Study Finds Electrifying NioCorp's Critical Minerals Mine Could Lead to Faster Time to Full Production Plus Significant Economic and Environmental Gains

Rhea-AI Summary

A recent study by Optimize Group Inc. suggests that NioCorp's Elk Creek Critical Minerals Mine could achieve significant economic and environmental benefits by switching to an electrified Railveyor system. This new approach could reduce initial capital expenditures (CAPEX) by 53.1%, operating expenses (OPEX) by 1.5%, and sustain capital expenses by 8.2%. The electrification could also cut the time to full production by five months and lower the mine's carbon footprint. The transition to a fully electric Railveyor system is not expected to delay the updated Feasibility Study.

Key findings include the potential for significant initial CAPEX reductions due to decreased pre-development time and infrastructure complexity, a reduction in operating cost-per-tonne of ore, and increased schedule flexibility. However, additional studies are needed to confirm these benefits.

Positive

- Potential 53.1% reduction in initial CAPEX, from $356 million to $167.1 million.

- Reduction in OPEX per tonne from $42.32 to $41.68, a decrease of 1.5%.

- Potential to cut the time to full production by five months.

- Lower carbon footprint with the Railveyor's reduced power consumption.

- Increased schedule flexibility for exploiting stopes economically.

- Electrification will not delay the updated Feasibility Study.

Negative

- Sustaining CAPEX could increase by 8.2%, from $198.4 million to $214.7 million.

- Additional study work is required to confirm the benefits of the new approach.

News Market Reaction 1 Alert

On the day this news was published, NB gained 0.92%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Mine Electrification and Replacement of Vertical Shafts with Railveyor™ System Could "Significantly" Reduce Initial CAPEX and OPEX1 for the Underground Mine Portion of NioCorp's proposed Elk Creek Critical Minerals Project

New Approach Could Cut NioCorp's Time to Full Commercial Production by as Much as 5 Months

Due to the Lower Power Consumption of the Railveyor System, Mine Electrification Could Reduce the Underground Mine's Carbon Footprint

Moving to an Electrified Mine with a Railveyor System Not Expected to Delay Completion of an Updated Feasibility Study, NioCorp Says

CENTENNIAL, CO / ACCESSWIRE / May 20, 2024 / A scoping study completed by Optimize Group Inc. ("Optimize") (https://optimizegroupinc.com/), NioCorp's contract mineral reserve engineering firm, suggests that NioCorp Developments Ltd. ("NioCorp" or the "Company") (Nasdaq:NB) could significantly cut CAPEX and OPEX costs, reach full commercial production sooner, and operate with a lower carbon footprint by electrifying its proposed Elk Creek Critical Minerals Mine ("Elk Creek Mine") via a Railveyor™ system instead of utilizing its currently planned vertical mining shafts.1 The development of the Elk Creek Mine and receipt of any of the benefits identified by the Optimize study are subject to, among other matters, the receipt of sufficient project financing to construct the planned Elk Creek Project facility.

A Railveyor system is a fully electric and autonomous bulk material handling system that delivers mined ore to processing facilities via a narrow-gauge light rail system propelled by low-horsepower drive stations adjacent to the rail route.

"This analysis points to many potentially powerful benefits of electrifying our Elk Creek Mine, both from an economic and an environmental perspective," said Mark A. Smith, CEO and Chairman of NioCorp. "The Optimize study hints at some very compelling potential benefits of this technology to NioCorp, including getting our critical minerals to market sooner and potentially lowering the CAPEX and OPEX associated with our underground operations."

"The Railveyor system is a tried-and-true technology that has been in operation for years in underground mines," said Scott Honan, NioCorp's Chief Operating Officer. "NioCorp is examining this option very seriously, and we do not anticipate that choosing this technology pathway will delay an update to the Feasibility Study for our Elk Creek Critical Minerals Project."

Findings of the Optimize Study

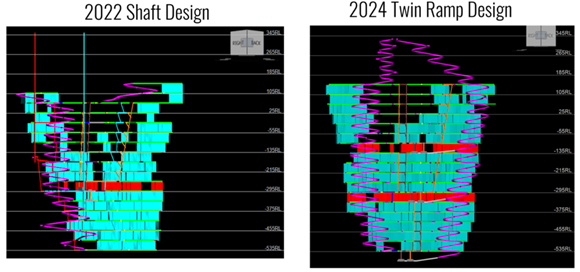

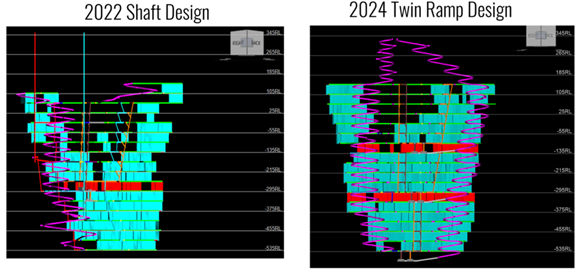

The study by Optimize examined the impacts of the following: removing the Elk Creek Mine's currently planned two vertical mining shafts and all required shaft infrastructure; creating a new twin ramp design to be used by the Railveyor system; determining the suitability for a Railveyor haulage system; considerations for electrification of the underground mobile equipment fleet; and a conceptual portal cut design to provide mobile equipment access through the upper soil layer from ground surface to the start of the ramp system in the underlying limestone.

The initial findings from the study by Optimize suggest that this new design could result in the following benefits:

- Potential significant reduction in initial CAPEX requirements due to reduced pre-development time and reduced infrastructure complexity;

- Increased schedule flexibility allowing for exploitation of stopes in an economically advantageous sequence; and

- Overall reduction in operating cost-per-tonne ore.

NioCorp's existing Feasibility Study shows full ore production at month 45 of the Elk Creek Project. In contrast, according to the Optimize study, the new twin ramp scenario could achieve full production at month 40, a savings of 5 months, due to the simplification of pre-development construction activities.

It should be noted that this scoping study was restricted to initial mine design, cost modelling, and scheduling. There has been no work completed on portal boxcut geotechnical, updated mine electrical distribution system, or modification to surface ventilation infrastructure. All assumptions utilized industry standards and best engineering judgment. NioCorp would require more study work to determine if this approach would be beneficial for the Company, but initial findings are positive.

| Project Outcomes Summary | ||||

Item | 2022 Shaft Scenario | 2024 Twin Ramp Scenario | Difference with Twin Ramp System | % Difference |

| Initial CAPEX (US | - | - | ||

| Sustaining CAPEX (US | ||||

| TOTAL CAPEX (US | - | - | ||

| OPEX/tonne | - | - | ||

Project Outcomes Summary | ||||

Item | 2022 Shaft Scenario | 2024 Twin Ramp Scenario | Difference with Twin Ramp System | % Difference |

Initial CAPEX (US | - | - | ||

Sustaining CAPEX (US | ||||

TOTAL CAPEX (US | - | - | ||

OPEX/tonne | - | - | ||

The Railveyor System

The design examined by Optimize removes the production shaft, ventilation shaft, and all material handling infrastructure. The removed infrastructure is replaced with two ramps. Ramp 1 would be for all personnel and equipment movement. The ramp has been designed with a maximum gradient of +/-

"The beauty of the Railveyor system is its simple and rugged design," said Scott Honan, NioCorp's COO. "It is well suited to operate in the challenging environment of an underground mine, and can be easily operated and maintained by individuals with a basic underground mining skill set."

According to Railveyor, the haulage system utilizes a train system with cars that will hold approximately 1.2 tonnes of material. These cars differ from a traditional train system inasmuch as the cars connect to create a single long trough akin to a conveyor belt. This system allows for simple continuous loading like a conveyor system with the haulage flexibility of a train system.

In addition to the Railveyor system running on electricity, the new design would use battery-powered equipment instead of currently planned diesel-powered equipment, which the study found would significantly reduce emissions.

According to Railveyor, these types of systems have been used in a number of hard rock mines around the world. More information on Railveyor can be seen here: https://www.railveyor.com/what-is-railveyor/technology/ A video describing the technology can be seen here: https://www.youtube.com/watch?v=yTbc9DWzxHg

"We are thrilled to see NioCorp exploring the integration of the Railveyor system for the Elk Creek Mine," said Tas Mohamed, CEO of Railveyor. "Our technology not only provides a cost-effective and efficient material handling solution, but also aligns perfectly with the industry's move towards sustainability. By reducing power consumption and emissions, the Railveyor system supports NioCorp's goals of economic efficiency and environmental responsibility, making it an ideal choice for modern mining operations."

"Our TrulyAutonomous system is designed with automated safety features to ensure operational reliability, thereby enhancing the overall safety profile of the mine," added Jerome Rodriguez, EVP of Sales at Railveyor. "The compact design of the Railveyor system allows access to deeper mineral deposits and the ability to operate close to the ore body, maximizing the resource extraction potential of the mine. These advantages are further supported by findings from the CanmetMINING study.[2]

Optimize has deep familiarity with the Elk Creek Mine. Optimize has provided mining consulting services to NioCorp since 2019, including the work performed on the Mineral Reserve and Resource Estimates in NioCorp's current Feasibility Study. Railveyor provided initial costing information and design criteria for the Optimize study. Additionally, on April 17, 2024, certain members of the NioCorp and Optimize teams visited an operating Railveyor system. That system has been in operation for more than five years.

Qualified Persons

Gavin Clow P.Eng, Manager of Mining of Optimize Group, is a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the technical information, and verified the data, contained in this press release.

Scott Honan, M.Sc., SME-RM, COO of NioCorp Developments Ltd., a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the technical information contained in this press release.

# # #

For More Information: Jim Sims, Chief Communications Officer, NioCorp Developments Ltd., 720-334-7066, jim.sims@niocorp.com

About NioCorp

NioCorp is developing a critical minerals project in Southeast Nebraska that is expected to produce niobium, scandium, and titanium. The Company also is evaluating the potential to produce several rare earths from the Elk Creek Project. Niobium is used to produce specialty alloys as well as High Strength, Low Alloy steel, which is a lighter, stronger steel used in automotive, structural, and pipeline applications. Scandium is a specialty metal that can be combined with Aluminum to make alloys with increased strength and improved corrosion resistance. Scandium is also a critical component of advanced solid oxide fuel cells. Titanium is used in various lightweight alloys and is a key component of pigments used in paper, paint and plastics and is also used for aerospace applications, armor, and medical implants. Magnetic rare earths, such as neodymium, praseodymium, terbium, and dysprosium are critical to the making of Neodymium-Iron-Boron magnets, which are used across a wide variety of defense and civilian applications. @NioCorp $NB

About Optimize Group

Optimize Group is an international project engineering company with offices in Canada and Australia. From geology to mineral processing, we provide project development and delivery, operational excellence, and due diligence. Integrated at the core we deliver ‘Optimized Mine Plans' and ‘Just Right Plants' with a commitment to help build a sustainable future. Our experienced team works collaboratively, draws on practical and innovative thinking.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements may include, but are not limited to, statements regarding the expected benefits from electrifying the Elk Creek Mine, utilizing a twin ramp design in the Elk Creek Mine and using a Railveyor system for the transport of mined ore, identified in the Optimize study, including potential reduces cost, reduced emissions, faster time to production, lower power consumption, faster removal of mined ore, increased schedule flexibility allowing for exploitation of stopes in an economically advantageous sequence and easier operation and maintenance, the Company's completion of an updated Feasibility Study and the timing thereof, and NioCorp's expectation to produce niobium, scandium and titanium and the potential to produce rare earths at the Elk Creek Project. Forward-looking statements are typically identified by words such as "plan," "believe," "expect," "anticipate," "intend," "outlook," "estimate," "forecast," "project," "continue," "could," "may," "might," "possible," "potential," "predict," "should," "would" and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on the current expectations of the management of NioCorp and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. Forward-looking statements reflect material expectations and assumptions, including, without limitation, expectations, and assumptions relating to: the potential geotechnical or hydrogeologic implications of accessing the mine via a twin ramp design, NioCorp's ability to recognize the potential benefits of electrifying the Elk Creek Mine, implementing a twin ramp design or utilizing a Railveyor system identified in the Optimize study, NioCorp's ability to secure sufficient project financing for the construction of the Elk Creek Project on acceptable terms, or at all, the technical implementation of the recommendations of the Optimize study and the future costs of implementing a twin ramp design and utilizing a Railveyor system. Such expectations and assumptions are inherently subject to uncertainties and contingencies regarding future events and, as such, are subject to change. Forward-looking statements involve a number of risks, uncertainties or other factors that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those discussed and identified in public filings made by NioCorp with the U.S. Securities and Exchange Commission and with the applicable Canadian securities regulatory authorities and the following: NioCorp's ability to recognize the anticipated benefits of the business combination with GX Acquisition Corp. II (the "Business Combination") and the standby equity purchase agreement (the "Yorkville Equity Facility Financing Agreement" and, together with the Business Combination, the "Transactions") with YA II PN, Ltd., an investment fund managed by Yorkville Advisors Global, LP, including NioCorp's ability to access the full amount of the expected net proceeds under the Yorkville Equity Facility Financing Agreement over the next three years; unexpected costs related to the Transactions; the outcome of any legal proceedings that may be instituted against NioCorp following closing of the Transactions; NioCorp's ability to continue to meet the listing standards of the NASDAQ; NioCorp's ability to operate as a going concern; risks relating to NioCorp's common shares, including price volatility, lack of dividend payments and dilution or the perception of the likelihood any of the foregoing; NioCorp's requirement of significant additional capital; the extent to which NioCorp's level of indebtedness and/or the terms contained in agreements governing NioCorp's indebtedness or the Yorkville Equity Facility Financing Agreement may impair NioCorp's ability to obtain additional financing; covenants contained in agreements with NioCorp's secured creditors that may affect its assets; the possibility that NioCorp does not receive a final commitment of financing from the Export-Import Bank of the United States on the anticipated timeline, on acceptable terms, or at all; NioCorp's limited operating history; NioCorp's history of losses; the material weaknesses in NioCorp's internal control over financial reporting, NioCorp's efforts to remediate such material weaknesses and the timing of remediation; the possibility that NioCorp may qualify as a passive foreign investment company under the U.S. Internal Revenue Code of 1986, as amended (the "Code"); the potential that the Transactions could result in NioCorp becoming subject to materially adverse U.S. federal income tax consequences as a result of the application of Section 7874 and related sections of the Code; cost increases for NioCorp's exploration and, if warranted, development projects; a disruption in, or failure of, NioCorp's information technology systems, including those related to cybersecurity; equipment and supply shortages; variations in the market demand for, and prices of, niobium, scandium, titanium and rare earth products; current and future off take agreements, joint ventures, and partnerships; NioCorp's ability to attract qualified management; the effects of global health crises on NioCorp's business plans, financial condition and liquidity; estimates of mineral resources and reserves; mineral exploration and production activities; feasibility study results; the results of metallurgical testing; the results of technological research; changes in demand for and price of commodities (such as fuel and electricity) and currencies; competition in the mining industry; changes or disruptions in the securities markets; legislative, political or economic developments, including changes in federal and/or state laws that may significantly affect the mining industry; the impacts of climate change, as well as actions taken or required by governments related to strengthening resilience in the face of potential impacts from climate change; the need to obtain permits and comply with laws and regulations and other regulatory requirements; the timing and reliability of sampling and assay data; the possibility that actual results of work may differ from projections/expectations or may not realize the perceived potential of NioCorp's projects; risks of accidents, equipment breakdowns, and labor disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in development programs; operating or technical difficulties in connection with exploration, mining, or development activities; management of the water balance at the Elk Creek Project site; land reclamation requirements related to the Elk Creek Project; the speculative nature of mineral exploration and development, including the risks of diminishing quantities of grades of reserves and resources; claims on the title to NioCorp's properties; potential future litigation; and NioCorp's lack of insurance covering all of NioCorp's operations.

Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of NioCorp prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

All subsequent written and oral forward-looking statements concerning the matters addressed herein and attributable to NioCorp or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements contained or referred to herein. Except to the extent required by applicable law or regulation, NioCorp undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date hereof to reflect the occurrence of unanticipated events.

[1] The study, conducted by Optimize, reflects 2024 dollars, whereas NioCorp's existing Feasibility Study utilized cost estimates that are in the process of being updated. The scoping study by Optimize did not assess the geotechnical or hydrogeologic implications of accessing the Elk Creek Mine via a twin ramp system. The Company expects to assess the geotechnical and hydrogeologic implications of accessing the mine via a twin ramp study in the updated Feasibility Study if it chooses to pursue this option.

[2] Source: Acuña, E. & Levesque, M. CanmetMINING mine electrification research: Goldex Railveyor study. October 2023. https://mdec.ca/2023/S5P2_Acuna_Duhart_NRCan__Railveyor_revB.pdf

SOURCE: NioCorp Developments Ltd

View the original press release on accesswire.com