Hot Chili Intersects Significant Copper-Gold Porphyry-style Mineralisation at La Verde

Rhea-AI Summary

Hot Chili has confirmed a significant copper-gold discovery at La Verde, located 30km south of their Costa Fuego Project in Chile. Key drilling results include a 202m intersection grading 0.6% copper and 0.3g/t gold from 70m depth. The first two drill holes of a 4,000m program have shown promising results, with DKP002 recording 308m grading 0.5% Cu and 0.3g/t Au.

La Verde's porphyry footprint measures approximately 850m by 700m, comparable to the Company's Cortadera Cuerpo 3 deposit. The program has been expanded to 6,000m with results pending for 10 more drill holes. The company maintains a strong financial position with A$25.7 million in treasury as of September 2024, and plans to release the Costa Fuego PFS and Water Supply Business Case Study PFS in Q1 2025.

Positive

- Significant copper-gold discovery with high-grade intersections (202m @ 0.6% Cu, 0.3g/t Au)

- Large porphyry footprint comparable to established Cortadera deposit

- Strong treasury position of A$25.7 million

- Mineralization remains open in all directions

- Drill program expanded from 4,000m to 6,000m due to promising results

Negative

- None.

News Market Reaction 1 Alert

On the day this news was published, HHLKF gained 20.55%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

202m grading

Highlights

- First drill hole (DKP001) at La Verde intersects intercepts 174m grading

0.4% copper (Cu), 0.1g/t gold (Au) from 36m depth - Second drill hole (DKP002), located 120m southeast of DKP001, recorded 308m grading

0.5% Cu and 0.3g/t Au from 46m depth to end of hole- including 202m grading

0.6% Cu, 0.3g/t Au from 70m depth - which includes 100m grading

0.7% Cu, 0.3g/t Au from 118m depth

- including 202m grading

- Results for 10 more drill holes pending and drill program expanded to 6,000m

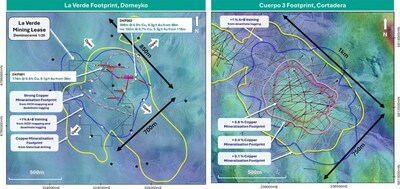

- La Verde's porphyry footprint, measures approximately 850m by 700m; comparable to Hot Chili's higher-grade Cortadera Cuerpo 3 copper-gold porphyry, located 30km north

- Costa Fuego Copper-Gold Project Pre-feasibility Study (PFS) and Huasco Water PFS advancing towards release in Q1, 2025

- Treasury of approximately A

$25.7 million as of 30 September 2024

Assay results for the first two drill holes of a 4,000m drill programme being undertaken across the recently secured La Verde porphyry copper-gold target have returned a wide drilling intersection of 202m grading

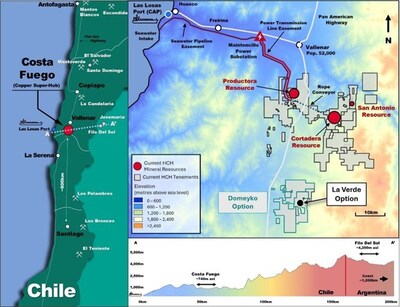

La Verde is part of Hot Chili's recent consolidation of the Domeyko landholding where the Company earlier executed the La Verde Option Agreement (see announcement dated 11th November 2024), which for the first time consolidated and provided access to drill test a large potential porphyry copper target footprint.

The historical La Verde open pit mine was previously exploited by private interests for shallow porphyry copper-style oxide mineralisation with limited drill testing outside the central lease or to depth.

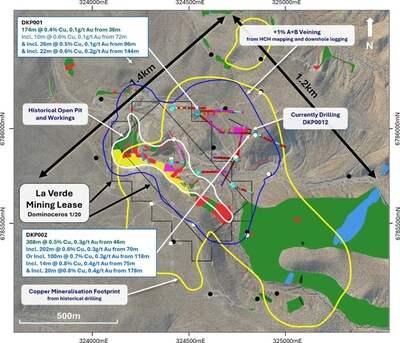

A total of twelve RC drill holes for approximately 3,150m are complete with results returned for the first two Reverse Circulation (RC) holes of the first-pass drill programme. The first two drill holes (DKP001 and DKP002) were designed to (1) validate historic drilling intercepts, and (2) test the interpreted northern extension of the porphyry from the previously exploited open pit, respectively.

Drill hole DKP001 was successful in validating the most notable copper intercept from historic exploration drill results, returning a broad significant intersection containing multiple higher-grade zones:

DKP001 returned 174m grading

- including 10m grading

0.6% Cu, 0.1g/t Au from 72m, and - including 26m grading

0.5% Cu, 0.1g/t Au from 96m, and - including 22m grading

0.6% Cu, 0.2g/t Au from 144m

- including 10m grading

Drill hole DKP002 was located approximately 120m southeast of DKP001, with assay results returning a drill intersection, that exceeded the Company's expectations and suggests potential for a higher- grade copper-gold zone within the La Verde porphyry:

A total of 308m grading

- including 202m grading

0.6% Cu, 0.3 g/t Au from 70m depth, - which includes 100m grading

0.7% Cu, 0.3 g/t Au from 118m depth

- including 202m grading

These consistent higher-grade results confirm the extension of the porphyry system almost 400m to the north-east of the open pit, a significant step out considering the existing pit measures approximately 200m x 400m. The higher-grade mineralisation is also located immediately beneath a gravel cover sequence which obscures the ultimate extent of the porphyry system. Oxide mineralisation is associated with copper clays and chalcocite up to approximately 80m vertical depth from surface with the primary sulphide mineralisation associated with chalcopyrite and pyrite.

Mineralisation appears to be open in all directions and where the system remains under cover.

Assay results are pending for ten RC drill holes, for which visual logging confirmed porphyry-style mineralisation associated with A- and B-type porphyry veining. Preliminary geological modelling indicates a +

The La Verde footprint is comparable to the +

The Company is particularly pleased with the high gold to copper ratio returned in drill hole DKP002 with additional results pending.

Hot Chili has expanded the first-pass RC drill programme with an additional 2,000m planned, now expected to be complete in late January 2025.

Hot Chili has a strong balance sheet with

The Company looks forward to providing further updates as additional drill results are returned and exploration drilling activities progress at La Verde.

This announcement is authorised by the Board of Directors for release to ASX and TSXV.

For more information please contact:

Christian Easterday Managing Director – Hot Chili | Tel: +61 8 9315 9009 Email: admin@hotchili.net.au |

Carol Marinkovich Company Secretary – Hot Chili | Tel: +61 8 9315 9009 Email: admin@hotchili.net.au |

Graham Farrell Investor & Public Relations | Email: graham@hotchili.net.au |

or visit Hot Chili's website at www.hotchili.net.au

1 | Copper equivalent. See page 10 for the basis for CuEq calculations. |

2 | Inferred mineral resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorised as Mineral Reserves. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Measured or Indicated Mineral Resource with continued exploration. See page 10 for details of the mineral resource estimate. |

Table 1. Significant Drilling Intersections from La Verde

Hole ID | Coordinates |

Dip | Hole Depth | Intersection | Interval | Copper | Gold | Silver | Molybdenum | ||||

North | East | RL | From | To | (m) | (% Cu) | (g/t Au) | (ppm Ag) | (ppm Mo) | ||||

DKP0001 | 6786079 | 324546 | 1153 | 89 | -59 | 390 | 28 | 390 | 362 | 0.3 | 0.1 | 0.5 | 33 |

Mineralised to end of hole at 390m depth | Or | 36 | 210 | 174 | 0.4 | 0.1 | 0.6 | 24 | |||||

Incl | 40 | 82 | 42 | 0.4 | 0.1 | 0.5 | 10 | ||||||

Or Incl | 72 | 82 | 10 | 0.6 | 0.1 | 0.3 | 10 | ||||||

And incl | 96 | 122 | 26 | 0.5 | 0.1 | 0.9 | 20 | ||||||

And incl | 144 | 166 | 22 | 0.6 | 0.2 | 0.7 | 49 | ||||||

And incl | 248 | 272 | 24 | 0.4 | 0.1 | 1.0 | 54 | ||||||

DKP0002 | 6785967 | 324835 | 1202 | 270 | -60 | 354 | 46 | 354 | 308 | 0.5 | 0.3 | 0.6 | 11 |

Mineralised to end of hole at 354m depth | Incl | 70 | 272 | 202 | 0.6 | 0.3 | 0.6 | 14 | |||||

Incl | 76 | 90 | 14 | 0.8 | 0.4 | 0.3 | 6 | ||||||

And incl | 118 | 218 | 100 | 0.7 | 0.3 | 0.8 | 15 | ||||||

And incl | 178 | 198 | 20 | 0.8 | 0.4 | 1.0 | 11 | ||||||

Or Incl | 186 | 190 | 4 | 0.9 | 0.5 | 1.0 | 11 | ||||||

DKP0003 | 6785963 | 324836 | 1202 | 117 | -59 | 282 | Results Pending | ||||||

DKP0004 | 6785831 | 324421 | 1123 | 90 | -60 | 120 | Results Pending | ||||||

DKP0005 | 6785792 | 324552 | 1167 | 91 | -60 | 248 | Results Pending | ||||||

DKP0006 | 6785717 | 324722 | 1178 | 110 | -60 | 200 | Results Pending | ||||||

DKP0007 | 6785846 | 324746 | 1148 | 270 | -60 | 204 | Results Pending | ||||||

DKP0008 | 6785854 | 324745 | 1145 | 5 | -60 | 324 | Results Pending | ||||||

DKP0009 | 6786068 | 324546 | 1151 | 131 | -60 | 354 | Results Pending | ||||||

DKP0010 | 6786097 | 324436 | 1160 | 209 | -60 | 276 | Results Pending | ||||||

DKP0011 | 6786097 | 324436 | 1160 | 91 | -60 | 326 | Results Pending | ||||||

DKP0012 | 6785967 | 324835 | 1202 | 299 | -60 | 72 | Currently drilling, results pending | ||||||

Notes to Table 1: Significant intercepts for La Verde are calculated above a nominal cut-off grade of |

Qualifying Statements

Qualified Person – NI 43-101

The technical information in this news release has been reviewed and approved by Mr. Christian Easterday, MAIG, Hot Chili's Managing Director and a qualified person within the meaning of NI43-101.

Competent Person – JORC

The information in this announcement that relates to Exploration Results for the La Verde project is based upon information compiled by Mr Christian Easterday, the Managing Director and a full-time employee of Hot Chili Limited, who is a Member of the Australasian Institute of Geoscientists (AIG). Mr Easterday has sufficient experience that is relevant to the style of mineralisation and type of deposits under consideration and to the activity which he is undertaking to qualify as a 'Competent Person' as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves' (JORC Code). Mr Easterday consents to the inclusion in the report of the matters based on their information in the form and context in which it appears.

Disclaimer

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this Report.

Forward Looking Statements

This announcement contains certain statements that are "forward-looking information" within the meaning of Canadian securities legislation and Australian securities legislation (each, a "forward-looking statement"). Forward-looking statements reflect the Company's current expectations, forecasts, and projections with respect to future events, many of which are beyond the Company's control, and are based on certain assumptions. No assurance can be given that these expectations, forecasts, or projections will prove to be correct, and such forward-looking statements included in this report should not be unduly relied upon. Forward-looking information is by its nature prospective and requires the Company to make certain assumptions and is subject to inherent risks and uncertainties. All statements other than statements of historical fact are forward-looking statements. The use of any of the words "could", "estimate", "expect", "expectations", "interpreted", "may", "plan", "planned", "potential", "project", "should", "will", "would" and similar expressions are intended to identify forward-looking statements.

The forward-looking statements within this announcement are based on information currently available and what management believes are reasonable assumptions. Forward-looking statements speak only as of the date of this report.

In this announcement, forward-looking statements relate, among other things, to: prospects, projections and success of the Company and its projects; the ability of the Company to expand mineral resources beyond current mineral resource estimates, including at La Verde; the results and impacts of planned drilling to extend mineral resources and to identify new deposits, including at La Verde; the metallurgical recoveries of any oxide and/or sulphide mineral resources defined at La Verde; the economics of any mineral resources defined at La Verde; the Company's ability to convert exploration potential into mineral resources, such as at La Verde; the Company's ability to explore effectively and execute drilling operations in a timely manner, including at La Verde; the Company's ability to fulfill obligations and exercise the La Verde and Domeyko Option Agreements; the Company's ability to convert mineral resources currently defined and those that may be defined through additional drilling to mineral reserves; the timing and outcomes of current and future planned economic studies including the planned PFS for the Costa Fuego copper-gold project; the potential to develop a water business in the Huasco valley and the future economics thereof; the timing and results of the PFS level Water Supply Business Case Study; the timing and outcomes of regulatory processes required to obtain permits for the development and operation of the Costa Fuego Project, including the EIA, as well as for the Huasco Water business and any mineral resources that may be defined at La Verde; whether or not the Company will make a development decision for the Costa Fuego Project and/or Huasco Water and the timing thereof; and estimates of planned exploration costs and the results thereof.

Forward-looking statements involve known and unknown risks, uncertainties, and other factors, which may cause the actual results, performance, or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. A number of factors could cause actual results to differ materially from a conclusion, forecast or projection contained in the forward-looking statements in this announcement, including, but not limited to, the following material factors: operational risks; risks related to the cost estimates of exploration; sovereign risks associated with the Company's operations in

Although the forward-looking statements contained in this announcement are based upon assumptions which the Company believes to be reasonable, the Company cannot assure investors that actual results will be consistent with these forward-looking statements. With respect to forward-looking statements contained in this announcement, the Company has made assumptions regarding: future commodity prices and demand; availability of skilled labour; timing and amount of capital expenditures; future currency exchange and interest rates; the impact of increasing competition; general conditions in economic and financial markets; availability of drilling and related equipment; effects of regulation by governmental agencies; future tax rates; future operating costs; availability of future sources of funding; ability to obtain financing; and assumptions underlying estimates related to adjusted funds from operations. The Company has included the above summary of assumptions and risks related to forward-looking information provided in this announcement to provide investors with a more complete perspective on the Company's future operations, and such information may not be appropriate for other purposes. The Company's actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward-looking statements and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what benefits the Company will derive therefrom.

For additional information with respect to these and other factors and assumptions underlying the forward- looking statements made herein, please refer to the public disclosure record of the Company, including the Company's most recent Annual Report, which is available on SEDAR+ (www.sedarplus.ca) under the Company's issuer profile. New factors emerge from time to time, and it is not possible for management to predict all those factors or to assess in advance the impact of each such factor on the Company's business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement.

The forward-looking statements contained in this announcement are expressly qualified by the foregoing cautionary statements and are made as of the date of this announcement. Except as may be required by applicable securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking statement to reflect events or circumstances after the date of this announcement or to reflect the occurrence of unanticipated events, whether as a result of new information, future events or results, or otherwise. Investors should read this entire announcement and consult their own professional advisors to ascertain and assess the income tax and legal risks and other aspects of an investment in the Company.

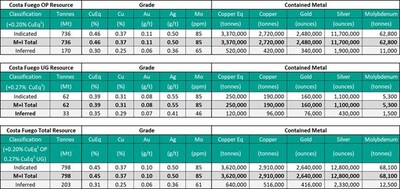

Mineral Resource Statement

Costa Fuego Combined Mineral Resource (Effective Date 26th February 2024)

1 Mineral Resources are reported on a |

2 The Productora deposit is |

3 The Cortadera deposit is controlled by a Chilean incorporated company Sociedad Minera La Frontera SpA (Frontera). Frontera is a subsidiary company – |

4 The |

5 The Mineral Resource Estimates (MRE) in the tables above form coherent bodies of mineralisation that are considered amenable to a combination of open pit and underground extraction methods based on the following parameters: Base Case Metal Prices: Copper |

6 All MRE were assessed for Reasonable Prospects of Eventual Economic Extraction (RPEEE) using both Open Pit and Block Cave Extraction mining methods at Cortadera and Open Pit mining methods at the Productora, |

7 Metallurgical recovery averages for each deposit consider Indicated + Inferred material and are weighted to combine sulphide flotation and oxide leaching performance. Process recoveries: Cortadera – Weighted recoveries of |

San Antonio - Weighted recoveries of |

8 Copper Equivalent (CuEq) grades are calculated based on the formula: CuEq% = ((Cu% × Cu price |

× Au price per g/t × Au_recovery) + (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price |

9 Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. The MRE include Inferred Mineral Resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorised as Mineral Reserves. It is reasonably expected that the majority of Inferred mineral resources could be upgraded to Measured or Indicated Mineral Resources with continued exploration. |

10 The effective date of the MRE is February 26th, 2024. The MRE were previously reported in Hot Chili's ASX announcement released February 26th, 2024 "Hot Chili Indicated Resource at Costa Fuego Copper-Gold Project Increases to 798 Mt" (Resource Announcement). Hot Chili confirms it is not aware of any new information or data that materially affects the information included in the Resource Announcement and all material assumptions and technical parameters stated for the MRE in the Resource Announcement continue to apply and have not materially changed. |

11 Hot Chili Limited is not aware of political, environmental, or other risks that could materially affect the potential development of the Mineral Resources other than as disclosed in this Report. A detailed list of Costa Fuego Project risks is included in Chapter 25.12 of the Technical Report "Costa Fuego Copper Project – NI 43-101 Technical Report Mineral Resource Estimate Update" dated April 8th, 2024. |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/hot-chili-intersects-significant-copper-gold-porphyry-style-mineralisation-at-la-verde-302334820.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/hot-chili-intersects-significant-copper-gold-porphyry-style-mineralisation-at-la-verde-302334820.html

SOURCE Hot Chili Limited