Upstart Launches the Upstart Macro Index

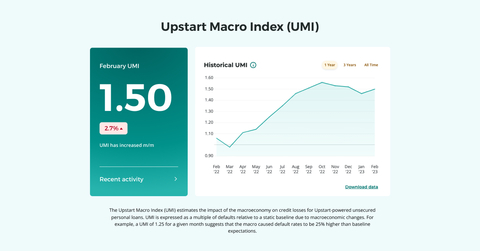

Upstart Macro Index (UMI) (Graphic: Business Wire)

“To date, it’s been difficult for lenders to isolate the impact of the macroeconomy on their loan portfolios,” said

UMI is enabled by Upstart’s patented AI loan-month model, which estimates the likelihoods of loss and prepayment for each month of every Upstart-powered loan. The precision of its AI-enabled models has enabled Upstart’s machine learning team to isolate and estimate the impact of the macroeconomy on losses within Upstart-powered loan portfolios.

UMI will be published monthly at www.upstart.com/umi. The site includes a detailed explanation of the metric, downloadable UMI data back to 2017, and the option to subscribe to monthly UMI updates. Like other economic indicators, prior UMI values are subject to revision. Because Upstart’s risk models are regularly calibrated to conservatively account for the most recent trend in UMI, UMI is not a measure of the performance of loans originated on the Upstart platform.

To learn more about how Upstart can help your bank or credit union provide all-digital lending enabled by AI, please visit www.upstart.com/lenders.

About Upstart

Upstart (NASDAQ: UPST) is a leading AI lending marketplace partnering with banks and credit unions to expand access to affordable credit. By leveraging Upstart’s AI marketplace, Upstart-powered banks and credit unions can have higher approval rates and lower loss rates across races, ages and genders, while simultaneously delivering the exceptional digital-first lending experience their customers demand. More than two-thirds of Upstart loans are approved instantly and are fully automated. Upstart was founded by ex-Googlers in 2012 and is based in

Forward-Looking Statements

This press release contains forward-looking statements, including but not limited to, statements regarding updates to UMI and what Upstart can provide by publishing UMI. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as "anticipate", "estimate", "expect", "project", "plan", "intend", “target”, “aim”, "believe", "may", "will", "should", “becoming”, “look forward”, “could”, “can,” "can have", "likely" and other words and terms of similar meaning in connection with any discussion of the timing or nature of UMI or other events. Forward-looking statements give our current expectations and projections relating to the information in this press release. Neither we nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. The forward-looking statements included in this press release relate only to events and information as of the date hereof. Upstart undertakes no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected. More information about factors that could affect UMI or our ability to publish UMI and related risks and uncertainties are provided in our public filings with the

View source version on businesswire.com: https://www.businesswire.com/news/home/20230322005633/en/

press@upstart.com

Source: Upstart