NioCorp Completes Metallurgical Test Program and Begins Making Titanium Samples for Prospective Customers

After completing its metallurgical testing program, NioCorp's demonstration plant is now making high-purity titanium samples in response to inquiries from prospective customers

NioCorp demonstrates potential production of higher-purity niobium and titanium than previously achieved, along with commercial purity scandium and magnetic rare earth oxides

NioCorp successfully extracts, at demonstration scale, all targeted magnetic rare earths from its Elk Creek resource, including highly-sought-after heavy rare earths dysprosium and terbium

CENTENNIAL, CO / ACCESSWIRE / December 4, 2023 / NioCorp Developments Ltd. ("NioCorp" or the "Company") (NASDAQ:NB)(TSX:NB) is pleased to announce that it has completed its metallurgical testing program at its Quebec-based demonstration plant. Results show that NioCorp's enhanced processing design can produce, at demonstration scale, higher-purity forms of niobium and titanium, and higher yields for each product, than previously attained. The results also show that NioCorp can produce, at demonstration scale, scandium and magnetic rare earth products with commercial purities at recovery rates of

With all metallurgical work required to update NioCorp's current Feasibility Study for the Elk Creek Critical Minerals Project (the "Elk Creek Project") now completed, NioCorp is working to update its mineral reserve to include rare earths, complete additional engineering required by the new processing design, update project capital and operating cost estimates, and producing other information required for publication in an updated Feasibility Study. This is expected to be completed as early as possible in 2024.

Higher-Purity Form of Titanium Can Be Produced

NioCorp's new process can produce, at demonstration scale, a higher purity and more valuable form of titanium, known as titanium tetrachloride ("TiCl4"), than its previous process. The Company has shifted operations at its demonstration plant to produce sufficient quantities of TiCl4 for quality and purity testing by multiple prospective customers who have requested samples. NioCorp expects to make a final determination on its plans to produce TiCl4 after completing all work required for publishing an updated Feasibility Study.

TiCl4 is a highly versatile form of titanium that can be used to make both titanium dioxide, used in paints and pigments, and titanium metal. Demand for titanium metal is forecasted to grow by

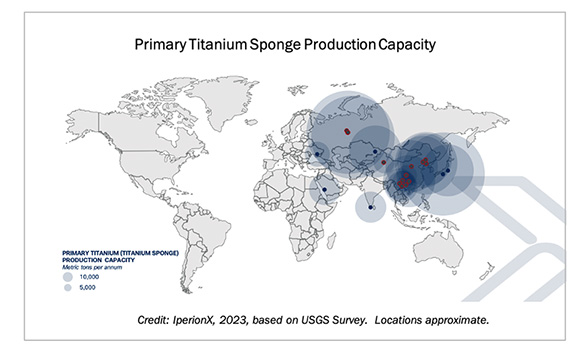

Global markets for aerospace-grade titanium metal have tightened sharply in recent years because of increased demand and supply chain pressures that have resulted from the Ukraine conflict with Russia, the world's largest supplier. The last titanium sponge plant in the US closed in 2020, and current titanium sponge production capacity is overwhelmingly centered today in China, Japan, Russia, Kazakhstan, and other nations.

The Second Largest Rare Earth Mineral Resource in the U.S.

NioCorp's demonstration plant also showed that the Company's process can make, at demonstration scale, the following high-purity forms of the separated magnetic rare earth oxides: neodymium-praseodymium ("NdPr") oxide, dysprosium ("Dy") oxide, and terbium ("Tb") oxide. The metallurgical testing showed that NioCorp can make, at demonstration scale, each of these commercial products at recovery rates of

However, as no economic analysis has been completed on the rare earth mineral resource comprising a portion of the Elk Creek Project, further studies are required before determining whether extraction of rare earth elements can be reasonably justified and economically viable after taking into account all relevant factors. Final determination by NioCorp of possible rare earth production can be made only after NioCorp publishes a new Feasibility Study, expected to occur as early as possible in 2024.

Currently, there is no commercial-scale production in the US of high-purity separated rare earth oxides, even though demand is forecasted to rise sharply because of increased demand for rare earth permanent magnets in electric and hybrid vehicles and advanced wind turbines.

In terms of its Mineral Resource, the Elk Creek Project represents the second largest indicated rare earth resource in the U.S. of indicated or higher classification, based on data from the USGS' "Critical Mineral Resources of the United States-Economic and Environmental Geology and Prospects for Future Supply (2017)" and from company-issued reports. Based on these sources, the Elk Creek Project represents the largest indicated Tb mineral resource in the U.S. and the second largest indicated Nd/Pr and Dy mineral resource in the U.S. Tb and Dy are used in high-strength rare earth permanent magnets used in the traction motor systems of most electric vehicles.

"By proving out this new approach to processing critical minerals at the demonstration plant level, we have shown that we can achieve, at the demonstration level, greater recoveries and higher purities of niobium and titanium products, while also adding significant quantities of key magnetic rare earths in a high-purity, separated oxide form," said Mark A. Smith, CEO and Executive Chairman of NioCorp.

"I am very pleased with the recovery rates and product purities that the development team obtained at the demonstration plant level in the new process, and this success brings us another step forward in our evaluation of the feasibility of adding rare earths to our product offering," said Scott Honan, Chief Operating Officer of NioCorp. "All of this testing data is integral to the updated Feasibility Study, on which we are working now."

Demonstration Plant Results

NioCorp's demonstration plant succeeded in demonstrating that NioCorp's new approach to processing ore that NioCorp expects to extract from the Elk Creek Project is more efficient than the previous design and is expected to require fewer processing steps. For example, it may allow the elimination of entire processes in NioCorp's planned processing, such as acid regeneration.

A high-level summary of the results obtained by NioCorp from the demonstration plant follows:

Qualified Persons:

Eric Larochelle, B.Eng., Co-Owner, L3 Process Development, a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the technical information, and verified the data contained in this news release.

Scott Honan, M.Sc., SME-RM, COO of NioCorp Developments Ltd., a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the technical information contained in the news release.

# # #

FOR MORE INFORMATION:

Jim Sims, Corporate Communications Officer, NioCorp Developments Ltd., 720-639-4650, jim.sims@niocorp.com

ABOUT NIOCORP

NioCorp is developing a critical minerals project in Southeast Nebraska that will produce niobium, scandium, and titanium. The Company also is evaluating the potential to produce several rare earths from the Elk Creek Project. Niobium is used to produce specialty alloys as well as High Strength, Low Alloy steel, which is a lighter, stronger steel used in automotive, structural, and pipeline applications. Scandium is a specialty metal that can be combined with Aluminum to make alloys with increased strength and improved corrosion resistance. Scandium is also a critical component of advanced solid oxide fuel cells. Titanium is used in various lightweight alloys and is a key component of pigments used in paper, paint and plastics and is also used for aerospace applications, armor, and medical implants. Magnetic rare earths, such as neodymium, praseodymium, terbium, and dysprosium are critical to the making of Neodymium-Iron-Boron magnets, which are used across a wide variety of defense and civilian applications.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements may include but are not limited to statements about NioCorp's expectation and ability to mine ore from the Elk Creek Project, the results of the demonstration plant metallurgical testing and its impact on potential future production levels and efficiency, NioCorp's expectation and ability to produce niobium, scandium, and titanium at the Elk Creek Project, NioCorp's ability to produce rare earth products, market demand for titanium and rare earth products, and completion of a new Feasibility Study, including the work related to a mineral reserve update, additional engineering, updated project capital and operating cost estimates, and other required information necessary for publication therein. Forward-looking statements are typically identified by words such as "plan," "believe," "expect," "anticipate," "intend," "outlook," "estimate," "forecast," "project," "continue," "could," "may," "might," "possible," "potential," "predict," "should," "would" and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on the current expectations of the management of NioCorp and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. Forward-looking statements reflect material expectations and assumptions, including, without limitation, expectations, and assumptions relating to: NioCorp's ability to obtain sufficient project financing to launch construction of the Elk Creek Project and move it to commercial production; the translatability of the demonstration-scale process to separate high-purity oxides of several magnetic rare earths, niobium, scandium and titanium from ore to the ore that NioCorp expects to extract from the Elk Creek Project; the stability of the financial and capital markets; the financial and business performance of NioCorp; NioCorp's anticipated results and developments in the operations of NioCorp in future periods; NioCorp's planned exploration activities; the adequacy of NioCorp's financial resources; NioCorp's expectation and ability to produce niobium, scandium, and titanium at the Elk Creek Project; the outcome of current recovery process improvement testing, and NioCorp's expectation that such process improvements could lead to greater efficiencies and cost savings in the Elk Creek Project; the Elk Creek Project's ability to produce multiple critical metals; the Elk Creek Project's projected ore production and mining operations over its expected mine life; the completion of technical and economic analyses on the potential addition of magnetic rare earth oxides to NioCorp's planned product suite; the exercise of options to purchase additional land parcels; the execution of contracts with engineering, procurement and construction companies; NioCorp's ongoing evaluation of the impact of inflation, supply chain issues and geopolitical unrest on the Elk Creek Project's economic model; and the creation of full time and contract construction jobs over the construction period of the Elk Creek Project. Forward-looking statements involve a number of risks, uncertainties or other factors that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those discussed and identified in public filings made by NioCorp with the SEC and with the applicable Canadian securities regulatory authorities and the following: NioCorp's ability to recognize the anticipated benefits of the business combination with GX Acquisition Corp. II (the "Business Combination") and the standby equity purchase agreement (the "Yorkville Equity Facility Financing Agreement" and, together with the Business Combination, the "Transactions") with YA II PN, Ltd., an investment fund managed by Yorkville Advisors Global, LP, including NioCorp's ability to access the full amount of the expected net proceeds under the Yorkville Equity Facility Financing Agreement over the next three years; unexpected costs related to the Transactions; the outcome of any legal proceedings that may be instituted against NioCorp following closing of the Transactions; NioCorp's ability to receive a final commitment of financing from the Export-Import Bank of the United States on the anticipated timeline, on acceptable terms, or at all; NioCorp's ability to continue to meet the listing standards of The Nasdaq Stock Market LLC; NioCorp's ability to operate as a going concern; risks relating to NioCorp's common shares, including price volatility, lack of dividend payments and dilution or the perception of the likelihood any of the foregoing; NioCorp's requirement of significant additional capital; the extent to which NioCorp's level of indebtedness and/or the terms contained in agreements governing NioCorp's indebtedness or the Yorkville Equity Facility Financing Agreement may impair NioCorp's ability to obtain additional financing; covenants contained in agreements with NioCorp's secured creditors that may affect its assets; NioCorp's limited operating history; NioCorp's history of losses; the restatement of NioCorp's consolidated financial statements as of and for the fiscal years ended June 30, 2022 and 2021 and the interim periods ended September 30, 2021, December 31, 2021, March 31, 2022, September 30, 2022, and December 31, 2022 and the impact of such restatement on NioCorp's future financial statements and other financial measures; the material weaknesses in NioCorp's internal control over financial reporting, NioCorp's efforts to remediate such material weaknesses and the timing of remediation; the possibility that NioCorp may qualify as a passive foreign investment company under the U.S. Internal Revenue Code of 1986, as amended (the "Code"); the potential that the Transactions could result in NioCorp becoming subject to materially adverse U.S. federal income tax consequences as a result of the application of Section 7874 and related sections of the Code; cost increases for NioCorp's exploration and, if warranted, development projects; a disruption in, or failure of, NioCorp's information technology systems, including those related to cybersecurity; equipment and supply shortages; variations in the market demand for, and prices of, niobium, scandium, titanium and rare earth products; current and future offtake agreements, joint ventures, and partnerships; NioCorp's ability to attract qualified management; the effects of global health crises on NioCorp's business plans, financial condition and liquidity; estimates of mineral resources and reserves; mineral exploration and production activities; feasibility study results; the results of metallurgical testing; changes in demand for and price of commodities (such as fuel and electricity) and currencies; competition in the mining industry; changes or disruptions in the securities markets; legislative, political or economic developments, including changes in federal and/or state laws that may significantly affect the mining industry; the impacts of climate change, as well as actions taken or required by governments related to strengthening resilience in the face of potential impacts from climate change; the need to obtain permits and comply with laws and regulations and other regulatory requirements; the timing and reliability of sampling and assay data; the possibility that actual results of work may differ from projections/expectations or may not realize the perceived potential of NioCorp's projects; risks of accidents, equipment breakdowns, and labor disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in development programs; operating or technical difficulties in connection with exploration, mining, or development activities; the management of the water balance at the Elk Creek Project site; land reclamation requirements related to the Elk Creek Project; the speculative nature of mineral exploration and development, including the risks of diminishing quantities of grades of reserves and resources; claims on the title to NioCorp's properties; potential future litigation; and NioCorp's lack of insurance covering all of NioCorp's operations.

Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of NioCorp prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

All subsequent written and oral forward-looking statements concerning the matters addressed herein and attributable to NioCorp or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements contained or referred to herein. Except to the extent required by applicable law or regulation, NioCorp undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date hereof to reflect the occurrence of unanticipated events.

[1]TiO2 market analysis performance for NioCorp by TZMI, 2023

SOURCE: NioCorp Developments Ltd.

View source version on accesswire.com:

https://www.accesswire.com/812776/niocorp-completes-metallurgical-test-program-and-begins-making-titanium-samples-for-prospective-customers