G Mining Ventures Provides Tocantinzinho Project Update

All amounts are in USD unless stated otherwise

TSX: GMIN

OTCQX: GMINF

- Project remains on schedule and on budget for commercial production in H2-2024

- Total project progress of

87% with construction89% complete - Total spending to date of

$433 million 95% of project total) - Updated virtual site tour available through VRIFY platform

Recent Highlights (All updates are dated as of March 31st, 2024, unless stated otherwise.)

- Health & Safety – Industry leading safety record of Lost Time Incident Frequency Rate ("LTIFR") of 0.04, and Total Recordable Incident Frequency Rate ("TRIFR") of 0.32 after a total of 4,941,128 person-hours worked.

- Budget – Total spend to date of

$433 million $16 million $449 million 98% of project total) and are tracking in line with the Feasibility Study (defined hereafter). - Schedule –Total Project is currently

87% complete and trending on time for commercial production in H2-24. Detailed engineering, procurement and powerline are complete. - Construction Progress – Construction is

89% complete, with Balance of Plant and infrastructures completed and commissioned. - Pre-production Mining – Pre-production mining activities have exceeded 50 thousand tonnes ("kt") per day ("pd") and have been operating on a 24/7 basis since May 2023. A total of 11.4 million tonnes ("Mt") of material has been excavated from the starter pit.

- Powerline – 193-km 138 kV transmission line from Novo Progresso to TZ and associated substations are complete and soon to be energized.

- Operational Readiness – Commissioning activities commencing in April starting with primary crusher and ore reclaim system.

- Human Resources – 1,680 employees and contractors are currently employed by the Project with

94% of the workforce comprised of Brazilians. - Site Drone Footage – Recent aerial drone footage of the side can be found here (https://youtu.be/sdelA8UKOEc )

Tocantinzinho Project Update

Area | Progress to Date (at March 31, 2024 unless otherwise noted) |

Health & Safety |

|

Budget |

|

Schedule |

|

Construction Progress |

|

Pre-Production Mining |

|

Powerline |

|

Operational Readiness |

|

Human Resources |

|

Project Development Timeline

The Project remains on track and on budget for commercial production in H2-2024.

Virtual Site Tour and Feasibility Study Presentation

Updated satellite imagery and 360 photography showing the site progress is available through the corporate presentation at: https://vrify.com/decks/14338. A 3D presentation of the Project Feasibility Study is available at: Feasibility Study 3D VRIFY Presentation. Both presentations can be accessed by visiting GMIN's website at https://www.gminingventures.com.

Timetable and Next Steps

Upcoming key milestones include:

- Process plant commissioning commence in Q2-24

- Commercial production in H2-24.

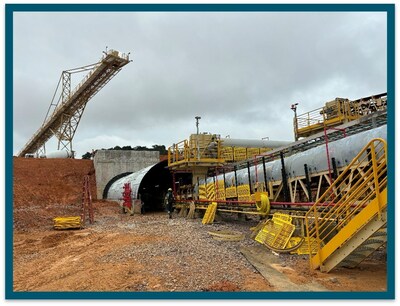

Update Photos

Qualified Person

Louis-Pierre Gignac, President & Chief Executive Officer of GMIN, a QP as defined in NI 43-101, has reviewed the press release on behalf of the Corporation and has approved the technical disclosure contained in this press release.

About G Mining Ventures Corp.

G Mining Ventures Corp. (TSX: GMIN) (OTCQX: GMINF) is a mining company engaged in the acquisition, exploration and development of precious metal projects, to capitalize on the value uplift from successful mine development. GMIN is well-positioned to grow into the next mid-tier precious metals producer by leveraging strong access to capital and proven development expertise. GMIN is currently anchored by its flagship Tocantinzinho Gold Project in mining friendly and prospective

Cautionary Statement on Forward-Looking Information

All statements, other than statements of historical fact, contained in this press release constitute "forward-looking information" and "forward-looking statements" within the meaning of certain securities laws and are based on expectations and projections as of the date of this press release. Forward-looking statements contained in this press release include, without limitation, those related to (i) the Project remaining on schedule and on budget for commercial production in H2-2024; (ii) the Project commitments tracking in line with the Feasibility Study; (iii) the power transmission line to be energized imminently (or in the near term); (iv) the commissioning activities in respect of various process plant components being planned for, or starting in April or, as applicable, May 2024; (v) the operational readiness being well advanced; and (vi) more generally, the horizontal bar chart entitled "Project Development Timeline" as well as the section entitled "About G Mining Ventures Corp.".

Forward-looking statements are based on expectations, estimates and projections as of the time of this press release. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by the Corporation as of the time of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. These estimates and assumptions may prove to be incorrect. Such assumptions include, without limitation, those relating to the price of gold and currency exchange rates, those outlined in the Feasibility Study and those underlying the items listed on the above section entitled "About G Mining Ventures Corp.".

Many of these uncertainties and contingencies can directly or indirectly affect, and could cause, actual results to differ materially from those expressed or implied in any forward-looking statements. There can be no assurance that, notably but without limitation, the Corporation will (i) continue to progress on all fronts at the Project, (ii) continue taking care of the health and safety of all its stakeholders, (iii) keep its expenditures and schedule in line with the Feasibility Study, (iv) carry its next steps as per the above timetable and effect the transition to commercial production as contemplated, (v) energize the transmission line in the near term and bring the Project into commercial production in the H2-2024, or at all, or (vi) use TZ to grow GMIN into the next intermediate producer, as future events could differ materially from what is currently anticipated by the Corporation. In addition, there can be no assurance that the

By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that estimates, forecasts, projections and other forward-looking statements will not be achieved or that assumptions do not reflect future experience. Forward-looking statements are provided for the purpose of providing information about management's expectations and plans relating to the future. Readers are cautioned not to place undue reliance on these forward-looking statements as a number of important risk factors and future events could cause the actual outcomes to differ materially from the beliefs, plans, objectives, expectations, anticipations, estimates, assumptions and intentions expressed in such forward-looking statements. All of the forward-looking statements made in this press release are qualified by these cautionary statements and those made in the Corporation's other filings with the securities regulators of

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/g-mining-ventures-provides-tocantinzinho-project-update-302114121.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/g-mining-ventures-provides-tocantinzinho-project-update-302114121.html

SOURCE G Mining Ventures Corp