Hot Chili Continues to Expand its Costa Fuego Coastal Copper Hub in Chile

- The acquisition of the Marsellesa and Cordillera mine areas provides Hot Chili with a pipeline of opportunities for new mineral resources, aligning with the company's growth strategy for the Costa Fuego copper hub.

- The Costa Fuego Project is established as a low-risk, long-life copper project with a high annual copper equivalent metal production profile, positioning Hot Chili well for future growth and returns.

- Hot Chili's strong financial position with A$21.8 million in cash as of September 30, 2023, supports the company's near-term focus on regional land consolidation and rapid definition of additional high-grade and bulk tonnage copper resources for Costa Fuego.

- None.

Options Executed to Acquire Two Historical Mine Areas

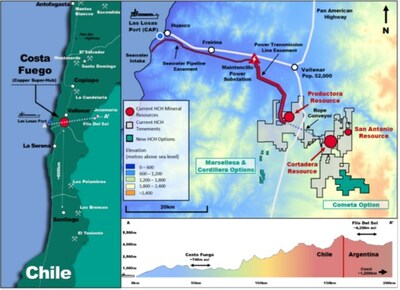

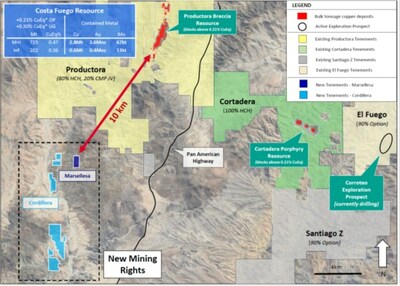

Marsellesa and Cordillera are located approximately 10km southwest of Costa Fuego's planned central processing hub (refer accompanying Figures 1 to 4).

Both mine areas have been privately held and historically exploited for shallow copper oxide and copper sulphide material but have never previously been drill tested.

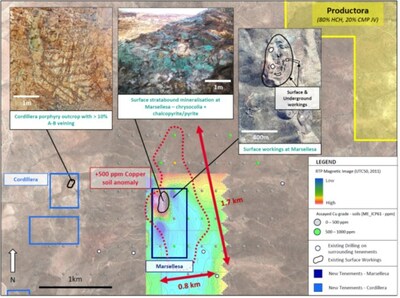

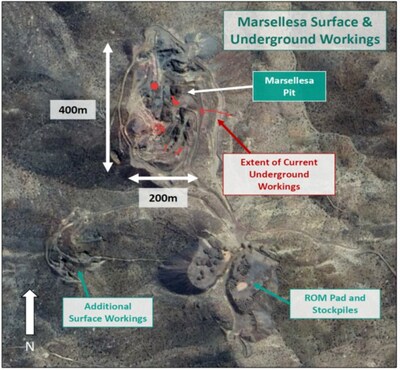

The Marsellesa mine area is laterally extensive, measuring 400m in length and 200m in width, with mine workings exposing multiple zones of shallowly-dipping, strata-bound (manto-style), copper mineralisation.

Lying approximately 1km west of Marsellesa, the smaller Cordillera mine workings expose outcropping porphyry copper mineralisation with well-developed stockwork and sheeted A and B style porphyry veining.

First-pass Reverse Circulation (RC) drilling is planned to commence at Marsellesa and Cordillera in the coming week, following completion of drilling at the Company's Corroteo exploration target, located 5km southeast of the Cortadera porphyry copper-gold deposit.

These latest project additions, including the Cometa project (as announced 28th August 2023), provide a pipeline of opportunities and additional optionality for the discovery of new mineral resources for the Company's Costa Fuego copper hub.

Hot Chili continues to pursue further regional consolidation as the Company advances its growth strategy for Costa Fuego.

The Company's recently published Preliminary Economic Assessment entitled Costa Fuego Copper Project – NI 43-101 Technical Report Preliminary Economic Assessment with an effective date of June 28, 2023 (the "PEA")1 establishes Costa Fuego as a low-risk, long life copper project benefiting from a low start-up capital and a high annual copper equivalent2 metal production profile of over 100 kt for a 16-year mine life, including 95 kt copper and 49 koz gold during primary production (first 14 years) at C1 Cash Cost3 of

Hot Chili is focussed on up-scaling Costa Fuego's resource base and potential study scale towards a 150,000 tpa copper production profile, in order to further enhance project returns ahead of the delivery of the Costa Fuego Pre-Feasibility Study ("PFS").

The material terms of the executed Marsellesa Option Agreement are as follows:

- Hot Chili's subsidiary Sociedad Minera La Frontera SpA ("Frontera") has executed a definitive option agreement with Hermanos Pefaur SpA, the holder of a

100% interest in the concession comprising Marsellesa, for the grant to Frontera of an option to acquire a100% interest in the Marsellesa concession ("Marsellesa Option"). - Non-refundable cash payment of

US to Pefaur upon grant of the Marsellesa Option.$100,000 - Non-refundable cash payment of

US within 12 months from the grant of the Marsellesa Option.$100,000 - Non-refundable cash payment of

US within 24 months from the grant of the Marsellesa Option.$150,000 - Option may be exercised within 36 months of the date of grant of the Marsellesa Option for a final non-refundable cash payment of

US .$1,000,000 - Pefaur will also be granted a

1% NSR royalty over the Marsellesa concession on exercise of the Marsellesa Option. Frontera will have a right of first refusal to buy-back the NSR royalty.

The material terms of the executed Cordillera Option Agreement are as follows:

- Hot Chili's subsidiary Sociedad Minera La Frontera SpA ("Frontera") has executed a definitive option agreement with Mr Arnaldo Del Campo ("ADC") the holder of a

100% interest in the concessions comprising Cordillera, for the grant to Frontera of an option to acquire a100% interest in the Cordillera concessions ("Cordillera Option"). - Non-refundable cash payment of

US to ADC upon grant of the Cordillera Option.$100,000 - Non-refundable cash payment of

US within 24 months from the grant of the Cordillera Option.$200,000 - Option may be exercised within 48 months of the date of grant of the Cordillera Option for a final non-refundable cash payment of

US .$3,700,000 - Within the Cordillera concessions, ADC will also be granted a

1% NSR royalty over any material extracted from underground operations, and a1.5% NSR royalty over any material extracted from open pit operations, on exercise of the Cordillera Option. Frontera will have a right of first refusal to buy-back the NSR royalties.

__________________________________ |

1 The PEA is preliminary in nature and includes |

2 CuEq considers assumed commodity prices and average metallurgical recoveries from testwork. See page 9 for complete mineral resource disclosure of Costa Fuego. |

3 See page 7 for full non-IFRS measures discussion. |

Hot Chili is well positioned with

The Company looks forward to providing further updates as exploration drilling activities progress across Corroteo, Marsellesa and Cordillera.

This announcement is authorised by the Board of Directors for release to ASX and TSXV.

Hot Chili's Managing Director and Chief Executive Officer Mr Christian Easterday is responsible for this announcement and has provided sign-off for release to the ASX and TSXV.

For more information please contact:

Christian Easterday Managing Director – Hot Chili | Tel: +61 8 9315 9009 Email: admin@hotchili.net.au

| |

Penelope Beattie Company Secretary – Hot Chili | Tel: +61 8 9315 9009 Email: admin@hotchili.net.au

| |

Harbor Access Investor & Public Relations ( | Email: graham.farrell@harbor-access.com Email: jonathan.paterson@harbor-access.com

|

or visit Hot Chili's website at www.hotchili.net.au

Technical Report

Certain scientific, technical and economic information contained in this news release is derived from the PEA. For readers to fully understand such information, they should read the PEA technical report prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101") (available on www.sedarplus.ca or at www.hotchili.net.au) in its entirety, including all qualifications, assumptions, limitations and exclusions that relate to the information set out in this news release. The PEA is intended to be read as a whole, and sections should not be read or relied upon out of context. The technical information in this news release is subject to the assumptions and qualifications contained in the PEA.

Qualified Persons – NI 43-101

The PEA was compiled by Wood Australia Pty Ltd with contributions from a team of independent qualified persons (within the meaning of NI 43-101). The scientific, technical and economic information contained in this news release pertaining to Coast Fuego is based on the PEA, which was prepared by the following independent qualified persons (within the meaning of NI 43-101):

- Ms Elizabeth Haren (MAUSIMM (CP) & MAIG) of Haren Consulting – Mineral Resource Estimate

- Mr Dean David (FAUSIMM (CP)) of Wood Pty Ltd – Metallurgy

- Mr Piers Wendlandt (PE) of Wood Pty Ltd – Market Studies and Contracts, Economic Analysis

- Mr Jeffrey Steven (PE) of Wood Pty Ltd – Capital and Operating Costs

- Mr Anton von Wielligh (FAUSIMM) of ABGM Consulting Pty Ltd – Mine Planning and Scheduling

- Mr Edmundo Laporte (PE) of GAC – Environmental Studies, Permitting and Social or Community Impact

- Mr Dave Morgan (PE) of Knight Piésold – Project Infrastructure (TSF)

The independent qualified persons have verified the information disclosed in the PEA, including the sampling, preparation, security, and analytical procedures underlying such information.

Disclosure regarding mine planning and infrastructure has been reviewed and approved by Mr Grant King, FAUSIMM, Hot Chili's Chief Operations Officer, and a qualified person within the meaning of NI 43-101.

The scientific and technical information in this new release, other than such information derived from the PEA, has been reviewed and approved by Mr Christian Easterday, MAIG, Hot Chili's Managing Director and Chief Executive Officer, and a qualified person within the meaning of NI 43-101.

Competent Persons – JORC

The information in this announcement that relates to Exploration Results for the Marsellesa and Cordillera projects is based upon information compiled by Mr Christian Easterday, the Managing Director and a full-time employee of Hot Chili Limited whom is a Member of the Australasian Institute of Geoscientists (AIG). Mr Easterday has sufficient experience that is relevant to the style of mineralisation and type of deposits under consideration and to the activity which he is undertaking to qualify as a 'Competent Person' as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves' (JORC Code). Mr Easterday consents to the inclusion in the report of the matters based on their information in the form and context in which it appears.

The information in this announcement that relates to Mineral Resources for the Costa Fuego Project is based on information compiled by Ms Elizabeth Haren, Mr Dean David, Mr Piers Wendlandt, Mr Jeffrey Steven, Mr Anton von Wielligh, Mr Edmundo Laporte and Mr Dave Morgan. Ms Haren is a full-time employee of Haren Consulting Pty Ltd and a Member and Chartered Professional of The Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Mr David is a full-time employee of Wood Pty Ltd and a Fellow of The Australasian Institute of Mining and Metallurgy. Mr Wendlandt is a full-time employee of Wood Pty Ltd and a Registered Professional Engineer in the

Ms Haren, Mr David, Mr Wendlandt, Mt Steven, Mr von Wielligh, Mr Laporte and Mr Morgan have sufficient experience, which is relevant to the style of mineralisation and types of deposits under consideration and to the activities undertaken, to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code of Reporting of Exploration Results, Mineral Resources and Ore Reserves'.

Disclaimer

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Note for U.S. Investors Concerning Mineral Resources

NI 43-101 is a rule of the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Technical disclosure contained in this news release has been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Classification System. These standards differ from the requirements of the

All amounts in this news release are in

Non IFRS Financial Performance Measures

"C1 Cash Cost" is not a performance measures reported in accordance with International Financial Reporting Standards ("IFRS"). These performance measures are included because these statistics are key performance measures that management uses to monitor performance. Management uses these statistics to assess how the Costa Fuego Project compares against its peer projects and to assess the overall effectiveness and efficiency of the contemplated mining operations. These performance measures do not have a meaning within IFRS and, therefore, amounts presented may not be comparable to similar data presented by other mining companies. These performance measures should not be considered in isolation as a substitute for measures of performance in accordance with IFRS.

Forward Looking Statements

This news release contains certain statements that are "forward-looking information" within the meaning of Canadian securities legislation and Australian securities legislation (each, a "forward-looking statement"). Forward-looking statements reflect the Company's current expectations, forecasts, and projections with respect to future events, many of which are beyond the Company's control, and are based on certain assumptions. No assurance can be given that these expectations, forecasts, or projections will prove to be correct, and such forward-looking statements included in this news release should not be unduly relied upon. Forward-looking information is by its nature prospective and requires the Company to make certain assumptions and is subject to inherent risks and uncertainties. All statements other than statements of historical fact are forward-looking statements. The use of any of the words "believe", "could", "estimate", "expect", "may", "plan", "planned", "planning", "potential", "project", "projections", "should", "up-scale", "will", "would" and similar expressions are intended to identify forward-looking statements.

The forward-looking statements within this news release are based on information currently available and what management believes are reasonable assumptions. Forward-looking statements speak only as of the date of this news release. In addition, this news release may contain forward-looking statements attributed to third-party industry sources, the accuracy of which has not been verified by the Company.

In this news release, forward-looking statements relate, among other things, to: the Company's timing and ability to enter into a definitive agreement with respect to the Option; the completion of the conditions to exercise the Option; receipt of all regulatory approvals in respect of the Option, including the approval of the TSXV (if required); prospects, projections and success of the Company and its projects; the ability of the Company to expand mineral resources beyond current mineral resource estimates; the results and impacts of current and planned drilling, to extend mineral resources and to identify new deposits, including at Marsellesa, Cordillera and Corroteo; the Company's ability to convert mineral resources to mineral reserves; opportunities for growth in mineral projects; the timing and outcomes of future planned economic studies; the Company's ability to up-scale the Project to 150,000 tpa of copper production; the timing and outcomes of regulatory processes required to obtain permits for the development and operation of the Costa Fuego Project as contemplated in the PEA and/or future planned economic studies; whether or not the Company will make a development decision and the timing thereof; the ability of the Company to consolidate additional landholdings around its Project; estimates of cost; and estimates of planned exploration across multiple Corroteo, Marsellesa and Cordillera.

Forward-looking statements involve known and unknown risks, uncertainties, and other factors, which may cause the actual results, performance, or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. A number of factors could cause actual results to differ materially from a conclusion, forecast or projection contained in the forward-looking statements in this news release, including, but not limited to, the following material factors: the ability of the Company to complete the conditions to exercise the Option; obtaining all regulatory approvals for the completion of the Option; operational risks; risks related to the cost estimates of exploration; sovereign risks associated with the Company's operations in

Although the forward-looking statements contained in this news release are based upon assumptions which the Company believes to be reasonable, the Company cannot assure investors that actual results will be consistent with these forward-looking statements. With respect to forward-looking statements contained in this news release, the Company has made assumptions regarding: future commodity prices and demand; availability of skilled labour; timing and amount of capital expenditures; future currency exchange and interest rates; the impact of increasing competition; general conditions in economic and financial markets; availability of drilling and related equipment; effects of regulation by governmental agencies; future tax rates; future operating costs; availability of future sources of funding; ability to obtain financing; and assumptions underlying estimates related to adjusted funds from operations. The Company has included the above summary of assumptions and risks related to forward-looking information provided in this news release to provide investors with a more complete perspective on the Company's future operations, and such information may not be appropriate for other purposes. The Company's actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward-looking statements and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what benefits the Company will derive therefrom.

For additional information with respect to these and other factors and assumptions underlying the forward-looking statements made herein, please refer to the public disclosure record of the Company, including the Company's most recent Annual Report, which is available on SEDAR+ (www.sedarplus.ca) under the Company's issuer profile. New factors emerge from time to time, and it is not possible for management to predict all those factors or to assess in advance the impact of each such factor on the Company's business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement.

The forward-looking statements contained in this news release are expressly qualified by the foregoing cautionary statements and are made as of the date of this news release. Except as may be required by applicable securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking statement to reflect events or circumstances after the date of this news release or to reflect the occurrence of unanticipated events, whether as a result of new information, future events or results, or otherwise. Investors should read this entire news release and consult their own professional advisors to ascertain and assess the income tax and legal risks and other aspects of an investment in the Company.

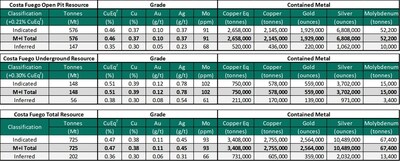

Costa Fuego Combined Mineral Resource (Effective Date 31st March 2022)

1 Mineral Resources are reported on a |

2 The Productora deposit is |

3. The Cortadera deposit is controlled by a Chilean incorporated company Sociedad Minera La Frontera SpA (Frontera). Frontera is a subsidiary company – |

4 The San Antonio deposit is controlled through Frontera ( |

5 The Mineral Resource estimates in the tables above form coherent bodies of mineralisation that are considered amenable to a combination of open pit and underground extraction methods based on the following parameters: Base Case Metal Prices: Copper |

6 Metallurgical recovery averages for each deposit consider Indicated + Inferred material and are weighted to combine sulphide flotation and oxide leaching performance. Process recoveries: Cortadera and |

7 Resource Copper Equivalent (CuEq) grades are calculated based on the formula: CuEq% = ((Cu% × Cu price |

8 Mineral resources are not mineral reserves and do not have demonstrated economic viability. These Mineral Resource estimates include Inferred Mineral Resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorised as Mineral Reserves. It is reasonably expected that the majority of Inferred mineral resources could be upgraded to Measured or Indicated Mineral Resources with continued exploration. |

9 The effective date of the estimate of Mineral Resources is March 31st, 2022. Refer to ASX Announcement "Hot Chili Delivers Next Level of Growth" ("Resource Announcement") for JORC Code Table 1 information related to the Costa Fuego Resource Estimate (MRE) by Competent Person Elizabeth Haren, constituting the MREs of Cortadera, Productora and |

10 Hot Chili Limited is not aware of political, environmental or other risks that could materially affect the potential development of the Mineral Resources. |

Appendix 1. JORC Code Table 1 for Marsellesa and Cordillera Landholdings

Section 1 Sampling Techniques and Data

Criteria | JORC Code explanation | Commentary |

Sampling | Nature and quality of sampling (e.g., cut channels, Include reference to measures taken to ensure sample Aspects of the determination of mineralisation that are In cases where 'industry standard' work has been done | No known drilling has been completed on the Marsellesa or For soil samples, maximum 1 kg sample collected from 20 cm Samples transported to La Serena sample preparation facility

|

Drilling | Drill type (eg core, reverse circulation, open-hole | No known drilling has been completed on the Marsellesa or |

Drill sample | Method of recording and assessing core and chip sample Measures taken to maximise sample recovery and Whether a relationship exists between sample recovery | No known drilling has been completed on the Marsellesa or Cordillera Landholdings. |

Logging | Whether core and chip samples have been geologically Whether logging is qualitative or quantitative in nature. The total length and percentage of the relevant | No known drilling has been completed on the Marsellesa or Cordillera Landholdings. Soils were qualitatively logged, including weathering and

|

Sub- | If core, whether cut or sawn and whether quarter, half or all core taken. If non-core, whether riffled, tube sampled, rotary split, etc For all sample types, the nature, quality and Quality control procedures adopted for all sub-sampling

Measures taken to ensure that the sampling is Whether sample sizes are appropriate to the grain size of | No known drilling has been completed on the Marsellesa or |

Quality of | The nature, quality and appropriateness of the assaying and laboratory procedures used and whether the technique is considered partial or total. For geophysical tools, spectrometers, handheld XRF instruments, etc, the parameters used in determining the times, calibrations factors applied and their derivation, Nature of quality control procedures adopted (eg bias) and precision have been established. | ME-MS61 was used for multi-element geochemistry due to the

Laboratory standards were used to determine data quality. A reduced to Pole (RTP) magnetic survey has been completed

|

Verification | The verification of significant intersections by either independent or alternative company personnel.

The use of twinned holes. Documentation of primary data, data entry procedures, data verification, data storage (physical and electronic) Discuss any adjustment to assay data. | Electronic copies of the analysis reports are available. They

|

Location of | Accuracy and quality of surveys used to locate drill holes (collar and down-hole surveys), trenches, mine workings Specification of the grid system used. Quality and adequacy of topographic control. | Soil sample data located using a Garmin hand-held GPS. |

Data | Data spacing for reporting of Exploration Results. Whether the data spacing and distribution is sufficient to Whether sample compositing has been applied. | Soil samples were located on a grid oriented north-south on |

Orientation | Whether the orientation of sampling achieves unbiased sampling of possible structures and the extent to which this is known, considering the deposit type. If the relationship between the drilling orientation and the | Soil sample points were located near-perpendicular to |

Sample | The measures taken to ensure sample security. | Soil samples were transported by company employees |

Audits or | The results of any audits or reviews of sampling | None completed. |

Section 2 Reporting of Exploration Results

Criteria | JORC Code explanation | Commentary | ||||||||

Mineral tenement and land tenure status | Type, reference name/number, location and partnerships, overriding royalties, native title The security of the tenure held at the time of | Geophysical survey and soil sampling was completed only on the

| ||||||||

Exploration done by other parties | Acknowledgment and appraisal of exploration by other parties. | Exploration and mining on the Marsellesa and Cordillera Drilling on surrounding tenements was completed by Compania Minera del Pacifico (CMP). | ||||||||

Geology | Deposit type, geological setting and style of mineralisation. | The Marsellesa landholding contains a Fe-Cu mineralised body, The Cordillera landholdings contain porphyry copper B porphyry veining.. Surface mapping projects are ongoing across both landholdings. | ||||||||

Drillhole Information | A summary of all information material to the understanding of the exploration results including a tabulation of the following information for all Material drill holes: easting and northing of the drill hole collar elevation or RL (Reduced Level – elevation above sea level in metres) of the drill hole collar dip and azimuth of the hole

down hole length and interception depth

hole length. If the exclusion of this information is justified on the basis that the information is not Material and this exclusion does not detract from the understanding of the report, the Competent Person should clearly explain why this is the case. | Drilling by CMP on surrounding landholdings in listed below (collar | ||||||||

HOLEID | X (PSAD_56) | Y (PSAD_86) | Z (PSAD_86) | DEPTH | ||||||

PMEX-079 | 316817 | 6810211 | 1070 | 414.75 | ||||||

PMEX-080 | 315611 | 6810548 | 1017 | 387.65 | ||||||

PMEX-081 | 315118 | 6810568 | 984 | 440.35 | ||||||

PMEX-082 | 315180 | 6809688 | 970 | 398.6 | ||||||

PMEX-083 | 315826 | 6809662 | 1011 | 514.3 | ||||||

PMEX-084 | 316611 | 6809670 | 1055 | 404.35 | ||||||

PMEX-086 | 316825 | 6809165 | 1020 | 408.35 | ||||||

PMEX-088 | 315893 | 6809155 | 973 | 461.6 | ||||||

PMEX-090 | 316615 | 6810569 | 1093 | 290.8 | ||||||

Data aggregation methods | In reporting Exploration Results, weighting averaging techniques, maximum and/or minimum grade truncations (eg cutting of high grades) and cut-off grades are usually Material and should be stated. Where aggregate intercepts incorporate short lengths of high-grade results and longer lengths of low grade results, the procedure used for such aggregation should be stated and some typical examples of such aggregations should be shown in detail. The assumptions used for any reporting of metal equivalent values should be clearly stated | No known drilling has been completed on the Marsellesa or | ||||||||

Relationship between mineralisation widths and intercept lengths | These relationships are particularly important in the reporting of Exploration Results. If the geometry of the mineralisation with respect to the drill hole angle is known, its nature should be reported. If it is not known and only the down hole lengths are reported, there should be a clear statement to this effect (eg 'down hole length, true width not known').. | No known drilling has been completed on the Marsellesa or | ||||||||

Diagrams | Appropriate maps and sections (with scales) and tabulations of intercepts should be included for any significant discovery being reported These should include, but not be limited to a plan view of drill hole collar locations and appropriate sectional views. | Refer to figures in the announcement.

| ||||||||

Balanced reporting | Where comprehensive reporting of all Exploration Results is not practicable, representative reporting of both low and high grades and/or widths should be practiced to avoid misleading reporting of Exploration Results. | All assayed soil samples reported within the Marsellesa and Cordillera landholdings. | ||||||||

Other substantive exploration data | Other exploration data, if meaningful and material, should be reported including (but not limited to): geological observations; geophysical survey results; geochemical survey results; bulk samples – size and method of treatment; metallurgical test results; bulk density, groundwater, geotechnical and rock characteristics; potential deleterious or contaminating substances. | A Reduced to Pole (RTP) magnetic survey has been completed November 2007 by Argali Geofisica on a line spacing of 200 m (E -W lines) on the PSAD56 grid.

| ||||||||

Further work | The nature and scale of planned further work (eg tests for lateral extensions or depth extensions or large-scale step-out drilling). Diagrams clearly highlighting the areas of possible extensions, including the main geological interpretations and future drilling areas, provided this information is not commercially sensitive. | Additional work currently being planned across the Marsellesa and Cordillera landholdings, including but not limited to detailed litho- and preliminary exploration drilling. | ||||||||

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/hot-chili-continues-to-expand-its-costa-fuego-coastal-copper-hub-in-chile-301988702.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/hot-chili-continues-to-expand-its-costa-fuego-coastal-copper-hub-in-chile-301988702.html

SOURCE Hot Chili Limited

FAQ

What mine areas did Hot Chili acquire?

What are the terms of the Option Agreements for the acquisitions?

What is the company's financial position?

What is the company's growth strategy for Costa Fuego?