CreditRiskMonitor Announces Second Quarter Results

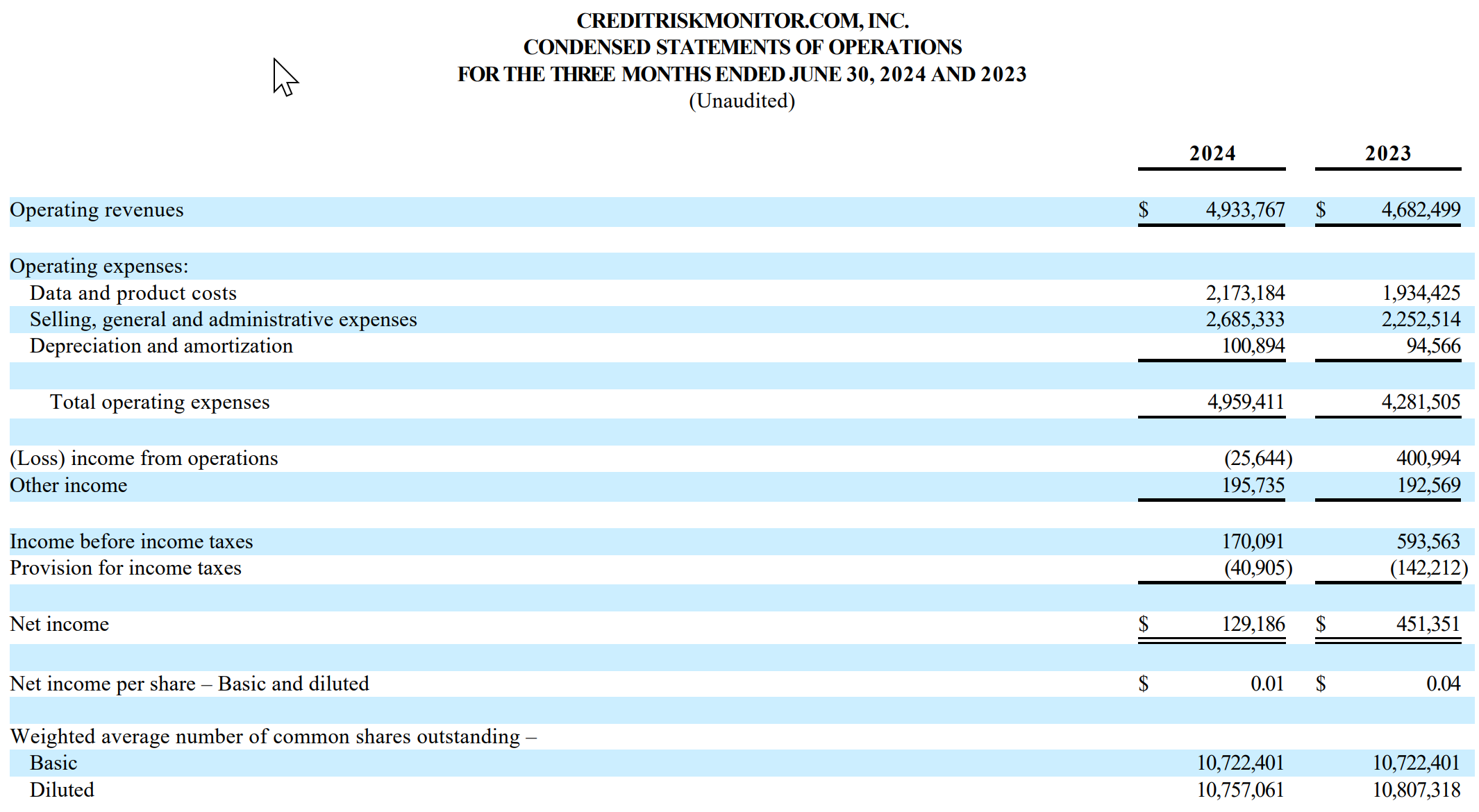

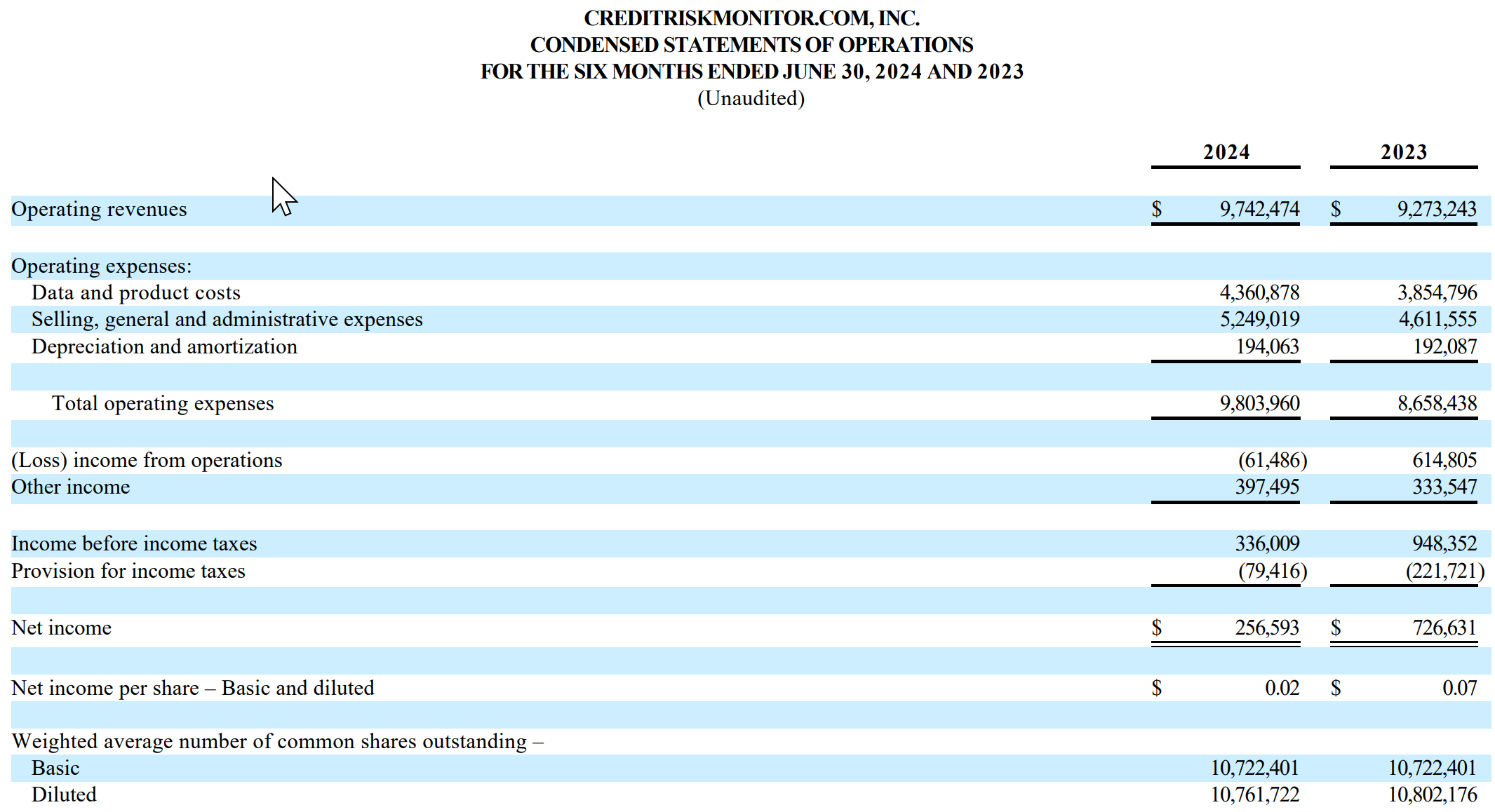

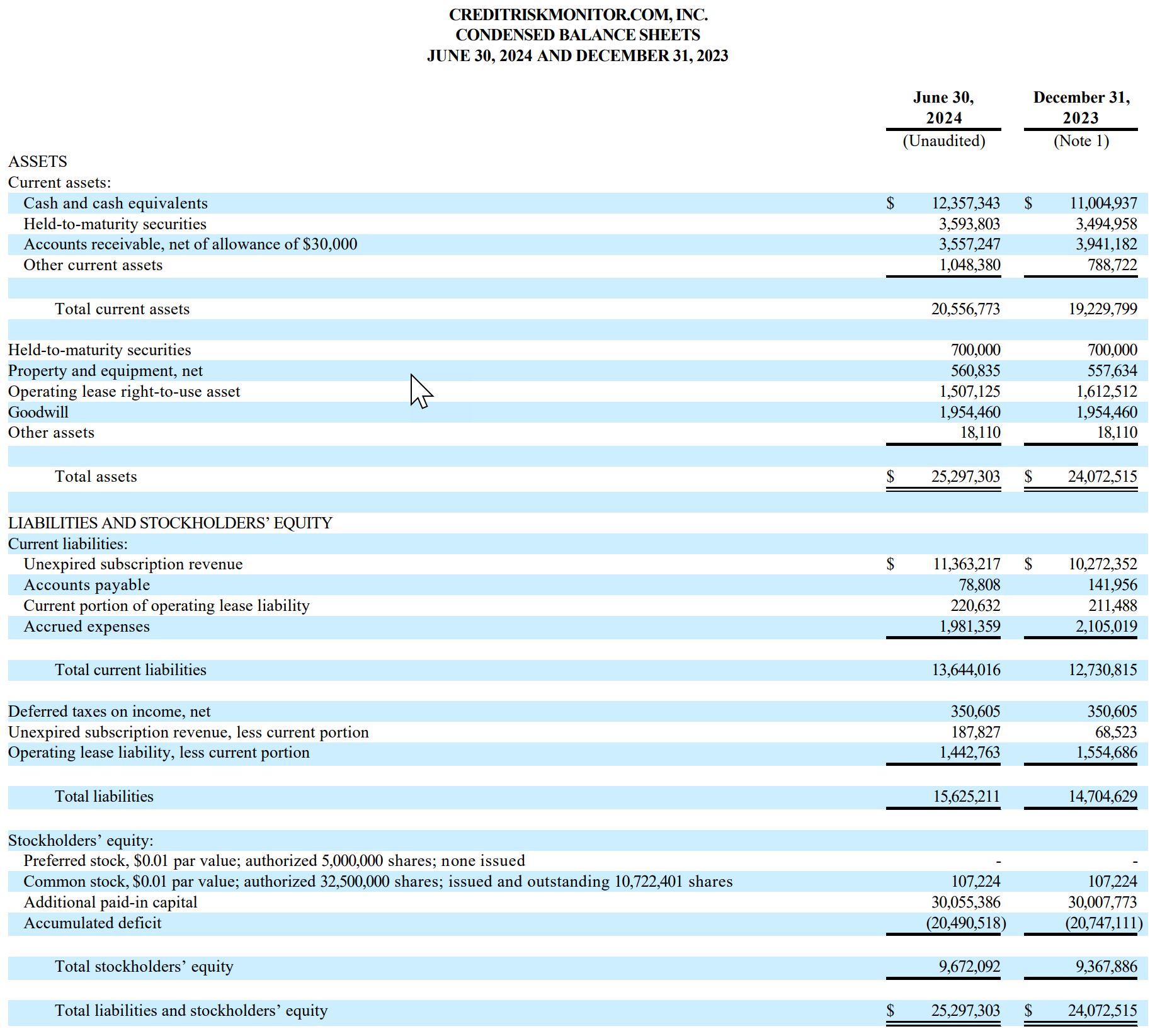

CreditRiskMonitor.com, Inc. (OTCQX:CRMZ) reported Q2 2024 operating revenues of $4.9 million, a 5% increase from Q2 2023. However, pre-tax income decreased by $423,000 to $170,000, primarily due to increased expenses. CEO Mike Flum attributed this to continued investment in data, technology, marketing, and employee upskilling to support future growth.

The company highlighted rising corporate bankruptcy filings and increased global business failure risks as potential drivers for demand. CreditRiskMonitor's new Confidential Financial Statements Solution and SupplyChainMonitor™ platform are receiving positive market feedback. The company serves nearly 40% of Fortune 1000 companies and provides comprehensive credit reports, bankruptcy risk analytics, and supply chain risk management solutions.

CreditRiskMonitor.com, Inc. (OTCQX:CRMZ) ha riportato entrate operative di $4.9 milioni per il Q2 2024, con un incremento del 5% rispetto al Q2 2023. Tuttavia, il reddito ante imposte è diminuito di $423.000 a $170.000, principalmente a causa dell'aumento delle spese. Il CEO Mike Flum ha attribuito questo a investimenti continui in dati, tecnologia, marketing e formazione dei dipendenti per supportare la crescita futura.

La società ha evidenziato l'aumento delle richieste di fallimento delle aziende e i crescenti rischi di fallimento aziendale globale come potenziali motori della domanda. La nuova Soluzione di Bilanci Finanziari Riservati e la piattaforma SupplyChainMonitor™ di CreditRiskMonitor stanno ricevendo feedback positivi dal mercato. L'azienda serve quasi il 40% delle società Fortune 1000 e fornisce rapporti di credito completi, analisi del rischio di fallimento e soluzioni di gestione del rischio della catena di approvvigionamento.

CreditRiskMonitor.com, Inc. (OTCQX:CRMZ) reportó ingresos operativos de $4.9 millones en el Q2 2024, un aumento del 5% con respecto al Q2 2023. Sin embargo, el ingreso antes de impuestos disminuyó en $423,000 a $170,000, principalmente debido al aumento de los gastos. El CEO Mike Flum atribuyó esto a la inversión continua en datos, tecnología, marketing y capacitación de empleados para apoyar el crecimiento futuro.

La empresa destacó el aumento de los archivos de quiebra corporativa y los crecientes riesgos de fracaso empresarial global como posibles motores de la demanda. La nueva Solución de Estados Financieros Confidenciales y la plataforma SupplyChainMonitor™ de CreditRiskMonitor están recibiendo comentarios positivos del mercado. La empresa sirve a casi el 40% de las compañías Fortune 1000 y proporciona informes de crédito completos, análisis de riesgo de quiebra y soluciones de gestión de riesgos de la cadena de suministro.

CreditRiskMonitor.com, Inc. (OTCQX:CRMZ)는 2024년 2분기 운영 수익이 $4.9백만으로 2023년 2분기 대비 5% 증가했다고 보고했습니다. 그러나 세전 수익이 $423,000 감소하여 $170,000이 되었으며, 이는 주로 비용 증가 때문입니다. CEO Mike Flum은 이와 같은 상황을 데이터, 기술, 마케팅 및 직원 기술 향상에 대한 지속적인 투자에 기인한다고 설명했습니다.

회사는 기업 파산 신청이 증가하고 있다고 강조하며, 글로벌 사업 실패 위험 증가를 수요의 잠재적 요인으로 언급했습니다. CreditRiskMonitor의 새로운 비밀 재무 제표 솔루션과 SupplyChainMonitor™ 플랫폼은 긍정적인 시장 피드백을 받고 있습니다. 이 회사는 Fortune 1000 기업의 거의 40%를 서비스하며, 종합 신용 보고서, 파산 위험 분석 및 공급망 리스크 관리 솔루션을 제공합니다.

CreditRiskMonitor.com, Inc. (OTCQX:CRMZ) a rapporté des revenus opérationnels de 4,9 millions de dollars pour le 2ème trimestre 2024, soit une augmentation de 5 % par rapport au 2ème trimestre 2023. Cependant, le revenu avant impôt a diminué de 423 000 dollars pour atteindre 170 000 dollars, principalement en raison d'une augmentation des dépenses. Le PDG Mike Flum a attribué cela à des investissements continus dans les données, la technologie, le marketing et le développement des compétences des employés pour soutenir la croissance future.

L'entreprise a souligné l'augmentation des dépôts de bilan des entreprises et les risques accrus d'échec commercial à l'échelle mondiale comme des moteurs potentiels de la demande. La nouvelle solution d'états financiers confidentiels et la plateforme SupplyChainMonitor™ de CreditRiskMonitor reçoivent des retours positifs du marché. L'entreprise sert près de 40 % des sociétés Fortune 1000 et fournit des rapports de crédit complets, des analyses de risque de faillite et des solutions de gestion des risques de la chaîne d'approvisionnement.

CreditRiskMonitor.com, Inc. (OTCQX:CRMZ) berichtete von Betriebseinnahmen von 4,9 Millionen US-Dollar im 2. Quartal 2024, was einem Anstieg von 5% im Vergleich zum 2. Quartal 2023 entspricht. Allerdings verringerte sich das Einkommen vor Steuern um 423.000 US-Dollar auf 170.000 US-Dollar, hauptsächlich aufgrund gestiegener Ausgaben. CEO Mike Flum führte dies auf fortlaufende Investitionen in Daten, Technologie, Marketing und Schulung der Mitarbeiter zurück, um zukünftiges Wachstum zu unterstützen.

Das Unternehmen wies auf steigende Unternehmenspleiten und gestiegene globale Geschäftsrisiken hin, die potenzielle Treiber für die Nachfrage darstellen. Die neue Lösung für vertrauliche Finanzberichte und die SupplyChainMonitor™-Plattform von CreditRiskMonitor erhalten positives Marktfeedback. Das Unternehmen bedient fast 40% der Fortune 1000-Unternehmen und bietet umfassende Kreditberichte, Analysen von Insolvenzrisiken und Lösungen im Bereich Risikomanagement in der Lieferkette an.

- Q2 2024 operating revenues increased by 5% to $4.9 million

- Positive market feedback on new Confidential Financial Statements Solution

- Increasing interest in SupplyChainMonitor™ platform

- Rising corporate bankruptcy filings potentially increasing demand for CRMZ products

- Q2 2024 pre-tax income decreased by $423,000 to $170,000

- Increased expenses due to inflation and investment strategy

VALLEY COTTAGE, NY / ACCESSWIRE / August 12, 2024 / CreditRiskMonitor.com, Inc. (OTCQX:CRMZ) reported operating revenues of

Mike Flum, CEO, said, "Our reduced operating income for the second quarter of 2024 reflects the continuation of our increased investment strategy in new data, technology development, marketing, and employee upskilling to support larger revenue growth as stated in our first quarter press release. We are still committed to staying profitable while pursuing this goal and expect these operational improvements to support our long-term profitability and valuation in time.

As reported in the media, US corporate bankruptcy filings are up approximately

Feedback on our new Confidential Financial Statements Solution has been strongly positive, continuing to validate its product-market fit for addressing the financial risk of unscored private companies in both trade credit and supply chain use cases. Our teams continue to demonstrate this innovative add-on product and we expect it to make contributions to our performance as these opportunities are monetized. We are also excited to see increasing interest in our SupplyChainMonitor™ platform, providing market confirmation that the product addresses prospects' need for financial risk analysis and continuing monitoring of vendors."

A full copy of the financial statements can be found at https://crmz.ir.edgar-online.com/

Overview

CreditRiskMonitor.com, Inc. (creditriskmonitor.com) sells a suite of web-based, SaaS subscription products providing access to comprehensive commercial credit reports, bankruptcy risk analytics, financial and payment information, and curated news on public and private companies worldwide. The products help corporate credit and supply chain professionals stay ahead of and manage financial risk more quickly, accurately, and cost-effectively.

The Company's newest platform, SupplyChainMonitor™, leverages its financial risk analytics expertise to create a risk management solution built specifically for procurement, supply chain, sourcing, and finance personnel involved in the supplier lifecycle, risk assessment, and ongoing risk monitoring. Users can assess counterparty risks at the aggregate and granular levels under a variety of categories including geography and industry, as well as customized, customer-specific configurations. The platform features mapping capabilities with real-time weather/natural disaster event overlays as well as customizable news notifications, reports, and charts.

Our subscribers, including nearly

The Company, through its Trade Contributor Program, receives confidential accounts receivables data from hundreds of subscribers and non-subscribers every month. This trade receivable data is parsed, processed, aggregated, and finally reported to summarize the invoice payment behavior of B2B counterparties, without disclosing the specific contributors of this information. The Trade Contributor Program's current trade credit file processes approximately

Safe Harbor Statement

Certain statements in this press release, including statements prefaced by the words "anticipates", "estimates", "believes", "expects" or words of similar meaning, constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, expectations or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, including, among others, risks associated with the COVID-19 pandemic and those risks, uncertainties and factors referenced from time to time as "risk factors" or otherwise in the Company's Registration Statements or Securities and Exchange Commission Reports. We disclaim any intention or obligation to revise any forward-looking statements, whether as a result of new information, a future event, or otherwise.

CONTACT:

CreditRiskMonitor.com, Inc.

Mike Flum, CEO & President

(845) 230-3037

ir@creditriskmonitor.com

SOURCE: CreditRiskMonitor.com, Inc.

View the original press release on accesswire.com