GameSquare's Stream Hatchet Publishes Q3 Report

Stream Hatchet, a GameSquare Holdings subsidiary, released its Q3 2024 report showing significant growth in gaming and live-streaming viewership. The report highlights an 8.5 billion hours of live streaming viewership, marking a 12% year-over-year increase. Key findings include an 8% rise in esports hours watched and YouTube Gaming's growth to 2 billion hours, increasing its market share from 17% to 23%. Kick demonstrated a 163% increase in hours watched. Twitch's market share decreased to 60%, while Spanish content surged by 59% on Kick. The report also notes a more diverse streaming market, with top creators' market share dropping from 98% to 86%.

Stream Hatchet, una sussidiaria di GameSquare Holdings, ha pubblicato il suo rapporto Q3 2024 che mostra una crescita significativa nella visione di giochi e live streaming. Il rapporto evidenzia 8,5 miliardi di ore di visione in diretta, segnando un 12% di aumento rispetto all'anno precedente. Tra i risultati chiave vi è un aumento dell'8% negli esports in ore viste e la crescita di YouTube Gaming a 2 miliardi di ore, aumentando la sua quota di mercato dal 17% al 23%. Kick ha mostrato un aumento del 163% nelle ore di visione. La quota di mercato di Twitch è diminuita al 60%, mentre i contenuti spagnoli sono aumentati del 59% su Kick. Il rapporto sottolinea anche un mercato dello streaming più diversificato, con la quota di mercato dei principali creatori che è scesa dal 98% all'86%.

Stream Hatchet, una subsidiaria de GameSquare Holdings, publicó su informe Q3 2024 mostrando un crecimiento significativo en la visualización de videojuegos y streaming en vivo. El informe destaca 8.5 mil millones de horas de visualización en vivo, marcando un aumento del 12% interanual. Los hallazgos clave incluyen un aumento del 8% en las horas vistas de esports y el crecimiento de YouTube Gaming a 2 mil millones de horas, aumentando su participación en el mercado del 17% al 23%. Kick demostró un aumento del 163% en las horas vistas. La participación de mercado de Twitch disminuyó al 60%, mientras que el contenido en español se disparó un 59% en Kick. El informe también señala un mercado de streaming más diversificado, con la participación de mercado de los principales creadores que cayó del 98% al 86%.

스트림 해쳇, 게임스퀘어 홀딩스의 자회사는 2024년 3분기 보고서를 발표하며 게이밍 및 라이브 스트리밍 시청자 수의 상당한 성장을 보여주었습니다. 보고서는 85억 시간의 라이브 스트리밍 시청 시간을 강조하며, 전년 대비 12% 증가를 기록했습니다. 주요 발견 사항으로는 e스포츠 시청 시간이 8% 증가했으며, YouTube Gaming은 20억 시간으로 성장하여 시장 점유율을 17%에서 23%로 늘렸습니다. Kick은 163% 증가를 기록했습니다. Twitch의 시장 점유율은 60%로 감소했으며, Kick에서 스페인어 콘텐츠가 59% 증가했습니다. 보고서는 또한 주요 크리에이터의 시장 점유율이 98%에서 86%로 감소하며 더 다양화된 스트리밍 시장을 언급하고 있습니다.

Stream Hatchet, une filiale de GameSquare Holdings, a publié son rapport pour le 3e trimestre 2024, montrant une croissance significative de l'audience des jeux et des diffusions en direct. Le rapport met en avant 8,5 milliards d'heures de visionnage en direct, marquant une augmentation de 12% par rapport à l'année précédente. Les principales conclusions incluent une augmentation de 8% des heures consacrées aux esports et la croissance de YouTube Gaming à 2 milliards d'heures, augmentant sa part de marché de 17% à 23%. Kick a montré une augmentation de 163% des heures de visionnage. La part de marché de Twitch a diminué à 60%, tandis que le contenu espagnol a connu une hausse de 59% sur Kick. Le rapport note également un marché du streaming plus diversifié, avec la part de marché des principaux créateurs passant de 98% à 86%.

Stream Hatchet, eine Tochtergesellschaft von GameSquare Holdings, hat ihren Bericht für das 3. Quartal 2024 veröffentlicht, der ein signifikantes Wachstum bei der Zuschauerzahl von Spielen und Livestreams zeigt. Der Bericht hebt 8,5 Milliarden Stunden Livestream-Zuschauer hervor, was einem 12%igen Anstieg im Jahresvergleich entspricht. Zu den wichtigsten Ergebnissen gehören ein 8%iger Anstieg der angesehenen eSports-Stunden und das Wachstum von YouTube Gaming auf 2 Milliarden Stunden, was den Marktanteil von 17% auf 23% erhöht. Kick hatte einen 163%igen Anstieg der angesehenen Stunden. Der Marktanteil von Twitch sank auf 60%, während spanische Inhalte auf Kick um 59% zunahmen. Der Bericht weist auch auf einen diversifizierteren Streaming-Markt hin, wobei der Marktanteil der Top-Creator von 98% auf 86% gesenkt wurde.

- Live streaming viewership increased 12% YoY to 8.5 billion hours

- YouTube Gaming grew viewership to 2 billion hours, increasing market share from 17% to 23%

- Kick platform showed 163% YoY growth in hours watched

- Esports viewership increased 8%, now representing one-fifth of all live-streaming views

- Twitch's market share declined to 60%

- Facebook Live dropped out of top 5 streaming platforms

Insights

The Q3 2024 streaming analytics report reveals significant market dynamics that could positively impact GameSquare's revenue potential. The

Particularly noteworthy is the platform diversification trend, with YouTube Gaming reaching 2 billion hours watched and Kick showing

Live Streaming Insights Show Major Growth in Gaming Content Engagement

New Report Reveals Today's Top Creators

View the report: https://streamhatchet.com/q3-2024-live-streaming-trend-report/

FRISCO, TX / ACCESSWIRE / November 21, 2024 / Stream Hatchet, a streaming analytics and business intelligence platform and wholly-owned subsidiary of GameSquare Holdings (NASDAQ:GAME), ("GameSquare", or the "Company"), has released its Q3 2024 report, revealing significant growth trends in gaming and live-streaming viewership. This quarter, live streaming viewership is at 8.5 billion hours watched, with a

"Live streaming is at the forefront of a broader shift in how audiences engage with entertainment," said Justin Kenna, CEO of GameSquare. "The Stream Hatchet Q3 2024 report demonstrates that as video continues to dominate the entertainment industry and creator economy, platforms like YouTube Gaming and Kick are seizing opportunities to reshape the competitive landscape. This data underscores a trend where audience attention-and platform strategies-are diversifying, fueling innovation and growth in live streaming as a primary medium of engagement."

Key Findings of the Q3 2024 Report:

Overall Growth in Gaming and Esports Viewership:

Live streaming rebounded with an8% rise in esports hours watched, fueled by tournaments such as MPL Indonesia Season 14 and LCK Summer 2024, which generated a combined 130 million hours watched. Esports now comprises one-fifth of all live-streaming viewership, underscoring its importance in the gaming sector.YouTube Gaming and Kick's Rapid Rise:

YouTube Gaming grew its viewership to 2 billion hours, marking a year-over-year increase in market share from17% to23% . Kick also demonstrated exponential growth, with a163% increase in hours watched compared to last year. This growth was bolstered by prominent streamers like xQc, who shifted much of their content to Kick.Shifts in Platform Dominance:

Twitch's market share dropped to60% , while other platforms, especially YouTube Gaming and Kick, gained ground. Facebook Live has fallen from the top five, with newer platforms like AfreecaTV and Rumble filling the gap.Spanish-Language Content and Emerging Platforms:

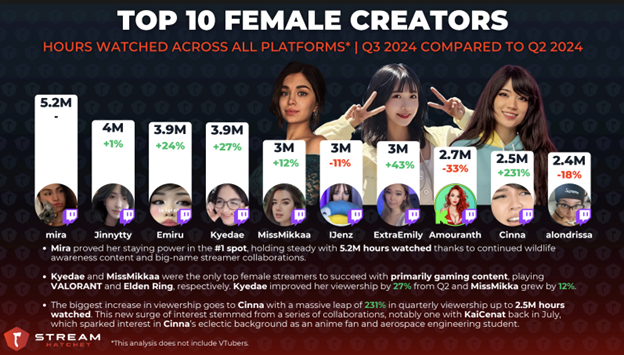

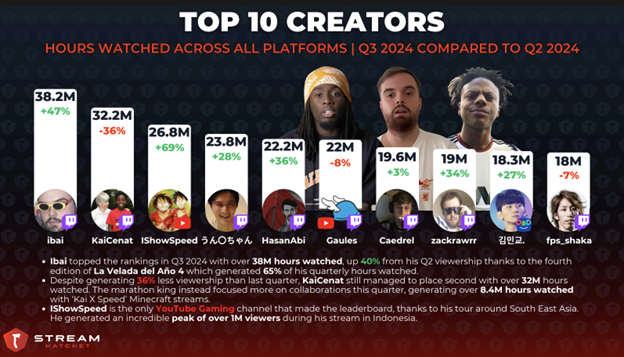

Spanish content surged by59% on Kick, making it the second most-watched language on the platform with 129 million hours. Meanwhile, new entrants like Chzzk and Rumble continue to offer alternatives, engaging unique audiences across diverse regions.Top Creators of Q3 2024:

The top creators are losing their stranglehold on the market, with the top

5% of streamers by hours watched dropping from98% of the total market share in Q2 2019 to just86% in Q2 2024, indicating a more diverse market for smaller streamers.Notable streamers such as KaiCenat and Ironmouse have set records this quarter. KaiCenat took the #1 spot with a

78% increase in viewership, while Ironmouse garnered 320,000 subscribers during "Subtember," marking a new milestone.

For more information on Stream Hatchet and insight into the esports and streaming markets, please visit their website at www.streamhatchet.com.

About GameSquare Holdings, Inc.

GameSquare's (NASDAQ:GAME) mission is to revolutionize the way brands and game publishers connect with hard-to-reach Gen Z, Gen Alpha, and Millennial audiences. Our next generation media, entertainment, and technology capabilities drive compelling outcomes for creators and maximize our brand partners' return on investment. Through our purpose-built platform, we provide award winning marketing and creative services, offer leading data and analytics solutions, and amplify awareness through FaZe Clan, one of the most prominent and influential gaming organizations in the world. With one of the largest gaming media networks in North America, as verified by Comscore, we are reshaping the landscape of digital media and immersive entertainment. GameSquare's largest investors are Dallas Cowboys owner Jerry Jones and the Goff family.

To learn more, visit www.gamesquare.com.

About Stream Hatchet

Stream Hatchet is the leading provider of data analytics for the live streaming industry. With a suite of services encompassing a user-friendly SaaS platform, custom reports, and strategic consulting, Stream Hatchet is a trusted guide for those navigating the dynamic landscape of live streaming. The company has up to 7 years of historical data with minute-level granularity from 20 platforms, Stream Hatchet provides stakeholders in the live streaming industry with powerful insights to drive innovation and growth. Stream Hatchet partners with a diverse clientele - from video game publishers and marketing agencies to esports organizers and teams - who rely on the company's cutting-edge data analytics to optimize their marketing strategies, secure lucrative sponsorships, enhance esports performance, and build successful tournaments.

For more information visit www.streamhatchet.com.

Forward-Looking Information

This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking statements") within the meaning of the applicable securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements relate, among other things, to: the Company's and FaZe Media Inc.'s future performance, revenue, growth and profitability; and the Company's and FaZe Media's ability to execute their business plans. These forward-looking statements are provided only to provide information currently available to us and are not intended to serve as and must not be relied on by any investor as, a guarantee, assurance or definitive statement of fact or probability. Forward-looking statements are necessarily based upon a number of estimates and assumptions which include, but are not limited to: the Company's and FaZe Media's ability to grow their business and being able to execute on their business plans, the Company being able to complete and successfully integrate acquisitions, the Company being able to recognize and capitalize on opportunities and the Company continuing to attract qualified personnel to supports its development requirements. These assumptions, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: the Company's ability to achieve its objectives, the Company successfully executing its growth strategy, the ability of the Company to obtain future financings or complete offerings on acceptable terms, failure to leverage the Company's portfolio across entertainment and media platforms, dependence on the Company's key personnel and general business, economic, competitive, political and social uncertainties. These risk factors are not intended to represent a complete list of the factors that could affect the Company which are discussed in the Company's most recent MD&A. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this news release. GameSquare assumes no obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by law.

Corporate Contact

Lou Schwartz, President

Phone: (216) 464-6400

Email: ir@gamesquare.com

Investor Relations

Andrew Berger

Phone: (216) 464-6400

Email: ir@gamesquare.com

Media Relations

Chelsey Northern / The Untold

Phone: (254) 855-4028

Email: pr@gamesquare.com

SOURCE: GameSquare Holdings, Inc.

View the original press release on accesswire.com