Cosmos Health Issues Letter to Shareholders

Rhea-AI Summary

Cosmos Health (NASDAQ:COSM) reports significant growth and transformation in its latest shareholder letter. The company achieved revenue increases of 18.1% in Q1 2024 and 6.8% in Q2 2024 year-over-year. From 2018 to June 2024, total assets grew 194% to $60.83 million, while total debt decreased 71% to $3.95 million. The company's updated 2024-2027 guidance projects revenue growth to $155.80 million and net income reaching $20.44 million by 2027. Key developments include strategic acquisitions, R&D initiatives, international brand expansion, and a strong balance sheet with stockholders' equity at $32.1 million as of Q2 2024.

Positive

- Revenue increased 18.1% in Q1 2024 and 6.8% in Q2 2024 year-over-year

- Total assets grew 194% to $60.83M (2018-June 2024)

- Total debt decreased 71% to $3.95M (2018-June 2024)

- Strong stockholders' equity of $32.1M in Q2 2024

- Record revenue of $43M at CosmoFarm subsidiary, up 8.62% YoY

- Amazon UK sales grew 160% to $596,000 YTD 2024

- Tangible assets value exceeding $12M covers debt twice over

Negative

- Share price declined to $0.72 from $11.50 capital raise price

- Currently operating at a loss with projected negative net income of $6.76M in 2024

- Increased investments and acquisition costs impacting bottom line

- Trading below book value at significant discount to sector averages

News Market Reaction 1 Alert

On the day this news was published, COSM gained 7.09%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

CHICAGO, IL / ACCESSWIRE / November 12, 2024 / Cosmos Health Inc. ("Cosmos Health" or the "Company'') (NASDAQ:COSM), a diversified, vertically integrated global healthcare group engaged in innovative R&D, owner of proprietary pharmaceutical and nutraceutical brands, manufacturer and distributor of healthcare products, and operator of a telehealth platform, announced today that its Chief Executive Officer, Greg Siokas, has issued the following letter to the Company's shareholders.

Dear Cosmos Health Shareholders,

It has been just over a year since my previous shareholder letter, and I would like to express my sincere gratitude for your continued support. We have achieved many positive milestones since then; however, our share price has not responded accordingly, despite strong execution across several key areas. These include completing strategic acquisitions, advancing our R&D initiatives, reducing our debt, and expanding our brands internationally.

Cosmos is in a dynamic growth phase, advancing through horizontal and vertical expansion. We are confident in the strength of our diversified strategy, which maximizes synergies and emphasizes expanding our distribution network, driving innovation through R&D, and developing high-margin brands with a global perspective, while maintaining a strong balance sheet and disciplined cost management.

We believe that, over time, our efforts will be recognized, reflected in both our financial performance. Encouragingly, we are already seeing positive momentum, as demonstrated by this year's earnings results. Revenue increased year-over-year by

I would like to take this opportunity to share some thoughts to provide our investors with a broader perspective. We concluded 2022 with strong liquidity, thanks to a significant capital raise of over

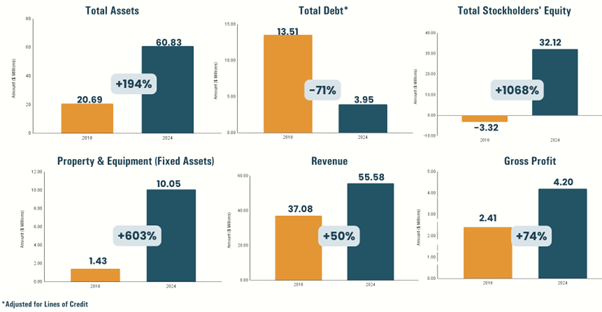

Improving Key Metrics: 2018 - June 2024

As highlighted above, we have been actively expanding our asset base while simultaneously deleveraging. Taking a step back to provide a broader view, from 2018 to June 2024, Cosmos has achieved the following milestones:

Increased Total Assets by

194% , from$20.69 million to$60.83 million Decreased Total Debt, adjusted for lines of credit, by

71% , from$13.51 million to$3.95 million Increased Revenue by

50% , from$37.08 million to$55.58 million Increased Gross Profit by

74% , from$2.41 million to$4.20 million

Fueled by strong growth and expanding requirements, our full-time team has more than doubled, increasing from 67 to 153 employees across diverse roles, from scientists to sales managers. Attracting and retaining top talent remains a key strategic priority as we continue to scale.

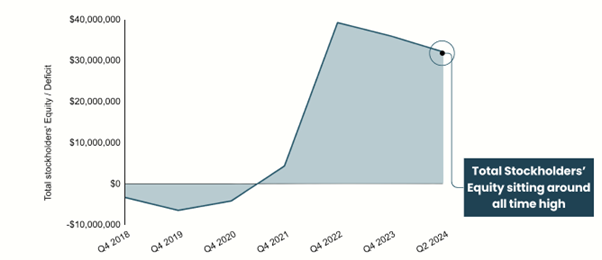

Robust Total Stockholders' Equity: What stands out is that we are currently experiencing one of the strongest financial positions in our history. Cosmos has transformed its balance sheet, with Total Stockholders' Equity near all-time highs at approximately

Tangible Assets: Our freehold properties - CosmoFarm's 29,000 sq. ft. distribution center and Cana's 54,000 sq. ft. production facility - along with other tangible assets, such as machinery and equipment, have a fair market value exceeding

Meanwhile, Cosmos maintains prudent debt levels of under

In effect, our shareholders would receive all our other assets essentially for free. Moreover, these assets - some of which I will highlight below - hold substantial intrinsic value.

Use of Proceeds

We are on the right track, as evidenced by the improving metrics over the past few years. That being said, I believe that providing more clarity on how our funds have been allocated will help shareholders gain insight into our priorities, which, in turn, should enhance their understanding of our strategic direction and vision.

For the period from December 19, 2022, to December 31, 2023, Cosmos deployed approximately

In 2024, year to date, we have continued our growth-oriented agenda, whether through acquisitions, advancing our R&D agenda, or business development initiatives to expand our brands globally. For example, through our wholly-owned subsidiary, CosmoFarm, we concluded the acquisitions of the pharmacy distribution networks of Pharmatrade in February 2024 and Pelofarm in June 2024. This, in conjunction with investments in advanced robotic systems, such as ROWA and SCHAEFER's A-frame for automated procurement, inventory management, and order processing, along with expanded sales and marketing initiatives, has resulted in CosmoFarm achieving record revenue of approximately

Increased investments, heightened acquisition integration costs, and elevated expenses have been a deliberate headwind on our bottom line. We expect this to change over time. Over the next couple of years, these factors are expected to normalize as revenue ramps up, enabling Cosmos to achieve sustained profitability in line with our recently updated guidance for the 2024-2027 period (more on this below).

While much remains to be done, it is fair to say that our core metrics are moving in the right direction. We will work diligently to maintain this momentum, with an increased focus on our bottom line as well.

Strong Asset Base

In addition to our hard assets and cash balances, other important assets include our proprietary brands, generic drugs, and R&D projects, as well as the substantial value of our strong inventory position and accounts receivable, which are being collected at an improved pace.

Proprietary Brands: Our portfolio of proprietary brands spans a wide range of categories, including food supplements, antiseptics, pain-relief ear drops, baby foods, and cosmetics. We expect these brands to be a significant driver of growth moving forward. Some, like Sky Premium Life, are expanding globally, while others, such as Otikon and Melatonin, hold a strong position in their respective local markets.

Research & Development: Our cutting-edge R&D projects, led by world-class scientists and powered by Cloudscreen, our recently acquired AI-driven drug repurposing platform, aim to address major health challenges such as obesity, diabetes, and cancer. We are making substantial progress across multiple fronts, with several products advancing through various development stages. Notably, this includes filing patent applications for our solution targeting central nervous system (CNS) cancers and for CCX0722, our product for obesity and weight management. Additionally, we recently entered the development phase for CCDL24, an innovative treatment for gastrointestinal disorders.

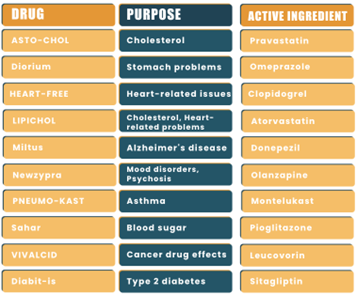

Generic Drugs: At the beginning of this year, we announced the acquisition of licenses and rights for a comprehensive portfolio of 10 generic drugs for approximately

Importantly, these drugs will be manufactured in-house at Cana's facilities. Our vertical integration capabilities are crucial not only for achieving cost savings and enhancing margins but also for allowing us greater control over our supply chain, ensuring we can serve our customers more efficiently and promptly.

Receivables and Inventories: These two assets alone are valued at approximately

Upside Potential

Cana Laboratories

Cana was acquired in Q2 2023 as part of a comprehensive court administered restructuring agreement at a discount to fair market value, resulting in a substantial bargain purchase gain. I'd like to highlight certain historical financial figures as a reference point for assessing its upside potential.

The restructuring allowed Cana to emerge as a debt-free entity. To provide context, prior to restructuring, total liabilities were approximately

$30 million in 2018.At its peak, Cana was generating revenue in excess of

$60 million annually. To put this in perspective, this is more than our FY 2022 revenue.

We have developed a strategic plan to rejuvenate Cana and restore it to its former strength, from revitalizing legacy brands like bio-bebe to establishing contract manufacturing agreements with multinational companies. We believe that achieving this will mark a game-changing moment for Cosmos, as Cana is one of our crown jewels.

In fact, we have already begun to rapidly scale our contract manufacturing (CMO) business by securing agreements with Provident Pharmaceuticals to produce 4.32 million units (vials) of DE3-SOLE, a treatment for vitamin D deficiency, as well as 408,000 units of MIOREL, 222,000 units of CALCIFOLIN, and 72,000 units of DEXA-DOSE. Additionally, we have secured a manufacturing agreement with the Australian wellness company Humacology to produce up to 500,000 units of its CBD products. And we're just getting started.

Opening Up New Markets & Partnerships

We are continually expanding our distribution network and global reach. We look forward to entering new markets and territories and are actively working on several strategic collaborations worldwide to further broaden our distribution network and accelerate market penetration.

Sky Premium Life

Our food supplements brand, Sky Premium Life, continues to strengthen its global presence, securing multiple distribution agreements worldwide. For example, in June 2024, we signed an exclusive distribution agreement with Pharmalink for the United Arab Emirates (UAE), securing our first purchase order of 130,000 units and anticipating over 500,000 units in the first year and more than 3,000,000 units over the next five years. In July 2024, we signed a distribution agreement with Zendon for Slovakia, Hungary, Poland, and the Czech Republic, gaining access to over 6,000 stores across leading pharmacy and retail chains, including Dr. Max, Teta Drogerie, and Rossmann.

Amazon

We are also expanding our presence on prominent direct-to-consumer channels like Amazon. For instance, in the UK, we reported strong sales growth for our brands on Amazon UK, with sales surging

C-Scrub/C-Sept

We are progressing with the global launch of our antimicrobial wash and antiseptic brands, C-sept and C-scrub, which offer substantial market potential with limited competition. Production is being scaled up, and additional products are in development. We are now receiving purchase orders for C-scrub Wash in the United Kingdom, have successfully submitted a tender to supply the National Health System (NHS) in Scotland, and have completed the registration process in Germany to initiate sales.

Mpox PCR detection kits

In August 2024, the World Health Organization declared mpox a global public health emergency. We responded swiftly by expanding our agreement with Virax Biolabs, securing distribution deals for PCR detection kits across multiple markets, including Europe, the Gulf Cooperation Council, and India. We are pleased to support public health authorities by enabling rapid detection and facilitating an effective response.

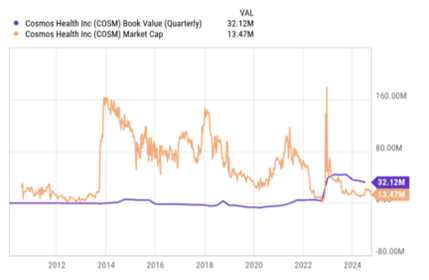

Discount to Book Value and Sector Average Multiples

Speaking of our valuation, our book value per share as of June 30, 2024, is

Trading below book value is not typical. Historically, Cosmos has traded at a substantial premium to book value. However, this relationship reversed in 2023, with the discount to book value persisting into 2024.

In fact, the valuation disconnect relative to book value is currently one of the most significant on record. These are unprecedented times for Cosmos, and we are committed to reversing this trend.

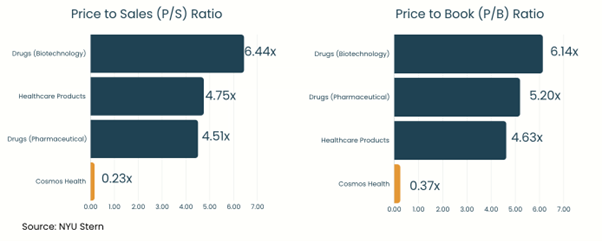

Moreover, we are currently trading at a significant discount relative to sector average multiples. Nearly all healthcare segments and subsegments are trading at a substantial premium compared to COSM across both price-to-sales and price-to-book ratios.

Analyst Coverage: Taglich Brothers

We believe that thorough analyst coverage will raise awareness within the investment community and showcase the intrinsic value of our assets. To this end, we are pleased that Taglich Brothers initiated coverage of our common stock. Their inaugural report, published on February 20, 2024, by analyst Howard Halpern, assigned a Speculative Buy rating and set a 12-month price target of

I am pleased that in Taglich's updated research report on the Company's common stock, dated September 16, 2024, Taglich maintained its Speculative Buy rating with a

From a valuation perspective, Taglich believes our valuation should improve as we achieve revenue growth, transition to operating profitability, and generate positive cash earnings. Cosmos Health's price-to-sales multiple (0.3x) currently lags behind the 2.4x sector average for comparable companies in medical distribution and drug manufacturing. Investors are likely to assign a valuation multiple closer to industry standards over time. Applying a 1.4x price-to-sales multiple to the 2025 sales per share forecast of

Updated Financial Guidance

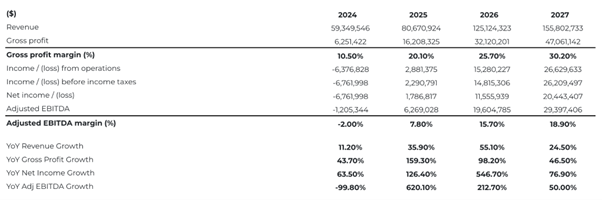

We are pleased to see the pieces of our multi-year strategy coming together, which has made us confident in communicating our 2024-2027 guidance. By 2027, we anticipate substantial value creation by achieving the following:

Revenue to increase by

163% , from$59.35 million in 2024 to$155.80 million in 2027.Gross profit to grow by

653% , from$6.25 million in 2024 to$47.06 million in 2027.Gross profit margin to expand by 1,970 basis points, from

10.50% in 2024 to30.20% in 2027.Net income to increase by

402% , reaching$20.44 million in 2027, compared to a loss of$6.76 million in 2024.Adjusted EBITDA to grow to

$29.40 million in 2027, from a loss of$1.21 million in 2024.

The table below shows our detailed guidance:

Growth Strategy

Moving forward, our strategy will center on these key pillars to drive value creation:

Target Markets: We are prioritizing high-margin segments, with a strategic push to expand our proprietary brands, such as Sky Premium Life and C-sept/C-scrub, across global markets. Additionally, we are enhancing our contract manufacturing division, targeting high-demand medicines with competitive pricing.

Innovation: Our R&D efforts are concentrated on IP-driven products, aiming for World Medical Organization patent approval and the completion of clinical trials for the CCX obesity pill by 2025, with commercialization projected for 2026. We are also progressing in treatments for CNS cancers, brain tumor-related issues, and gastrointestinal disorders.

Vertical Integration & Efficiency: Our in-house manufacturing strengthens efficiency, quality, and cost control. We also aim to achieve operational efficiencies and economies of scale through organic growth and targeted bolt-on acquisitions at CosmoFarm, mirroring recent acquisitions of pharmacy distribution networks, including Pelofarm, Pharmatrade, and Bikas.

Global Networks: We will leverage our extensive global network to access new markets and business segments, amplifying our reach and impact. We aim to expand the distribution of our brands through strategic agreements in new regions and territories, such as recent deals in the UAE and Eastern Europe, while strengthening market share in core markets like Greece and Cyprus.

Diversification: We are pursuing new opportunities and synergies to reduce risk, focusing on expanding our generic pharmaceutical portfolio across the EU and international markets, with an emphasis on advanced generics and innovative OTC products, and a focus on government-backed clients such as the NHS in the United Kingdom.

Corporate Reorganization: A reorganization is underway to streamline costs and enhance asset and resource utilization through the integration of business units. A key component of this plan is a cost optimization initiative aimed at significantly reducing recurring operating expenses while maintaining the Company's growth outlook. Following a comprehensive review, the Company has identified several strategic opportunities to reduce operating expenses, including payroll optimization, investments in technology, and fostering a bonus-driven compensation culture.

Closing Remarks

Despite our achievements and detailed guidance, our share price has become markedly disconnected from our fundamental strengths and future growth prospects, reaching what I believe is an unjustifiably low level. Since inception, I have invested over

My role is to ensure Cosmos is well-positioned to execute its multifaceted business plan, pursuing a balanced approach that includes operational excellence, organic growth, and strategic acquisitions aligned with our investment criteria. I am committed to doing everything within my power to achieve these objectives and significantly enhance shareholder value. Looking ahead, as we work to eliminate our cash burn and generate strong positive operating cash flow, we anticipate that our net worth will grow organically.

Thank you for your continued trust. I am confident that the investment community will eventually recognize our efforts. We have many exciting developments underway, and I look forward to updating you on our progress. My dedication remains unwavering.

Sincerely,

Greg Siokas, CEO

About Cosmos Health Inc.

Cosmos Health Inc. (Nasdaq:COSM), incorporated in 2009 in Nevada, is a diversified, vertically integrated global healthcare group. The Company owns a portfolio of proprietary pharmaceutical and nutraceutical brands, including Sky Premium Life®, Mediterranation®, bio-bebe®, C-Sept® and C-Scrub®. Through its subsidiary Cana Laboratories S.A., licensed under European Good Manufacturing Practices (GMP) and certified by the European Medicines Agency (EMA), it manufactures pharmaceuticals, food supplements, cosmetics, biocides, and medical devices within the European Union. Cosmos Health also distributes a broad line of pharmaceuticals and parapharmaceuticals, including branded generics and OTC medications, to retail pharmacies and wholesale distributors through its subsidiaries in Greece and the UK. Furthermore, the Company has established R&D partnerships targeting major health disorders such as obesity, diabetes, and cancer, enhanced by artificial intelligence drug repurposing technologies, and focuses on the R&D of novel patented nutraceuticals, specialized root extracts, proprietary complex generics, and innovative OTC products. Cosmos Health has also entered the telehealth space through the acquisition of ZipDoctor, Inc., based in Texas, USA. With a global distribution platform, the Company is currently expanding throughout Europe, Asia, and North America, and has offices and distribution centers in Thessaloniki and Athens, Greece, and in Harlow, UK. More information is available at www.cosmoshealthinc.com, www.skypremiumlife.com, www.cana.gr, www.zipdoctor.co, as well as LinkedIn and X.

Forward-Looking Statements

With the exception of the historical information contained in this news release, the matters described herein, may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements preceded by, followed by, or that otherwise, include the words "believes," "expects," "anticipates," "intends," "projects," "estimates," "plans" and similar expressions or future or conditional verbs such as "will," "should," "would," "may" and "could", are generally forward-looking in nature and not historical facts, although not all forward-looking statements include the foregoing. These statements, involve unknown risks and uncertainties that may individually or materially impact the matters discussed, herein for a variety of reasons that are outside the control of the Company, including, but not limited to, the Company's ability to raise sufficient financing to implement its business plan, the impact of the COVID-19 pandemic and the war in Ukraine, on the Company's business, operations and the economy in general, and the Company's ability to successfully develop and commercialize its proprietary products and technologies. Readers are cautioned not to place undue reliance on these forward- looking statements, as actual results could differ materially from those described in the forward-looking statements contained herein. Readers are urged to read the risk factors set forth in the Company's filings with the SEC, which are available at the SEC's website (www.sec.gov). The Company disclaims any intention or obligation to update, or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Investor Relations Contact:

BDG Communications

cosm@bdgcommunications.com

+44 207 0971 653

SOURCE: Cosmos Health Inc.

View the original press release on accesswire.com