Oak View Bankshares, Inc. Announces Strong Third Quarter Performance

Oak View Bankshares (OAKV) reported strong Q3 2024 performance with net income of $1.46 million, up 22.97% from Q3 2023. For the nine months ended September 30, 2024, net income reached $4.63 million, a 43.10% increase year-over-year. The bank showed solid growth across key metrics: total assets increased to $676.27 million, total loans reached $322.71 million, and deposits grew to $569.41 million. The net interest margin was 2.92% for Q3 2024, with strong liquidity of $503.50 million and maintaining excellent asset quality with an allowance for credit losses at 0.93% of outstanding loans.

Oak View Bankshares (OAKV) ha riportato una solida performance nel terzo trimestre del 2024, con un utile netto di 1,46 milioni di dollari, in aumento del 22,97% rispetto al terzo trimestre del 2023. Nei nove mesi conclusisi il 30 settembre 2024, l'utile netto ha raggiunto 4,63 milioni di dollari, con un incremento del 43,10% rispetto all'anno precedente. La banca ha mostrato una crescita consistente in vari indicatori chiave: il totale degli attivi è aumentato a 676,27 milioni di dollari, i prestiti totali sono arrivati a 322,71 milioni di dollari e i depositi sono cresciuti a 569,41 milioni di dollari. Il margine di interesse netto è stato del 2,92% per il terzo trimestre del 2024, con una solida liquidità di 503,50 milioni di dollari e mantenendo un'eccellente qualità degli attivi, con un accantonamento per perdite su crediti pari allo 0,93% dei prestiti in essere.

Oak View Bankshares (OAKV) reportó un sólido rendimiento en el tercer trimestre de 2024, con un ingreso neto de 1,46 millones de dólares, un aumento del 22,97% en comparación con el tercer trimestre de 2023. Para los nueve meses que terminaron el 30 de septiembre de 2024, el ingreso neto alcanzó 4,63 millones de dólares, un incremento del 43,10% interanual. El banco mostró un crecimiento firme en métricas clave: los activos totales aumentaron a 676,27 millones de dólares, los préstamos totales alcanzaron 322,71 millones de dólares y los depósitos crecieron a 569,41 millones de dólares. El margen de interés neto fue del 2,92% para el tercer trimestre de 2024, con una sólida liquidez de 503,50 millones de dólares y manteniendo una excelente calidad de activos, con una provisión para pérdidas crediticias del 0,93% de los préstamos pendientes.

오크 뷰 뱅크셰어즈 (OAKV)는 2024년 3분기에 146만 달러의 순이익을 보고하며 2023년 3분기와 비교해 22.97% 증가한 강력한 실적을 나타냈습니다. 2024년 9월 30일 종료된 9개월 동안 순이익은 463만 달러에 도달하여 전년 대비 43.10% 상승했습니다. 이 은행은 주요 지표에서 견실한 성장을 보였습니다: 총 자산은 6억 7,627만 달러로 증가하고, 총 대출은 3억 2,271만 달러로, 예금은 5억 6,941만 달러로 성장했습니다. 2024년 3분기 순이자 마진은 2.92%였으며, 5억 3,503만 달러의 강력한 유동성을 유지하고 있으며, 대출 잔액의 0.93%에 해당하는 대손충당금으로 훌륭한 자산 품질을 지속적으로 유지하고 있습니다.

Oak View Bankshares (OAKV) a rapporté de solides performances au troisième trimestre 2024, avec un revenu net de 1,46 million de dollars, en hausse de 22,97% par rapport au troisième trimestre 2023. Pour les neuf mois se terminant le 30 septembre 2024, le revenu net a atteint 4,63 millions de dollars, soit une augmentation de 43,10% par rapport à l'année précédente. La banque a montré une croissance solide à travers des indicateurs clés : les actifs totaux ont augmenté à 676,27 millions de dollars, les prêts totaux ont atteint 322,71 millions de dollars et les dépôts ont crû à 569,41 millions de dollars. La marge d'intérêt nette a été de 2,92% pour le troisième trimestre 2024, avec une solide liquidité de 503,50 millions de dollars et un maintien d'une excellente qualité d'actif, avec une provision pour pertes sur crédits de 0,93% des prêts en cours.

Oak View Bankshares (OAKV) hat für das dritte Quartal 2024 eine starke Leistung mit einem Nettogewinn von 1,46 Millionen Dollar gemeldet, was einem Anstieg von 22,97% im Vergleich zum dritten Quartal 2023 entspricht. Für die neun Monate bis zum 30. September 2024 erreichte der Nettogewinn 4,63 Millionen Dollar, ein Anstieg von 43,10% im Jahresvergleich. Die Bank zeigte ein solides Wachstum in allen wichtigen Kennzahlen: Die Gesamtvermögen stiegen auf 676,27 Millionen Dollar, die Gesamtdarlehen erreichten 322,71 Millionen Dollar und die Einlagen wuchsen auf 569,41 Millionen Dollar. Die Nettozinsmarge betrug im dritten Quartal 2024 2,92%, mit einer starken Liquidität von 503,50 Millionen Dollar und einer hervorragenden Vermögensqualität, mit einer Rückstellung für Kreditverluste von 0,93% der ausstehenden Darlehen.

- Net income increased 22.97% YoY to $1.46M in Q3 2024

- Nine-month net income grew 43.10% to $4.63M

- Total assets increased to $676.27M from $600.16M

- Total deposits grew to $569.41M from $474.23M

- Strong liquidity position with $503.50M in liquid assets

- Excellent asset quality with low credit losses (0.93% of loans)

- Net interest margin slightly decreased to 2.92% from 2.95% YoY

- Cost of funds increased to 3.00% from 2.59% YoY

WARRENTON, VA / ACCESSWIRE / October 29, 2024 / Oak View Bankshares, Inc. (the "Company") (OTC Pink:OAKV), parent company of Oak View National Bank (the "Bank"), reported net income of

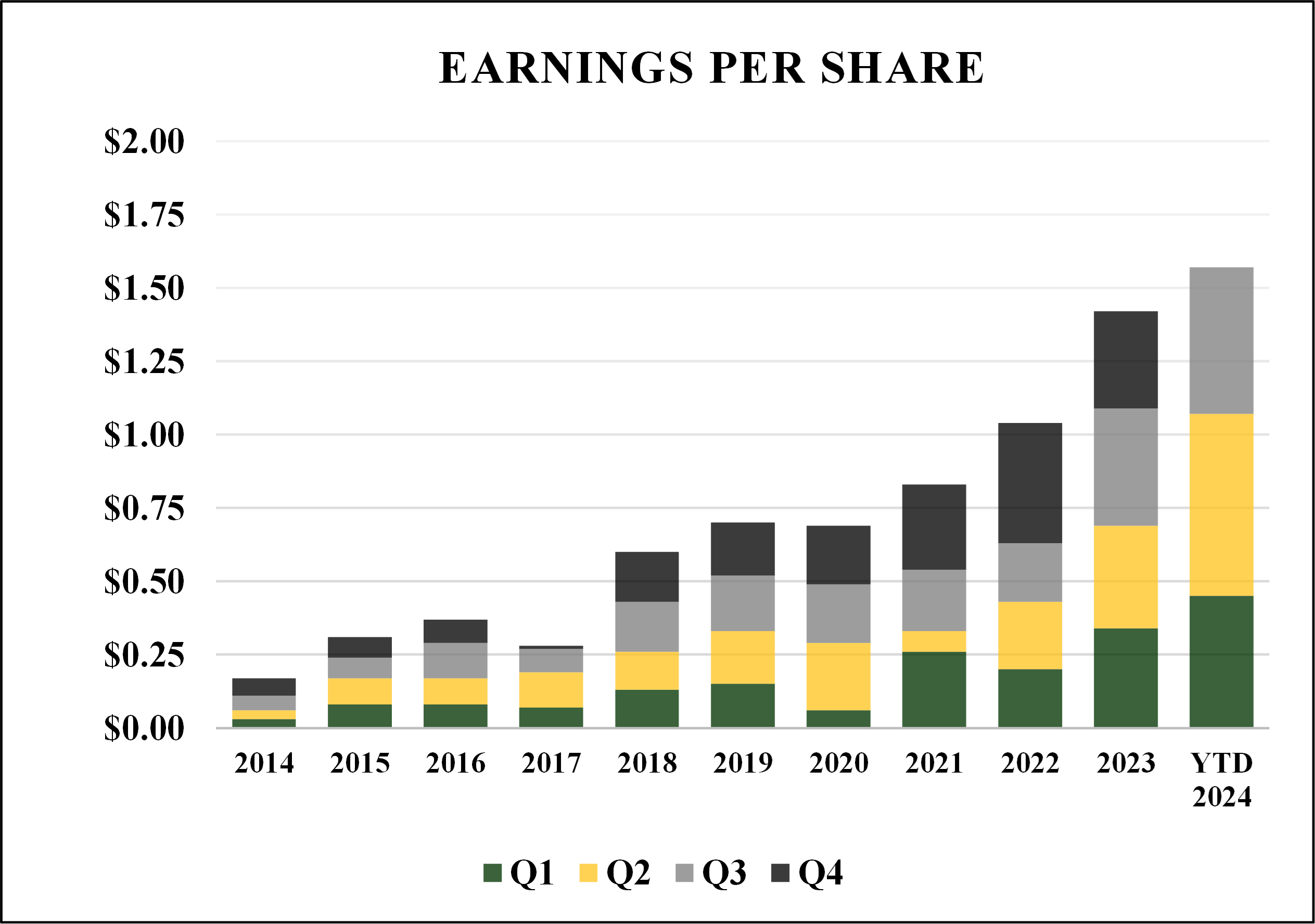

Basic and diluted earnings per share were

Selected Highlights:

Return on average assets was

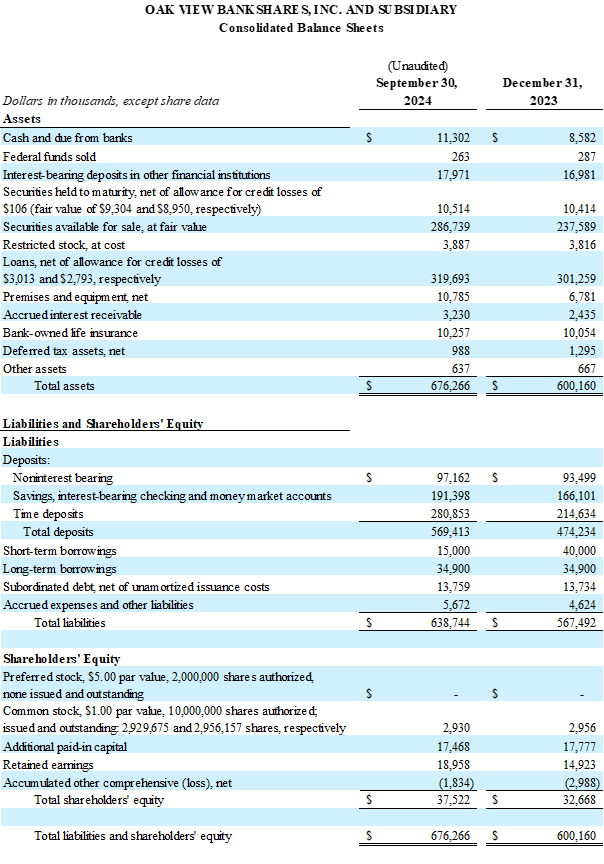

0.88% and return on average equity was16.10% for the quarter ended September 30, 2024, compared to0.81% and15.75% , respectively, for the quarter ended September 30, 2023. Return on average assets was0.98% and return on average equity was18.09% for the nine months ended September 30, 2024, compared to0.78% and14.90% , respectively, for the nine months ended September 30, 2023.Total assets were

$676.27 million on September 30, 2024, compared to$600.16 million on December 31, 2023.Total loans were

$322.71 million on September 30, 2024, compared to$304.05 million on December 31, 2023.Total securities were

$297.36 million on September 30, 2024, compared to$248.11 million on December 31, 2023.Total deposits were

$569.41 million on September 30, 2024, compared to$474.23 million on December 31, 2023.Regulatory capital remains strong with ratios exceeding the "well capitalized" thresholds in all categories.

Asset quality continues to be outstanding

On-balance sheet liquidity remains strong with

$503.50 million as of September 30, 2024, compared to$453.94 million as of December 31, 2023. Liquidity includes cash, unencumbered securities available for sale, and available secured and unsecured borrowing capacity.

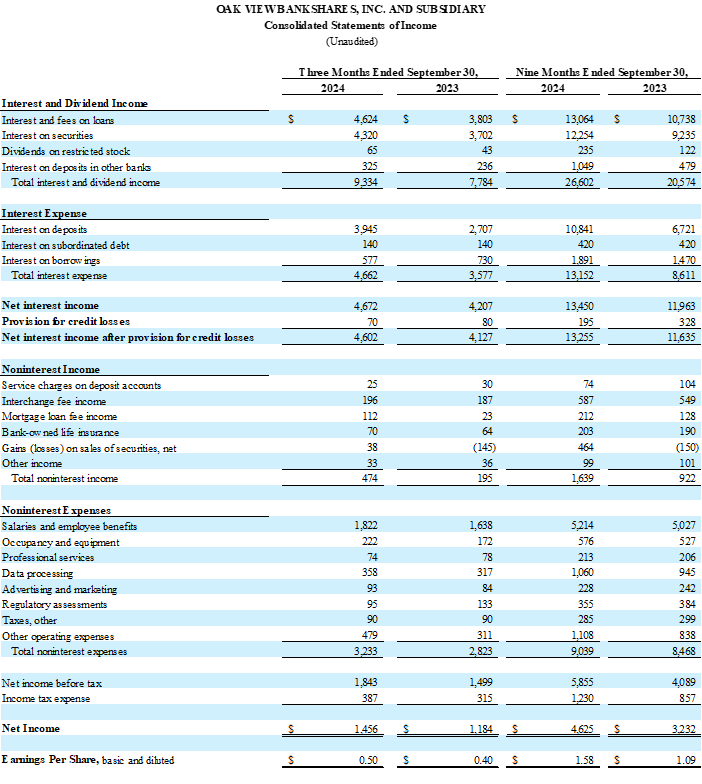

Net Interest Income

The net interest margin was

The net interest margin was

Noninterest Income

Noninterest income was

Noninterest Expense

Noninterest expenses were

Liquidity

Liquidity remains exceptionally strong with

The Company's deposits proved to be stable with core deposits, which are defined as total deposits excluding brokered deposits, of

Asset Quality

As of September 30, 2024, the allowance for credit losses related to the loan portfolio was

The provision for credit losses was

Shareholders' Equity & Regulatory Capital

Shareholders' equity was

About Oak View Bankshares, Inc. and Oak View National Bank

Oak View Bankshares, Inc. is the parent bank holding company for Oak View National Bank, a locally owned and managed community bank serving Fauquier, Culpeper, Rappahannock, and surrounding Counties. For more information about Oak View Bankshares, Inc. and Oak View National Bank, please visit our website at www.oakviewbank.com. Member FDIC.

For additional information, contact Tammy Frazier, Executive Vice President & Chief Financial Officer, Oak View Bankshares, Inc., at 540-359-7155.

SOURCE: Oak View Bankshares, Inc. VA

View the original press release on accesswire.com