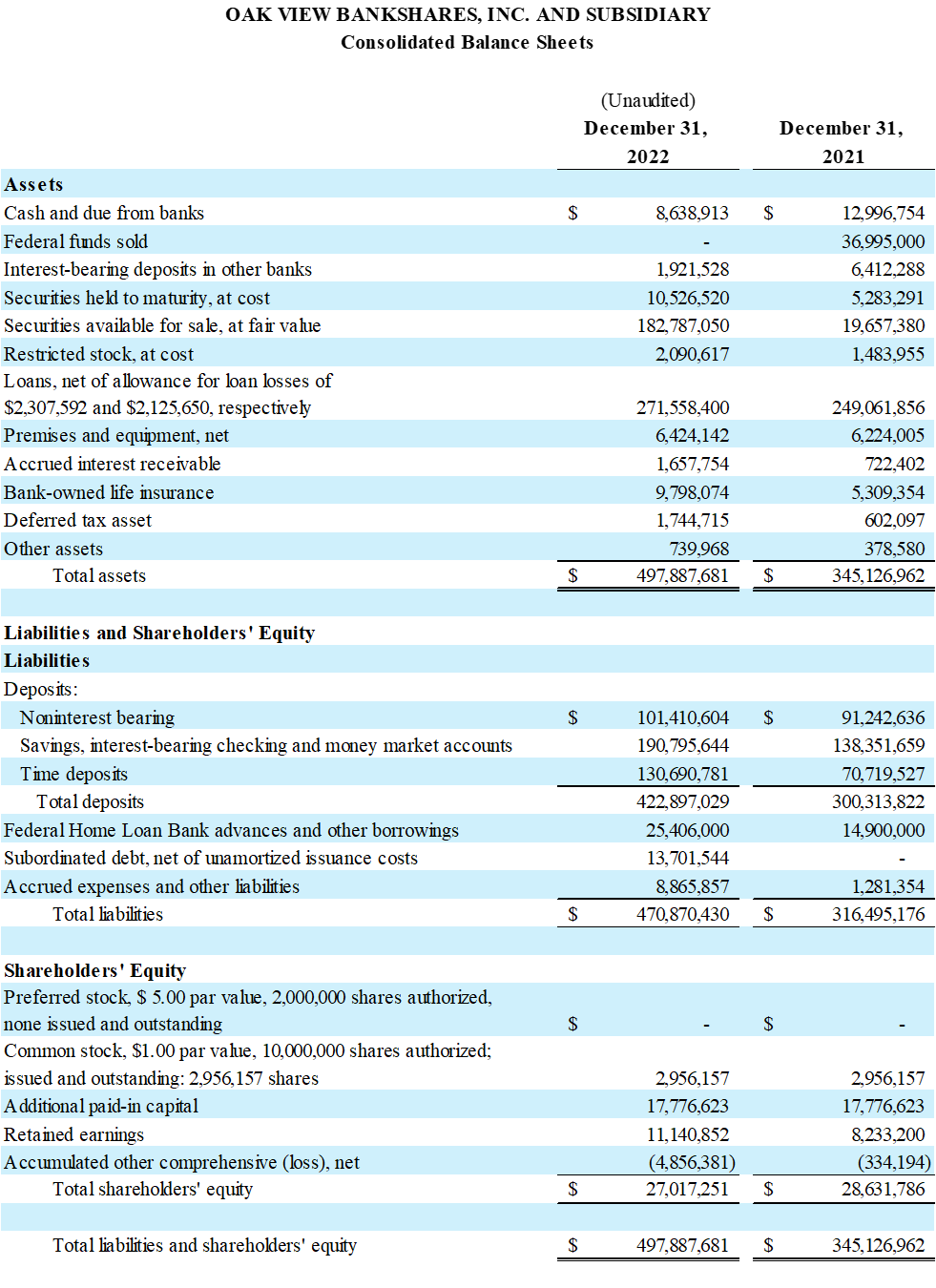

1.02% and return on average equity was17.64% for the quarter ended December 31, 2022, compared to1.01% and12.19% , respectively, for the quarter ended December 31, 2021. Return on average assets was0.75% and0.78% and return on average equity was11.73% and8.98% for the twelve months ended December 31, 2022, and 2021, respectively. - Total assets were

$497.89 million on December 31, 2022, compared to$345.13 million on December 31, 2021. - Total loans were

$273.87 million on December 31, 2022, compared to$251.19 million on December 31, 2021. - The investment portfolio increased to

$193.31 million on December 31, 2022, compared to$24.94 million on December 31, 2021. - Total deposits were

$422.90 million on December 31, 2022, compared to$300.31 million on December 31, 2021. - Credit quality continues to be outstanding. There were no nonperforming loans as of December 31, 2022.

- Regulatory capital remains strong with ratios exceeding the "well capitalized" thresholds in all categories.

Michael Ewing, CEO and Chairman of the Board said, " This was a phenomenal year for our Company. We began the year by finalizing a proactive subordinated debt issuance which fortified our capital foundation, allowing us to pursue increased deposit market share. Deposits were deployed into loans and securities, with a greater proportion in securities as demand for well-priced and well-structured loans tempered." Mr. Ewing continued, "Management constantly evaluates the most efficient way to deploy the capital entrusted to it, with the aim of striking the optimal balance among safety and soundness, profitability and growth. Our strong liquidity and capital profiles will allow us to continue building franchise value."

Mr. Ewing concluded, "We are very happy to share our success with shareholders by doubling the annual dividend over the prior year year, while retaining an appropriate capital cushion to support our strategic objectives."

Net Interest Income

The net interest margin was

Net interest income was

Interest income increased

Interest expense increased

Noninterest Income

Noninterest income was

Year to date noninterest income was

During the third and fourth quarters, management sold investment securities and redeployed the proceeds into assets with more attractive risk and return characteristics. As part of the portfolio repositioning, the Company incurred year to date net losses on sales of securities of

Noninterest Expense

Noninterest expense was

Salaries and employee benefits were the largest category of noninterest expense. Fourth quarter expenses related to salaries and benefits were

Asset Quality

On December 31, 2022, the allowance for loan losses was

The provision for loan losses was

Shareholders' Equity

Shareholders' equity was

As of December 31, 2022, the Bank's regulatory capital ratios were

About Oak View Bankshares, Inc. and Oak View National Bank

Oak View Bankshares, Inc. is the parent bank holding company for Oak View National Bank, a locally owned and managed community bank serving Fauquier, Culpeper, Rappahannock, and surrounding Counties. For more information about Oak View Bankshares, Inc. and Oak View National Bank, please visit our website at www.oakviewbank.com. Member FDIC.

For additional information, contact Tammy Frazier, Executive Vice President & Chief Financial Officer, Oak View Bankshares, Inc., at 540-359-7155.

SOURCE: Oak View Bankshares, Inc. VA

View source version on accesswire.com:

https://www.accesswire.com/736734/Oak-View-Bankshares-Inc-Announces-Record-Earnings-for-2022-and-Doubles-Dividend