Oak View Bankshares, Inc. Announces Financial Results for 2021 and the Declaration of an Annual Dividend

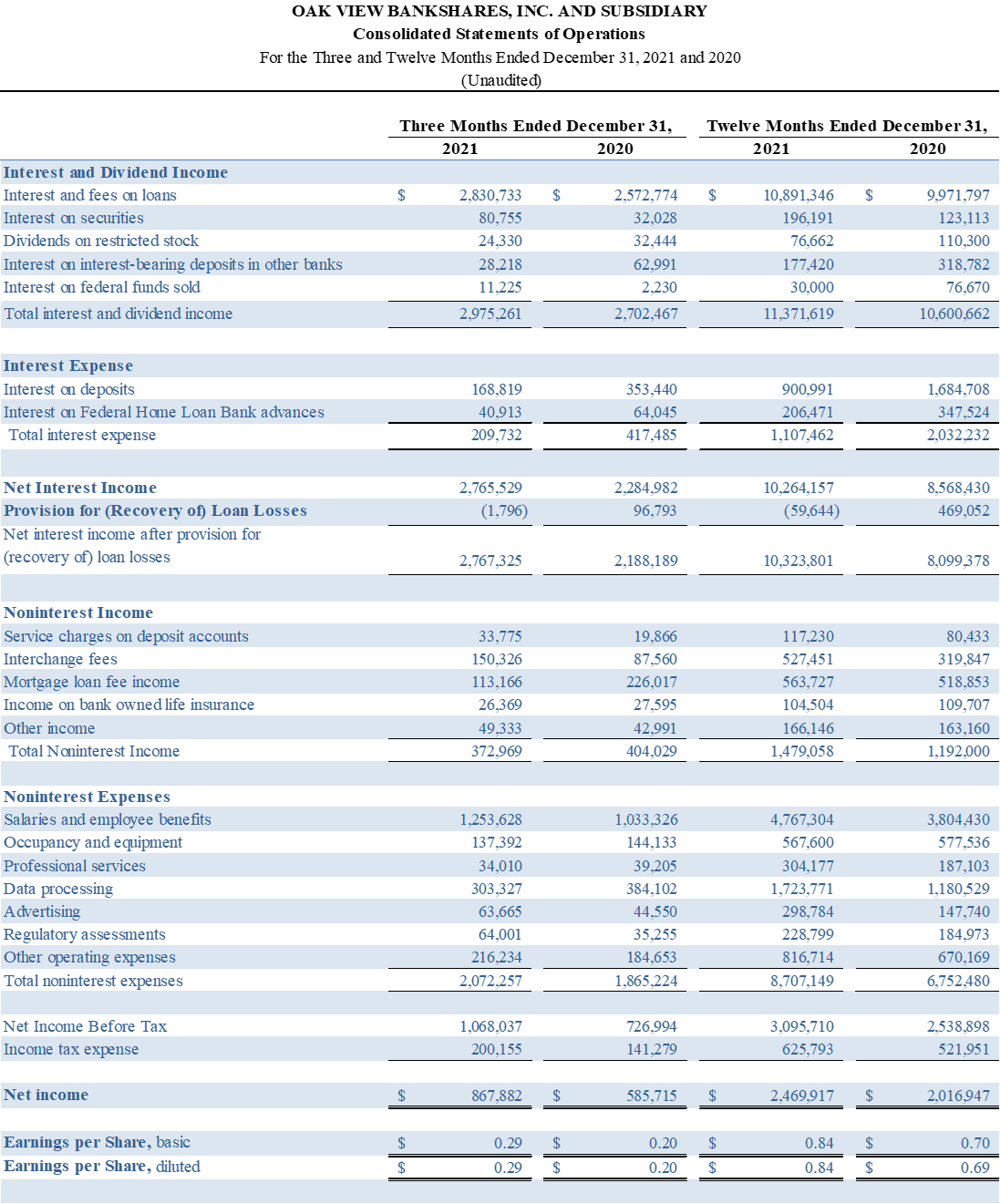

Oak View Bankshares, Inc. (OAKV) reported a 48.17% increase in net income for Q4 2021, reaching $867,882 compared to $585,715 in Q4 2020. Annual net income rose 22.46% to $2.47 million. Earnings per share for the quarter were $0.29, up from $0.20 in 2020. Total assets grew to $345.10 million, and total loans increased to $251.20 million. The company declared an annual dividend of $0.05 per share, to be paid on February 7, 2022. Noninterest income showed mixed results, with debit card fee income rising but mortgage loan fees declining.

- Net income increased 48.17% in Q4 2021 to $867,882.

- Annual net income for 2021 rose 22.46% to $2.47 million.

- Earnings per share for Q4 2021 were $0.29, up from $0.20 in 2020.

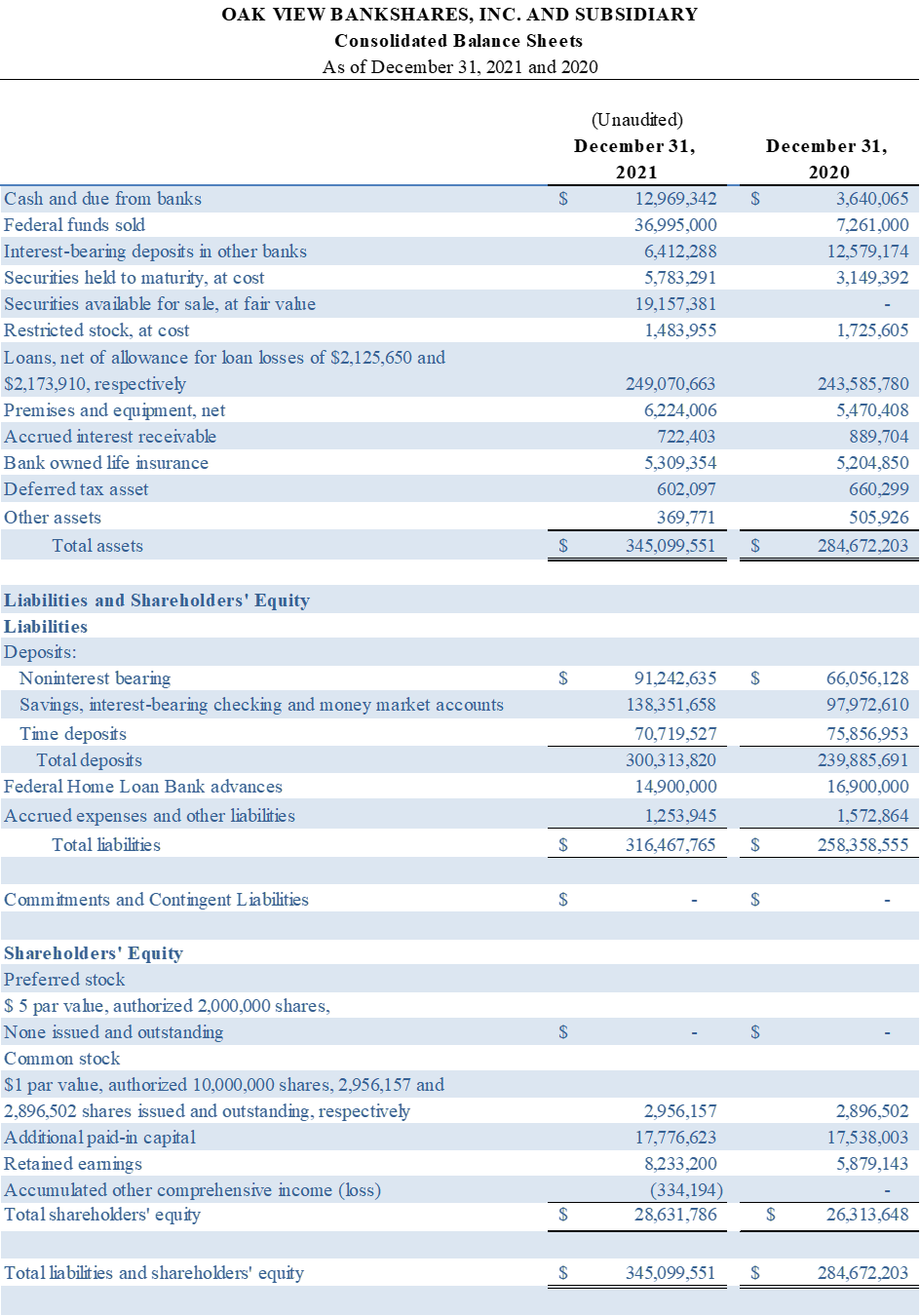

- Total assets increased by $17.38 million, reaching $345.10 million.

- Total loans increased to $251.20 million, indicating growth.

- Dividend of $0.05 declared, indicating shareholder returns.

- Noninterest income decreased by approximately $93,490 compared to Q4 2020.

Insights

Analyzing...

WARRENTON, VA / ACCESSWIRE / January 28, 2022 / Oak View Bankshares, Inc. (the "Company") (OTC Pink:OAKV), parent company of Oak View National Bank (the "Bank"), reported net income of

Net income for the twelve months ended December 31, 2021, was

On January 20, 2022, the Board of Directors of the Company declared an annual dividend of

Selected Highlights:

- The net interest margin was

3.35% for the quarter, compared to3.28% and3.32% for the prior quarter and the fourth quarter of 2020, respectively. Year to date net interest margin was3.37% , compared to3.16% for the twelve months ended December 31, 2020. - Total assets were

$345.10 million on December 31, 2021, an increase of$17.38 million and$60.43 million compared to September 30, 2021, and December 31, 2020, respectively. - Total loans increased to

$251.20 million on December 31, 2021, compared to$246.50 million on September 30, 2021, and$245.76 million on December 31, 2020. Excluding Paycheck Protection Program loans (PPP) which declined due to anticipated forgiveness by the SBA, loan growth was4.77% and13.13% compared to September 30, 2021, and December 31, 2020, respectively. - Credit quality continues to be outstanding as the Bank had just one non-performing loan, totaling

$2,385 and one loan totaling$9,148 t hat was thirty-four days past due on December 31, 2021. - The Bank recorded a recovery in the provision for loan losses of

$1,796 for the quarter, compared to a provision for loan losses of$9,695 for the prior quarter and$96,793 for the fourth quarter of 2020. Year to date recovery of provision for loan losses was$59,644 , compared to a provision for loan losses of$469,052 for the twelve months ended December 31, 2020. While the Bank provided additional reserves for loan growth, these additional reserves were partially offset by reserve releases as previously anticipated credit deterioration at the onset of the pandemic has not been experienced. - Total deposits increased to

$300.31 million on December 31, 2021, compared to$283.73 million on September 30, 2021, and$239.89 million on December 31, 2020. This represents an increase of$16.59 million and$60.43 million compared to September 30, 2021, and December 31, 2020, respectively. - Regulatory capital remains strong with ratios exceeding the well capitalized thresholds in all categories.

Michael Ewing, CEO and Chairman of the Board said, "We are thrilled to report another year of record earnings for the Company. Our Company had an exceptional year that was full of change and opportunity. We began the year preparing for and converting our core data processing system to a new, more scalable platform which will offer efficiencies in operations and added value and flexibility for our customers. Mid-year, we began our reorganization into a bank holding company and completed that transaction during the fourth quarter. While these two initiatives added approximately

Earnings

Return on average assets was

Paycheck Protection Program Lending Update

The Bank originated a total of

Net Interest Margin

Increases in the net interest margin were impacted by changes in the yield on average earning assets, primarily higher yield on loans resulting from the acceleration of net deferred loan fees from the forgiveness of PPP loans. The yield on loans was

Year to date yield on loans was

Noninterest Income

Noninterest income was

Year to date noninterest income increased

Noninterest Expense

Noninterest expense was

Salaries and employee benefits represents the largest category of noninterest expense. Expenses related to salaries and benefits were

Data processing expenses also contributed to the increase in noninterest expense. Data processing expenses were

The Bank reorganized into a bank holding company effective December 15, 2021. During the year, this reorganization added an additional

About Oak View Bankshares, Inc. and Oak View National Bank

Oak View Bankshares, Inc. is the parent bank holding company for Oak View National Bank, a locally owned and managed community bank serving Fauquier, Culpeper, Rappahannock, and surrounding Counties. For more information about Oak View Bankshares, Inc. and Oak View National Bank, please visit our website at www.oakviewbank.com. Member FDIC.

For additional information, contact Tammy Frazier, Executive Vice President & Chief Financial Officer, Oak View Bankshares, Inc., at 540-359-7155.

SOURCE: Oak View Bankshares, Inc.

View source version on accesswire.com:

https://www.accesswire.com/686105/Oak-View-Bankshares-Inc-Announces-Financial-Results-for-2021-and-the-Declaration-of-an-Annual-Dividend