Hannover House Expands Production and Financing Opportunities in Oklahoma as Natural Extension to Form 10 Filing and MyFlix Launch

Rhea-AI Summary

Hannover House (OTC PINK:HHSE) has filed to do business in Oklahoma, aiming to capitalize on the state's incentives for film production. The company plans to acquire 12 acres in Cherokee County to construct a 15,000 sq. ft. film stage for its $20 million project, "Meltdown". Following necessary approvals, the land acquisition is expected within 45 days. Hannover is also preparing a Form 10 registration and an S1 stock offering to raise funds for its MyFlix streaming service, offering initial shares at $0.05 each. This move is seen as a shift towards producing higher-budget films.

Positive

- Plans to acquire land for a 15,000 sq. ft. production stage in Oklahoma, supporting a $20 million film project.

- Intended land acquisition will enhance production efficiency and take advantage of Oklahoma's film incentives.

- Preparation of Form 10 registration and S1 stock offering to raise capital for MyFlix launch, focusing 70% of funds on operations and project development.

Negative

- The land acquisition and construction won't directly qualify for state incentives.

- Past delays in filing the Form 10 due to foreign defaults and other obstacles may reflect operational challenges.

FAYETTEVILLE, AR / ACCESSWIRE / July 25, 2021 / Hannover House, Inc., (OTC PINK:HHSE) has filed with the Oklahoma Secretary of State to conduct business in Oklahoma as part of the company's current activities with the newly announced

The State of Oklahoma has been supporting motion picture and television production through a series of incentives and rebates that make it one of the best locales for filming in the U.S.A. With the maturation of the entertainment market moving towards "event" level films - as well as Hannover's own desire to create locomotive titles for the company's upcoming MyFlix streaming portal - a presence in Oklahoma should prove to be financially beneficial to the company, explained C.E.O. Eric Parkinson.

Following approval of the Flood Plain Permit and other documentation required by the Oklahoma Department of Environmental Quality and the Cherokee County planning department, Hannover House plans to tender an offer for the land and to make the appropriate material disclosures to the Securities and Exchange Commission and OTC Markets. To qualify for the maximum level of incentive support from Oklahoma, it may be necessary to purchase the land and pursue the "Meltdown" production through an Oklahoma-domiciled, special-purpose entity instead of directly under Hannover House, Inc. as a foreign corporation doing business in Oklahoma.

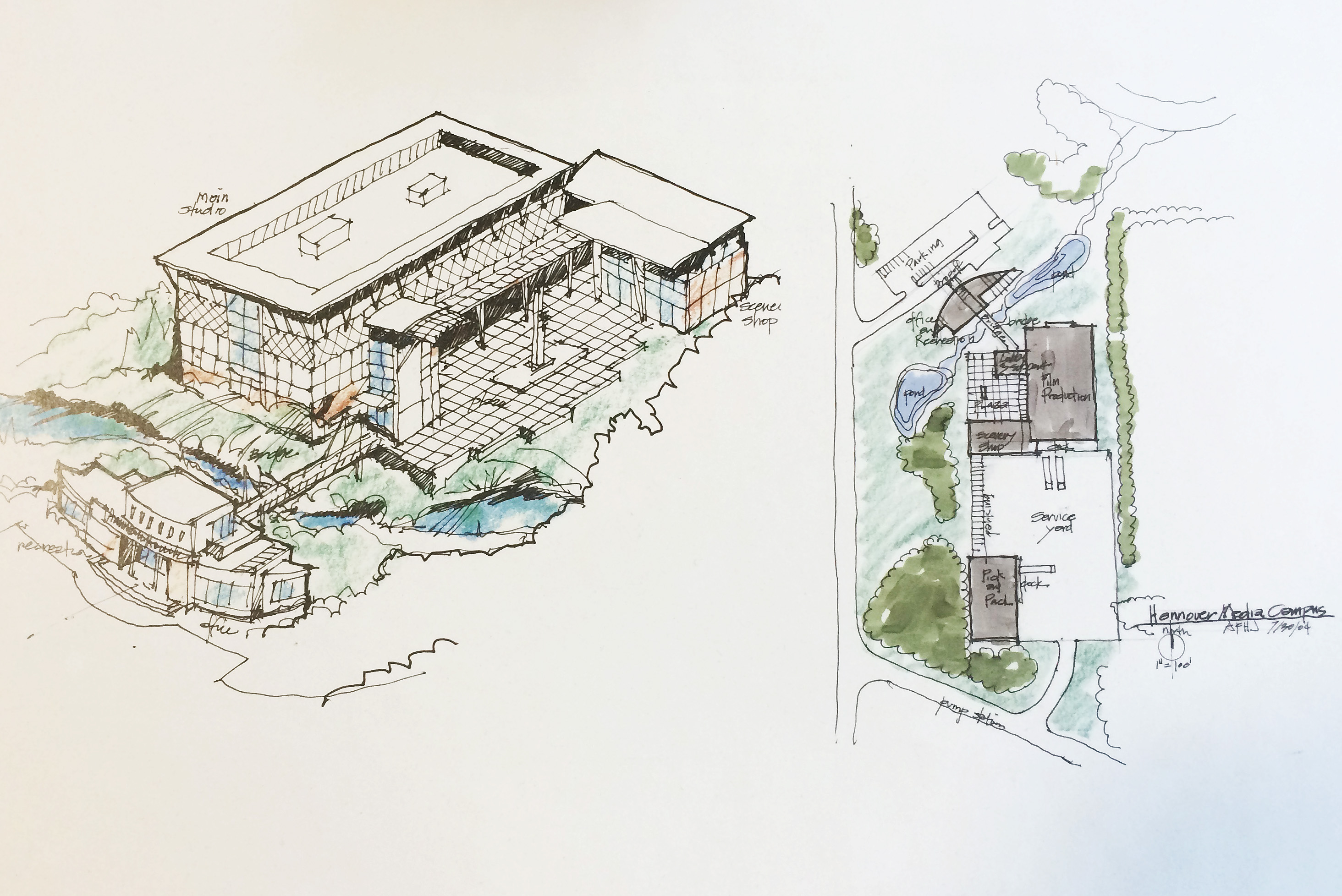

Due to the material nature of this transaction, specific details including the plot location, the architectural plans, the special purpose entity and the financing structure will be added this week into the Hannover House Form 10-12(g) Registration Filing. Although the acquisition of the land and the construction of a film stage will not qualify for State of Oklahoma incentives, the use of the facility for "Meltdown" and other features will be allowed. Hannover House has prepared the Form 10 registration as a key step towards elevating the company's stature and financing opportunities. The company has been addressing prior obstacles that have delayed or otherwise impeded the filing of the Form 10, including actions to contest or otherwise set-aside foreign defaults that were filed against the company but for which meritorious defenses exist. Other issues have been addressed, including the engagement of outside advisors to the Board of Directors and updated accounting reporting periods for the PCAOB auditors. Hannover's current actions with MyFlix, "Meltdown" and other ongoing activities evidences the company's confidence that the publication of the Form 10 registration is imminent.

"The development of a film and office facility is an important step as we move Hannover House out of the budget-DVD arena and into the front-line marketplace for ‘A' level movies," said Parkinson. "Production opportunities in Oklahoma are arguably the best in the nation, due to both the State's programs as well as the generally lowered rates for many services and personnel. Having access to this facility will enable us to work efficiently on ‘Meltdown' and other features, as well as have the option for the housing of operational offices for Hannover House and MyFlix," he concluded.

Hannover House, Inc. is a Wyoming registered corporation. But since 2002, the company has maintained offices in Fayetteville, Arkansas due to the prior business model as a DVD distributor, with the locally-based Walmart Stores, Inc. as the company's primary retail customer. As sales of independent DVDs have declined - which trend was dramatically accelerated with the general retail market shut down from COVID-19 - Hannover House has found greater opportunities and market support with the development of the multi-studio streaming venture, MyFlix. Parkinson describes the business model for MyFlix as being the "Blockbuster of Streaming" in that the site and APP will have over 50 supplier studios and over 20,000 titles, rivaling the broad selection that made Blockbuster Video into the nation's home entertainment leader for over 20-years during the era of video rentals. Parkinson sees the streaming market as following a similar path as the prior video rental industry, with consumers "renting" programs directly from home, on either a per-transaction basis or on a monthly subscription basis. Studio specific sites have an inherent weakness in that they can offer consumers only a limited number of titles - as evidenced by the term of "Netflix-fatigue" which can also apply to other streaming services.

Hannover House stock is currently traded on the OTC Markets Exchange under ticker symbol HHSE. The company's stock has seen an increase in trading volume and pricing following several successful activities at the recently completed Cannes Film Festival and Marche du Film in France. Contemporaneous with the current Form 10 filing, the company will be making a S1 stock registration offering to raise funds for the MyFlix launch. The company will initially offer 30-million shares at $.05 each with additional shares offered at $.08 and $.10 each. Under the use-of-proceeds of the S1 registration and stock offering, seventy percent of the new revenues are designated solely for MyFlix, operations and new project development, with thirty percent eligible for debt and payables management.

For more information contact: ERIC PARKINSON, C.E.O., Eric@HannoverHouse.com, 818-481-5277.

SOURCE: Hannover House, Inc.

View source version on accesswire.com:

https://www.accesswire.com/656957/Hannover-House-Expands-Production-and-Financing-Opportunities-in-Oklahoma-as-Natural-Extension-to-Form-10-Filing-and-MyFlix-Launch