Commencement Bancorp, Inc. (CBWA) Announces 2024 Third Quarter Earnings

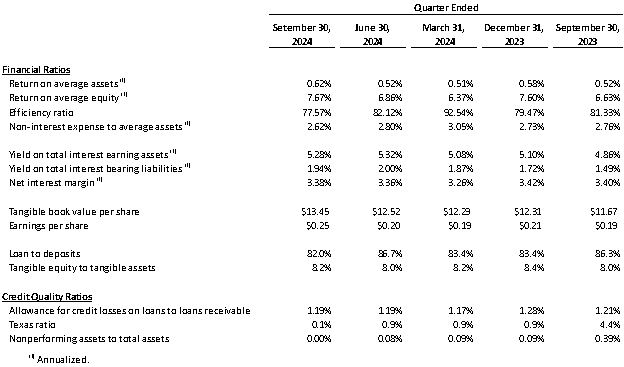

Commencement Bancorp reported strong Q3 2024 results with net income of $959,000 ($0.25 per share), up from $776,000 in Q2 2024. Key highlights include a $32.7 million (6.1%) increase in deposits, a $1.5 million (0.3%) growth in loans receivable, and improvement in nonperforming assets to 0.00%. The bank's net interest margin increased to 3.38%, while tangible book value per share rose to $13.45. The company opened a new branch in Gig Harbor and added 126 new relationships during the quarter, contributing to lower cost of funds.

Commencement Bancorp ha riportato solidi risultati per il terzo trimestre del 2024, con un reddito netto di $959.000 ($0,25 per azione), in aumento rispetto ai $776.000 del secondo trimestre del 2024. Tra i punti salienti, si evidenzia un incremento dei depositi di $32,7 milioni (6,1%), una crescita dei prestiti di $1,5 milioni (0,3%) e un miglioramento degli attivi non performanti allo 0,00%. Il margine di interesse netto della banca è aumentato al 3,38%, mentre il valore contabile tangibile per azione è salito a $13,45. L'azienda ha aperto una nuova filiale a Gig Harbor e ha instaurato 126 nuove relazioni durante il trimestre, contribuendo così a una riduzione del costo dei fondi.

Commencement Bancorp reportó resultados sólidos para el tercer trimestre de 2024, con un ingreso neto de $959,000 ($0.25 por acción), un aumento desde los $776,000 en el segundo trimestre de 2024. Los puntos destacados incluyen un aumento de depósitos de $32.7 millones (6.1%), un crecimiento en préstamos por $1.5 millones (0.3%) y una mejora en los activos no productivos al 0.00%. El margen de interés neto del banco aumentó al 3.38%, mientras que el valor contable tangible por acción subió a $13.45. La compañía abrió una nueva sucursal en Gig Harbor y estableció 126 nuevas relaciones durante el trimestre, lo que contribuyó a reducir el costo de los fondos.

Commencement Bancorp는 2024년 3분기 강력한 실적을 보고했고, 순이익은 $959,000($0.25 per 주식)으로 2024년 2분기의 $776,000에서 증가했습니다. 주요 하이라이트로는 예금이 $32.7 백만(6.1%) 증가하고, 대출금이 $1.5 백만(0.3%) 성장했으며, 부실 자산이 0.00%로 개선되었습니다. 은행의 순이자 마진은 3.38%로 증가했으며, 주당 실질 장부 가치는 $13.45로 상승했습니다. 이 회사는 Gig Harbor에 새로운 지점을 열고 분기 동안 126개의 새로운 관계를 추가하여 자금 조달 비용을 낮추는 데 기여했습니다.

Commencement Bancorp a rapporté de solides résultats pour le troisième trimestre 2024, avec un revenu net de 959 000 $ (0,25 $ par action), en hausse par rapport à 776 000 $ au deuxième trimestre 2024. Parmi les points clés, on note une augmentation des dépôts de 32,7 millions $ (6,1 %), une croissance des prêts de 1,5 million $ (0,3 %) et une amélioration des actifs non performants à 0,00 %. La marge d'intérêt nette de la banque a augmenté à 3,38 %, tandis que la valeur comptable tangible par action est passée à 13,45 $. L'entreprise a ouvert une nouvelle succursale à Gig Harbor et a ajouté 126 nouvelles relations au cours du trimestre, contribuant ainsi à réduire le coût des fonds.

Commencement Bancorp hat starke Ergebnisse für das dritte Quartal 2024 gemeldet, mit einem Nettoeinkommen von $959.000 ($0,25 pro Aktie), ein Anstieg von $776.000 im zweiten Quartal 2024. Zu den wichtigsten Punkten gehören ein Anstieg der Einlagen um $32,7 Millionen (6,1%), ein Wachstum der Forderungen aus Darlehen von $1,5 Millionen (0,3%) und eine Verbesserung der不良資産 auf 0,00%. Die Nettozinsmarge der Bank stieg auf 3,38%, während der tangierte Buchwert pro Aktie auf $13,45 anstieg. Das Unternehmen eröffnete eine neue Filiale in Gig Harbor und fügte im Laufe des Quartals 126 neue Beziehungen hinzu, was zu einer Senkung der Kosten für Mittel beitrug.

- Net income increased 23.6% QoQ to $959,000

- Deposits grew 6.1% ($32.7M) from Q2 2024

- Nonperforming assets improved to 0.00% from 0.08%

- Net interest margin increased to 3.38% from 3.36%

- Tangible book value per share improved to $13.45 from $12.52

- Loan origination commitments decreased to $20.8M from $27.3M in Q2

- Non-interest income decreased 10.1% QoQ

- Loan yield decreased 5 basis points to 5.87%

2024 Third Quarter Financial Highlights:

Net income was

$959,000 compared to$776,000 for the second quarter of 2024.Deposits increased

$32.7 million , or6.1% , from the second quarter of 2024. Annualized growth of9.3% .Loans receivable increased

$1.5 million , or0.3% , from the second quarter of 2024. Annualized growth of7.0% .Nonperforming assets to total assets decreased to

0.00% compared to0.08% for the second quarter of 2024.Tangible book value per share increased to

$13.45 compared to$12.52 for the second quarter of 2024.Capital ratios remained well above regulatory requirements.

TACOMA, WA / ACCESSWIRE / November 13, 2024 / Commencement Bancorp, Inc. (OTCQX:CBWA) (the "Company", "we," or "us"), the parent company of Commencement Bank (the "Bank") reported net income of

"We are very pleased with the Bank's performance in third quarter. In this interest rate environment, it is our deposits that drive our revenues. During the quarter, we had significant growth in our deposits which supported a selling position into overnight, higher-yielding investments, and an improvement in our cost of funds and overall earnings. Although we continue to focus on growth in our deposit portfolio, we look forward to an economy that supports increased borrowings," said John E. Manolides, Chief Executive Officer.

"Our team brought in an impressive 126 new relationships over the course of third quarter, further contributing to our lowered cost of funds. We are well-positioned for this trend to continue as we gain more recognition in our communities and expand our footprint. In addition to relationships, we opened the doors of our permanent branch location in Gig Harbor and have seen a promising amount of traction as a result. We are very pleased with the overall direction of the bank," said Nigel L. English, President and Chief Operating Officer.

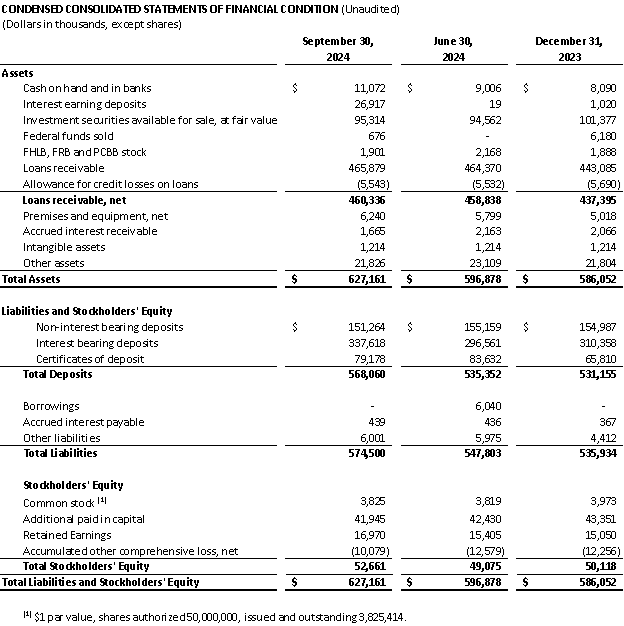

Balance Sheet

Interest earning deposits increased to

Investment securities available for sale increased

Loans receivable increased

Total deposits increased

Credit Quality

The Bank's nonperforming assets to total assets decreased to

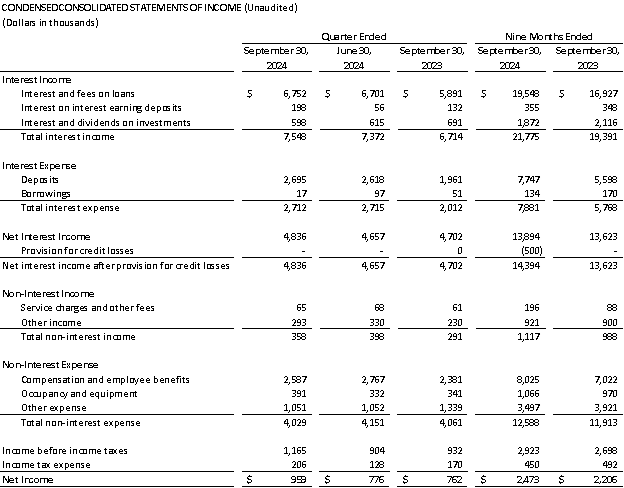

Income Statement

Net interest income increased

Interest on cash and cash equivalents increased

Interest income on loans increased

Interest expense on deposits increased

The Bank recorded

Total non-interest income decreased

Total non-interest expense decreased

###

About Commencement Bancorp, Inc.

Commencement Bancorp, Inc. is the holding company for Commencement Bank, headquartered in Tacoma, Washington. Commencement Bank was formed in 2006 to provide traditional, reliable, and sustainable banking in Pierce, King, and Thurston counties and the surrounding areas. Their team of experienced banking experts focuses on personal attention, flexible service, and building strong relationships with customers through state-of-the-art technology as well as traditional delivery systems. As a local bank, Commencement Bank is deeply committed to the community. For more information, please visit www.commencementbank.com. For information related to the trading of CBWA, please visit www.otcmarkets.com.

For further discussion, please contact the following:

John E. Manolides,Chief Executive Officer | 253-284-1802

Nigel L. English, President & Chief Operating Officer | 253-284-1801

Brandi Parker, Executive Vice President & Chief Financial Officer | 253-284-1803

Forward-Looking Statement Safe Harbor: This news release contains comments or information that constitutes forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995) that are based on current expectations that involve a number of risks and uncertainties. Forward-looking statements describe Commencement Bancorp, Inc.'s projections, estimates, plans and expectations of future results and can be identified by words such as "believe," "intend," "estimate," "likely," "anticipate," "expect," "looking forward," and other similar expressions. They are not guarantees of future performance. Actual results may differ materially from the results expressed in these forward-looking statements, which because of their forward-looking nature, are difficult to predict. Investors should not place undue reliance on any forward-looking statement, and should consider factors that might cause differences including but not limited to the degree of competition by traditional and nontraditional competitors, declines in real estate markets, an increase in unemployment or sustained high levels of unemployment; changes in interest rates; greater than expected costs to integrate acquisitions, adverse changes in local, national and international economies; changes in the Federal Reserve's actions that affect monetary and fiscal policies; changes in legislative or regulatory actions or reform, including without limitation, the Dodd-Frank Wall Street Reform and Consumer Protection Act; demand for products and services; changes to the quality of the loan portfolio and our ability to succeed in our problem-asset resolution efforts; the impact of technological advances; changes in tax laws; and other risk factors. Commencement Bancorp, Inc.undertakes no obligation to publicly update or clarify any forward-looking statement to reflect the impact of events or circumstances that may arise after the date of this release.

SOURCE: Commencement Bank

View the original press release on accesswire.com