Helo Corp Announces First Quarter Results of 39% Revenue Growth and Investment in New Markets

Rhea-AI Summary

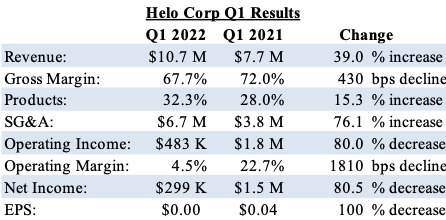

Helo Corp. (OTC PINK:HLOC) reported a 39% increase in revenue for Q1 2022, totaling $10.7 million. Gross margin decreased to 67.7%, down by 430 basis points, attributed to higher material costs. Selling expenses rose to 35% of revenue, while general and administrative costs grew to 27.7%. Overall profitability fell to 4.5%, with earnings per share down by four cents. The company ended the quarter with $25.9 million in total assets and no debt. Helo remains optimistic about navigating COVID-related challenges and expanding into new markets.

Positive

- Q1 2022 revenue increased by 39% year-over-year to $10.7 million.

- Maintained a strong balance sheet with total assets of $25.9 million and no debt.

Negative

- Gross margin decreased by 430 basis points to 67.7% due to rising material costs.

- Selling expenses increased to 35% of revenue, reflecting higher temporary incentives.

- General and administrative costs rose to 27.7% of revenue, impacting overall profitability.

News Market Reaction 1 Alert

On the day this news was published, HLOC gained 10.62%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

SAN FRANCISCO, CA / ACCESSWIRE / May 16, 2022 / Helo Corp. (OTC PINK:HLOC) ("Helo" or the "Company"), a leading developer of wearable devices at the forefront of digital health sharing and data-driven wellness, is pleased to announce its first quarter 2022 results.

"We continued to see a healthy market for our VyvoTM products and services being sold to wellness consumers worldwide," said Sean McVeigh Chief Executive Officer. "I am pleased with the start we had to 2022. We continue to navigate challenges related to COVID-19, including restrictions on in-person meetings, international travel and supply chain delays and we expect to experience these challenges for the foreseeable future. However, with the strong product pipeline that we already have in development, our robust business model and resources together with the hiring of senior management and planned expansion into sizable new markets, I believe we are well positioned to address these challenges in the short term and take advantage of growth opportunities as they emerge."

"Our first quarter 2022 revenue was

About Helo Corp.

Helo Corp. (OTC PINK:HLOC) is a data-driven wellness technology company at the forefront of the Digital Health Sharing Economy. Helo uses its life watches and other personal devices and its proprietary bio-metrics data platform to encourage wellness-centered lifestyles and consumer data empowerment under its Vyvo TM brand and to power the self-funding, Digital Health Sharing Economy. Our Life Sensing TechnologyTM uses state-of-the-art sensors, enhanced signal processing, and algorithms to collect and process specific bio-parameters for the user and Healthtech market. We incentivize our customers with token rewards to continuously build up our shared bio-bank through self-tracking. Our data rich platform empowers our customers to own and control their bio-metric data, while providing AI-formulated personalized reports and alerts, as well as customized Nutrapak supplements. Our platform also presents Big Data opportunities for technology development, medical research and diagnostics.

For further information on Vyvo and Helo, please click on the links below:

https://www.vyvo.com and http://www.helocorp.com

The Company's disclosure statements and unaudited financial statements are available at https://www.otcmarkets.com/stock/HLOC/disclosure.

Forward Looking Statements

This news release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as may, "will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates," potential and similar statements. All statements other than statements of historical fact in this press release are forward-looking statements and involve certain risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. These forward-looking statements are based on management's current expectations, assumptions, estimates and projections about the Company and the industry in which the Company operates, but involve a number of unknown risks and uncertainties. Further information regarding these and other risks is included in the Company's filings with the OTC Markets and the Securities and Exchange Commission. The Company undertakes no obligation to update forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and actual results may differ materially from the anticipated results. You are urged to consider these factors carefully in evaluating the forward-looking statements contained herein and are cautioned not to place undue reliance on such forward-looking statements, which are qualified in their entirety by these cautionary statements.

Investors Contact:

investors@helocorp.com

650-646-2193

SOURCE: Helo Corp.

View source version on accesswire.com:

https://www.accesswire.com/701224/Helo-Corp-Announces-First-Quarter-Results-of-39-Revenue-Growth-and-Investment-in-New-Markets