Teleperformance SE: Sustained Business and Earnings Growth in First-Half 2022

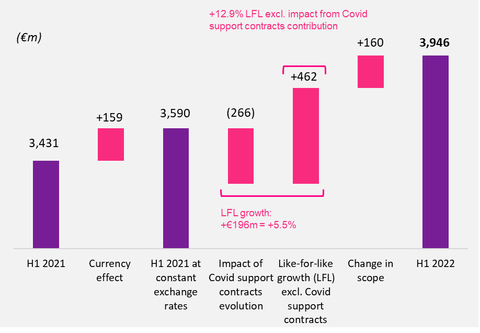

Teleperformance reported significant growth in its first-half 2022 results, with total revenue reaching €3,946 million, a 15.0% increase compared to the previous year. The like-for-like growth was 5.5%, and 12.9% when excluding Covid-related contracts. The EBITA margin improved to 14.3%, up from 14.0% in H1 2021. The Group confirmed its 2022 targets for revenue growth and margin expansion, despite the challenge of lower revenue from Covid support contracts. The positive dynamics were driven by strong performances in social media, healthcare, and travel sectors.

- First-half revenue increased to €3,946 million, up +15.0% year-on-year.

- Like-for-like growth of +5.5%, or +12.9% excluding non-recurring items.

- EBITA margin improved to 14.3%, compared to 14.0% in H1 2021.

- Significant growth in sectors like social media, healthcare, and travel.

- Revenue from Covid support contracts decreased by €266 million compared to H1 2021.

- The CEMEA region saw a decline of -9.5% like-for-like revenue.

Insights

Analyzing...

2022 guidance confirmed

-

First-half 2022 revenue up +

15.0% as reported, including like-for-like growth* of +5.5% despite high prior-year comparatives and +12.9% excluding non-recurring items** -

Faster like-for-like growth of +

14.5% in second-quarter 2022, excluding non-recurring items** -

Improved EBITA margin excluding non-recurring items, at

14.3% versus14.0% in first-half 2021 - 2022 targets for like-for-like revenue growth and EBITA margin confirmed

Analysis of first-half 2022 revenue growth (Graphic: Teleperformance)

The Board of Directors of Teleperformance (Paris:TEP), the global leader in outsourced customer and citizen experience management and related digital solutions, met today and reviewed the consolidated financial statements for the six months ended

Strong business and earnings growth

-

H1 2022 revenue:

€3,946 million

- up +15.0% as reported and +5.5% like-for-like

- up +12.9% like-for-like excluding impact of lower revenue from Covid support contracts

-

Q2 2022 revenue:

€1,984 million

- up +15.4% as reported and +4.5% like-for-like

- up +14.5% like-for-like excluding impact of lower revenue from Covid support contracts

-

EBITA before non-recurring items:

€566 million , for a margin of14.3% vs.14.0% in H1 2021

-

Net profit – Group share:

€274 million vs.€255 million in H1 2021

Robust sales dynamic maintained

- Despite an uncertain economic environment, the market's structural digitalization and the Group’s robust and diversified client portfolio continued to drive momentum, especially in the social media, healthcare and travel sectors

- TLScontact's visa application management business recovered strongly

-

The Group’s 2021 acquisitions in

the United States in the healthcare and government sectors (Health Advocate andSenture ) were successfully integrated - Revenue from support services for government vaccination campaigns (“Covid contracts”) fell sharply as expected

2022 financial objectives confirmed

-

More than +

10% like-for-like revenue growth excluding the impact of Covid support contracts -

More than +

5% like-for-like revenue growth - A 30 basis-point increase in EBITA margin before non-recurring items

- Further targeted acquisitions capable of creating value and strengthening the Group’s high value-added businesses

* At constant scope of consolidation and exchange rates

** Excluding the impact of the change in revenue from Covid support contracts (Covid contracts)

Commenting on this performance, Teleperformance Chairman and Chief Executive Officer

The strong recovery of TLScontact's visa application management business also contributed to this good performance. The Group’s recent strategic acquisitions in

On the strength of this encouraging first half, taking into account the uncertain economic environment and ever-present health risk, we confirm our 2022 targets of like-for-like revenue growth of more than +

INTERIM FINANCIAL HIGHLIGHTS

€ millions |

H1 2022 |

H1 2021 |

|

|

|

Revenue |

3,946 |

3,431 |

Reported growth |

+ |

|

Like-for-like growth |

+ |

|

Like-for-like change excluding non-recurring items* |

+ |

|

EBITDA before non-recurring items |

792 |

678 |

% of revenue |

|

|

EBITA before non-recurring items |

566 |

479 |

% of revenue |

|

|

EBIT |

438 |

398 |

Net profit – Group share |

274 |

255 |

Diluted earnings per share (€) |

4.60 |

4.31 |

Net free cash flow |

325 |

333 |

* Excluding the impact of the change in revenue from Covid support contracts

FIRST-HALF AND SECOND-QUARTER 2022 REVENUE

Consolidated revenue

First half 2022 revenue came in at

Like-for-like growth in first-half 2022 was particularly strong given the negative impact of lower revenue from Covid support contracts (down -

Revenue for the second quarter of 2022 amounted to

Revenue by activity

|

H1 2022 |

H1 2021 |

% change |

|

€ millions |

|

|

Like-for-like |

Reported |

CORE SERVICES & D.I.B.S.* |

3,412 |

3,075 |

+ |

+ |

English-speaking & |

1,175 |

992 |

+ |

+ |

Ibero-LATAM |

1,098 |

895 |

+ |

+ |

Continental |

875 |

977 |

- |

- |

|

264 |

211 |

+ |

+ |

SPECIALIZED SERVICES |

534 |

356 |

+ |

+ |

TOTAL |

3,946 |

3,431 |

+ |

+ |

Adjusted like-for-like growth** |

|

|

+ |

|

|

Q2 2022 |

Q2 2021 |

% change |

|

€ millions |

|

|

Like-for-like |

Reported |

CORE SERVICES & D.I.B.S.* |

1,700 |

1,539 |

+ |

+ |

English-speaking & |

576 |

484 |

+ |

+ |

Ibero-LATAM |

573 |

454 |

+ |

+ |

Continental |

416 |

495 |

- |

- |

|

135 |

106 |

+ |

+ |

SPECIALIZED SERVICES |

284 |

180 |

+ |

+ |

TOTAL |

1,984 |

1,719 |

+ |

+ |

Adjusted like-for-like growth** |

|

|

+ |

|

* Digital Integrated Business Services

** Excluding the impact of the change in revenue from Covid support contracts

- Core Services & Digital Integrated Business Services (D.I.B.S.)

Core Services & D.I.B.S. revenue amounted to

Second-quarter 2022 revenue rose by +

-

English-speaking &

Asia-Pacific (EWAP)

EWAP region revenue came to

Second-quarter 2022 revenue was globally stable versus the first quarter, rising by +

After staging a recovery in the second half of 2021, the North American market continued to enjoy renewed momentum in first-half 2022, both in the domestic market and in

- Ibero-LATAM

First-half 2022 revenue for the Ibero-LATAM region amounted to

Business in the region grew at a rapid pace throughout the first half against a high basis of comparison, particularly in the social media, online entertainment, healthcare, financial services and travel sectors.

Growth rates were high in all the countries of the region in the first half, led by

-

Continental

Europe & MEA (CEMEA)

Revenue in the CEMEA region amounted to

Excluding the impact of the Covid support contracts, first-half 2022 business growth in the region was strong, with the start-up of new contracts driving a clear acceleration in the second quarter compared with the first. Business with multinational clients, particularly in the travel, automotive, financial services and online entertainment sectors, was brisk over the period. This was particularly the case in

-

India

In first-half 2022, operations in

Offshore activities, which are the region’s main source of revenue and include high value-added solutions, continued to grow rapidly. They benefited from the dynamism of the Group’s client base of global leaders in the buoyant travel, consumer electronics, healthcare, internet, online entertainment and e-tailing sectors. Revenue in the automotive sector also grew rapidly during the period.

- Specialized Services

Revenue from Specialized Services stood at

Faster revenue growth in the second quarter was mainly due to the resounding recovery in TLScontact volumes and also reflected the very favorable prior-period basis of comparison. In particular,

LanguageLine Solutions, the main contributor to Specialized Services revenue, grew at a satisfactory rate, especially in the healthcare sector which accounts for more than half of its revenue, although growth rates were dampened by a high basis of comparison, especially in the spring 2021. The basis of comparison will be lower in the second half.

The rapid growth of debt collection activities in

FIRST-HALF 2022 RESULTS

EBITDA before non-recurring items stood at

EBITA before non-recurring items rose by +

Earnings by activity

EBITA before non-recurring items |

H1 2022 |

H1 2021 |

€ millions |

|

|

CORE SERVICES & D.I.B.S.* |

398 |

374 |

% of revenue |

|

|

English-speaking & |

97 |

57 |

% of revenue |

|

|

Ibero-LATAM |

133 |

113 |

% of revenue |

|

|

Continental |

83 |

138 |

% of revenue |

|

|

|

46 |

35 |

% of revenue |

|

|

Holding companies |

39 |

31 |

SPECIALIZED SERVICES |

168 |

105 |

% of revenue |

|

|

TOTAL |

566 |

479 |

% of revenue |

|

|

|

|

|

* Digital Integrated Business Services

- Core Services & D.I.B.S.

For Core Services & D.I.B.S., EBITA before non-recurring items came to

-

English-speaking &

Asia-Pacific (EWAP)

The EWAP region generated EBITA before non-recurring items of

- Ibero-LATAM

EBITA before non-recurring items in the Ibero-LATAM region rose to

-

Continental

Europe & MEA (CEMEA)

EBITA before non-recurring items in the CEMEA region came to 83 million in first-half 2022, versus

-

India

EBITA before non-recurring items in the

- Specialized Services

Specialized Services EBITA before non-recurring items came to

This good performance mainly reflects the return of TLScontact's operating margins to levels close to those achieved pre-Covid-19, following a strong recovery in business volumes, satisfactory growth in premium ancillary services and implementation of cost-cutting measures during the crisis. TLScontact's margins were very low in first-half 2021, because the travel restrictions and border closures imposed since

LanguageLine Solutions continued to enjoy high margins in first-half 2022, reflecting satisfactory business growth backed by an efficient business model based on entirely home-based interpreters, unrivaled technological tools and a very assertive marketing process.

Other income statement items

EBIT amounted to

•

• the

The financial result represented a net expense of

Income tax expense came to

Net profit – Group share totaled

Cash flows and financial structure

Net free cash flow after lease expenses, interest and tax paid amounted to

The change in consolidated working capital requirement was an outflow of

Net capital expenditure amounted to

After paying

OPERATING HIGHLIGHTS

- Expansion of the global footprint and deployment of work-from-home solutions

In first-half 2022, Teleperformance continued to deploy its global expansion strategy in the structurally growing outsourced customer and citizen experience management market despite the uncertain economic context. Some 20 new sites were opened around the world, including in

- Best Employer certifications: 64 country organizations certified

Teleperformance has made the well-being of its employees a key priority worldwide. As of

OUTLOOK

On the strength of this encouraging first half, taking into account the uncertain economic environment and ever-present health risk, Teleperformance confirms its 2022 targets:

- Like-for-like revenue growth above +

- Like-for-like revenue growth above +

- A 30 basis-point increase in EBITA margin before non-recurring items.

The Group also plans to make further targeted acquisitions capable of creating value and strengthening its high value-added businesses.

-----------------

DISCLAIMER

All forward-looking statements are based on Teleperformance management’s present expectations of future events and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. For a detailed description of these factors and uncertainties, please refer to the “Risk Factors” section of our Universal Registration Document, available at www.teleperformance.com. Teleperformance undertakes no obligation to publicly update or revise any of these forward-looking statements.

Webcast / Conference call with analysts and investors

A conference call and webcast will be held today at

The half-year financial report and presentation materials will be available after the conference call on Teleperformance’s website (www.teleperformance.com) – section Investor Relations / Press releases and documentation / Annual and half-yearly financial information, and by clicking on the following link:

https://www.teleperformance.com/en-us/investors/publications-and-events/financial-publications/

Indicative investor calendar

Third-quarter 2022 revenue:

About

Teleperformance (TEP – ISIN: FR0000051807 – Reuters: TEPRF.PA - Bloomberg: TEP FP), the global leader in outsourced customer and citizen experience management and related digital services, serves as a strategic partner to the world’s largest companies in many industries. It offers a One Office support services model including end-to-end digital solutions, which guarantee successful customer interaction and optimized business processes, anchored in a unique, comprehensive high touch, high tech approach. Nearly 420,000 employees, based in 88 countries, support billions of connections every year in over 265 languages and around 170 markets, in a shared commitment to excellence as part of the “Simpler, Faster, Safer” process. This mission is supported by the use of reliable, flexible, intelligent technological solutions and compliance with the industry’s highest security and quality standards, based on Corporate Social Responsibility excellence. In 2021, Teleperformance reported consolidated revenue of

Teleperformance shares are traded on the Euronext Paris market, Compartment A, and are eligible for the deferred settlement service. They are included in the following indices: CAC 40, STOXX 600,

For more information: www.teleperformance.com Follow us on Twitter: @teleperformance

Appendices

Appendix 1 – Quarterly and Half-Yearly Revenue by Activity

|

H1 2022 |

H1 2021 |

% change |

|

€ millions |

|

|

Like-for-like |

Reported |

CORE SERVICES & D.I.B.S.* |

3,412 |

3,075 |

+ |

+ |

English-speaking & |

1,175 |

992 |

+ |

+ |

Ibero-LATAM |

1,098 |

895 |

+ |

+ |

Continental |

875 |

977 |

- |

- |

|

264 |

211 |

+ |

+ |

SPECIALIZED SERVICES |

534 |

356 |

+ |

+ |

TOTAL |

3,946 |

3,431 |

+ |

+ |

Like-for-like change excluding non-recurring items** |

|

|

+ |

|

|

Q2 2022 |

Q2 2021 |

% change |

|

€ millions |

|

|

Like-for-like |

Reported |

CORE SERVICES & D.I.B.S.* |

1,700 |

1,539 |

+ |

+ |

English-speaking & |

576 |

484 |

+ |

+ |

Ibero-LATAM |

573 |

454 |

+ |

+ |

Continental |

416 |

495 |

- |

- |

|

135 |

106 |

+ |

+ |

SPECIALIZED SERVICES |

284 |

180 |

+ |

+ |

TOTAL |

1,984 |

1,719 |

+ |

+ |

Adjusted like-for-like growth** |

|

|

+ |

|

|

Q1 2022 |

Q1 2021 |

% change |

|

€ millions |

|

|

Like-for-like |

Reported |

CORE SERVICES & D.I.B.S.* |

1,711 |

1,536 |

+ |

+ |

English-speaking & |

599 |

508 |

+ |

+ |

Ibero-LATAM |

525 |

442 |

+ |

+ |

Continental |

459 |

481 |

- |

- |

|

128 |

105 |

+ |

+ |

SPECIALIZED SERVICES |

251 |

176 |

+ |

+ |

TOTAL |

1,962 |

1,712 |

+ |

+ |

Adjusted like-for-like growth** |

|

|

+ |

|

* Digital Integrated Business Services

** Excluding the impact of the change in revenue from Covid support contracts

Appendix 2 – Simplified Consolidated Financial Statements

Consolidated income statement

€ millions

| 1st HY 2022 | 1st HY 2021 | ||

| Revenues | 3 946 |

3 431 |

|

| Other revenues | 4 |

3 |

|

| Personnel | -2 645 |

-2 363 |

|

| External expenses | -498 |

-380 |

|

| Taxes other than income taxes | -15 |

-13 |

|

| Depreciation and amortization | -124 |

-108 |

|

| Amortization of intangible assets acquired as part of a business combination | -70 |

-49 |

|

| Depreciation of right-of-use assets (personnel-related) | -7 |

-6 |

|

| Depreciation of right-of-use assets | -95 |

-85 |

|

| Impairment loss on goodwill | -5 |

||

| Share-based payments | -51 |

-31 |

|

| Other operating income and expenses | -2 |

-1 |

|

| Operating profit | 438 |

398 |

|

| Income from cash and cash equivalents | 4 |

3 |

|

| Gross financing costs | -31 |

-27 |

|

| Interest on lease liabilities | -21 |

-20 |

|

| Net financing costs | -48 |

-44 |

|

| Other financial income and expenses | -4 |

0 |

|

| Financial result | -52 |

-44 |

|

| Profit before taxes | 386 |

354 |

|

| Income tax | -112 |

-99 |

|

| Net profit | 274 |

255 |

|

| Net profit - Group share | 274 |

255 |

|

| Net profit attributable to non-controlling interests | |||

| Earnings per share (in euros) | 4,67 |

4,34 |

|

| Diluted earnings per share (in euros) | 4,60 |

4,31 |

Consolidated balance sheet

€ millions

| ASSETS | |||

| Non-current assets | |||

2 989 |

2 892 |

||

| Other intangible assets | 1 466 |

1 289 |

|

| Right-of-use assets | 685 |

626 |

|

| Property, plant and equipment | 622 |

592 |

|

| Loan hedging instruments - Assets | 19 |

10 |

|

| Othe financial assets | 60 |

59 |

|

| Deferred tax assets | 83 |

66 |

|

| Total non-current assets | 5 924 |

5 534 |

|

| Current assets | |||

| Current income tax receivable | 95 |

87 |

|

| Accounts receivable - Trade | 1 642 |

1 580 |

|

| Other current assets | 276 |

226 |

|

| Other financial assets | 72 |

46 |

|

| Cash and cash equivalents | 756 |

837 |

|

| Total current assets | 2 841 |

2 776 |

|

| TOTAL ASSETS | 8 765 |

8 310 |

|

| EQUITY AND LIABILITIES | |||

| Equity | |||

| Share capital | 148 |

147 |

|

| Share premium | 575 |

575 |

|

| Translation reserve | 246 |

-101 |

|

| Other reserves | 2 632 |

2 536 |

|

| Equity attributable to owners of the Company | 3 601 |

3 157 |

|

| Non-controlling interests | 0 |

0 |

|

| Total equity | 3 601 |

3 157 |

|

| Non-current liabilities | |||

| Post-employment benefits | 34 |

33 |

|

| Lease liabilities | 561 |

515 |

|

| Loan hedging instruments - Liabilities | 6 |

||

| Other financial liabilities | 2 201 |

2 270 |

|

| Deferred tax liabilities | 352 |

296 |

|

| Total non-current liabilities | 3 154 |

3 114 |

|

| Current liabilities | |||

| Provisions | 86 |

83 |

|

| Current income tax | 130 |

127 |

|

| Accounts payable - Trade | 242 |

280 |

|

| Other current liabilities | 912 |

831 |

|

| Lease liabilities | 186 |

172 |

|

| Other financial liabilities | 454 |

546 |

|

| Total current liabilities | 2 010 |

2 039 |

|

| TOTAL EQUITY AND LIABILITIES | 8 765 |

8 310 |

Consolidated cash flow statement

€ millions

| Cash flows from operating activities | 1st HY 2022 | 1st HY 2021 | ||

| Net profit - Group share | 274 |

255 |

||

| Income tax expense | 112 |

99 |

||

| Net financial interest expense | 23 |

19 |

||

| Interest expense on lease liabilities | 21 |

20 |

||

| Non-cash items of income and expense | 362 |

275 |

||

| Income tax paid | -136 |

-73 |

||

| Internally generated funds from operations | 656 |

595 |

||

| Change in working capital requirements | -40 |

-38 |

||

| Net cash flow from operating activities | 616 |

557 |

||

| Cash flows from investing activities | ||||

| Acquisition of intangible assets and property, plant and equipment | -151 |

-100 |

||

| Loans granted | -10 |

|||

| Acquisition of subsidiaries, net of cash acquired | -1 |

-573 |

||

| Proceeds from disposals of intangible assets and property, plant and equipment | 1 |

2 |

||

| Net cash flow from investing activities | -161 |

-671 |

||

| Cash flows from financing activities | ||||

| Acquisition net of disposal of treasury shares | -34 |

4 |

||

| Dividends paid to parent company shareholders | -194 |

-141 |

||

| Financial interest paid | -21 |

-15 |

||

| Lease payments | -120 |

-111 |

||

| Increase in financial liabilities | 891 |

608 |

||

| Repayment of financial liabilities | -1 067 |

-383 |

||

| Net cash flow from financing activities | -545 |

-38 |

||

| Change in cash and cash equivalents | -90 |

-152 |

||

| Effect of exchange rates on cash held | 11 |

10 |

||

| Net cash at |

835 |

993 |

||

| Net cash at |

756 |

851 |

||

Appendix 3 – Glossary - Alternative Performance Measures

Change in like-for-like revenue:

Change in revenue at constant exchange rates and scope of consolidation = [current year revenue - last year revenue at current year rates - revenue from acquisitions at current year rates] / last year revenue at current year rates.

|

|

|

H1 2021 revenue |

3,431 |

|

Currency effect |

159 |

|

H1 2021 revenue at constant exchange rates |

3,590 |

|

Like-for-like growth |

196 |

|

Change in scope |

160 |

|

H1 2022 revenue |

3,946 |

|

EBITDA before non recurring items or current EBITDA (Earnings before Interest, Taxes, Depreciation and Amortizations):

Operating profit before depreciation & amortization, depreciation of right-of-use of leased assets, amortization of intangible assets acquired as part of a business combination, goodwill impairment charges and non-recurring items.

H1 2022 |

H1 2021 |

||

|

|

|

|

Operating profit |

438 |

398 |

|

Depreciation and amortization |

124 |

108 |

|

Depreciation of right-of-use of leased assets |

95 |

85 |

|

Depreciation of right-of-use of leased assets – personnel related |

7 |

6 |

|

Amortization of intangible assets acquired as part of a business combination |

70 |

49 |

|

|

5 |

- |

|

Share-based payments |

51 |

31 |

|

Other operating income and expenses |

2 |

1 |

|

EBITDA before non-recurring items |

792 |

678 |

|

EBITA before non recurring items or current EBITA (Earnings before Interest, Taxes and Amortizations):

Operating profit before amortization of intangible assets acquired as part of a business combination, goodwill impairment charges and non-recurring items.

H1 2022 |

H1 2021 |

||

|

|

|

|

Operating profit |

438 |

398 |

|

Amortization of intangible assets acquired as part of a business combination |

70 |

49 |

|

|

5 |

- |

|

Share-based payments |

51 |

31 |

|

Other operating income and expenses |

2 |

1 |

|

EBITA before non-recurring items |

566 |

479 |

|

Non recurring items:

Principally comprises restructuring costs, incentive share award plan expense, costs of closure of subsidiary companies, transaction costs for the acquisition of companies, and all other expenses that are unusual by reason of their nature or amount.

Net free cash flow:

Cash flow generated by the business - acquisitions of intangible assets and property, plant and equipment net of disposals - lease payments - financial income/expenses.

H1 2022 |

H1 2021 |

||

|

|

|

|

Net cash flow from operating activities |

616 |

557 |

|

Acquisition of intangible assets and property, plant and equipment |

-151 |

-100 |

|

Proceeds from disposals of intangible assets and property, plant and equipment |

1 |

2 |

|

Lease payments |

-120 |

-111 |

|

Financial interest paid |

-21 |

-15 |

|

Net cash flow from financing activities |

325 |

333 |

|

Net debt:

Current and non-current financial liabilities - cash and cash equivalents

|

|

||

|

|

|

|

Non-current liabilities* |

|||

Financial liabilities |

2,201 |

2,270 |

|

Current liabilities* |

|||

Financial liabilities |

454 |

546 |

|

Lease liabilities (IFRS 16) |

747 |

687 |

|

Loan hedging instruments |

-13 |

-10 |

|

Cash and cash equivalents |

-756 |

-837 |

|

Net debt |

2,633 |

2,656 |

|

* Excluding lease liabilities

Diluted earnings per share (net profit attributable to shareholders divided by the number of diluted shares and adjusted):

Diluted earnings per share is determined by adjusting the net profit attributable to ordinary shareholders and the weighted average number of ordinary shares outstanding by the effects of all potentially diluting ordinary shares. These include convertible bonds, stock options and incentive share awards granted to employees when the required performance conditions have been met at the end of the financial year.

NB: The alternative performance measures (APMs) are defined in Appendix

View source version on businesswire.com: https://www.businesswire.com/news/home/20220727005551/en/

FINANCIAL ANALYSTS AND INVESTORS

Investor relations and financial

communication department

TELEPERFORMANCE

Tel: +33 1 53 83 59 15

investor@teleperformance.com

PRESS RELATIONS

Karine Allouis – Leslie Jung-Isenwater –

IMAGE7

Tel: +33 1 53 70 74 70

teleperformance@image7.fr

PRESS RELATIONS

TELEPERFORMANCE

Tel: + 1 801-257-5811

mark.pfeiffer@teleperformance.com

Source: