Stillwater Critical Minerals Drills Wide and High-Grade Nickel, Platinum, and Palladium Mineralization in Resource Expansion Drilling at Stillwater West in Montana, USA

Rhea-AI Summary

Stillwater Critical Minerals has announced the results of its 2023 drilling campaign at its Stillwater West project in Montana, funded by Glencore's strategic equity investments totaling approximately $7.05 million. High-grade nickel, platinum, and palladium mineralization was discovered, with significant intersections including 3.96 g/t Pt and 2.84 g/t Pd. Six holes totaling 2,310 meters were drilled, revealing potential to expand mineral resources at various cut-off grades. Highlights include 44.2m at 0.83 g/t 3E and 347.3m at 0.20% NiEq. The drilling campaign has also advanced the geological model of the Stillwater Igneous Complex, demonstrating three styles of mineralization: Platreef-style, N-series, and reef-type. The company is focused on further expansion and potential production scenarios, with rhodium assay results pending.

Positive

- High-grade nickel, platinum, and palladium mineralization discovered.

- Significant intersections: 3.96 g/t Pt and 2.84 g/t Pd.

- Potential to expand mineral resources at various cut-off grades.

- Positive results from six drilled holes totaling 2,310 meters.

- Glencore's strategic equity investments totaling $7.05 million.

- Advanced geological model of the Stillwater Igneous Complex.

- Three styles of mineralization demonstrated: Platreef-style, N-series, reef-type.

Negative

- None.

News Market Reaction

On the day this news was published, PGEZF gained 8.29%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

VANCOUVER, BC / ACCESSWIRE / June 26, 2024 / Stillwater Critical Minerals Corp. (TSXV:PGE)(OTCQB:PGEZF)(FSE:J0G) (the "Company" or "Stillwater") is pleased to provide the final tranche of drill results from resource expansion drilling completed at the Company's flagship Stillwater West Ni-PGE-Cu-Co + Au project in Montana in 2023.

The campaign was funded by a June 2023 strategic equity investment by Glencore Canada Corporation, a wholly owned subsidiary of Glencore plc ("Glencore"). Glencore has also provided on-going technical support to the project through the technical committee which included multiple site visits and assistance with geological and geophysical interpretations. As announced May 1, 2024, Glencore made an additional investment in Stillwater, bringing them to a

Highlights

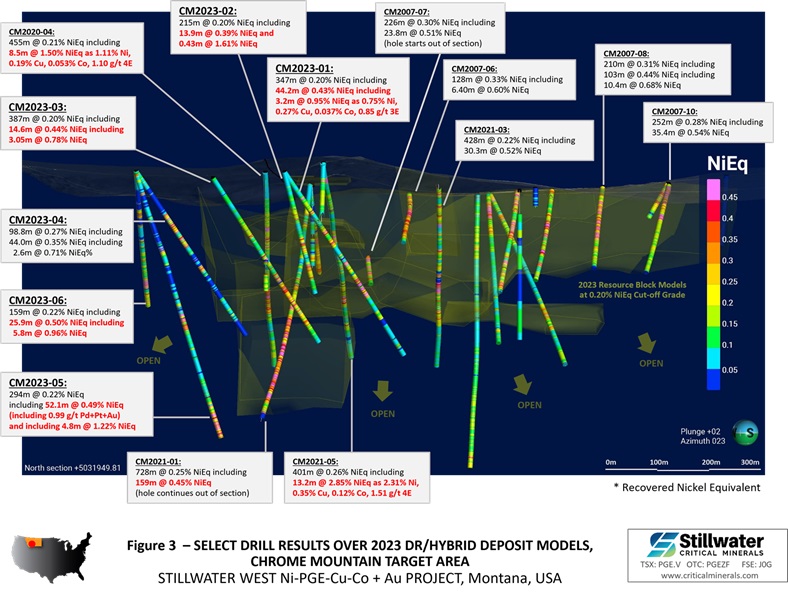

- Six holes totaling 2,310 meters were completed with a focus on expanding deposits at the west end of the current nine-kilometer-long Stillwater West resource area.

- Holes CM2023-01, -02 and -03, reported here, targeted and successfully intercepted magmatic nickel and copper sulphide mineralization with significant platinum group element ("PGE") in several styles of mineralization, furthering known parallels with the Bushveld Igneous Complex, in particular the Northern Limb, or Platreef.

- Drilling also successfully intercepted N-series mineralization in structures that are not known in the Bushveld Igneous Complex but have now been modeled in a series of eight north-south trending structures at Stillwater West. As announced on December 5, 2023, the N structures contain high-grade nickel sulphide mineralization that was first discovered by the Company in drill holes CM2020-04 and CM2021-05 and later re-interpreted.

- Multiple high-grade base and precious metals intervals were returned including multigram PGE intercepts ranging up to 3.96 g/t Pt and 2.84 g/t Pd over 1.16 meters ("m") starting at 308.8m in CM2023-03, in addition to wider intervals such as 44.2m at 0.83 g/t 3E (Pd+Pt+Au) starting at 252.7m in CM2023-01.

- Results demonstrate significant potential to expand the 2023 Mineral Resource Estimate ("MRE") at three cut-off grades, with wide widths of higher-grade mineralization at >

0.70% recovered Nickel Equivalent ("NiEq") cut-off grade contained within thick mid-grade intervals at >0.35% NiEq cut-off that are in turn set within long lengths of potential bulk tonnage mineralization at >0.20% NiEq cut-off grade, including:- CM2023-01:

- Bulk tonnage: 347.3 meters @

0.20% NiEq (0 to 347.3m); - Mid-grade: 44.2 meters @

0.43% NiEq (252.7 to 296.9m); - High-grade: 3.2 meters @

0.95% NiEq (60.7 to 63.9m).

- Bulk tonnage: 347.3 meters @

- CM2023-02:

- Bulk tonnage: 214.9 meters @

0.20% NiEq (28.4 to 243.2m); - Mid-grade: 13.9 meters @

0.39% NiEq (184.6 to 198.4m);

- Bulk tonnage: 214.9 meters @

- CM2023-01:

- High-grade: 0.43 meters @

1.61% NiEq (71.6 to 72.1m).- CM2023-03:

- Bulk tonnage: 386.8 meters @

0.20% NiEq (0 to 386.8m); - Mid-grade: 11.0 meters @

0.44% NiEq (182.3 to 193.2m)

- Bulk tonnage: 386.8 meters @

- CM2023-03:

and 14.6 meters @

- High-grade: 3.66 meters @

0.78% NiEq (189.6 to 193.2m)

and 3.05 meters @

- Results continue to drive the first ever detailed geological model completed across the lower Stillwater Igneous Complex, with these results further demonstrating three mineralization styles in particular: 1) broad Platreef-style Ni-PGE-Cu-Co mineralization; 2) nickel sulphide-rich N-series mineralization; and 3) stratiform reef-type PGE-Ni-Cu chromitite mineralization, as detailed below.

- All deposits and mineralization remain open for expansion in planned follow-up drilling.

- The Company is also looking at the ferrochrome potential of the Stillwater West project, driven by the 2.3-billion-pound chromium resource defined by the January 2023 MRE and historic production of chromium from the Stillwater district.

- Rhodium assay results are pending.

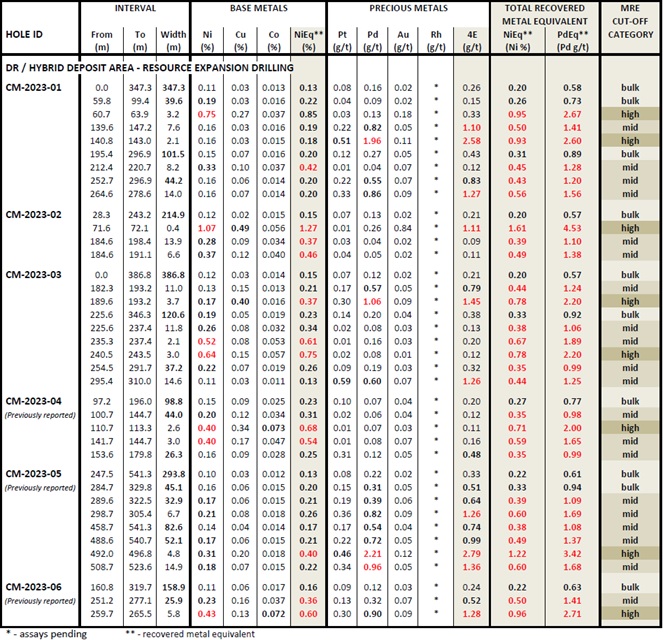

Table 1 - Highlight Results from the 2023 Expansion Drill Campaign in the DR/Hybrid Deposit Area at Chrome Mountain, Stillwater West Project, Montana, USA

Highlighted significant intercepts with grade-thickness values over 7 percent-meter recovered NiEq are presented above, except as noted. Recovered Nickel Equivalents ("NiEq") are presented for comparative purposes using conservative long-term metal prices (all USD):

Table 2 - Drill Hole Location and Depths

Stillwater's President and CEO, Michael Rowley, said "We are very pleased with the expansion of known mineralization that was returned by our 2023 drill campaign and the potential we continue to see in several possible mining scenarios at Stillwater West. Our drill campaigns have successfully leveraged a substantial historic database to arrive at a total of approximately 40,000 meters of drilling in 236 holes to date. That wealth of data, combined with Glencore's backing and in-house expertise from similar geology in South Africa's Bushveld Igneous Complex, has positioned us exceptionally well with the largest nickel resource in an active American mining district at a time when the US is looking to onshore supply chains of nine of the commodities we have inventoried. We look forward to further announcements with a focus on continued expansion at Stillwater West while also turning our attention to various studies relating to potential production scenarios, as well as updates on other initiatives including non-core assets."

Dr. Danie Grobler, Vice-President Exploration commented, "Results from the 2023 drill campaign demonstrate the accuracy of our developing model of the Stillwater Igneous Complex while providing essential data from areas that have never been drill tested previously. Multiple highly mineralized intervals were encountered in which we continue to see strong parallels with the Bushveld Igneous Complex including net-textured to semi-massive magmatic sulphides, chromitite seams, and wider pegmatoidal chromite-rich PGE mineralized zones that are directly comparable to the Platreef-style of mineralization reported for the Flatreef deposit of Ivanhoe Mines on the Northern Limb of the Bushveld. The Chromite-rich high-grade intersections reported within these wider zones are comparable in grade and thickness to the Merensky and UG2 reefs of South Africa which produce approximately

Mineralization Styles

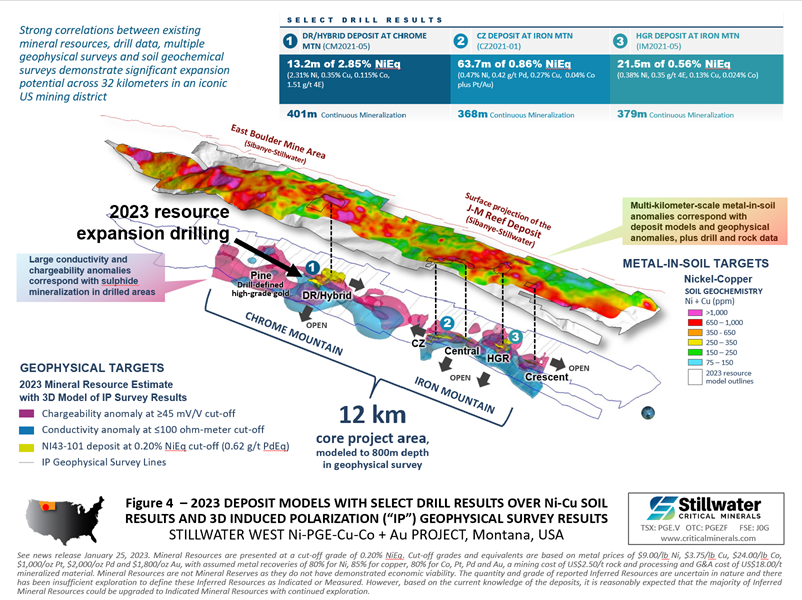

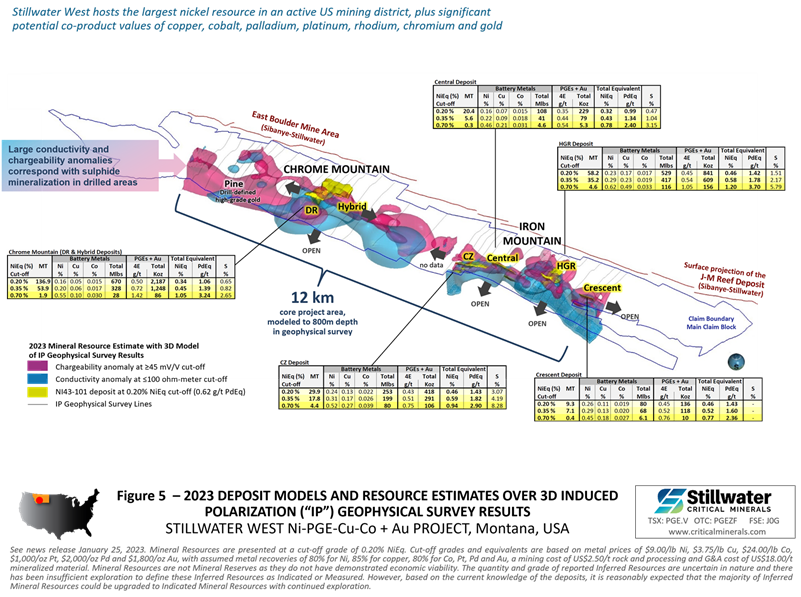

Results continue to advance the first ever detailed geological model of the lower Stillwater Igneous Complex, with an initial focus on the 25-kilometer-long main claim block that hosts the current resources. Informed by senior in-house expertise from similar geology in the Bushveld Igneous Complex, the Company's 3D geologic model demonstrated a very high success rate during the 2023 campaign, intersecting the following mineralization styles:

1 - Platreef-style Ni-PGE-Cu-Co mineralization - The Stillwater West project covers the lower Stillwater Igneous Complex stratigraphy immediately adjacent to Sibanye-Stillwater's mining operations on the J-M Reef deposit, a 40km-long reef deposit that contains the highest palladium-platinum grades in the world, hosted within nickel-copper sulphide. Recognizing the geologic parallels with South Africa's Bushveld Igneous Complex, the Company has successfully defined large-scale deposits in Montana's Stillwater Igneous Complex that are directly analogous to the giant mines of the Platreef.

Production on the northern limb of the Bushveld, or Platreef, started in 1993 at Anglo American's Mogalakwena mines and will be joined by Ivanhoe's Platreef mine later this year. Although known primarily as a platinum group element mine, Mogalakwena is one of the largest nickel sulphide mines in the world and is the largest nickel producer in South Africa, in addition to producing a significant amount of copper. Ivanhoe's Platreef mine is projected to become the second largest nickel producer in South Africa.

The mines of the Platreef are attractive because they are among the largest and most profitable mines in the world. Their scale and grade allow the application of mechanized bulk mining methods with resulting economies of scale and low operating costs. These deposits also contain significant quantities of nickel, copper, and platinum group metals in a polymetallic combination that is globally very rare.

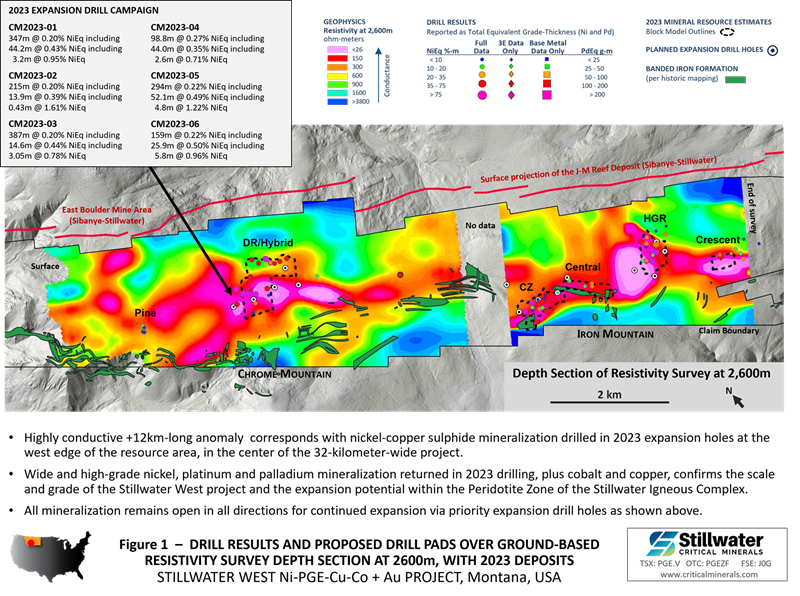

To date, the Company has modeled five deposits of Platreef-style mineralization located primarily in the peridotite zone of the lower Stillwater Igneous Complex, hosting a total of 1.6 billion pounds of nickel, copper and cobalt, and 3.8 million ounces of palladium, platinum, rhodium, and gold, as announced January 2023. See Figure 2 for a 3D presentation of the peridotite zone in context of Stillwater complex geology at the west end of the Chrome Mountain resource area.

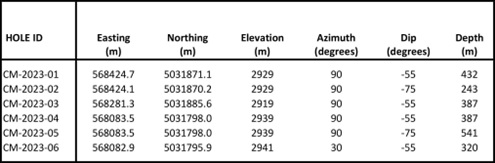

The peridotite zone at Stillwater varies from approximately 400 to 800m in thickness and spans the 32-kilometer length of the Stillwater West project. Expansion drilling in 2023 confirmed Platreef-style mineralization in the first ever drill tests of an EM geophysical anomaly within the peridotite zone that forms part of a string of anomalies extending over 12 kilometers along strike associated with sulphide-bearing hornfels and banded iron formation proximal to the Stillwater Igneous Complex footwall contact. As reported May 23, 2024, these drill results contain significant evidence of assimilation textures and high sulphide contents reminiscent of incorporation of crustal sulphur into the magma from the footwall sediments.

Additional drilling is planned to further expand this discovery in addition to continued expansion of mineral resources within the peridotite zone.

2 - N-Series Structures - N-series mineralization consists of north-south trending structures that crosscut the broadly layered nature of the Stillwater Igneous Complex. As announced on December 5, 2023, the N structures contain high-grade nickel sulphide mineralization that was first discovered by the Company in drill holes CM2020-04 and CM2021-05. First reported on March 3, 2021 and later re-interpreted, hole CM2020-04 returned 8.5 meters of

As shown in Figure 2, modeling has now identified eight N-series structures in the Chrome Mountain area and confirmed the existence of similar N-structures more broadly across Stillwater West. A high-resolution ground magnetic survey early in the 2023 field season enabled a more detailed geologic model, leading directly to the intersection of the N1 and N2 structures in holes CM2023-01 to 05.

Drilling in 2023 successfully intersected the N1 and N2 structures, which are thought to be related to distinctly sulphur-rich mineralization closely associated with the cross-cutting N-series structures identified during 2022. The N-structures exhibit enhanced hydrothermal alteration associated with intrusive gabbroic dykes containing elevated Ni+Cu+PGE+Au grades and tenors that were encountered in holes CM2023-01 to 05. The N1 structure in CM2023-01 contains a high-grade interval of 3.2 meters of

3 - Reef-type PGE-Ni-Cu Mineralization - Stillwater West contains another mineralization style that is common in layered magmatic systems, the narrower but higher-grade Reef-type deposits. Historically, the majority of the world's supply of platinum group elements ("PGE") has been sourced from mines of this type, and the close proximity of Sibanye-Stillwater's world-class J-M Reef deposit makes Stillwater West highly prospective for high-grade PGE-Ni-Cu reef deposits.

The 2023 drill campaign intersected two wide zones of chromite-rich pegmatoidal pyroxenite/harzburgite associated with PGE+Au+Ni+Cu mineralization within the lower part of the Peridotite Zone of the Stillwater Layered Complex correlated with the known A and B Chromitite seams. These mineralized zones have been intersected in five of the six holes drilled during 2023. In drill hole CM2023-01, the B-Chromitite contains 2.1 meters at 2.58 g/t 3E and

Drilling in 2023 confirmed continuity of the stratiform pegmatoidal reef-type "A-B" chromitite zone discovered on Chrome Mountain, providing an important foundation for follow-up drill campaigns. As reported May 23, 2024, drillhole CM2023-05 also intersected two chromite-rich high-grade PGE horizons towards the bottom part of the hole. These zones returned significant PGE+Ni-Cu mineralization characteristic of the stratiform reef-type high-grade "A-B" chromitite, containing a high-grade zone of 2.79 g/t PGE+Au, plus also

Option Grant

The Company further announces it has granted 1,690,000 incentive stock options (the "Options") to certain Directors and Officers of the Company, plus additional Options to certain employees and consultants of the Company. The Options are exercisable for up to five years, expiring on June 26, 2029, and each Option will allow the holder to purchase one common share of the Company at a price of

Upcoming Events

Stillwater is pleased to announce that President and CEO Michael Rowley will be presenting at the following events:

- The Montana Mining Association Annual General Meeting in Butte Montana July 8-10, 2024. For information and registration please click here.

- Precious Metals Summit, Beaver Creek, CO, September 10-13, 2024. For information and registration please click here.

About Stillwater Critical Minerals Corp.

Stillwater Critical Minerals (TSXV:PGE)(OTCQB:PGEZF)(FSE:J0G) is a mineral exploration company focused on its flagship Stillwater West Ni-PGE-Cu-Co + Au project in the iconic and famously productive Stillwater mining district in Montana, USA. With the addition of two renowned Bushveld and Platreef geologists to the team and strategic investments by Glencore, the Company is well positioned to advance the next phase of large-scale critical mineral supply from this world-class American district, building on past production of nickel, copper, and chromium, and the on-going production of platinum group, nickel, and other metals by neighboring Sibanye-Stillwater. An expanded NI 43-101 mineral resource estimate, released January 2023, positions Stillwater West with the largest nickel resource in an active US mining district as part of a compelling suite of nine minerals now listed as critical in the USA. To date, five Platreef-style nickel and copper sulphide deposits host a total of 1.6 billion pounds of nickel, copper and cobalt, and 3.8 million ounces of palladium, platinum, rhodium, and gold at Stillwater West, and all deposits remain open for expansion along trend and at depth.

Stillwater also holds the high-grade Black Lake-Drayton Gold project adjacent to Treasury Metals' development-stage Goliath Gold Complex in northwest Ontario, currently under an earn-in agreement with Heritage Mining, and the Kluane PGE-Ni-Cu-Co critical minerals project on trend with Nickel Creek Platinum‘s Wellgreen deposit in Canada‘s Yukon Territory.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Michael Rowley, President, CEO & Director - Stillwater Critical Minerals

Email: info@criticalminerals.com Phone: (604) 357 4790

Web: http://criticalminerals.com Toll Free: (888) 432 0075

Quality Control and Quality Assurance

2023 drill core samples were analyzed by ACT Labs in Vancouver, B.C. Sample preparation: crush (< 7 kg) up to

Mr. Mike Ostenson, P.Geo., is the qualified person for the purposes of National Instrument 43-101, and he has reviewed and approved the technical disclosure contained in this news release.

Forward-Looking Statements

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Stillwater Critical Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Stillwater Critical Minerals and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Stillwater Critical Minerals

View the original press release on accesswire.com