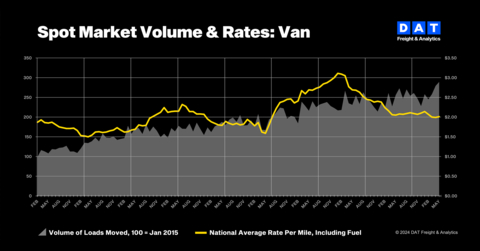

DAT: Truckload spot rates gained in May on robust van and reefer volumes

DAT: Truckload spot rates gained in May on robust van and reefer volumes (Graphic: DAT Freight & Analytics)

The DAT Truckload Volume Index (TVI), an indicator of loads moved during a given month, hit all-time highs for van and refrigerated (“reefer”) loads:

-

Van TVI: 289, up

4% from April -

Reefer TVI: 224, a

4% increase month over month -

Flatbed TVI: 301, down

2% from April

The van and reefer TVI numbers climbed

“Stronger van and reefer volumes are consistent with May, when shippers move seasonal produce and retail goods and truckload capacity tightens due to the Roadcheck inspection event and Memorial Day holiday,” said Ken Adamo, DAT Chief of Analytics. “Carrier attrition created further pressure on capacity.”

Spot rates reflected higher demand

Spot prices responded last month, with national average van and reefer line-haul rates within

-

Spot van:

$2.01 2 cents -

Spot reefer:

$2.41 9 cents -

Spot flatbed:

$2.52

Line-haul rates, which subtract an amount equal to an average fuel surcharge, increased for all three equipment types. The average van line-haul rate was

National average rates for contracted van and reefer freight declined compared to April:

-

Contract van rate:

$2.43 2 cents -

Contract reefer rate:

$2.79 3 cents -

Contract flatbed rate:

$3.16 1 cent

Load-to-truck ratios edged higher

National average van and reefer load-to-truck ratios rose in May:

- Van ratio: 4.4, up from 1.9 in April, meaning there were 4.4 loads for every van truck on the DAT One marketplace

- Reefer ratio: 6.3, up from 4.8

- Flatbed ratio: 18.0, down from 18.5

Load-to-truck ratios reflect truckload supply and demand on the DAT One marketplace and indicate the pricing environment for spot truckload freight.

About the DAT Truckload Volume Index

The DAT Truckload Volume Index reflects the change in the number of loads with a pickup date during that month. A baseline of 100 equals the number of loads moved in January 2015, as recorded in DAT RateView, a truckload pricing database and analysis tool with rates paid on an average of 3 million loads per month.

DAT benchmark spot rates are derived from invoice data for hauls of 250 miles or more with a pickup date during the month reported. Line-haul rates subtract an amount equal to an average fuel surcharge.

About DAT Freight & Analytics

DAT Freight & Analytics operates both the largest truckload freight marketplace and truckload freight data analytics service in

Founded in 1978, DAT is a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000. DAT is headquartered in

View source version on businesswire.com: https://www.businesswire.com/news/home/20240618135924/en/

Annabel Reeves

Corporate Communications, DAT Freight & Analytics

PR@dat.com / annabel.reeves@dat.com; 503-501-0143

Source: DAT Freight & Analytics