Immatics Announces First Quarter 2024 Financial Results and Business Update

Immatics (NASDAQ: IMTX) reported its Q1 2024 financial results and provided a business update, including clinical data from their ongoing Phase 1 trial of ACTengine® IMA203 targeting PRAME. The trial showed a 55% confirmed objective response rate in heavily pre-treated metastatic melanoma patients, with tumor shrinkage in 87% and a median response duration of 13.5 months. IMA203 maintained a favorable safety profile. A Phase 2/3 trial is planned for 2024.

The company also completed a $201.5 million public offering in January 2024, ending the quarter with $609.7 million in cash and equivalents, funding operations into 2027. Q1 2024 revenues were $32.8 million, largely due to a terminated collaboration, while net loss narrowed to $3.4 million from $21.3 million in Q1 2023. Upcoming milestones include updates on IMA203, IMA203CD8, and TCER® programs in 2H 2024.

- 55% confirmed objective response rate in IMA203 trial.

- 87% of patients experienced tumor shrinkage.

- IMA203 maintained a favorable safety profile with no grade 5 events.

- Completed $201.5M public offering.

- Q1 2024 revenue increased to $32.8M from $10.6M in Q1 2023.

- Cash and equivalents increased to $609.7M, funding operations into 2027.

- Net loss reduced to $3.4M from $21.3M in Q1 2023.

- Phase 2/3 trial for IMA203 planned for 2024.

- First clinical data for IMA401 and IMA402 expected in 2H 2024.

- Increased R&D expenses to $34.7M from $29.8M in Q1 2023.

- Increased G&A expenses to $12.5M from $10.4M in Q1 2023.

- Dependence on positive trial results for future growth.

- Termination of Genmab collaboration impacts future revenue streams.

Insights

The financial update from Immatics reveals a robust financial position. The company's

The clinical data update for IMA203 in metastatic melanoma patients is promising. A confirmed objective response rate (cORR) of

Immatics is firmly positioning itself within the competitive cancer immunotherapy market. The diverse pipeline, including next-generation TCR Bispecifics like IMA401 and IMA402, represents a strategic expansion beyond melanoma. The first clinical data for IMA401 and IMA402 expected in 2H 2024 will be critical in validating these novel platforms. The company's modular GMP manufacturing capabilities and a new 100,000 square foot facility underscore a commitment to scaling production efficiently. Market dynamics favor companies that can swiftly bring innovative treatments to market and Immatics’ progress in regulatory and manufacturing readiness could provide significant competitive advantages. The anticipated Phase 2/3 trial aligns with the FDA’s “one-trial” approach for accelerated approval, which could be a catalyst for market entry and adoption, addressing the unmet needs in PRAME-positive melanoma patients.

Company Provides Clinical Data Update from Ongoing Phase 1 Clinical Trial with

ACTengine® IMA203 TCR-T Targeting PRAME

- Updated clinical data on ACTengine® IMA203 targeting PRAME in 30 heavily pre-treated metastatic melanoma patients at RP2D:

55% confirmed objective response rate, including tumor shrinkage achieved in87% of patients; median duration of response of 13.5 months including 11/16 ongoing confirmed responses; IMA203 continues to maintain a favorable safety profile - Registration-enabling randomized Phase 2/3 trial for ACTengine® IMA203 in 2L+ melanoma planned to commence in 2024 following further discussions with FDA

- Next data update on IMA203 and IMA203CD8 (GEN2) planned for 2H 2024

- First clinical data updates for Immatics’ next-generation, half-life extended TCR Bispecifics, TCER® IMA401 (MAGEA4/8) and TCER® IMA402 (PRAME), from ongoing Phase 1 dose escalation trials planned for 2H 2024; updates to include details on safety, pharmacokinetics and initial anti-tumor activity

$201.5 million public offering completed on January 22, 2024- Cash and cash equivalents, as well as other financial assets, amount to

$609.7 million 1 (€564.0 million ) as of March 31, 2024 funding company operations into 2027

Houston, Texas and Tuebingen, Germany, May 14, 2024 – Immatics N.V. (NASDAQ: IMTX, “Immatics”), a clinical-stage biopharmaceutical company active in the discovery and development of T cell-redirecting cancer immunotherapies, today provided a business update and reported financial results for the quarter ended March 31, 2024.

“Our lead cell therapy candidate, IMA203, continues to show deep and durable responses in a significantly expanded data set since our last data readout in November 2023. This update emphasizes the meaningful impact our novel immunotherapy may have on the lives of metastatic cutaneous, uveal and mucosal melanoma patients and the medical needs that IMA203 has a real opportunity to address. We continue to plan to move IMA203 into a registration-enabling clinical trial within this year while also continuing to ramp up our commercial manufacturing buildout,” said Harpreet Singh, Ph.D., CEO and Co-Founder of Immatics. “In addition to IMA203’s progress, we also look forward to presenting the first clinical data on the two lead candidates from our bispecifics pipeline in the second half of the year.”

First Quarter 2024 and Subsequent Company Progress

ACTengine® Cell Therapy Program

ACTengine® IMA203 monotherapy

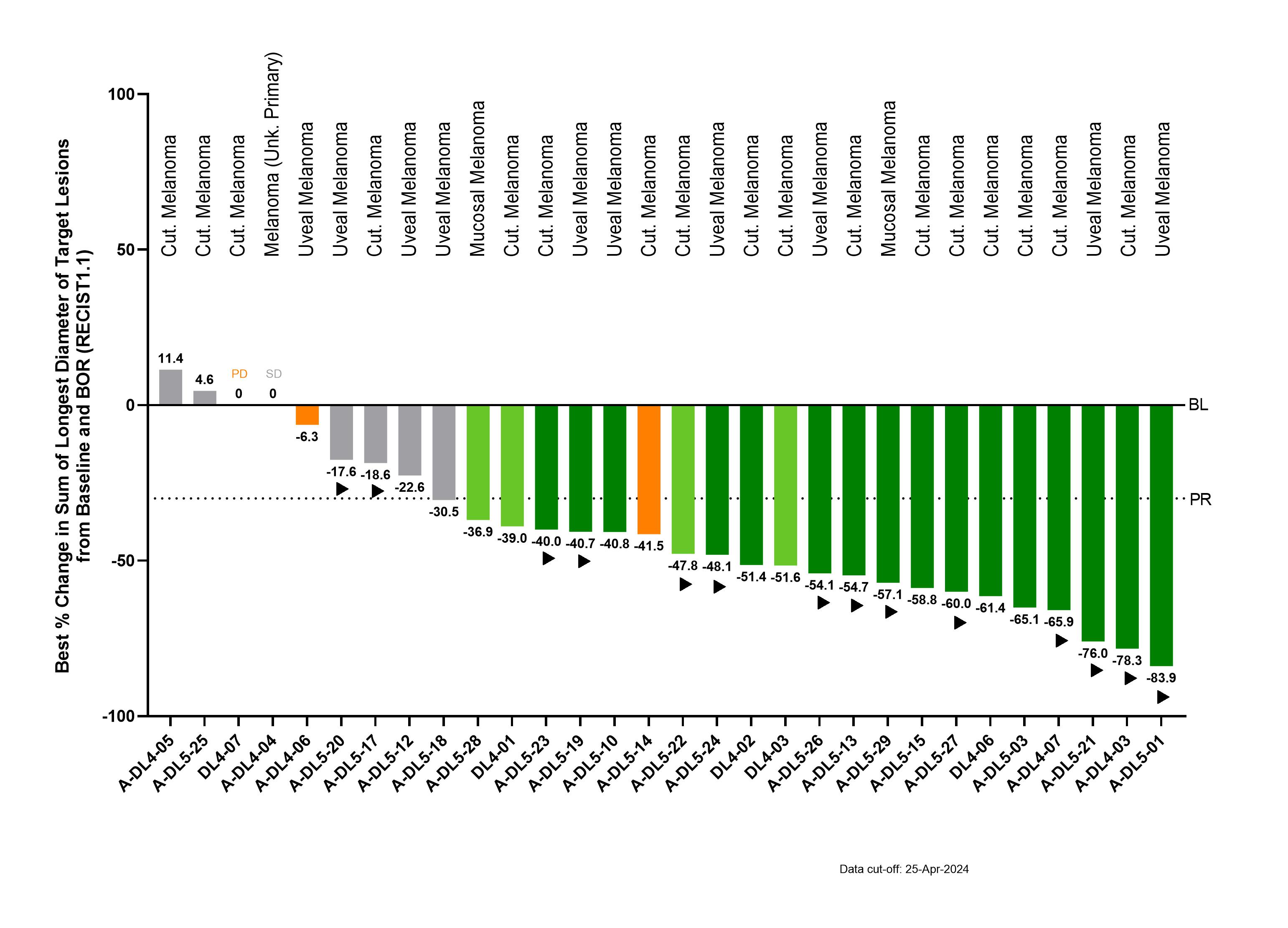

Today, Immatics is providing a data update on IMA203 monotherapy targeting PRAME from the ongoing Phase 1 trial at the recommended Phase 2 dose (RP2D, 1 to 10 billion total TCR-T cells) in 30 heavily pretreated metastatic melanoma patients evaluable for efficacy. The treated patient population is composed of patients with a median of 3 lines of prior systemic treatments, consisting of cutaneous melanoma patients (N=17), uveal melanoma patients (N=10), mucosal melanoma patients (N=2) and a patient with melanoma of unknown primary (N=1). The current data represent an update to the previously communicated interim data readout in the IMA203 melanoma efficacy population of November 8, 2023.

As of the data cut-off on April 25, 2024, treatment with IMA203 monotherapy in the efficacy population has demonstrated:

- Confirmed objective response rate (cORR) of

55% (16/29) - Disease control rate of

90% (27/30) - Tumor shrinkage in

87% (26/30) of patients - Median duration of response (mDOR) was 13.5 months (min 1.2+, max 21.5+ months) including 11 of 16 confirmed objective responses ongoing at data cut-off and longest duration of response ongoing at >21 months after infusion

- Confirmed response rates are similar across all melanoma subtypes (

56% (9/16) in cutaneous melanoma;54% (7/13) in other melanoma subtypes)

To date, IMA203 has maintained a favorable safety profile with no treatment-related grade 5 events in the safety population (N=65 patients across all dose levels and all tumor types).

Best overall response for IMA203 at RP2D in melanoma

More information and details on the IMA203 clinical data update in melanoma are available in the Immatics corporate presentation: https://investors.immatics.com/events-presentations

The next data update with translational and clinical data for IMA203 is planned for 2H 2024 at a medical conference.

Immatics’ late-stage clinical cell therapy development is supported by its differentiated manufacturing related to timeline, capabilities and facilities. ACTengine® IMA203 cell therapy products are manufactured within 7 days, followed by a 7-day QC release testing at a success rate of >

Following an RMAT designation in October 2023 and productive interactions with the FDA, Immatics plans to initiate a randomized Phase 2/3 trial in 4Q 2024 for IMA203 in patients with second-line or later (2L+) cutaneous melanoma, potentially also including uveal melanoma patients.

The Phase 2/3 trial is expected to assess IMA203 targeting PRAME in HLA-A*02:01-positive cutaneous melanoma patients versus a control arm. This approach is consistent with the FDA’s “one-trial” approach2, i.e., a single randomized controlled trial to support accelerated approval and the verification of clinical benefit to achieve full approval. The high prevalence of PRAME (≥

IMA203 is being developed to treat patients with metastatic melanoma, a prevalent cancer type with increasing incidence both inside and outside the United States. Currently, eligible PRAME-positive melanoma patients for the ongoing trials, i.e., 2L+, HLA-A*02:01 positive, include ~3,000 cutaneous melanoma patients and ~300 eligible uveal melanoma patients3 in the US.

ACTengine® IMA203CD8 (GEN2) monotherapy

As of the previously reported interim clinical update from November 8, 2023, the first data on the company’s second-generation product candidate, IMA203CD8 (consisting of PRAME-specific functional CD8+ and CD4+ cells), demonstrated

For IMA203CD8 (GEN2), Immatics cleared dose level 4a (DL4a, up to ~1.6x109 TCR-T cells) in December 2023. Immatics plans to continue dose escalation with the goal to define the optimal dose for further development. In addition to treating melanoma patients, Immatics has also started to expand its clinical footprint outside of melanoma to address a broader patient population with a particular focus on ovarian and uterine cancers.

A next data update for IMA203CD8 (GEN2) is planned for 2H 2024.

Immatics’ T cell engaging receptor (TCER®) candidates are next-generation, half-life extended TCR Bispecific molecules. They are designed to achieve a patient-convenient dosing schedule and to maximize efficacy while minimizing toxicities in patients through the proprietary format using a high-affinity TCR domain against the tumor target and a low-affinity T cell recruiter binding to the T cell.

Upcoming milestones for Immatics’ clinical TCER® pipeline

Immatics seeks to deliver clinical proof-of-concept for its novel TCER® platform as quickly as possible and plans to provide first clinical data for IMA401 (MAGEA4/8) and IMA402 (PRAME) in 2H 2024.

Key objectives include:

- Demonstrating tolerability of the novel, next-generation, half-life extended TCR Bispecifics format;

- Optimizing dosing schedule to a less frequent regimen during dose escalation based on pharmacokinetics data;

- Demonstrating initial clinical anti-tumor activity (i.e., confirmed objective responses according to RECIST 1.1).

TCER® IMA401 (MAGEA4/8)

The Phase 1 dose escalation basket trial to evaluate safety, tolerability and initial anti-tumor activity of TCER® IMA401 in patients with recurrent and/or refractory solid tumors is ongoing. IMA401 targets an HLA-A*02:01-presented peptide that occurs identically in two different proteins, MAGEA4 and MAGEA8. This target peptide has been selected based on natural expression in native solid tumors at particularly high target density (peptide copy number per tumor cell identified by Immatics’ proprietary quantitative mass spectrometry engine XPRESIDENT® is >5x higher than for a MAGEA4 peptide target used in other clinical trials).

MAGEA4 and MAGEA8 are expressed in multiple solid cancers, including lung cancer, head and neck cancer, melanoma, ovarian cancer, sarcoma and others. Tolerability continues to be manageable with transient low-grade CRS, lymphopenia and neutropenia at high doses, all of which are expected for a bispecific T cell engager. A premedication with low doses of dexamethasone administered prior to the first 4 infusions, as used with other approved bispecific products, has been implemented as a preventative measure for continued dose escalation. Since the implementation of this premedication, to date, no cases of high-grade neutropenia among the patients treated have been observed. Based on pharmacokinetics data, the treatment schedule for IMA401 was switched from weekly to bi-weekly dosing. Confirmed objective responses have been observed in multiple patients.

IMA401 is being developed in collaboration with Bristol Myers Squibb. First clinical data in at least 25 patients in dose escalation across all doses and multiple solid cancers is expected to be announced in 2H 2024.

TCER® IMA402 (PRAME)

Immatics initiated the Phase 1/2 trial investigating the company’s fully owned TCER® candidate IMA402 in patients with recurrent and/or refractory solid tumors in August 2023 and the first patients have been dosed. Initial focus indications are ovarian cancer, lung cancer, uterine cancer and cutaneous and uveal melanoma, among others. IMA402 targets an HLA-A*02:01-presented peptide derived from the tumor antigen PRAME. This target peptide has been selected based on natural expression in native solid primary tumors and metastases at particularly high target density (peptide copy number per tumor cell identified by Immatics’ proprietary quantitative mass spectrometry engine XPRESIDENT®).

Immatics has recently engaged Patheon UK Limited, a subsidiary of ThermoFisher Scientific Inc., for the manufacturing of clinical IMA402 batches for its use within a potential registration-enabling trial. Patient recruitment and dose escalation continue to scale. First clinical data in at least 15 patients in dose escalation across multiple solid cancers, but initially focused on melanoma, is anticipated to be announced in 2H 2024.

Corporate Development

- On January 22, 2024, Immatics completed an offering of 18,313,750 ordinary shares at a public offering price of

$11.00 per share. The gross proceeds from the offering, before deducting the underwriting discount and offering expenses, were approximately$201.5 million .

First Quarter 2024 Financial Results

Cash Position: Cash and cash equivalents, as well as other financial assets, total

Revenue: Total revenue, consisting of revenue from collaboration agreements, was

Research and Development Expenses: R&D expenses were

General and Administrative Expenses: G&A expenses were

Net Profit and Loss: Net loss was

Full financial statements can be found in the 6-K filed with the Securities and Exchange Commission (SEC) on May 14, 2024, and published on the SEC website under www.sec.gov.

Upcoming Investor Conferences

- Bank of America Health Care Conference, Las Vegas (NV) – May 14 - 16, 2024

- Jefferies Global Healthcare Conference, New York (NY) – June 5 - 7, 2024

To see the full list of events and presentations, visit www.investors.immatics.com/events-presentations.

- END -

About IMA203 and target PRAME

ACTengine® IMA203 T cells are directed against an HLA-A*02-presented peptide derived from preferentially expressed antigen in melanoma (PRAME), a protein frequently expressed in a large variety of solid cancers, thereby supporting the program’s potential to address a broad cancer patient population. Immatics’ PRAME peptide is present at a high copy number per tumor cell and is homogeneously and specifically expressed in tumor tissue. The peptide has been identified and characterized by Immatics’ proprietary mass spectrometry-based target discovery platform, XPRESIDENT®. Through its proprietary TCR discovery and engineering platform XCEPTOR®, Immatics has generated a highly specific T cell receptor (TCR) against this target for its TCR-based cell therapy approach, ACTengine® IMA203.

ACTengine® IMA203 TCR-T is currently being evaluated in Phase 1 IMA203 monotherapy, and IMA203CD8 (GEN2) monotherapy, where IMA203 engineered T cells are co-transduced with a CD8αβ co-receptor. As previously reported, IMA203 in combination with an immune checkpoint inhibitor has been deprioritized.

About Immatics

Immatics combines the discovery of true targets for cancer immunotherapies with the development of the right T cell receptors with the goal of enabling a robust and specific T cell response against these targets. This deep know-how is the foundation for our pipeline of Adoptive Cell Therapies and TCR Bispecifics as well as our partnerships with global leaders in the pharmaceutical industry. We are committed to delivering the power of T cells and to unlocking new avenues for patients in their fight against cancer.

Immatics intends to use its website www.immatics.com as a means of disclosing material non-public information. For regular updates you can also follow us on X, Instagram and LinkedIn.

Forward-Looking Statements

Certain statements in this press release may be considered forward-looking statements. Forward-looking statements generally relate to future events or the Company’s future financial or operating performance. For example, statements concerning timing of data read-outs for product candidates, the timing, outcome and design of clinical trials, the nature of clinical trials (including whether such clinical trials will be registration-enabling), the timing of IND or CTA filing for pre-clinical stage product candidates, estimated market opportunities of product candidates, the Company’s focus on partnerships to advance its strategy, and other metrics are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expect”, “plan”, “target”, “intend”, “will”, “estimate”, “anticipate”, “believe”, “predict”, “potential” or “continue”, or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Immatics and its management, are inherently uncertain. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Factors that may cause actual results to differ materially from current expectations include, but are not limited to, various factors beyond management's control including general economic conditions and other risks, uncertainties and factors set forth in the Company’s Annual Report on Form 20-F and other filings with the Securities and Exchange Commission (SEC). Nothing in this press release should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Company undertakes no duty to update these forward-looking statements. All the scientific and clinical data presented within this press release are – by definition prior to completion of the clinical trial and a clinical study report – preliminary in nature and subject to further quality checks including customary source data verification.

For more information, please contact:

| Media | |

| Trophic Communications | |

| Phone: +49 171 3512733 | |

| immatics@trophic.eu |

| Immatics N.V. | |

| Jordan Silverstein | |

| Head of Strategy | |

| Phone: +1 346 319-3325 | |

| InvestorRelations@immatics.com |

Immatics N.V. and subsidiaries

Condensed Consolidated Statement of Loss of Immatics N.V.

| Three months ended March 31, | ||

| 2024 | 2023 | |

| (Euros in thousands, except per share data) | ||

| Revenue from collaboration agreements | 30,269 | 9,796 |

| Research and development expenses | (32,108) | (27,581) |

| General and administrative expenses | (11,642) | (9,586) |

| Other income | 12 | 941 |

| Operating result | (13,469) | (26,430) |

| Change in fair value of liabilities for warrants | 1,043 | 7,397 |

| Other financial income | 11,381 | 2,795 |

| Other financial expenses | (677) | (3,509) |

| Financial result | 11,747 | 6,683 |

| Loss before taxes | (1,722) | (19,747) |

| Taxes on income | (1,332) | — |

| Net loss | (3,054) | (19,747) |

| Net loss per share: | ||

| Basic | (0.03) | (0.26) |

| Diluted | (0.04) | (0.26) |

Immatics N.V. and subsidiaries

Condensed Consolidated Statement of Comprehensive Loss of Immatics N.V.

| Three months ended March 31, | ||

| 2024 | 2023 | |

| (Euros in thousands) | ||

| Net loss | (3,054) | (19,747) |

| Other comprehensive income | ||

| Items that may be reclassified subsequently to profit or loss | ||

| Currency translation differences from foreign operations | 336 | 564 |

| Total comprehensive loss for the year | (2,718) | (19,183) |

Immatics N.V. and subsidiaries

Condensed Consolidated Statement of Financial Position of Immatics N.V.

| As of | ||

| March 31, 2024 | December 31, 2023 | |

| (Euros in thousands) | ||

| Assets | ||

| Current assets | ||

| Cash and cash equivalents | 122,093 | 218,472 |

| Other financial assets | 441,857 | 207,423 |

| Accounts receivables | 1,781 | 4,093 |

| Other current assets | 22,666 | 19,382 |

| Total current assets | 588,397 | 449,370 |

| Non-current assets | ||

| Property, plant and equipment | 49,968 | 43,747 |

| Intangible assets | 1,501 | 1,523 |

| Right-of-use assets | 11,886 | 13,308 |

| Other non-current assets | 1,373 | 2,017 |

| Total non-current assets | 64,728 | 60,595 |

| Total assets | 653,125 | 509,965 |

| Liabilities and shareholders’ equity | ||

| Current liabilities | ||

| Provisions | 1,740 | - |

| Accounts payables | 20,537 | 25,206 |

| Deferred revenue | 96,525 | 100,401 |

| Liabilities for warrants | 17,950 | 18,993 |

| Lease liabilities | 2,762 | 2,604 |

| Other current liabilities | 9,590 | 9,348 |

| Total current liabilities | 149,104 | 156,552 |

| Non-current liabilities | ||

| Deferred revenue | 91,358 | 115,527 |

| Lease liabilities | 11,877 | 12,798 |

| Other non-current liabilities | — | 4 |

| Total non-current liabilities | 103,235 | 128,329 |

| Shareholders’ equity | ||

| Share capital | 1,031 | 847 |

| Share premium | 1,001,402 | 823,166 |

| Accumulated deficit | (600,347) | (597,293) |

| Other reserves | (1,300) | (1,636) |

| Total shareholders’ equity | 400,768 | 225,084 |

| Total liabilities and shareholders’ equity | 653,125 | 509,965 |

Immatics N.V. and subsidiaries

Condensed Consolidated Statement of Cash Flows of Immatics N.V.

| Three months ended March 31, | ||

| 2024 | 2023 | |

| (Euros in thousands) | ||

| Cash flows from operating activities | ||

| Net profit/(loss) | (3,054) | (19,747) |

| Taxes on income | 1,332 | — |

| Profit/(loss) before tax | (1,722) | (19,747) |

| Adjustments for: | ||

| Interest income | (6,294) | (2,254) |

| Depreciation and amortization | 3,014 | 1,811 |

| Interest expenses | 194 | 195 |

| Equity-settled share-based payment | 4,297 | 6,103 |

| Net foreign exchange differences and expected credit losses | (4,553) | 3,143 |

| Change in fair value of liabilities for warrants | (1,043) | (7,397) |

| Changes in: | ||

| Decrease/(increase) in accounts receivables | 2,312 | 880 |

| Decrease/(increase) in other assets | 574 | 234 |

| (Decrease)/increase in deferred revenue, accounts payables and other liabilities | (31,674) | (7,793) |

| Interest received | 2,484 | 1,189 |

| Interest paid | (194) | (79) |

| Income tax paid | — | — |

| Net cash (used in)/provided by operating activities | (32,605) | (23,715) |

| Cash flows from investing activities | ||

| Payments for property, plant and equipment | (9,174) | (4,317) |

| Payments for intangible assets | (2) | (8) |

| Proceeds from disposal of property, plant and equipment | — | — |

| Payments for investments classified in Other financial assets | (290,599) | (67,735) |

| Proceeds from maturity of investments classified in Other financial assets | 57,957 | 68,341 |

| — | — | |

| Net cash (used i n)/provided by investing activities | (241,818) | (3,719) |

| Cash flows from financing activities | ||

| Proceeds from issuance of shares to equity holders | 185,669 | — |

| Transaction costs deducted from equity | (11,548) | — |

| Payments related to lease liabilities | 524 | (866) |

| Net cash provided by/(used in) financing activities | 174,645 | (866) |

| Net (decrease)/increase in cash and cash equivalents | (99,778) | (28,300) |

| Cash and cash equivalents at beginning of the year | 218,472 | 148,519 |

| Effects of exchange rate changes and expected credit losses on cash and cash equivalents | 3,399 | (2,300) |

| Cash and cash equivalents at end of the year | 122,093 | 117,919 |

Immatics N.V. and subsidiaries

Condensed Consolidated Statement of Changes in Shareholders’ equity of Immatics N.V.

| (Euros in thousands) | Share capital | Share premium | Accumulated deficit | Other reserves | Total share- holders’ equity |

| Balance as of January 1, 2023 | 767 | 714,177 | (500,299) | (1,481) | 213,164 |

| Other comprehensive income | — | — | — | 564 | 564 |

| Net loss | — | — | (19,747) | — | (19,747) |

| Comprehensive loss for the year | — | — | (19,747) | 564 | (19,183) |

| Equity-settled share-based compensation | — | 6,103 | — | — | 6,103 |

| Share options exercised | — | — | — | — | — |

| Issue of share capital – net of transaction costs | — | — | — | — | — |

| Balance as of March 31, 2023 | 767 | 720,280 | (520,046) | (917) | 200,084 |

| Balance as of January 1, 2024 | 847 | 823,166 | (597,293) | (1,636) | 225,084 |

| Other comprehensive income | — | — | — | 336 | 336 |

| Net loss | — | — | (3,054) | — | (3,054) |

| Comprehensive loss for the year | — | — | (3,054) | 336 | (2,718) |

| Equity-settled share-based compensation | — | 4,297 | — | — | 4,297 |

| Share options exercised | 1 | 682 | — | — | 683 |

| Issue of share capital – net of transaction costs | 183 | 173,257 | — | — | 173,440 |

| Balance as of March 31, 2024 | 1,031 | 1,001,402 | (600,347) | (1,300) | 400,786 |

1 All amounts translated using the exchange rate published by the European Central Bank in effect as of March 31, 2024 (1 EUR = 1.0811 USD).

2 FDA Draft Guidance “Clinical Trial Considerations To Support Accelerated Approval of Oncology Therapeutics – Guidance for Industry,” March 2023

3 Estimated

Attachment