Risk Redefined: CoreLogic Catastrophe Report Emphasizes Need to Address Increasing Frequency of Hazard Events Due to Climate Change

CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, today released its annual Catastrophe Report highlighting the value of modern insurance and mortgage solutions in addressing the increase in climate change-induced hazard events and impact on the real estate economy. Most homes in the U.S. have some risk, often unbeknownst to the homeowner. With an increasing intensity of catastrophic events worldwide and the resulting risks they pose to the economy, CoreLogic analyzes how these industries can leverage new technologies to increase efficiency, reduce risk and ensure protection of American homeownership and commercial assets.

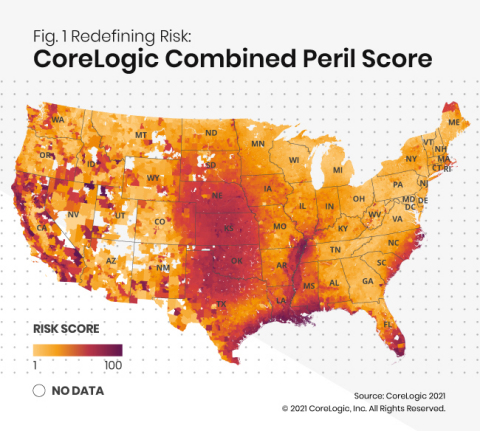

Figure 1. Redefining Risk: CoreLogic Combined Peril Score (Graphic: Business Wire)

“CoreLogic data shows that nearly every property in the U.S. has exposure to peril risk. The unexpected nature of these occurrences should encourage businesses to better prepare for potential risks,” said Frank Nothaft, chief economist at CoreLogic. “The trickle-down effect of a catastrophic event, as seen most recently by the pandemic, can result in a shaky economy with high levels of unemployment and mortgage delinquency.”

Redefining Risk: CoreLogic Combined Peril Risk Scores Show Most U.S. Properties Have Risk

Using its advanced risk modeling technology, CoreLogic combined the severity and frequency of damage caused by natural perils into a single composite risk score that represents the sum of the average annual loss for seven individual hazards (earthquake, wildfire, inland flood, severe convective storm, winter storm, hurricane and tropical storm coastal surge and wind) for approximately 105 million residential structures across the U.S. As seen in Figure 1, a majority of properties in the U.S. are exposed to risk, however, not all geography is created equally. The highest risk homes are in California, Texas, Oklahoma, Kansas, Nebraska, along the Mississippi River, and large Gulf and Atlantic coastal stretches. The report outlines how this risk score can help various industries understand the relative risk for any structure across the U.S.

“By leveraging granular data for the increasing frequency and severity of catastrophes, we are able to see that 35 million homes, which is almost a third of the U.S. housing stock, are exposed to high risk from natural hazards,” said Howard Botts, chief scientist at CoreLogic. “How insurers and lenders understand that risk through new technologies can allow them to better protect homeowners and lead to faster recovery times.”

What Happened in 2020

2020 was a year full of ‘a thousand paper cuts’ for natural hazards, with over ten weather events surpassing

New Tools for Protecting Homeownership

An increasingly volatile catastrophe risk environment is causing profit margins to shrink and prompting deep losses in areas where intense, large-spread catastrophes like wildfire, hurricanes and unemployment are concentrated. The computational power brought from cloud-computing has allowed probabilistic risk models to help insurers, mortgage and financial professionals to anticipate the severity of a potential disaster. Tech-savvy insurers and mortgage lenders are leveraging catastrophe risk science, weather verification tools and digital workflows to better understand peril risk and damages down to a parcel level. This allows them to create new homeowner products and services that better protect and secure their customers’ homes and strengthen the financial security of their businesses.

If the CoreLogic lookback at 2020’s peril and economic catastrophe events tells us anything, it’s that major players in the property ecosystem need to lean harder on technology and risk science to protect their customers and businesses when the next disaster inevitably strikes again. With access to catastrophe modeling and property data, insurance businesses have an important opportunity to change the way they protect homeownership and property, offering new insurance options and transformational experiences that better suit today’s reality of risk and policyholder expectations.

To download the full 2020 Catastrophe Report, visit this link.

Source: CoreLogic

The data provided are for use only by the primary recipient or the primary recipient's publication or broadcast. This data may not be resold, republished or licensed to any other source, including publications and sources owned by the primary recipient’s parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data, contact newsmedia@corelogic.com. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic (NYSE: CLGX), the leading provider of property insights and solutions, promotes a healthy housing market and thriving communities. Through its enhanced property data solutions, services and technologies, CoreLogic enables real estate professionals, financial institutions, insurance carriers, government agencies and other housing market participants to help millions of people find, buy and protect their homes. For more information, please visit www.corelogic.com.

CORELOGIC and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries. All other trademarks are the property of their respective owners.

1 https://www.noaa.gov/news/us-hit-by-16-billion-dollar-disasters-year-so-far

View source version on businesswire.com: https://www.businesswire.com/news/home/20210127005261/en/