PagerDuty Announces Fourth Quarter and Full Year Fiscal 2023 Financial Results

Fourth quarter revenue increased

Fourth quarter GAAP operating loss of

“PagerDuty had another strong year where we grew revenue

Fourth Quarter Fiscal 2023 Financial Highlights

-

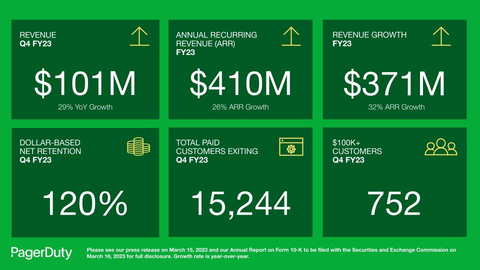

Revenue was

$101.0 million 28.6% year over year. -

GAAP operating loss was

$26.5 million -

Non-GAAP operating income was

$6.1 million 6.1% . -

GAAP net loss per share attributable to

PagerDuty, Inc. was$0.27 PagerDuty, Inc. was$0.08 -

Operating cash flow was

$17.6 million $15.6 million -

Cash, cash equivalents and current investments were

$477.0 million January 31, 2023 .

Full Year Fiscal 2023 Financial Highlights

-

Revenue was

$370.8 million 31.8% year over year. -

GAAP operating loss was

$129.4 million -

Non-GAAP operating income was

$3.5 million 0.9% . -

GAAP net loss per share attributable to

PagerDuty, Inc. was$1.45 PagerDuty, Inc. was$0.07 -

Operating cash flow was

$17.0 million $8.5 million

The section titled “Non-GAAP Financial Measures” below contains a description of the non-GAAP financial measures and reconciliations between historical GAAP and non-GAAP information.

Fourth Quarter and Recent Highlights

-

Finished the fourth quarter with 15,244 total paid customers as of

January 31, 2023 , compared to 14,865 in the year ago period. -

Reported 752 customers with annual recurring revenue ("ARR") over

$100,000 January 31, 2023 , compared to 594 in the year ago period. -

Reported 50 customers with ARR over

$1,000,000 January 31, 2023 , compared to 43 in the year ago period. -

Delivered a dollar-based net retention rate of

120% as ofJanuary 31, 2023 , compared to124% in the year ago period. -

Reported international revenue of

24% of total revenue for the year endedJanuary 31, 2023 , consistent with the year ago period. - Announced the general availability of PagerDuty Status Pages.

-

Announced the availability of

PagerDuty for Customer Service in ServiceNow CSM. -

Expanded leadership team with appointment of

Jeremy Kmet as Senior Vice President of Global Field Operations. - Published Third Annual Inclusion, Diversity, & Equity (ID&E) Report.

- Featured case study: BRINKS

- Land and Expands include: Carrefour, IBM, Recruit Holdings, Proofpoint, Trimble and Workday

Financial Outlook

For the first quarter of fiscal 2024,

-

Total revenue of

$102.0 million $104.0 million 19% -22% year over year -

Non-GAAP net income per diluted share attributable to

PagerDuty, Inc. of$0.09 $0.10

For the full fiscal year 2024,

-

Total revenue of

$446.0 million $452.0 million 20% -22% year over year -

Non-GAAP net income per diluted share attributable to

PagerDuty, Inc. of$0.45 $0.50

These statements are forward-looking and actual results may differ materially. Please refer to the Forward-Looking Statements section below for information on the factors that could cause our actual results to differ materially from these forward-looking statements.

Conference Call Information:

Supplemental Financial and Other Information:

Supplemental financial and other information can be accessed through PagerDuty’s investor relations website at investor.pagerduty.com.

Non-GAAP Financial Measures:

This press release and the accompanying tables contain the following non-GAAP financial measures: non-GAAP gross profit, non-GAAP gross margin, non-GAAP research and development, non-GAAP sales and marketing, non-GAAP general and administrative, non-GAAP operating income (loss), non-GAAP operating margin, non-GAAP net income (loss) attributable to

The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in PagerDuty’s financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgment by PagerDuty’s management about which expenses and income are excluded or included in determining these non-GAAP financial measures. A reconciliation is provided below for each historical non-GAAP financial measure to the most directly comparable financial measure presented in accordance with GAAP.

Specifically,

Stock-based Compensation:

Employer Taxes Related to Employee Stock Transactions:

Amortization of Acquired Intangible Assets:

Acquisition-Related Expenses:

Amortization of Debt Issuance Costs: The imputed interest rate of the Convertible Senior Notes (the "Notes") was approximately

Restructuring costs:

Income Tax Effect of Non-GAAP Adjustments:

There are a number of limitations related to the use of free cash flow as compared to net cash provided by (used in) operating activities, including that free cash flow includes capital expenditures, the benefits of which are realized in periods subsequent to those when expenditures are made.

Please see the reconciliation tables at the end of this release for the reconciliation of GAAP and non-GAAP results.

Forward-Looking Statements:

This press release contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding our future financial performance and outlook and market positioning. Words such as “expect,” “extend,” “anticipate,” “should,” “believe,” “hope,” “target,” “project,” “accelerate,” “goals,” “estimate,” “potential,” “predict,” “may,” “will,” “might,” “could,” “intend,” “shall” and variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond our control. Our actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to, risks and other factors detailed in our Annual Report on Form 10-K filed with the

Past performance is not necessarily indicative of future results. The forward-looking statements included in this press release represent our views as of the date of this press release. We anticipate that subsequent events and developments will cause our views to change. We undertake no intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this press release.

About

Consolidated Statements of Operations (in thousands, except per share data) (unaudited) |

|||||||||||||||

|

Three Months Ended |

|

Year Ended |

||||||||||||

|

2023 |

|

2022 |

|

2023 |

|

2022 |

||||||||

Revenue |

$ |

100,966 |

|

|

$ |

78,509 |

|

|

$ |

370,793 |

|

|

$ |

281,396 |

|

Cost of revenue(1) |

|

18,344 |

|

|

|

13,928 |

|

|

|

70,434 |

|

|

|

48,361 |

|

Gross profit |

|

82,622 |

|

|

|

64,581 |

|

|

|

300,359 |

|

|

|

233,035 |

|

Operating expenses: |

|

|

|

|

|

|

|

||||||||

Research and development(1) |

|

34,569 |

|

|

|

27,628 |

|

|

|

134,876 |

|

|

|

95,690 |

|

Sales and marketing(1) |

|

52,621 |

|

|

|

43,400 |

|

|

|

195,622 |

|

|

|

161,624 |

|

General and administrative(1) |

|

21,922 |

|

|

|

20,752 |

|

|

|

99,238 |

|

|

|

77,432 |

|

Total operating expenses |

|

109,112 |

|

|

|

91,780 |

|

|

|

429,736 |

|

|

|

334,746 |

|

Loss from operations |

|

(26,490 |

) |

|

|

(27,199 |

) |

|

|

(129,377 |

) |

|

|

(101,711 |

) |

Interest income |

|

2,005 |

|

|

|

640 |

|

|

|

4,765 |

|

|

|

2,946 |

|

Interest expense |

|

(1,361 |

) |

|

|

(1,353 |

) |

|

|

(5,433 |

) |

|

|

(5,398 |

) |

Other income (expense), net |

|

1,307 |

|

|

|

(826 |

) |

|

|

(19 |

) |

|

|

(2,757 |

) |

Loss before (provision for) benefit from income taxes |

|

(24,539 |

) |

|

|

(28,738 |

) |

|

|

(130,064 |

) |

|

|

(106,920 |

) |

(Provision for) benefit from income taxes |

|

(463 |

) |

|

|

(157 |

) |

|

|

839 |

|

|

|

(535 |

) |

Net loss |

$ |

(25,002 |

) |

|

$ |

(28,895 |

) |

|

$ |

(129,225 |

) |

|

$ |

(107,455 |

) |

Net loss attributable to redeemable non-controlling interest |

|

(440 |

) |

|

|

— |

|

|

|

(802 |

) |

|

|

— |

|

Net loss attributable to |

|

(24,562 |

) |

|

|

(28,895 |

) |

|

|

(128,423 |

) |

|

|

(107,455 |

) |

Net loss per share, basic and diluted, attributable to |

$ |

(0.27 |

) |

|

$ |

(0.34 |

) |

|

$ |

(1.45 |

) |

|

$ |

(1.27 |

) |

Weighted-average shares used in calculating net loss per share, basic and diluted |

|

90,269 |

|

|

|

86,101 |

|

|

|

88,721 |

|

|

|

84,514 |

|

(1) Includes stock-based compensation expense as follows: |

|||||||||||

|

Three Months Ended |

|

Year Ended |

||||||||

|

2023 |

|

2022 |

|

2023 |

|

2022 |

||||

Cost of revenue |

$ |

1,879 |

|

$ |

1,191 |

|

$ |

6,827 |

|

$ |

3,751 |

Research and development |

|

8,946 |

|

|

7,534 |

|

|

39,012 |

|

|

23,764 |

Sales and marketing |

|

7,271 |

|

|

6,051 |

|

|

29,804 |

|

|

19,012 |

General and administrative |

|

5,333 |

|

|

7,391 |

|

|

34,264 |

|

|

23,506 |

Total |

$ |

23,429 |

|

$ |

22,167 |

|

$ |

109,907 |

|

$ |

70,033 |

Consolidated Balance Sheets (in thousands) |

|||||||

|

As of |

||||||

|

2023 |

|

2022 |

||||

|

(unaudited) |

|

|

||||

Assets |

|

|

|

||||

Current assets: |

|

|

|

||||

Cash and cash equivalents |

$ |

274,019 |

|

|

$ |

349,785 |

|

Investments |

|

202,948 |

|

|

|

193,571 |

|

Accounts receivable, net of allowance for credit losses of |

|

91,345 |

|

|

|

75,279 |

|

Deferred contract costs, current |

|

18,674 |

|

|

|

16,672 |

|

Prepaid expenses and other current assets |

|

13,350 |

|

|

|

9,777 |

|

Total current assets |

|

600,336 |

|

|

|

645,084 |

|

Property and equipment, net |

|

18,390 |

|

|

|

18,229 |

|

Deferred contract costs, non-current |

|

27,715 |

|

|

|

26,159 |

|

Lease right-of-use assets |

|

13,982 |

|

|

|

20,227 |

|

|

|

118,862 |

|

|

|

72,126 |

|

Intangible assets, net |

|

37,224 |

|

|

|

23,133 |

|

Other assets |

|

1,364 |

|

|

|

1,490 |

|

Total assets |

$ |

817,873 |

|

|

$ |

806,448 |

|

Liabilities and stockholders’ equity |

|

|

|

||||

Current liabilities: |

|

|

|

||||

Accounts payable |

$ |

7,398 |

|

|

$ |

9,505 |

|

Accrued expenses and other current liabilities |

|

11,804 |

|

|

|

13,640 |

|

Accrued compensation |

|

41,834 |

|

|

|

35,327 |

|

Deferred revenue, current |

|

204,137 |

|

|

|

162,881 |

|

Lease liabilities, current |

|

5,904 |

|

|

|

5,637 |

|

Total current liabilities |

|

271,077 |

|

|

|

226,990 |

|

Convertible senior notes, net |

|

282,908 |

|

|

|

281,069 |

|

Deferred revenue, non-current |

|

4,914 |

|

|

|

7,343 |

|

Lease liabilities, non-current |

|

12,704 |

|

|

|

20,912 |

|

Other liabilities |

|

4,184 |

|

|

|

3,159 |

|

Total liabilities |

|

575,787 |

|

|

|

539,473 |

|

Redeemable non-controlling interest |

|

1,108 |

|

|

|

— |

|

Stockholders’ equity: |

|

|

|

||||

Common stock |

|

— |

|

|

|

— |

|

Additional paid-in-capital |

|

719,816 |

|

|

|

616,467 |

|

Accumulated other comprehensive loss |

|

(1,592 |

) |

|

|

(669 |

) |

Accumulated deficit |

|

(477,246 |

) |

|

|

(348,823 |

) |

Total stockholders’ equity |

|

240,978 |

|

|

|

266,975 |

|

Total liabilities, redeemable non-controlling interest, and stockholders’ equity |

$ |

817,873 |

|

|

$ |

806,448 |

|

Consolidated Statements of Cash Flows (in thousands) (unaudited) |

|||||||||||||||

|

Three Months Ended |

|

Year Ended |

||||||||||||

|

2023 |

|

2022 |

|

2023 |

|

2022 |

||||||||

Cash flows from operating activities |

|

|

|

|

|

|

|

||||||||

Net loss attributable to |

|

(24,562 |

) |

|

|

(28,895 |

) |

|

|

(128,423 |

) |

|

|

(107,455 |

) |

Net loss attributable to redeemable non-controlling interest |

|

(440 |

) |

|

|

— |

|

|

|

(802 |

) |

|

|

— |

|

Net loss |

$ |

(25,002 |

) |

|

$ |

(28,895 |

) |

|

$ |

(129,225 |

) |

|

$ |

(107,455 |

) |

Adjustments to reconcile net loss to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

|

||||||||

Depreciation and amortization |

|

4,651 |

|

|

|

2,196 |

|

|

|

17,429 |

|

|

|

8,356 |

|

Amortization of deferred contract costs |

|

5,069 |

|

|

|

4,272 |

|

|

|

19,247 |

|

|

|

14,923 |

|

Amortization of debt issuance costs |

|

463 |

|

|

|

455 |

|

|

|

1,839 |

|

|

|

1,805 |

|

Stock-based compensation |

|

23,429 |

|

|

|

22,167 |

|

|

|

109,907 |

|

|

|

70,033 |

|

Non-cash lease expense |

|

1,160 |

|

|

|

1,133 |

|

|

|

4,073 |

|

|

|

4,464 |

|

Tax benefit related to release of valuation allowance |

|

— |

|

|

|

— |

|

|

|

(1,330 |

) |

|

|

— |

|

Other |

|

155 |

|

|

|

1,178 |

|

|

|

1,841 |

|

|

|

3,770 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

||||||||

Accounts receivable |

|

(19,634 |

) |

|

|

(21,954 |

) |

|

|

(16,586 |

) |

|

|

(21,594 |

) |

Deferred contract costs |

|

(6,482 |

) |

|

|

(9,325 |

) |

|

|

(22,805 |

) |

|

|

(26,167 |

) |

Prepaid expenses and other assets |

|

91 |

|

|

|

2,136 |

|

|

|

(2,843 |

) |

|

|

1,279 |

|

Accounts payable |

|

(356 |

) |

|

|

(935 |

) |

|

|

(1,473 |

) |

|

|

2,901 |

|

Accrued expenses and other liabilities |

|

(94 |

) |

|

|

(20 |

) |

|

|

(1,444 |

) |

|

|

(99 |

) |

Accrued compensation |

|

6,771 |

|

|

|

3,006 |

|

|

|

6,147 |

|

|

|

6,766 |

|

Deferred revenue |

|

29,336 |

|

|

|

27,374 |

|

|

|

37,971 |

|

|

|

40,252 |

|

Lease liabilities |

|

(1,985 |

) |

|

|

(1,443 |

) |

|

|

(5,768 |

) |

|

|

(5,255 |

) |

Net cash provided by (used in) operating activities |

|

17,572 |

|

|

|

1,345 |

|

|

|

16,980 |

|

|

|

(6,021 |

) |

Cash flows from investing activities |

|

|

|

|

|

|

|

||||||||

Purchases of property and equipment |

|

(882 |

) |

|

|

(2,081 |

) |

|

|

(4,637 |

) |

|

|

(3,457 |

) |

Capitalization of internal-use software costs |

|

(1,111 |

) |

|

|

(652 |

) |

|

|

(3,836 |

) |

|

|

(3,353 |

) |

Business acquisitions, net of cash acquired |

|

— |

|

|

|

— |

|

|

|

(66,262 |

) |

|

|

(160 |

) |

Asset acquisition |

|

— |

|

|

|

— |

|

|

|

(1,845 |

) |

|

|

— |

|

Purchases of available-for-sale investments |

|

(56,900 |

) |

|

|

(46,485 |

) |

|

|

(212,210 |

) |

|

|

(197,093 |

) |

Proceeds from maturities of available-for-sale investments |

|

53,000 |

|

|

|

37,443 |

|

|

|

202,625 |

|

|

|

194,059 |

|

Proceeds from sales of available-for-sale investments |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

27,380 |

|

Net cash (used in) provided by investing activities |

|

(5,893 |

) |

|

|

(11,775 |

) |

|

|

(86,165 |

) |

|

|

17,376 |

|

Cash flows from financing activities |

|

|

|

|

|

|

|

||||||||

Investment from redeemable non-controlling interest holder |

|

— |

|

|

|

— |

|

|

|

1,908 |

|

|

|

— |

|

Proceeds from employee stock purchase plan |

|

4,139 |

|

|

|

2,853 |

|

|

|

9,875 |

|

|

|

7,742 |

|

Proceeds from issuance of common stock upon exercise of stock options |

|

2,022 |

|

|

|

2,591 |

|

|

|

10,481 |

|

|

|

15,108 |

|

Employee payroll taxes paid related to net share settlement of restricted stock units |

|

(6,490 |

) |

|

|

(4,967 |

) |

|

|

(28,677 |

) |

|

|

(23,586 |

) |

Net cash (used in) provided by financing activities |

|

(329 |

) |

|

|

477 |

|

|

|

(6,413 |

) |

|

|

(736 |

) |

Effects of foreign currency exchange rates on cash, cash equivalents, and restricted cash |

|

336 |

|

|

|

— |

|

|

|

(168 |

) |

|

|

— |

|

Net increase (decrease) in cash, cash equivalents, and restricted cash |

|

11,686 |

|

|

|

(9,953 |

) |

|

|

(75,766 |

) |

|

|

10,619 |

|

Cash, cash equivalents, and restricted cash at beginning of period |

|

262,333 |

|

|

|

359,738 |

|

|

|

349,785 |

|

|

|

339,166 |

|

Cash, cash equivalents, and restricted cash at end of period |

$ |

274,019 |

|

|

$ |

349,785 |

|

|

$ |

274,019 |

|

|

$ |

349,785 |

|

Reconciliation of GAAP to Non-GAAP Financial Measures (in thousands, except percentages) (unaudited) |

|||||||||||||||

|

Three Months Ended |

|

Year Ended |

||||||||||||

|

2023 |

|

2022 |

|

2023 |

|

2022 |

||||||||

Reconciliation of gross profit and gross margin |

|

|

|

|

|

|

|

||||||||

GAAP gross profit |

$ |

82,622 |

|

|

$ |

64,581 |

|

|

$ |

300,359 |

|

|

$ |

233,035 |

|

Plus: Stock-based compensation |

|

1,879 |

|

|

|

1,191 |

|

|

$ |

6,827 |

|

|

$ |

3,751 |

|

Plus: Employer taxes related to employee stock transactions |

|

84 |

|

|

|

53 |

|

|

|

163 |

|

|

|

131 |

|

Plus: Amortization of acquired intangible assets |

|

2,087 |

|

|

|

280 |

|

|

|

7,401 |

|

|

|

1,120 |

|

Plus: Restructuring costs |

|

357 |

|

|

|

— |

|

|

|

357 |

|

|

|

— |

|

Non-GAAP gross profit |

$ |

87,029 |

|

|

$ |

66,105 |

|

|

$ |

315,107 |

|

|

$ |

238,037 |

|

GAAP gross margin |

|

81.8 |

% |

|

|

82.3 |

% |

|

|

81.0 |

% |

|

|

82.8 |

% |

Non-GAAP adjustments |

|

4.4 |

% |

|

|

1.9 |

% |

|

|

4.0 |

% |

|

|

1.8 |

% |

Non-GAAP gross margin |

|

86.2 |

% |

|

|

84.2 |

% |

|

|

85.0 |

% |

|

|

84.6 |

% |

|

|

|

|

|

|

|

|

||||||||

Reconciliation of operating expenses |

|

|

|

|

|

|

|

||||||||

GAAP research and development |

$ |

34,569 |

|

|

$ |

27,628 |

|

|

$ |

134,876 |

|

|

$ |

95,690 |

|

Less: Stock-based compensation |

|

(8,946 |

) |

|

|

(7,534 |

) |

|

$ |

(39,012 |

) |

|

$ |

(23,764 |

) |

Less: Employer taxes related to employee stock transactions |

|

(383 |

) |

|

|

(311 |

) |

|

|

(942 |

) |

|

|

(929 |

) |

Less: Acquisition-related expenses |

|

(5 |

) |

|

|

(441 |

) |

|

|

(3,105 |

) |

|

|

(1,789 |

) |

Less: Amortization of acquired intangible assets |

|

(87 |

) |

|

|

— |

|

|

|

(232 |

) |

|

|

— |

|

Less: Restructuring costs |

|

(2,004 |

) |

|

|

— |

|

|

|

(2,004 |

) |

|

|

— |

|

Non-GAAP research and development |

$ |

23,144 |

|

|

$ |

19,342 |

|

|

$ |

89,581 |

|

|

$ |

69,208 |

|

|

|

|

|

|

|

|

|

||||||||

GAAP sales and marketing |

$ |

52,621 |

|

|

$ |

43,400 |

|

|

$ |

195,622 |

|

|

$ |

161,624 |

|

Less: Stock-based compensation |

|

(7,271 |

) |

|

|

(6,051 |

) |

|

|

(29,804 |

) |

|

|

(19,012 |

) |

Less: Employer taxes related to employee stock transactions |

|

(424 |

) |

|

|

(232 |

) |

|

|

(892 |

) |

|

|

(765 |

) |

Less: Amortization of acquired intangible assets |

|

(610 |

) |

|

|

(595 |

) |

|

|

(2,546 |

) |

|

|

(2,380 |

) |

Less: Restructuring costs |

|

(2,200 |

) |

|

|

— |

|

|

|

(2,200 |

) |

|

|

— |

|

Non-GAAP sales and marketing |

$ |

42,116 |

|

|

$ |

36,522 |

|

|

$ |

160,180 |

|

|

$ |

139,467 |

|

|

|

|

|

|

|

|

|

||||||||

GAAP general and administrative |

$ |

21,922 |

|

|

$ |

20,752 |

|

|

$ |

99,238 |

|

|

$ |

77,432 |

|

Less: Stock-based compensation |

|

(5,333 |

) |

|

|

(7,391 |

) |

|

|

(34,264 |

) |

|

|

(23,506 |

) |

Less: Employer taxes related to employee stock transactions |

|

(449 |

) |

|

|

(335 |

) |

|

|

(1,099 |

) |

|

|

(1,192 |

) |

Less: Acquisition-related expenses |

|

— |

|

|

|

(311 |

) |

|

|

(1,454 |

) |

|

|

(319 |

) |

Less: Amortization of acquired intangible assets |

|

(22 |

) |

|

|

— |

|

|

|

(58 |

) |

|

|

— |

|

Less: Restructuring costs |

|

(474 |

) |

|

|

— |

|

|

|

(474 |

) |

|

|

— |

|

Non-GAAP general and administrative |

$ |

15,644 |

|

|

$ |

12,715 |

|

|

$ |

61,889 |

|

|

$ |

52,415 |

|

Reconciliation of GAAP to Non-GAAP Financial Measures (in thousands, except percentages and per share data) (unaudited) |

|||||||||||||||

|

Three Months Ended |

|

Year Ended |

||||||||||||

|

2023 |

|

2022 |

|

2023 |

|

2022 |

||||||||

Reconciliation of operating income (loss) and operating margin |

|

|

|

|

|

|

|

||||||||

GAAP operating loss |

$ |

(26,490 |

) |

|

$ |

(27,199 |

) |

|

$ |

(129,377 |

) |

|

$ |

(101,711 |

) |

Plus: Stock-based compensation |

|

23,429 |

|

|

|

22,167 |

|

|

|

109,907 |

|

|

|

70,033 |

|

Plus: Employer taxes related to employee stock transactions |

|

1,340 |

|

|

|

931 |

|

|

|

3,096 |

|

|

|

3,017 |

|

Plus: Amortization of acquired intangible assets |

|

2,806 |

|

|

|

875 |

|

|

|

10,237 |

|

|

|

3,500 |

|

Plus: Acquisition-related expenses |

|

5 |

|

|

|

752 |

|

|

|

4,559 |

|

|

|

2,108 |

|

Plus: Restructuring costs |

|

5,035 |

|

|

|

— |

|

|

|

5,035 |

|

|

|

— |

|

Non-GAAP operating income (loss) |

$ |

6,125 |

|

|

$ |

(2,474 |

) |

|

$ |

3,457 |

|

|

$ |

(23,053 |

) |

GAAP operating margin |

|

(26.2 |

) % |

|

|

(34.6 |

) % |

|

|

(34.9 |

) % |

|

|

(36.1 |

) % |

Non-GAAP adjustments |

|

32.3 |

% |

|

|

31.4 |

% |

|

|

35.8 |

% |

|

|

27.9 |

% |

Non-GAAP operating margin |

|

6.1 |

% |

|

|

(3.2 |

) % |

|

|

0.9 |

% |

|

|

(8.2 |

) % |

|

|

|

|

|

|

|

|

||||||||

Reconciliation of net income (loss) |

|

|

|

|

|

|

|

||||||||

GAAP net loss attributable to |

$ |

(24,562 |

) |

|

$ |

(28,895 |

) |

|

$ |

(128,423 |

) |

|

$ |

(107,455 |

) |

Plus: Stock-based compensation |

|

23,429 |

|

|

|

22,167 |

|

|

|

109,907 |

|

|

|

70,033 |

|

Plus: Employer taxes related to employee stock transactions |

|

1,340 |

|

|

|

931 |

|

|

|

3,096 |

|

|

|

3,017 |

|

Plus: Amortization of debt issuance costs |

|

463 |

|

|

|

455 |

|

|

|

1,839 |

|

|

|

1,805 |

|

Plus: Amortization of acquired intangible assets |

|

2,806 |

|

|

|

875 |

|

|

|

10,237 |

|

|

|

3,500 |

|

Plus: Acquisition-related expenses |

|

5 |

|

|

|

752 |

|

|

|

4,559 |

|

|

|

2,108 |

|

Plus: Restructuring costs |

|

5,035 |

|

|

|

— |

|

|

|

5,035 |

|

|

|

— |

|

Plus: Income tax effect of non-GAAP adjustments |

|

(1,226 |

) |

|

|

— |

|

|

|

(2,556 |

) |

|

|

— |

|

Non-GAAP net income (loss) attributable to |

$ |

7,290 |

|

|

$ |

(3,715 |

) |

|

$ |

3,694 |

|

|

$ |

(26,992 |

) |

|

|

|

|

|

|

|

|

||||||||

Reconciliation of net income (loss) per share, basic |

|

|

|

|

|

|

|

||||||||

GAAP net loss per share, basic, attributable to |

$ |

(0.27 |

) |

|

$ |

(0.34 |

) |

|

$ |

(1.45 |

) |

|

$ |

(1.27 |

) |

Non-GAAP adjustments to net loss attributable to |

|

0.35 |

|

|

|

0.30 |

|

|

|

1.49 |

|

|

|

0.95 |

|

Non-GAAP net income (loss) per share, basic, attributable to |

$ |

0.08 |

|

|

$ |

(0.04 |

) |

|

$ |

0.04 |

|

|

$ |

(0.32 |

) |

|

|

|

|

|

|

|

|

||||||||

Reconciliation of net income (loss) per share, diluted(1) |

|

|

|

|

|

|

|

||||||||

GAAP net loss per share, diluted, attributable to |

$ |

(0.27 |

) |

|

$ |

(0.34 |

) |

|

$ |

(1.45 |

) |

|

$ |

(1.27 |

) |

Non-GAAP adjustments to net loss attributable to |

|

0.35 |

|

|

|

0.30 |

|

|

|

1.52 |

|

|

|

0.95 |

|

Non-GAAP net income (loss) per share, diluted, attributable to |

$ |

0.08 |

|

|

$ |

(0.04 |

) |

|

$ |

0.07 |

|

|

$ |

(0.32 |

) |

|

|

|

|

|

|

|

|

||||||||

Weighted-average shares used in calculating GAAP net loss per share, basic and diluted |

|

90,269 |

|

|

|

86,101 |

|

|

|

88,721 |

|

|

|

84,514 |

|

|

|

|

|

|

|

|

|

||||||||

Weighted-average shares used in calculating non-GAAP net income (loss) per share |

|

|

|

|

|

|

|

||||||||

Basic |

|

90,269 |

|

|

|

86,101 |

|

|

|

88,721 |

|

|

|

84,514 |

|

Diluted |

|

101,747 |

|

|

|

86,101 |

|

|

|

100,862 |

|

|

|

84,514 |

|

Note: Certain figures may not sum due to rounding.

(1) The company uses the if-converted method to calculate the non-GAAP net income per diluted share attributable to

Reconciliation of GAAP to Non-GAAP Financial Measures (in thousands, except percentages and per share data) (unaudited) |

|||||||||||||||

Free Cash Flow |

|||||||||||||||

|

Three Months Ended |

|

Year Ended |

||||||||||||

|

2023 |

|

2022 |

|

2023 |

|

2022 |

||||||||

Net cash provided by (used in) operating activities |

$ |

17,572 |

|

|

$ |

1,345 |

|

|

$ |

16,980 |

|

|

$ |

(6,021 |

) |

Less: |

|

|

|

|

|

|

|

||||||||

Purchases of property and equipment |

|

(882 |

) |

|

|

(2,081 |

) |

|

|

(4,637 |

) |

|

|

(3,457 |

) |

Capitalization of internal-use software costs |

|

(1,111 |

) |

|

|

(652 |

) |

|

|

(3,836 |

) |

|

|

(3,353 |

) |

Free cash flow |

$ |

15,579 |

|

|

$ |

(1,388 |

) |

|

$ |

8,507 |

|

|

$ |

(12,831 |

) |

Net cash (used in) provided by investing activities |

$ |

(5,893 |

) |

|

$ |

(11,775 |

) |

|

$ |

(86,165 |

) |

|

$ |

17,376 |

|

Net cash (used in) provided by financing activities |

$ |

(329 |

) |

|

$ |

477 |

|

|

$ |

(6,413 |

) |

|

$ |

(736 |

) |

Free cash flow margin |

|

15.4 |

% |

|

|

(1.8 |

) % |

|

|

2.3 |

% |

|

|

(4.6 |

) % |

View source version on businesswire.com: https://www.businesswire.com/news/home/20230315005778/en/

Investor Relations Contact:

investor@pagerduty.com

SOURCE

Source: