CreditRiskMonitor Announces First Quarter Results

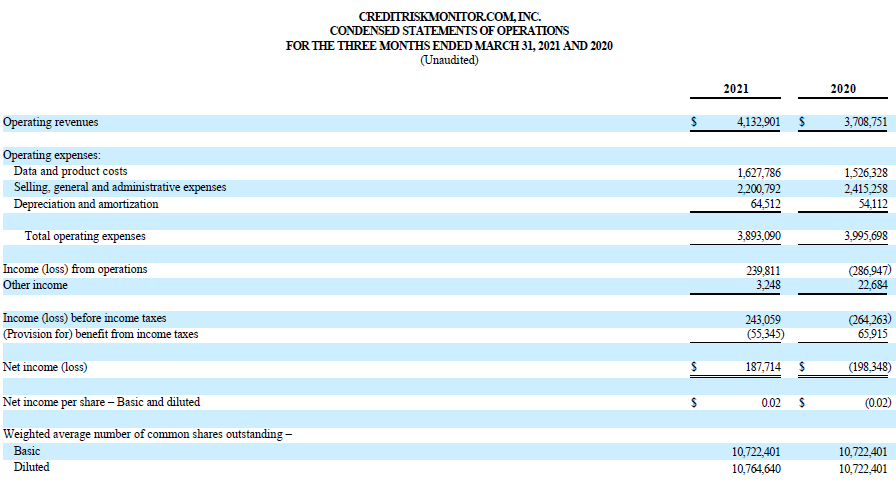

CreditRiskMonitor (CRMZ) reported impressive first-quarter results for 2021, with revenues reaching $4.13 million, marking an 11% increase from $3.71 million in 2020. Operating expenses decreased by approximately $102,600 or 2.5%, mainly due to a revised commission accrual methodology. The company shifted from a pre-tax loss of approximately $264,200 last year to a pre-tax income of $243,000 this quarter. President Mike Flum emphasized ongoing investments in product development and infrastructure aimed at enhancing service delivery and expanding coverage.

- Revenue increased to $4.13 million, up 11% from $3.71 million in 2020.

- Operating expenses reduced by approximately $102,600 (2.5%).

- Pre-tax income improved to approximately $243,000 compared to a pre-tax loss of $264,200 in the prior year.

- None.

VALLEY COTTAGE, NY / ACCESSWIRE / May 14, 2021 / CreditRiskMonitor (OTCQX:CRMZ) reported that revenues for the quarter ended March 31, 2021 increased to

Mike Flum, President & COO, said, "We continue to reinvest in our service with new product development, additional data acquisition, and employee retention. We remain committed to enhancing the value proposition of our services and expanding our staff to support the financial risk analysis needs of our customer base. We continue to press forward with the development of our new supply chain focused platform as well as the expansion of our private company coverage as both avenues represent significant growth opportunities for our business. We also continue to invest in streamlining our infrastructure systems, allowing us to become more productive and more effectively scale up our operations over time."

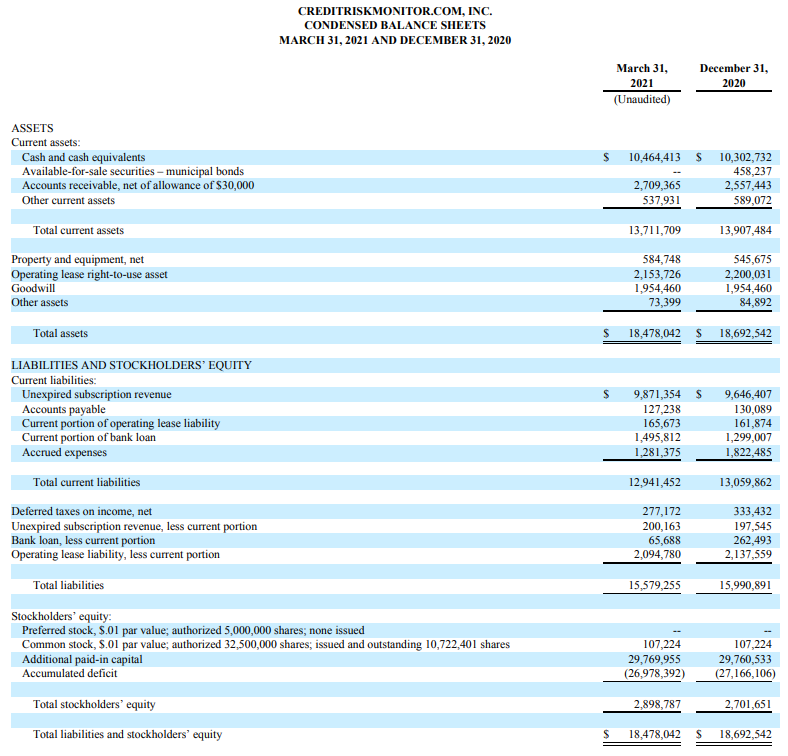

A full copy of the financial statements can be found at https://crmz.ir.edgar-online.com/

Overview

CreditRiskMonitor (http://www.crmz.com) is a web-based publisher of financial information that helps corporate credit and procurement professionals stay ahead of business financial risk quickly, accurately and cost effectively. The service offers comprehensive commercial credit reports and financial risk analysis covering public companies worldwide.

The Company also collects a significant amount of trade receivable data on both public and a select group of private companies every month, to help subscribers determine payment performance.

Over

Safe Harbor Statement

Certain statements in this press release, including statements prefaced by the words "anticipates", "estimates", "believes", "expects" or words of similar meaning, constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, expectations or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, including, among others, risks associated with the COVID-19 pandemic and those risks, uncertainties and factors referenced from time to time as "risk factors" or otherwise in the Company's Registration Statements or Securities and Exchange Commission Reports. We disclaim any intention or obligation to revise any forward-looking statements, whether as a result of new information, a future event, or otherwise.

CONTACT:

CreditRiskMonitor.com, Inc.

Mike Flum, President & COO

(845) 230-3037

ir@creditriskmonitor.com

SOURCE: CreditRiskMonitor.com, Inc.

View source version on accesswire.com:

https://www.accesswire.com/647571/CreditRiskMonitor-Announces-First-Quarter-Results

FAQ

What were CreditRiskMonitor's (CRMZ) revenues for Q1 2021?

How much did CreditRiskMonitor (CRMZ) reduce its operating expenses in Q1 2021?

What was CreditRiskMonitor's (CRMZ) pre-tax income for Q1 2021?

What growth opportunities did CreditRiskMonitor (CRMZ) mention for the future?