Laser Photonics Reports Strong Q1 2025 Revenue Growth Driven by Strategic CMS Integration and Multi-Sector Growth

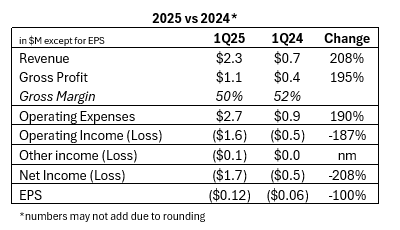

Laser Photonics (NASDAQ:LASE) reported exceptional Q1 2025 results, with revenue surging 208% year-over-year to $2.3 million. The growth was primarily driven by the successful integration of Control Micro Systems (CMS) acquisition and expansion across defense, medical, and industrial sectors.

Key highlights include repeat orders from the U.S. Navy for DefenseTech systems, a fourth CleanTech system order from Acuren, and significant CMS orders in dental and manufacturing applications. The company also demonstrated innovative laser-cleaning robotic crawlers at Pearl Harbor Naval Shipyard, targeting the Navy's $23 billion annual corrosion challenge.

Looking ahead to Q2 2025, LASE expects year-over-year revenue growth compared to Q2 2024's $0.7 million. The company has implemented cost-cutting initiatives aimed at reducing annual expenses by $2 million.

Laser Photonics (NASDAQ:LASE) ha riportato risultati eccezionali nel primo trimestre del 2025, con ricavi in aumento del 208% su base annua, raggiungendo 2,3 milioni di dollari. La crescita è stata principalmente trainata dall'integrazione riuscita dell'acquisizione di Control Micro Systems (CMS) e dall'espansione nei settori della difesa, medico e industriale.

I punti salienti includono ordini ripetuti dalla Marina degli Stati Uniti per i sistemi DefenseTech, un quarto ordine di sistemi CleanTech da Acuren e ordini significativi da CMS per applicazioni dentali e manifatturiere. L'azienda ha inoltre presentato innovativi robot pulitori laser presso il Pearl Harbor Naval Shipyard, affrontando la sfida annuale della corrosione della Marina, stimata in 23 miliardi di dollari.

Guardando al secondo trimestre del 2025, LASE prevede una crescita dei ricavi su base annua rispetto ai 0,7 milioni di dollari del Q2 2024. L'azienda ha inoltre implementato iniziative di riduzione dei costi volte a diminuire le spese annuali di 2 milioni di dollari.

Laser Photonics (NASDAQ:LASE) reportó resultados excepcionales en el primer trimestre de 2025, con ingresos que aumentaron un 208% interanual hasta 2.3 millones de dólares. El crecimiento se debió principalmente a la exitosa integración de la adquisición de Control Micro Systems (CMS) y la expansión en los sectores de defensa, médico e industrial.

Los aspectos más destacados incluyen pedidos repetidos de la Marina de los EE.UU. para sistemas DefenseTech, un cuarto pedido de sistemas CleanTech de Acuren y pedidos significativos de CMS en aplicaciones dentales y de manufactura. La compañía también mostró innovadores robots limpiadores láser en el astillero naval de Pearl Harbor, enfocados en el desafío anual de corrosión de la Marina, valorado en 23 mil millones de dólares.

De cara al segundo trimestre de 2025, LASE espera un crecimiento interanual de los ingresos en comparación con los 0.7 millones de dólares del Q2 2024. La empresa ha implementado iniciativas de reducción de costos para disminuir los gastos anuales en 2 millones de dólares.

Laser Photonics (NASDAQ:LASE)는 2025년 1분기에 매출이 전년 동기 대비 208% 증가한 230만 달러를 기록하며 탁월한 실적을 발표했습니다. 이 성장은 Control Micro Systems(CMS) 인수의 성공적인 통합과 방위, 의료, 산업 부문에서의 확장에 주로 기인합니다.

주요 성과로는 미국 해군의 DefenseTech 시스템 반복 주문, Acuren의 네 번째 CleanTech 시스템 주문, CMS의 치과 및 제조 응용 분야에서의 상당한 주문이 포함됩니다. 또한 회사는 Pearl Harbor 해군 조선소에서 연간 230억 달러 규모의 부식 문제를 겨냥한 혁신적인 레이저 청소 로봇 크롤러를 시연했습니다.

2025년 2분기를 전망하며, LASE는 2024년 2분기의 70만 달러 대비 연간 매출 성장을 기대하고 있습니다. 또한 연간 비용을 200만 달러 절감하기 위한 비용 절감 조치를 시행했습니다.

Laser Photonics (NASDAQ:LASE) a annoncé des résultats exceptionnels pour le premier trimestre 2025, avec un chiffre d'affaires en hausse de 208% en glissement annuel, atteignant 2,3 millions de dollars. Cette croissance a été principalement portée par l'intégration réussie de l'acquisition de Control Micro Systems (CMS) et l'expansion dans les secteurs de la défense, médical et industriel.

Les points forts incluent des commandes répétées de la Marine américaine pour les systèmes DefenseTech, une quatrième commande de systèmes CleanTech de la part d'Acuren, ainsi que des commandes importantes de CMS dans les applications dentaires et industrielles. L'entreprise a également présenté des robots nettoyeurs laser innovants au chantier naval de Pearl Harbor, ciblant le défi annuel de corrosion de la Marine estimé à 23 milliards de dollars.

Pour le deuxième trimestre 2025, LASE prévoit une croissance du chiffre d'affaires en glissement annuel par rapport aux 0,7 million de dollars du T2 2024. La société a mis en place des initiatives de réduction des coûts visant à diminuer les dépenses annuelles de 2 millions de dollars.

Laser Photonics (NASDAQ:LASE) meldete herausragende Ergebnisse für das erste Quartal 2025, mit einem Umsatzanstieg von 208% im Jahresvergleich auf 2,3 Millionen US-Dollar. Das Wachstum wurde hauptsächlich durch die erfolgreiche Integration der Übernahme von Control Micro Systems (CMS) und die Expansion in den Bereichen Verteidigung, Medizin und Industrie getrieben.

Wichtige Highlights sind wiederholte Bestellungen der US Navy für DefenseTech-Systeme, eine vierte Bestellung von CleanTech-Systemen von Acuren sowie bedeutende CMS-Bestellungen in zahnmedizinischen und Fertigungsanwendungen. Das Unternehmen präsentierte zudem innovative laserbasierte Reinigungsroboter im Pearl Harbor Naval Shipyard, die sich der jährlichen Korrosionsherausforderung der Marine in Höhe von 23 Milliarden US-Dollar widmen.

Blick auf das zweite Quartal 2025: LASE erwartet ein Umsatzwachstum im Jahresvergleich gegenüber 0,7 Millionen US-Dollar im Q2 2024. Das Unternehmen hat Kostensenkungsmaßnahmen umgesetzt, um die jährlichen Ausgaben um 2 Millionen US-Dollar zu reduzieren.

- Revenue grew 208% year-over-year to $2.3 million in Q1 2025

- Secured repeat orders from U.S. Navy and Acuren, demonstrating strong product validation

- Successfully integrated CMS acquisition, expanding into new market segments

- Implemented cost-cutting measures to reduce annual expenses by $2 million

- Developed innovative laser-cleaning robotic crawler targeting $23B naval maintenance market

- Company remains in investment phase, indicating continued expenses for growth

- Still working towards achieving sustainable profitability

Insights

LASE reports 208% revenue growth to $2.3M, implementing cost cuts, though still in investment phase before profitability.

Laser Photonics delivered impressive

The company's growth strategy is showing tangible results through repeat orders that validate their technology. Notable wins include a fourth CleanTech system from Acuren, a second Navy order for DefenseTech systems, and multiple new CMS orders across dental and manufacturing applications. The continued defense sector penetration is particularly promising, as their partnership with Boston Engineering addresses the Navy's massive

While the revenue growth is substantial, management's language indicates the company remains unprofitable as they characterized themselves in an "investment phase." This is common for growing technology companies prioritizing market share over immediate profitability. However, they've implemented cost-cutting measures expected to reduce annualized expenses by

The forward outlook appears positive, with management expecting continued year-over-year revenue growth in Q2 2025 compared to the

Revenue Surges

Cost cutting initiatives to reduce run rate expenses by

ORLANDO, FLORIDA / ACCESS Newswire / July 7, 2025 / Laser Photonics Corporation (NASDAQ:LASE), ("Laser Photonics" or "the Company") $LASE, a leading global developer of CleanTech laser systems for laser cleaning and other material applications, today announced results for its first quarter ended March 31, 2025.

Wayne Tupuola, CEO of Laser Photonics, commented:

"The first quarter demonstrated the potential of our strategic transformation, with revenue growth of over

"We're particularly excited about the medium- to long-term potential of our strategic partnerships, including the revolutionary laser-enabled robotic crawler demonstrated with Boston Engineering at Pearl Harbor Naval Shipyard. This breakthrough technology addresses the Navy's

Carlos Sardinas, Chief Financial Officer of Laser Photonics, added:

"Our first quarter results reflect the successful progress we've made to date on the integration of CMS and the revenue growth opportunities this acquisition has created. While, as a company, we're in an investment phase to capture the significant market potential ahead of us, we remain focused on improving operational efficiency and the path to sustainable profitability."

Business Highlights

DefenseTech: Building on strong Q4 2024 momentum, Laser Photonics secured additional orders from the U.S. Navy through distribution partner Incredible Supply & Logistics (ISL). The repeat order for the DefenseTech MRLS Portable Finishing Laser (DTMF-1020) handheld cleaning system validates the technology's reliability and effectiveness for naval maintenance applications. Additionally, the Company's strategic partnership with Boston Engineering showcased revolutionary laser-cleaning-enabled robotic crawlers at Pearl Harbor Naval Shipyard, demonstrating transformational potential for naval MRO processes.

CleanTech Industrial: Laser Photonics secured its fourth CleanTech system order from Acuren, a leading provider of asset protection services. The Company also received repeat orders from Bruce Power for additional CleanTech 500-CTHD laser cleaning systems for use at North America's largest operational nuclear power plant, highlighting the safety and environmental advantages of laser cleaning technology in critical infrastructure applications.

Medical and Precision Manufacturing: CMS continued to demonstrate strong market traction with significant orders from a prominent global dental implant provider for robotic-feed dental drill bit marking systems and a leading U.S. high-performance bicycle manufacturer for advanced laser engraving systems. These wins highlight CMS's technological prowess in precision applications and the strategic value of the acquisition in expanding Laser Photonics' addressable markets.

2nd Quarter 2025 Outlook

Laser Photonics entered the second quarter of 2025, which ended June 30, 2025, with strong momentum and expects to report year-over-year revenue growth from the

About Laser Photonics Corporation

Laser Photonics is a vertically integrated manufacturer and R&D Center of Excellence for industrial laser technologies and systems. Laser Photonics seeks to disrupt the

Cautionary Note Concerning Forward-Looking Statements

This press release contains "forward-looking statements" (within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended), including statements regarding the Company's plans, prospects, potential results and use of proceeds. These statements are based on current expectations as of the date of this press release and involve a number of risks and uncertainties, which may cause results and uses of proceeds to differ materially from those indicated by these forward-looking statements. These risks include, without limitation, those described under the caption "Risk Factors" in the Registration Statement. Any reader of this press release is cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company undertakes no obligation to revise or update any forward-looking statements to reflect events or circumstances after the date of this press release except as required by applicable laws or regulations.

Laser Photonics Investor Relations Contact:

Brian Siegel, IRC, MBA

Senior Managing Director

Hayden IR

(346) 396-8696

laser@haydenir.com

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except par value data)

(unaudited)

As of March 31, 2025 (Unaudited) | As of December 31, 2024 (Audited) | |||||||

Assets | ||||||||

Current Assets: | ||||||||

Cash and Cash Equivalents | $ | 179,091 | $ | 533,871 | ||||

Accounts Receivable, Net | 904,155 | 973,605 | ||||||

Accounts Receivable | - | - | ||||||

Contract Assets | 639,108 | 759,658 | ||||||

Inventory | 2,001,760 | 2,338,759 | ||||||

Other Assets | 271,813 | 58,567 | ||||||

Total Current Assets | 3,995,927 | 4,664,460 | ||||||

Property, Plant, & Equipment, Net | 1,780,036 | 1,872,034 | ||||||

Intangible Assets, Net | 5,350,900 | 5,458,522 | ||||||

Other Long Term Assets | 316,378 | 316,378 | ||||||

Operating Lease Right-of-Use Asset | 4,592,058 | 4,840,753 | ||||||

Total Assets | $ | 16,035,299 | $ | 17,152,147 | ||||

Liabilities & Stockholders' Equity | ||||||||

Current Liabilities: | ||||||||

Accounts Payable | $ | 1,211,407 | $ | 531,268 | ||||

Account payable related parties | 80,771 | 27,988 | ||||||

Short term loan | 825,000 | - | ||||||

Account payable | 27,988 | |||||||

Deferred Revenue | 470,493 | 55,383 | ||||||

Contract Liabilities | 1,337,963 | 1,042,090 | ||||||

Current Portion of Operating Lease | 472,882 | 649,989 | ||||||

Accrued Expenses | 474,189 | 266,717 | ||||||

Total Current Liabilities | 4,872,705 | 2,573,435 | ||||||

Long Term Liabilities: | ||||||||

Lease liability - less current | 4,314,889 | 4,366,419 | ||||||

Total Long Term Liabilities | 4,314,889 | 4,366,419 | ||||||

Total Liabilities | 9,187,594 | 6,939,854 | ||||||

Stockholders' Equity: | ||||||||

Preferred stock Par value | - | - | ||||||

Common Stock Par Value | 14,276 | 14,257 | ||||||

Additional Paid in Capital | 16,302,275 | 17,886,159 | ||||||

Retained Earnings (Deficit) | (9,435,036 | ) | (7,754,313 | ) | ||||

Shares to be issued | - | 100,000 | ||||||

Treasury Stock | (33,810 | ) | (33,810 | ) | ||||

Total Stockholders' Equity | 6,847,705 | 10,212,293 | ||||||

Total Liabilities & Stockholders' Equity | $ | 16,035,299 | $ | 17,152,147 | ||||

STATEMENTS OF PROFIT AND LOSS

(in thousands, except per share data)

(unaudited)

March 31, 2025 | March 31, 2024 | |||||||

Net Sales | $ | 2,290,282 | $ | 742,991 | ||||

Cost of Sales | 1,150,516 | 357,123 | ||||||

Gross Profit | 1,139,766 | 385,868 | ||||||

Operating Expenses: | ||||||||

Sales & Marketing | 617,699 | 136,610 | ||||||

General & Administrative | 900,034 | 356,265 | ||||||

Depreciation & Amortization | 237,011 | 185,316 | ||||||

Payroll Expenses | 840,861 | 208,455 | ||||||

Research and Development Cost | 116,686 | 47,691 | ||||||

Total Operating Expenses | 2,712,291 | 934,337 | ||||||

Operating Income (Loss) | (1,572,525 | ) | (548,469 | ) | ||||

Other Income (Expenses): | ||||||||

Other Income | 1,451 | 30 | ||||||

Other Expenses | (109,649 | ) | 2,730 | |||||

Total Other Income (Loss) | (108,198 | ) | 2,760 | |||||

Income (Loss) Before Tax | (1,680,723 | ) | (545,709 | ) | ||||

Tax Provision | - | - | ||||||

Net Income (Loss) | $ | (1,680,723 | ) | $ | (545,709 | ) | ||

Loss per Share: | ||||||||

Basic | $ | (0.12 | ) | $ | (0.06 | ) | ||

Fully diluted | $ | (0.12 | ) | $ | (0.06 | ) | ||

WASO | 14,271,581 | 9,234,650 | ||||||

Statement of Cash Flows

(in thousands)

(unaudited)

Quarter Ended March 31 | ||||||||

2025 | 2024 | |||||||

OPERATING ACTIVITIES | ||||||||

Net Loss/Gain | $ | (1,680,723 | ) | (545,709 | ) | |||

Adjustments to Reconcile Net Loss to Net Cash Flow from Operating Activities: | ||||||||

Bad Debt | 10,651 | - | ||||||

Shares issued for compensation | 33,336 | |||||||

Distribution to affiliate | (1,683,865 | ) | (1,019,687 | ) | ||||

Impairment | - | |||||||

Depreciation & Amortization | 237,011 | 185,316 | ||||||

Net Change, Right-of-Use Asset & Liabilities | 20,059 | - | ||||||

Change in Operating Assets & Liabilities: | ||||||||

Accounts Receivable | 58,800 | 373,055 | ||||||

Contract Assets | 120,550 | - | ||||||

Inventory | 322,167 | 110,816 | ||||||

Prepaids & Other Current Assets | (213,247 | ) | (75,565 | ) | ||||

Accounts Payable | 732,922 | 83,261 | ||||||

Contract Liabilities | 295,873 | |||||||

Accrued Expenses | 207,475 | (82,531 | ) | |||||

Deferred Revenue | 415,107 | 71,452 | ||||||

Net Cash Used in Operating Activities | (1,157,220 | ) | (866,256 | ) | ||||

INVESTING ACTIVITIES | ||||||||

Purchase of Property, Plant an Equipment | (22,560 | ) | (161,755 | ) | ||||

Net Cash Used in Investing Activities | (22,560 | ) | (161,755 | ) | ||||

FINANCING ACTIVITIES | ||||||||

Borrowings on debt | 825,000 | - | ||||||

Net Cash provided by (used in) Financing Activities | 825,000 | - | ||||||

Net Cash Flow for Period | (354,780 | ) | (1,028,011 | ) | ||||

Cash and Cash Equivalents - Beginning of Period | 533,871 | 6,201,137 | ||||||

Cash and Cash Equivalents- End of Period | $ | 179,091 | 5,173,126 | |||||

NON-CASH INVESTING AND FINANCING ACTIVITIES | ||||||||

Shares issued for Investment | 100,000 | - | ||||||

Transfer demo inventory to PPE | 14,833 | - | ||||||

SUPPLEMENTARY CASH FLOW INFORMATION | - | |||||||

Cash Received / Paid During the Period for: | - | |||||||

Income Taxes | - | - | ||||||

Interest | - | - | ||||||

SOURCE: Laser Photonics Corp.

View the original press release on ACCESS Newswire