Commencement Bancorp, Inc. (CBWA) Announces Full Year 2022 Earnings

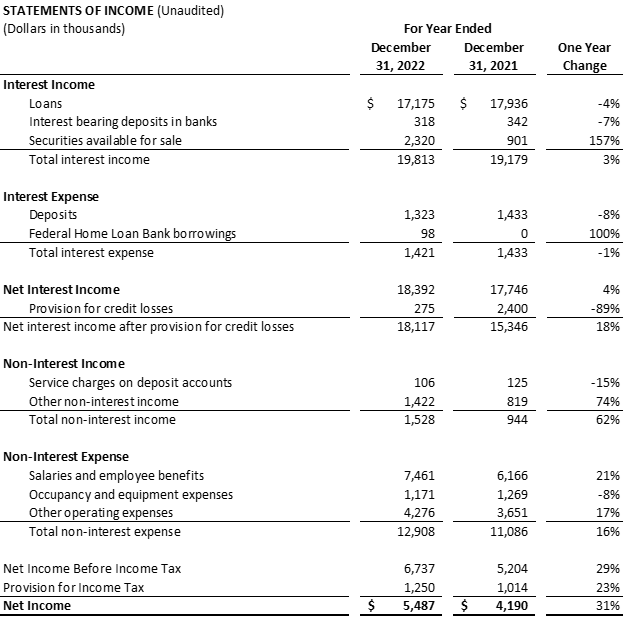

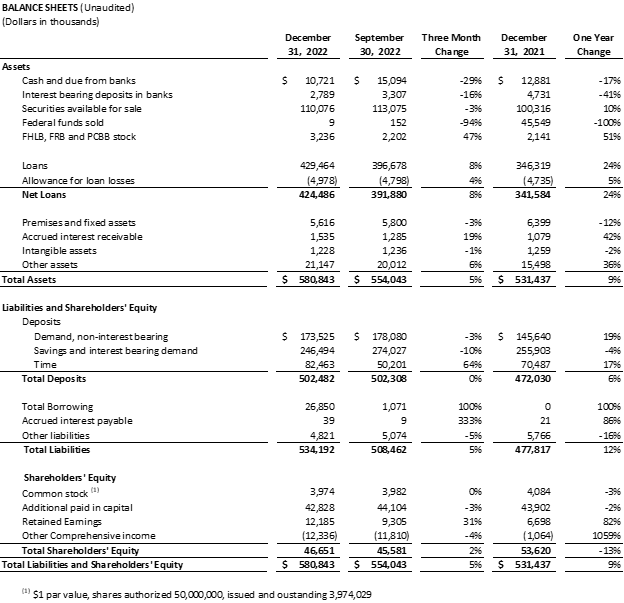

Commencement Bancorp, Inc. (OTCQX:CBWA) reported a net income of $5.5 million, or $1.38 per share for 2022, up 31% from 2021's $4.2 million. The Q4 2022 net income stood at $1.6 million, or $0.41 per share. Total assets reached $580.8 million, reflecting a 9% annual growth, with a 29% increase in loans, excluding PPP loans. Deposits grew by 6%, driven by a 19% surge in non-interest-bearing deposits. The bank's return on average assets was 1.14%, improving from 0.86% year-over-year. Management expressed optimism in navigating future market opportunities.

- 31% increase in net income for 2022 to $5.5 million compared to $4.2 million in 2021.

- Total assets increased by 9% year-over-year to $580.8 million.

- 29% annual loan growth, a milestone for organic growth.

- 6% year-over-year deposit growth, with non-interest-bearing deposits up 19%.

- Increased competition for deposits led to higher costs of funds in Q4 2022.

Insights

Analyzing...

- Q4 2022 net income of

$1.6 million , or$0.41 per share. - Net income of

$5.5 million , or$1.38 per share. - Total assets were

$580.8 million , including29% year-over-year loan growth (excluding Paycheck Protection Program loans). - Year-over-year deposit growth of

6% . Non-interest-bearing deposits increased19% and represented35% of total deposits on December 31, 2022, compared to31% one year earlier. - Return on average assets for Q4 2022 was

1.14% , compared to0.86% one year earlier.

TACOMA, WA / ACCESSWIRE / February 6, 2023 / Commencement Bancorp, Inc. (OTCQX:CBWA) reported net income of

Total assets ended the year at

Annual loan growth, net of PPP balances, totaled

In 2022, the company recognized strong profitability alongside consistent growth on the balance sheet. Return on average equity was

"While 2022 presented economic uncertainty and an evolving rate environment, our high performing team of bankers persisted in establishing and deepening client relationships. Our team is trustworthy and knowledgeable, earning the confidence and loyalty of our clients and community. The core of Commencement is built around sound banking decisions and, as a result, our financial condition remains strong. The continued momentum throughout the year leaves us excited for the future and we look forward to seeing our market opportunities come to fruition," said John Manolides, Chief Executive Officer.

The Bank continues to hold low balances of non-performing assets with a total of non-performing assets to total assets at

Deposit competition heightened in fourth quarter, spurred by the Federal Open Market Committee (FOMC) rate increases. While the Bank experienced flat deposit interest expense during the first three quarters in 2022, competition during fourth quarter increased substantially. In response, the Bank adjusted rates to retain deposits, reflecting a corresponding increase in cost of funds. Management remained focused on balancing the rate environment, repricing deposits, and leveraging funding sources as needed.

The Bank is prepared to take advantage of new market opportunities as Columbia Bank, previously the largest Tacoma-headquartered bank, merges with Portland, Oregon-based Umpqua Bank. At the close of this merger, Commencement will be the largest community bank headquartered in Pierce County, Washington. To prepare for an increase in activity, key additions to staff, including production and support staff, have been made to accelerate growth and new banking relationship opportunities.

"We recently announced the addition of James Miller, David Evans, and Amanda Bowes, who joined Commencement after many years with Columbia Bank. Their expertise and local connections will enhance the Bank's growth efforts and support our strategic initiatives. Commencement has ample opportunity to grow its banking relationships and is preparing for this with new key additions to staff," said Nigel English, President and Chief Operating Officer.

About Commencement Bancorp, Inc.

Commencement Bancorp, Inc. is the holding company for Commencement Bank, headquartered in Tacoma, Washington. Commencement Bank was formed in 2006 to provide traditional, reliable, and sustainable banking in Pierce, King, and Thurston counties and the surrounding areas. Their team of experienced banking experts focuses on personal attention, flexible service, and building strong relationships with customers through state-of-the-art technology as well as traditional delivery systems. As a local bank, Commencement Bank is deeply committed to the community. For more information, please visit. For information related to the trading of CBWA, please visit www.otcmarkets.com.

For further discussion, please contact the following:

John E. Manolides, Chief Executive Officer | 253-284-1802

Nigel L. English, President & Chief Operating Officer | 253-284-1801

Thomas L. Dhamers, Executive Vice President & Chief Financial Officer | 253-284-1803

Forward-Looking Statement Safe Harbor: This news release contains comments or information that constitutes forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995) that are based on current expectations that involve a number of risks and uncertainties. Forward-looking statements describe Commencement Bancorp, Inc.'s projections, estimates, plans and expectations of future results and can be identified by words such as "believe," "intend," "estimate," "likely," "anticipate," "expect," "looking forward," and other similar expressions. They are not guarantees of future performance. Actual results may differ materially from the results expressed in these forward-looking statements, which because of their forward-looking nature, are difficult to predict. Investors should not place undue reliance on any forward-looking statement, and should consider factors that might cause differences including but not limited to the degree of competition by traditional and nontraditional competitors, declines in real estate markets, an increase in unemployment or sustained high levels of unemployment; changes in interest rates; greater than expected costs to integrate acquisitions, adverse changes in local, national and international economies; changes in the Federal Reserve's actions that affect monetary and fiscal policies; changes in legislative or regulatory actions or reform, including without limitation, the Dodd-Frank Wall Street Reform and Consumer Protection Act; demand for products and services; changes to the quality of the loan portfolio and our ability to succeed in our problem-asset resolution efforts; the impact of technological advances; changes in tax laws; and other risk factors. Commencement Bancorp, Inc. undertakes no obligation to publicly update or clarify any forward-looking statement to reflect the impact of events or circumstances that may arise after the date of this release.

SOURCE: Commencement Bank (WA)

View source version on accesswire.com:

https://www.accesswire.com/738292/Commencement-Bancorp-Inc-CBWA-Announces-Full-Year-2022-Earnings