Formation Metals Expands Maiden Drill Program at the Advanced N2 Gold Project to Fully Funded 7,500 Metres

Formation Metals (OTCPK:FOMTF) has expanded its maiden drill program at the N2 Gold Project in Quebec to a fully funded 7,500 metres, as part of a planned 20,000-metre multi-phase program. The project hosts a historic resource of approximately 870,000 ounces of gold, with 18 Mt grading 1.4 g/t Au across four zones and 243 Kt grading 7.82 g/t Au in the RJ zone.

The Phase 1 program will target expansion in the "A" zone, which contains ~522,900 ounces with only 35% of strike drilled, and the "RJ" zone, which features high-grade intercepts up to 51 g/t Au. The company has filed its 30-day exploration notice and plans to commence drilling in July 2025. Formation also announced two concurrent private placements totaling C$2.1 million to fund exploration activities.

The company has identified significant base metal potential at N2, with copper and zinc intercepts ranging from 200-4,750 ppm and 203-6,700 ppm respectively. Formation maintains a strong financial position with working capital of approximately C$2.6 million.

Formation Metals (OTCPK:FOMTF) ha ampliato il suo programma di perforazione iniziale presso il progetto aurifero N2 in Quebec, portandolo a un totale finanziato di 7.500 metri, parte di un programma multi-fase pianificato di 20.000 metri. Il progetto ospita una risorsa storica di circa 870.000 once d'oro, con 18 Mt con una gradazione di 1,4 g/t Au distribuiti su quattro zone e 243 Kt con una gradazione di 7,82 g/t Au nella zona RJ.

Il programma della Fase 1 punterà all'espansione nella zona "A", che contiene circa 522.900 once con solo il 35% della traccia perforata, e nella zona "RJ", che presenta intersezioni ad alto tenore fino a 51 g/t Au. La società ha presentato il suo avviso di esplorazione di 30 giorni e prevede di iniziare le perforazioni a luglio 2025. Formation ha inoltre annunciato due collocamenti privati simultanei per un totale di 2,1 milioni di dollari canadesi per finanziare le attività di esplorazione.

La società ha identificato un significativo potenziale per metalli di base a N2, con intersezioni di rame e zinco che variano rispettivamente da 200 a 4.750 ppm e da 203 a 6.700 ppm. Formation mantiene una solida posizione finanziaria con un capitale circolante di circa 2,6 milioni di dollari canadesi.

Formation Metals (OTCPK:FOMTF) ha ampliado su programa inicial de perforación en el Proyecto de Oro N2 en Quebec a un total financiado de 7,500 metros, como parte de un programa multifase planificado de 20,000 metros. El proyecto cuenta con un recurso histórico de aproximadamente 870,000 onzas de oro, con 18 Mt con una ley de 1.4 g/t Au en cuatro zonas y 243 Kt con una ley de 7.82 g/t Au en la zona RJ.

El programa de la Fase 1 buscará expandirse en la zona "A", que contiene aproximadamente 522,900 onzas con solo el 35% de la extensión perforada, y en la zona "RJ", que presenta intercepciones de alta ley de hasta 51 g/t Au. La compañía ha presentado su aviso de exploración de 30 días y planea comenzar la perforación en julio de 2025. Formation también anunció dos colocaciones privadas simultáneas por un total de 2.1 millones de dólares canadienses para financiar las actividades de exploración.

La compañía ha identificado un potencial significativo para metales base en N2, con intercepciones de cobre y zinc que varían entre 200-4,750 ppm y 203-6,700 ppm respectivamente. Formation mantiene una posición financiera sólida con un capital de trabajo de aproximadamente 2.6 millones de dólares canadienses.

Formation Metals (OTCPK:FOMTF)는 퀘벡의 N2 금 프로젝트에서 최초 시추 프로그램을 총 7,500미터로 확대했으며, 이는 계획된 20,000미터 다단계 프로그램의 일부입니다. 이 프로젝트는 약 870,000 온스의 금 역사적 자원을 보유하고 있으며, 네 개 구역에서 18Mt가 1.4 g/t Au 등급을, RJ 구역에서는 243Kt가 7.82 g/t Au 등급을 나타냅니다.

1단계 프로그램은 스트라이크의 35%만 시추된 약 522,900 온스를 포함하는 "A" 구역과 최대 51 g/t Au의 고등급 간격을 특징으로 하는 "RJ" 구역의 확장에 중점을 둘 예정입니다. 회사는 30일 탐사 공지를 제출했으며 2025년 7월 시추를 시작할 계획입니다. Formation은 탐사 활동 자금 조달을 위해 총 210만 캐나다 달러 규모의 두 건의 동시 사모 발행도 발표했습니다.

회사는 N2에서 구리와 아연 간격이 각각 200-4,750 ppm 및 203-6,700 ppm 범위에 이르는 상당한 기본 금속 잠재력을 확인했습니다. Formation은 약 260만 캐나다 달러의 운전자본으로 강한 재무 상태를 유지하고 있습니다.

Formation Metals (OTCPK:FOMTF) a étendu son programme de forage initial au projet aurifère N2 au Québec à un total entièrement financé de 7 500 mètres, dans le cadre d’un programme multi-phases prévu de 20 000 mètres. Le projet abrite une ressource historique d’environ 870 000 onces d’or, avec 18 Mt à 1,4 g/t Au réparties sur quatre zones et 243 Kt à 7,82 g/t Au dans la zone RJ.

Le programme de phase 1 ciblera l’expansion de la zone « A », qui contient environ 522 900 onces avec seulement 35 % de la longueur forée, et la zone « RJ », qui présente des interceptations à haute teneur allant jusqu’à 51 g/t Au. La société a déposé son avis d’exploration de 30 jours et prévoit de commencer le forage en juillet 2025. Formation a également annoncé deux placements privés simultanés totalisant 2,1 millions de dollars canadiens pour financer les activités d’exploration.

La société a identifié un potentiel significatif pour les métaux de base à N2, avec des interceptations de cuivre et de zinc allant respectivement de 200 à 4 750 ppm et de 203 à 6 700 ppm. Formation maintient une solide position financière avec un fonds de roulement d’environ 2,6 millions de dollars canadiens.

Formation Metals (OTCPK:FOMTF) hat sein erstes Bohrprogramm beim N2 Goldprojekt in Quebec auf insgesamt 7.500 Meter ausgeweitet, finanziert als Teil eines geplanten mehrphasigen Programms mit 20.000 Metern. Das Projekt verfügt über eine historische Ressource von etwa 870.000 Unzen Gold, mit 18 Mt bei 1,4 g/t Au über vier Zonen und 243 Kt bei 7,82 g/t Au in der RJ-Zone.

Das Programm der Phase 1 wird auf die Erweiterung der "A"-Zone abzielen, die etwa 522.900 Unzen enthält und von der erst 35 % der Streichlänge gebohrt wurden, sowie auf die "RJ"-Zone mit hochgradigen Abschnitten bis zu 51 g/t Au. Das Unternehmen hat seine 30-tägige Explorationsanzeige eingereicht und plant, im Juli 2025 mit den Bohrungen zu beginnen. Formation kündigte außerdem zwei gleichzeitige Privatplatzierungen in Höhe von insgesamt 2,1 Millionen kanadischen Dollar zur Finanzierung der Explorationsaktivitäten an.

Das Unternehmen hat ein erhebliches Basismetallpotenzial bei N2 identifiziert, mit Kupfer- und Zinkabschnitten, die von 200 bis 4.750 ppm bzw. 203 bis 6.700 ppm reichen. Formation verfügt über eine starke finanzielle Position mit einem Betriebskapital von etwa 2,6 Millionen kanadischen Dollar.

- Historic resource of ~870,000 ounces of gold across multiple zones

- Only 35% of strike length drilled at A zone, indicating significant expansion potential

- High-grade intercepts at RJ zone up to 51 g/t Au

- Strong treasury with C$2.6M working capital plus new C$2.1M financing

- Additional upside from significant copper and zinc mineralization

- Historic resource requires verification and updating to current standards

- Project has remained largely unexplored since 2008

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Highlights:

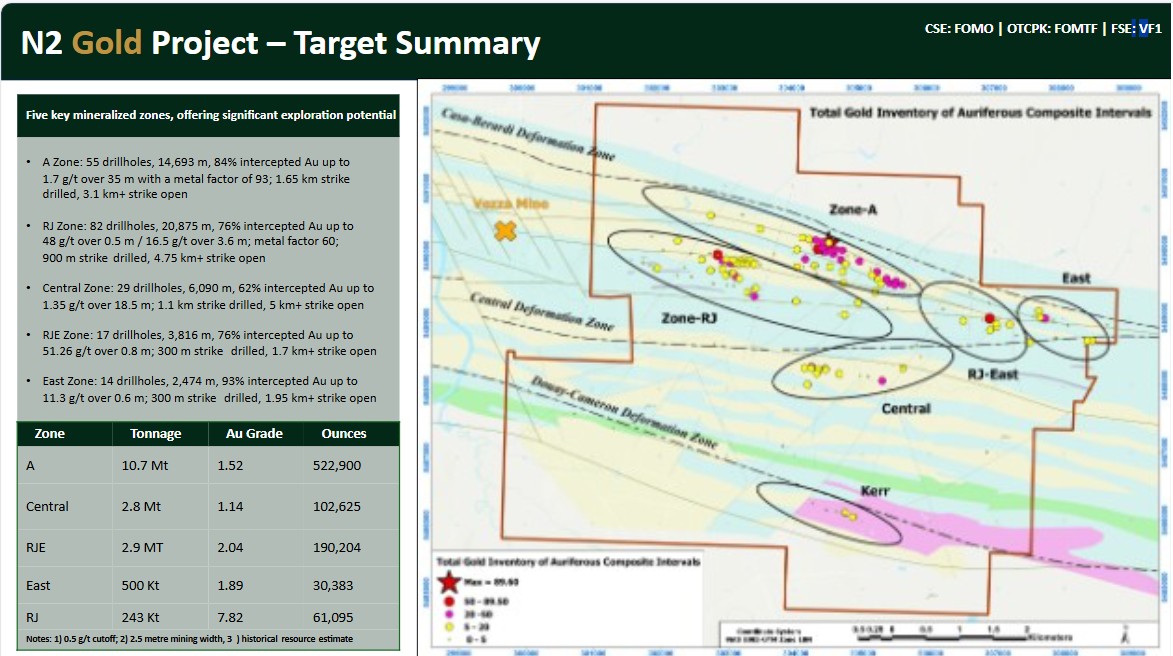

Formation has planned a 20,000 metre multi-phase drill program at its flagship N2 Gold Project in Quebec, host to a global historic resource of ~870,000 ounces comprised of 18 Mt grading 1.4 g/t Au (~809,000 oz Au) across four zones (A, East, RJ-East, and Central)2,3 and 243 Kt grading 7.82 g/t Au (~61,000 oz Au) across the RJ zone2,4.

Phase 1 has been expanded to a fully funded 7,500 metre program targeting expansion targets in the “A” zone, a shallow, highly continuous, low-variability historic gold deposit with ~522,900 ounces of which only ~

35% of strike has been drilled (>3.1 km open), and the “RJ” zone, host to high-grade intercepts from historical drill holes as high as 51 g/t Au over 0.8 metres2, which was expanded by Agnico Eagle Mines in 2008 in the most recent drilling at the Property.Formation anticipates commencing its drill program in July. The Company filed its 30-day notice with the responsible municipal authorities for its upcoming 2025 exploration activities on June 17, 2025.

Formation will also focus on N2's significant base metal potential, where it recently completed a revaluation process which revealed significant copper and zinc intercepts within historic drillholes with significant gold grades (>1 g/t Au).

The Company has working capital of ~C

$2.6M , putting it in a very strong financial position to execute its exploration programs.

VANCOUVER, BC / ACCESS Newswire / July 6, 2025 / Formation Metals Inc. ("Formation" or the "Company") (CSE:FOMO)(FSE:VF1)(OTCPK:FOMTF), a North American mineral acquisition and exploration company, is pleased to announce that it has elected to expand its maiden drill program at its N2 Gold Property ("N2" or the "Property"), located 25 km south of Matagami, Quebec, to a fully funded 7,500 metres.

The Company anticipates commencing on the program in July, having officially filed its Annual Exploration Work Notice ("Planification Annuelle Des Travaux d'Exploration") with the responsible municipal authorities for its upcoming 2025 exploration activities on June 17, 2025. This filing must be completed 30-days in advance of the commencement of fieldwork and ensures compliance with regulatory requirements and reflects the Company's continued commitment to transparency, community engagement, and responsible mineral exploration practices. The work program will focus on advancing key targets across Formation's Quebec-based properties.

The 7,500 metres comprising Phase 1 is part of its planned 20,000 metre multi-phase drill program at N2, an advanced gold project with a global historic resource of ~870,000 ounces comprised of 18 Mt grading 1.4 g/t Au (~809,000 oz Au) across four zones (A, East, RJ-East, and Central)2,3 and 243 Kt grading 7.82 g/t Au (~61,000 oz Au) across the RJ zone2,4.

"We are very excited to commence our maiden drill program at N2" said Deepak Varshney, Chief Executive Officer of Formation. "Filing the Annual Exploration Work Notice marked the final regulatory step as we prepare to commence field activities upon receipt of the ATI. Based on our on-going review and planning for Phase 1, we feel comfortable in expanding our maiden drill program to a fully funded 7,500 metres. We anticipate receiving the ATI permit shortly, allowing us to proceed with our exploration activities as scheduled."

Mr. Varshney continued: "The summer is going to be a very exciting time as we embark on our fully funded maiden 7,500 metre drill program at N2. Given the scale of the property, the compelling geological data, and the Abitibi Greenstone Belt's established history as a hotbed for gold mining, we are hopeful that the program will deliver our goal of delivering a near-surface multi-million-ounce deposit at N2.

We see the potential for a significant gold deposit at N2, and our maiden 7,500-metre drilling program will mark the beginning of Formation's pursuit of that goal. Our maiden program will focus on building on the successes of our predecessors. The drilling discoveries made by Agnico-Eagle and Cypress show the potential at N2. With gold at almost

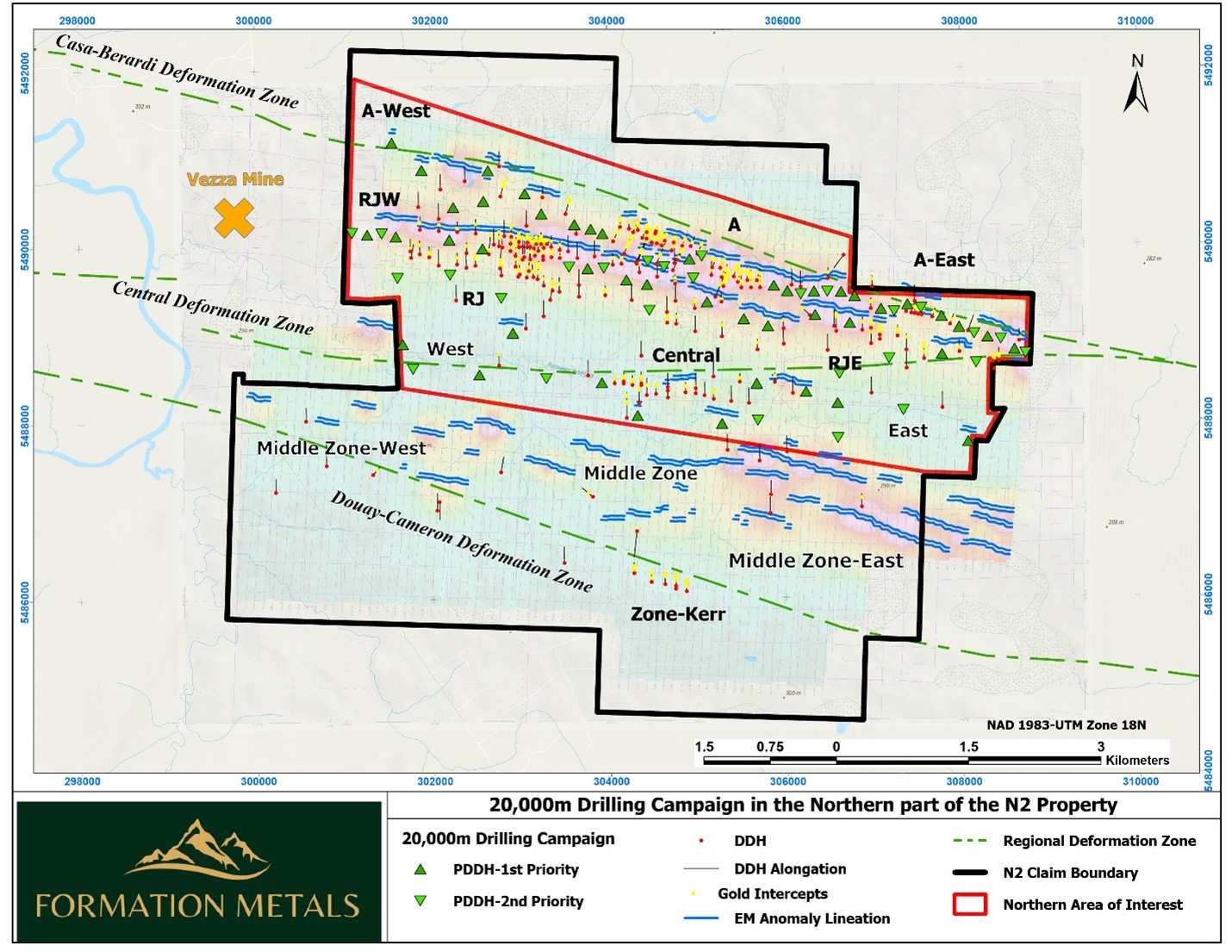

The drill program is designed to focus on discovery drilling at new high-potential targets along the mineralization strikes at the "A", "RJ" and "Central" zones in the northern part of the Property in order to discover new auriferous trends and unlock new zones of gold mineralization. The program will also focus on high-priority infilling and expansion targets in these zones to significantly enhance the auriferous zones identified to-date (Figure 1).

Historical highlights from the top two priority zones include:

A Zone: With a historical resource of ~522,900 gold ounces (10.7 Mt @ 1.52 g/t Au), the "A" Zone is a shallow, highly continuous, low-variability historic gold deposit with ~15,000 metres of drilling across 55 drillholes,

84% of which intercepted gold mineralization. The best historical intercept includes up to 1.7 g/t over 35 metres. ~1.65 km of strike has been drilled, with 3.1+ km of strike to be tested as part of the 20,000 metre program.RJ Zone: With a historical resource of ~61,100 gold ounces (243 Kt @ 7.82 g/t Au), the "RJ" Zone is a high-grade target that was expanded upon in the last drill program in 2008 by Agnico-Eagle when gold was approximately ~

$800 /oz. Historically, 20,875 metres has been drilled over 82 drillholes, with best intercepts of 48 g/t over 0.5 metres and 16.5 g/t over 3.6 metres. ~900 metres of strike has been drilled, with 4.75+ km of strike to be tested as part of the 20,000 metre program.

The Company has retained Strategy Exploration Advisors ("Stratexplo"), an independent exploration consulting firm based out of Rouyn-Noranda, Québec, as the field operations manager for its planned 20,000 metre multi-phase drill program.

Stratexplo crews will be responsible for conducting surface exploration at N2, including field logistics, sample collection and dispatch, geological mapping and interpretation, exploration targeting and advising as per National Instrument 43-101 collection and reporting guidelines.

These responsibilities are in addition to Stratexplo's on-going work as the Company's permitting manager, where they recently facilitated Formation's submission for its Application for Autorisation de Travaux d'exploration à Impacts (ATI) to the Ministère des Ressources naturelles et des Forets (MERN), and were responsible for the submission of its Planification Annuelle Des Travaux d'Exploration.

The ATI submission was completed following discussions with all necessary parties and the Company anticipates receiving its ATI permit within the coming weeks, after which it intends on commencing its maiden drill program at N2.

Comprising 87 claims totaling ~4,400 ha within the Abitibi sub province of Northwestern Quebec, Formation's flagship N2 Gold Project is an advanced gold project with a global historic resource of 877,000 ounces: 18.2 Mt grading 1.48 g/t Au (~810,000 oz Au) across four zones (A, East, RJ-East, and Central)2,3 and 243 Kt grading 7.82 g/t Au (~67,000 oz Au) across the RJ zone2,4. There are six primary auriferous mineralized zones in total, each open for expansion along strike and at depth. Compilation and geophysical work by Balmoral Resources Ltd. (now Wallbridge Mining) from 2010 to 2018 generated numerous targets that have not yet been investigated with diamond drilling. There are two primary focuses for Formation:

the "A" zone, a shallow, highly continuous, low-variability historic gold deposit with numerous intermittent and consecutive auriferous intervals (

84% of historical drill holes intercepted Au up to 1.7 g/t over 35 m)2, of which only ~35% of strike has been drilled (>3.1 km open); andthe "RJ" zone, host to high-grade intercepts from historical drill holes as high as 51 g/t Au over 0.8 metres2, which was expanded by Agnico Eagle Mines in 2008 in the most recent drilling at the Property.

The Company also believes that N2 has significant base metal potential, where it recently completed a revaluation process which revealed significant copper and zinc intercepts within historic drillholes known to have significant gold grades (>1 g/t Au). Assay results range from 200 to 4,750 ppm and 203 ppm to 6,700 ppm, for copper and zinc, respectively, indicating strong potential for elevated base metal (Cu-Zn) concentrations across the property, specifically at the A and RJ zones. Property wide geology at N2 features volcanic and sedimentary rocks formed in regional anticlinal and synclinal flexures. Three principal deformation structures (Figure 1), oriented along the known NW-SE to WNW-ESE structural trends typical of VMS deposits in the Matagami region, function as critical geologic controls for mineralization on the property.

For the 2025 exploration season, Formation plans to concentrate its efforts on the northern part of N2, targeting gold deposit expansion and discovery along identified zones and fault systems associated with the main deformation features (specifically WNW-ESE trend), with IP surveys and drilling planned to model mineralized zones that will hopefully contribute to an updated NI-43 101 compliant resource. Formation will also look to further review historic base metal assays from older drill core and undertake additional work in 2025 to assess the property's copper and zinc potential.

The Company is also pleased to announce a non-brokered listed issuer financing exemption (LIFE) private placement (the "LIFEOffering") for up to 2,200,000 charitable flow-through units ("CFT Units") of the Company at

Concurrent with the LIFE Offering, the Company is completing a non-brokered private placement (the "CFT 4MH Unit Offering" and, together with the LIFE Offering, the "Offerings") of up to 2,298,850 units (each a "CFT 4MH Unit") of the Company at

Closing of the Offerings may take place in one or more tranches as determined by the Company and is subject to certain conditions including, but not limited to, the receipt of all necessary approvals, including approval of the Canadian Securities Exchange.

The Company may pay certain eligible finders a cash fee of up to

The Company intends to use the net proceeds of the Offerings for fieldwork at the Company's exploration projects and, in the case of the net proceeds from the LIFE Offering, as more particularly set out in the Offering Document.

Qualified person

The technical content of this news release has been reviewed and approved by Mr. Babak Vakili Azar, P.Geo., an independent contractor and a qualified person as defined by National Instrument 43-101. Historical reports provided by the optionor were reviewed by the qualified person. The information provided has not been verified and is being treated as historic.

About Formation Metals Inc.

Formation Metals Inc. is a North American mineral acquisition and exploration company focused on the development of quality properties that are drill-ready with high-upside and expansion potential. Formation's flagship asset is the N2 Gold Project, an advanced gold project with a global historic resource of ~870,000 ounces (18 Mt grading 1.4 g/t Au (~809,000 oz Au) across four zones (A, East, RJ-East, and Central)2,3 and 243 Kt grading 7.82 g/t Au (~61,000 oz Au) across the RJ zone2,4) and six mineralized zones, each open for expansion along strike and at depth including the "A" zone, of which only ~

FORMATION METALS INC.

Deepak Varshney, CEO and Director

For more information, please call 778-899-1780, email info@formationmetalsinc.com or visit www.formationmetalsinc.com.

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Notes and References:

Readers are cautioned that the geology of nearby properties is not necessarily indicative of the geology of the Property.

The above referenced resource estimates do not have a category, are considered historical in nature, and are based on prior data prepared by a previous property owner, and do not conform to current CIM categories.

While the Company considers the estimates to be reliable, a qualified person has not done sufficient work to classify the historical estimates as current resources in accordance with current CIM categories and the Company is not treating the historical estimates as a current resource. A 0.5 g/t Au cut-off was used in the preparation of the historical estimates with a minimum 2.5 metre mining width.

Significant data compilation, re-drilling, re-sampling and data verification may be required by a qualified person before the historical estimates can be classified as current resources. There can be no assurance that any of the historical mineral resources, in whole or in part, will ever become economically viable. In addition, mineral resources are not mineral reserves and do not have demonstrated economic viability. The Company is not aware of any more recent estimates prepared for the N2 Property.

Needham, B. (1994), 1993 Diamond Drill Report, Northway Joint Venture, Northway Property; Cypress Canada Inc.; 492 pages.

Guy K. (1991), Exploration Summary May 1, 1990 to May 1, 1991 Vezza Joint Venture Northway Property; Total Energold; 227 pages.

Forward-looking statements:

This news release includes "forward-looking statements" under applicable Canadian securities legislation, including statements respecting: the Company's plans for the Property and the expected timing and scope of the 2025 drilling program at the Property; the Company's goal of delivering a near-surface multi-million-ounce deposit the Property; the Company's anticipated timeline with respect to the Application for Autorisation de Travaux d'exploration à Impacts (ATI) to the Ministère des Ressources naturelles et des Forets (MERN); the Company's view that the Property has the potential for over three million ounces of gold; the 7,500-metre drilling program marking the beginning of the Company's pursuit of that goal; and statements respecting the Offerings and the expected use of proceeds therefrom. Such forward-looking information reflects management's current beliefs and is based on a number of estimates and/or assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Readers are cautioned that such forward-looking statements are neither promises nor guarantees and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.

No Offer or Solicitation to Purchase Securities in the United States

This press release does not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States. The securities referred to herein have not been and will not be registered under the Securities Act of 1933, as amended (the "Securities Act"), or with any securities regulatory authority of any state or other jurisdiction in the United States, and may not be offered or sold, directly or indirectly, within the United States or to, or for the account or benefit of, U.S. persons, as such term is defined in Regulation S under the Securities Act ("Regulation S"), except pursuant to an exemption from or in a transaction not subject to the registration requirements of the Securities Act.

Not for distribution to United States newswire services or for dissemination in the United States. This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available. This news release shall not constitute an offer to sell or the solicitation of an offer to buy in the United States or to, or for the account or benefit of, persons in the United States or U.S. Persons nor shall there by any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

SOURCE: Formation Metals

View the original press release on ACCESS Newswire