Nationwide Homeowner Equity Gains Hit $1.9 Trillion in Q1 2021, CoreLogic Reports

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the Homeowner Equity Report for the first quarter of 2021. The report shows U.S. homeowners with mortgages (which account for roughly

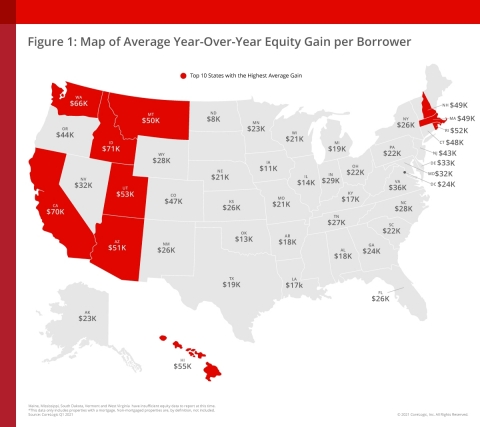

CoreLogic Map of Average Year-over-Year Equity Gain per Borrower (Graphic: Business Wire)

While the coronavirus pandemic created economic uncertainty for many, the continued acceleration in home prices over the last year has meant existing homeowners saw a notable boost in home equity. The accumulation of equity has become critically important to homeowners deciding on their post-forbearance options. In contrast to the financial crisis, when many borrowers were underwater, borrowers today who are behind on mortgage payments can tap into their equity and sell their home rather than lose it through foreclosure. These conditions are reflected in a recent CoreLogic survey, with

“Homeowner equity has more than doubled over the past decade and become a crucial buffer for many weathering the challenges of the pandemic,” said Frank Martell, president and CEO of CoreLogic. “These gains have become an important financial tool and boosted consumer confidence in the U.S. housing market, especially for older homeowners and baby boomers who've experienced years of price appreciation."

“Double-digit home price growth in the past year has bolstered home equity to a record amount. The national CoreLogic Home Price Index recorded an

Negative equity, also referred to as underwater or upside down, applies to borrowers who owe more on their mortgages than their homes are currently worth. As of the first quarter of 2021, negative equity share, and the quarter-over-quarter and year-over-year changes, were as follows:

-

Quarterly change: From the fourth quarter of 2020 to the first quarter of 2021, the total number of mortgaged homes in negative equity decreased by

7% to 1.4 million homes, or2.6% of all mortgaged properties. -

Annual change: In the first quarter of 2020, 1.8 million homes, or

3.4% of all mortgaged properties, were in negative equity. This number decreased by24% , or 450,000 properties, in the first quarter of 2021. -

National aggregate value: The national aggregate value of negative equity was approximately

$273 billion at the end of the first quarter of 2021. This is down quarter over quarter by approximately$8.1 billion , or2.9% , from$281.1 billion in the fourth quarter of 2020, and down year over year by approximately$13.3 billion , or4.6% , from$286.3 billion in the first quarter of 2020.

Because home equity is affected by home price changes, borrowers with equity positions near (+/-

The next CoreLogic Homeowner Equity Report will be released in September 2021, featuring data for Q2 2021. For ongoing housing trends and data, visit the CoreLogic Insights Blog: www.corelogic.com/insights-index.aspx.

Methodology

The amount of equity for each property is determined by comparing the estimated current value of the property against the mortgage debt outstanding (MDO). If the MDO is greater than the estimated value, then the property is determined to be in a negative equity position. If the estimated value is greater than the MDO, then the property is determined to be in a positive equity position. The data is first generated at the property level and aggregated to higher levels of geography. CoreLogic uses public record data as the source of the MDO, which includes more than 50 million first- and second-mortgage liens, and is adjusted for amortization and home equity utilization in order to capture the true level of MDO for each property. Only data for mortgaged residential properties that have a current estimated value are included. There are several states or jurisdictions where the public record, current value or mortgage data coverage is thin and have been excluded from the analysis. These instances account for fewer than

About the CoreLogic Consumer Housing Sentiment Study

3,000+ consumers were surveyed by CoreLogic via Qualtrics. The study is an annual pulse of U.S. housing market dynamics concentrated on consumers looking to purchase a home, consumers not looking to purchase a home, and current mortgage holder. The survey was conducted in April 2021 and hosted on Qualtrics.

The survey has a sampling error of ~

Source: CoreLogic

The data provided is for use only by the primary recipient or the primary recipient's publication or broadcast. This data may not be re-sold, republished or licensed to any other source, including publications and sources owned by the primary recipient's parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data, contact Amy Brennan at newsmedia@corelogic.com. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic®, the leading provider of property insights and solutions, promotes a healthy housing market and thriving communities. Through its enhanced property data solutions, services and technologies, CoreLogic enables real estate professionals, financial institutions, insurance carriers, government agencies and other housing market participants to help millions of people find, buy and protect their homes. For more information, please visit www.corelogic.com.

CORELOGIC and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries. All other trademarks are the property of their respective owners.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210610005232/en/