CreditRiskMonitor Announces Third Quarter Results

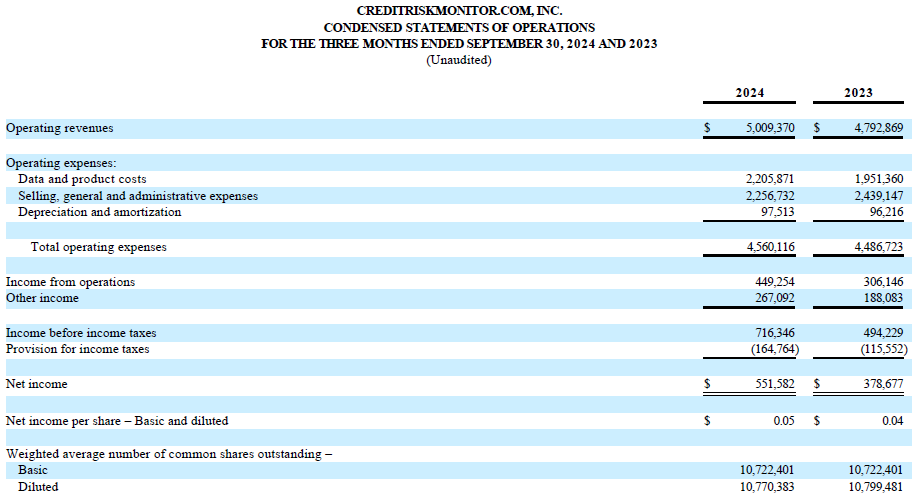

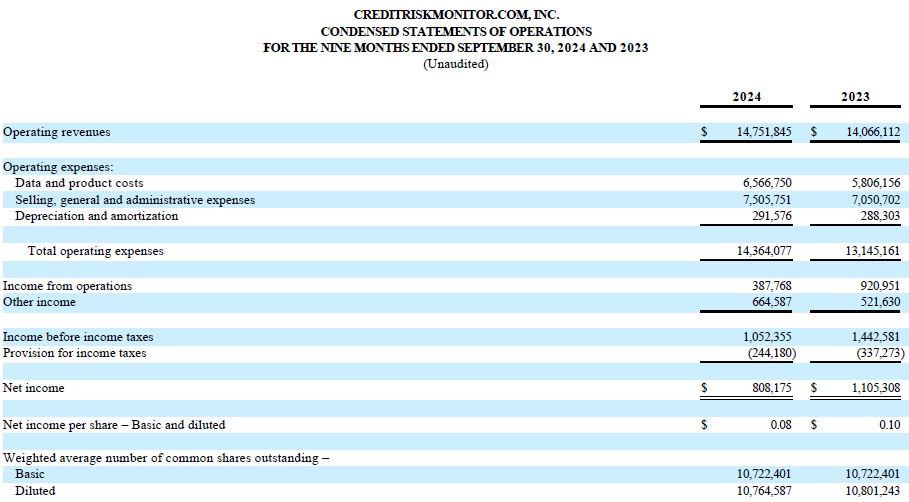

CreditRiskMonitor (OTCQX:CRMZ) reported Q3 2024 operating revenues of $5.0 million, up 5% year-over-year, with pre-tax income reaching $716 thousand, an increase of $222 thousand compared to Q3 2023. The improved profitability was attributed to reduced salary expenses, lower customer acquisition costs, and increased interest income.

The company expects short-to-medium term profitability to decrease due to increased investments in data, technology, and employee upskilling. Their SupplyChainMonitor™ platform continues to gain new clients and was recognized as a top provider of financial risk analytics by Spend Matters. The company is also enhancing its news systems with new natural language techniques to improve content tagging and analysis.

CreditRiskMonitor (OTCQX:CRMZ) ha riportato entrate operative del Q3 2024 di $5,0 milioni, in aumento del 5% rispetto all'anno precedente, con un reddito ante imposte di $716 mila, un incremento di $222 mila rispetto al Q3 2023. L'aumento della redditività è stato attribuito alla riduzione delle spese salariali, ai minori costi di acquisizione clienti e all'aumento del reddito da interessi.

L'azienda prevede che la redditività a breve e medio termine diminuisca a causa degli investimenti crescenti in dati, tecnologia e formazione dei dipendenti. La loro piattaforma SupplyChainMonitor™ continua ad acquisire nuovi clienti ed è stata riconosciuta come uno dei principali fornitori di analisi del rischio finanziario da Spend Matters. L'azienda sta anche migliorando i suoi sistemi di notizie con nuove tecniche di linguaggio naturale per migliorare il tagging e l'analisi dei contenuti.

CreditRiskMonitor (OTCQX:CRMZ) reportó ingresos operativos en el tercer trimestre de 2024 de $5.0 millones, un aumento del 5% interanual, con ingresos antes de impuestos alcanzando $716 mil, un incremento de $222 mil en comparación con el tercer trimestre de 2023. La mejora en la rentabilidad se atribuyó a la reducción de gastos salariales, menores costos de adquisición de clientes y un aumento en los ingresos por intereses.

La compañía espera que la rentabilidad a corto y medio plazo disminuya debido a mayores inversiones en datos, tecnología y capacitación de empleados. Su plataforma SupplyChainMonitor™ sigue ganando nuevos clientes y fue reconocida como un proveedor destacado de análisis de riesgo financiero por Spend Matters. La empresa también está mejorando sus sistemas de noticias con nuevas técnicas de lenguaje natural para mejorar el etiquetado y análisis de contenido.

CreditRiskMonitor (OTCQX:CRMZ)는 2024년 3분기 운영 수익이 $5.0 백만으로 작년 대비 5% 증가했으며, 세전 소득이 $716 천에 도달하여 2023년 3분기보다 $222 천 증가했다고 보고했습니다. 개선된 수익성은 급여 비용 감소, 고객 유치 비용 절감, 그리고 증가한 이자 수입에 기인했습니다.

회사는 데이터, 기술 및 직원 재교육에 대한 투자 증가로 인해 단기 및 중기 수익성이 감소할 것으로 예상하고 있습니다. 그들의 SupplyChainMonitor™ 플랫폼은 지속적으로 새로운 고객을 유치하고 있으며, Spend Matters에 의해 금융 리스크 분석의 주요 제공업체로 인정받았습니다. 또한 회사는 콘텐츠 태그 지정 및 분석을 개선하기 위해 새로운 자연어 처리 기법으로 뉴스 시스템을 강화하고 있습니다.

CreditRiskMonitor (OTCQX:CRMZ) a rapporté des revenus opérationnels de $5,0 millions pour le troisième trimestre 2024, en hausse de 5 % par rapport à l'année précédente, avec un revenu avant impôt atteignant $716 mille, soit une augmentation de $222 mille par rapport au troisième trimestre 2023. L'amélioration de la rentabilité a été attribuée à la réduction des dépenses salarial, à des coûts d'acquisition de clients inférieurs et à une augmentation des revenus d'intérêts.

L'entreprise s'attend à ce que la rentabilité à court et moyen terme diminue en raison d'investissements accrus dans les données, la technologie et la formation des employés. Leur plateforme SupplyChainMonitor™ continue d'attirer de nouveaux clients et a été reconnue comme l'un des principaux fournisseurs d'analyses des risques financiers par Spend Matters. L'entreprise améliore également ses systèmes de nouvelles avec de nouvelles techniques de traitement du langage naturel pour améliorer le balisage et l'analyse du contenu.

CreditRiskMonitor (OTCQX:CRMZ) berichtete im 3. Quartal 2024 von Betriebseinnahmen in Höhe von $5,0 Millionen, was einem Anstieg von 5% im Jahresvergleich entspricht, und einem Gewinn vor Steuern von $716 Tausend, was eine Steigerung von $222 Tausend im Vergleich zum 3. Quartal 2023 darstellt. Die verbesserte Rentabilität wurde auf reduzierte Gehaltsausgaben, niedrigere Kundenakquisitionskosten und erhöhte Zinserträge zurückgeführt.

Das Unternehmen erwartet, dass die Rentabilität im kurz- bis mittelfristigen Zeitraum aufgrund steigender Investitionen in Daten, Technologie und Mitarbeiterschulungen sinken wird. Ihre Plattform SupplyChainMonitor™ gewinnt weiterhin neue Kunden und wurde von Spend Matters als einer der führenden Anbieter von finanziellen Risikoanalysen anerkannt. Das Unternehmen verbessert auch seine Nachrichtensysteme mit neuen Techniken der natürlichen Sprachverarbeitung zur Optimierung der Inhaltskennzeichnung und -analyse.

- Revenue increased by 5% YoY to $5.0 million in Q3 2024

- Pre-tax income grew by $222 thousand to $716 thousand in Q3 2024

- Reduced operational costs through decreased salary expenses and lower customer acquisition costs

- Recognition as top provider by Spend Matters in Fall 2024 SolutionMap rankings

- Expected decrease in profitability in short-to-medium term due to increased spending

- Higher expenses anticipated for data, technology, and employee training investments

VALLEY COTTAGE, NY / ACCESSWIRE / November 14, 2024 / CreditRiskMonitor.com, Inc. (OTCQX:CRMZ) reported operating revenues of

Mike Flum, CEO, said, "We continue our optimization initiatives to achieve higher efficiency for our teams. While our operating results have improved quarter over quarter, we still expect lower profitability in the short-to-medium term as we increase spending for data, technology, and employee upskilling. We expect these investments will support higher revenue growth and higher profitability in the long term.

Our Confidential Financial Statements Solution continues to receive positive feedback from prospects and customers as it gains momentum. We are making minor tweaks to the process based on user input as we refine product market fit. The add-on helps to address the private company coverage problem without resorting to the firmographic/technographic models used in thin file situations, which we feel provide a false sense of security.

We also continue to gain new clients for our SupplyChainMonitor™ platform and were excited to be rated as a top provider of financial risk analytics for supply chain risk management and third-party risk management by Spend Matters in their Fall 2024 SolutionMap rankings. There is a clear need for financial risk analysis in supply chain management and the movement from one-time onboarding checks to more robust continuous monitoring supports our value proposition.

Finally, we are working to improve our news systems with new natural language techniques to support better content tagging, fewer duplicated stories, and clear materiality to our subscribers. These steps will further support extracting more useful signals from news, improving our reports and counterparty relationship identification. Ultimately, this data will aid our long-term ambitions to offer lower-cost digital twin models leveraging our analytics to surface financial risk contagions within n-tier supply chains.

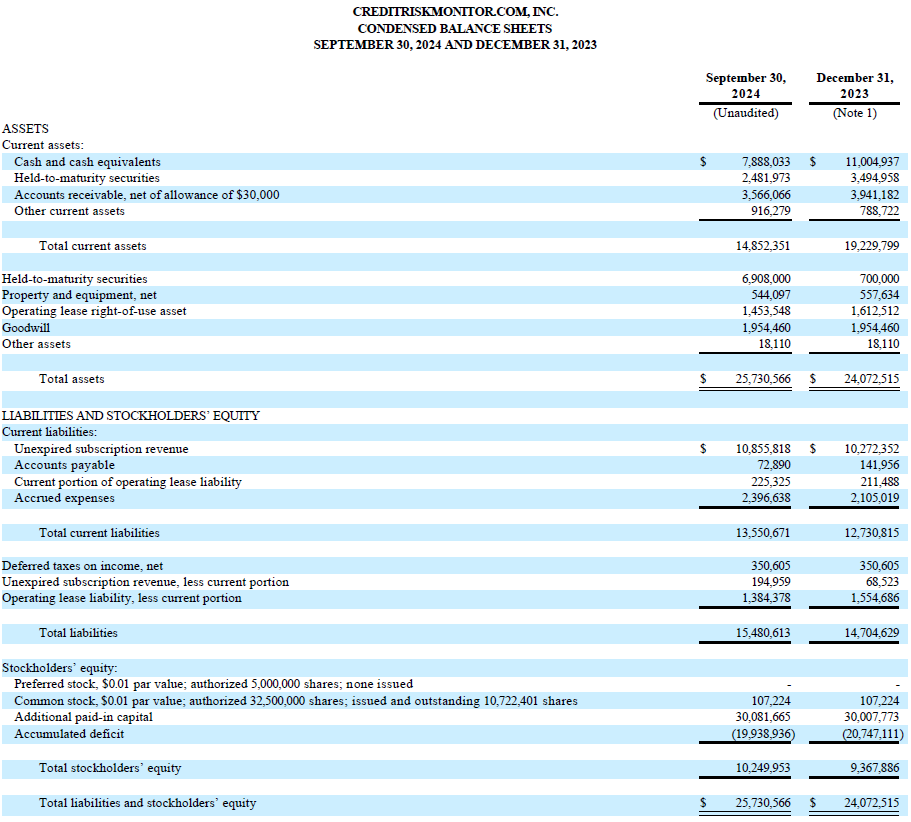

A full copy of the financial statements can be found at https://crmz.ir.edgar-online.com/

Overview

CreditRiskMonitor (creditriskmonitor.com) sells a suite of web-based, SaaS subscription products providing access to comprehensive commercial credit reports, bankruptcy risk analytics, financial and payment information, and curated news on public and private companies worldwide. The products help corporate credit and supply chain professionals stay ahead of and manage financial risk more quickly, accurately, and cost-effectively.

The Company's newest platform, SupplyChainMonitor™, leverages its financial risk analytics expertise to create a risk management solution built specifically for procurement, supply chain, sourcing, and finance personnel involved in the supplier lifecycle, risk assessment, and ongoing risk monitoring. Users can assess counterparty risks at the aggregate and granular levels under a variety of categories including geography and industry, as well as customized, customer-specific configurations. The platform features mapping capabilities with real-time weather/natural disaster event overlays as well as customizable news notifications, reports, and charts.

Our subscribers, including nearly

The Company, through its Trade Contributor Program, receives confidential accounts receivables data from hundreds of subscribers and non-subscribers every month. This trade receivable data is parsed, processed, aggregated, and finally reported to summarize the invoice payment behavior of B2B counterparties, without disclosing the specific contributors of this information. The Trade Contributor Program's current trade credit file processes approximately

Safe Harbor Statement

Certain statements in this press release, including statements prefaced by the words "anticipates", "estimates", "believes", "expects" or words of similar meaning, constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, expectations or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, including, among others, risks associated with the COVID-19 pandemic and those risks, uncertainties and factors referenced from time to time as "risk factors" or otherwise in the Company's Registration Statements or Securities and Exchange Commission Reports. We disclaim any intention or obligation to revise any forward-looking statements, whether as a result of new information, a future event, or otherwise.

CONTACT:

CreditRiskMonitor.com, Inc.

Mike Flum, CEO & President

(845) 230-3037

ir@creditriskmonitor.com

SOURCE: CreditRiskMonitor.com, Inc.

View the original press release on accesswire.com