Commencement Bancorp, Inc. (CBWA) Announces Fourth Quarter and Annual 2024 Results

Commencement Bancorp (CBWA) reported Q4 2024 net income of $539,000 ($0.14 per share), down from $959,000 in Q3 2024 ($0.25 per share). The quarter included strategic balance sheet restructuring with a pre-tax loss of $944,000 from securities sales.

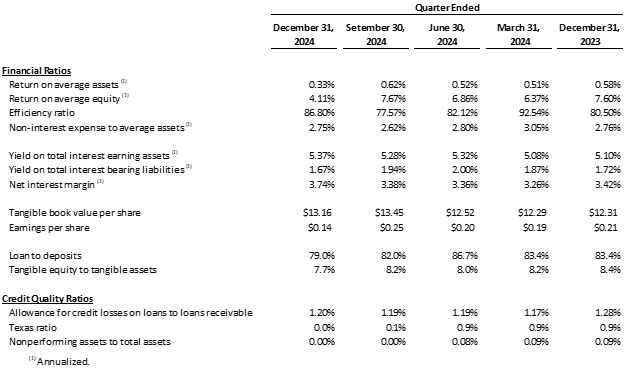

Key highlights include: deposits increased 4.2% quarter-over-quarter to $591.9 million, loans grew 0.3% to $467.3 million, and net interest margin improved to 3.74% from 3.38%. The bank maintained strong credit quality with no nonperforming assets and executed an interest rate swap of $40 million to hedge against rate risk.

Notable transactions included selling $13.3 million in securities yielding 2.57% to purchase $12.4 million yielding 5.00%, and restructuring the BOLI portfolio for improved yields. The bank maintains strong liquidity with $139.3 million in on-balance sheet sources and $233.4 million in available credit lines.

Commencement Bancorp (CBWA) ha riportato un reddito netto per il Q4 2024 di $539.000 ($0,14 per azione), in calo rispetto ai $959.000 nel Q3 2024 ($0,25 per azione). Il trimestre ha incluso un'importante ristrutturazione del bilancio con una perdita ante imposte di $944.000 derivante dalla vendita di titoli.

I punti salienti includono: depositi aumentati del 4,2% rispetto al trimestre precedente, raggiungendo $591,9 milioni, prestiti cresciuti dello 0,3% a $467,3 milioni, e un margine di interesse netto migliorato al 3,74% rispetto al 3,38%. La banca ha mantenuto una forte qualità creditizia con nessun attivo non performante e ha eseguito uno swap sui tassi di interesse di $40 milioni per proteggersi dal rischio di tasso.

Le transazioni degne di nota hanno incluso la vendita di $13,3 milioni in titoli con rendimento del 2,57% per acquistare $12,4 milioni con rendimento del 5,00%, e la ristrutturazione del portafoglio BOLI per rendimenti migliori. La banca mantiene una forte liquidità con $139,3 milioni in fonti di bilancio e $233,4 milioni in linee di credito disponibili.

Commencement Bancorp (CBWA) informó un ingreso neto de $539,000 ($0.14 por acción) en el cuarto trimestre de 2024, una disminución respecto a los $959,000 en el tercer trimestre de 2024 ($0.25 por acción). El trimestre incluyó una reestructuración estratégica del balance con una pérdida antes de impuestos de $944,000 por ventas de valores.

Los puntos clave incluyen: los depósitos aumentaron un 4.2% con respecto al trimestre anterior a $591.9 millones, los préstamos crecieron un 0.3% a $467.3 millones y el margen de interés neto mejoró al 3.74% desde el 3.38%. El banco mantuvo una sólida calidad crediticia sin activos no productivos y ejecutó un swap de tasas de interés de $40 millones para cubrirse contra el riesgo de tasas.

Las transacciones notables incluyeron la venta de $13.3 millones en valores que ofrecían un rendimiento del 2.57% para comprar $12.4 millones que ofrecían un 5.00%, y la reestructuración de la cartera BOLI para mejorar los rendimientos. El banco mantiene una fuerte liquidez con $139.3 millones en fuentes en el balance y $233.4 millones en líneas de crédito disponibles.

Commencement Bancorp (CBWA)는 2024년 4분기 동안 순이익이 $539,000($0.14 per share)로, 2024년 3분기 $959,000($0.25 per share)에서 감소했다고 보고했습니다. 이번 분기에는 증권 매각으로 인한 세전 손실이 $944,000에 달하는 전략적 재무 구조 조정이 포함되었습니다.

주요 사항은 다음과 같습니다: 예금은 전 분기 대비 4.2% 증가하여 $591.9 백만에 달하고, 대출은 0.3% 증가하여 $467.3 백만에 이르며, 순이자 마진은 3.74%로 증가했습니다(3.38%에서 개선됨). 은행은 비수익 자산이 없으며 금리 리스크에 대한 헤지를 위한 $40 백만 규모의 금리 스왑을 실행하여 강력한 신용 품질을 유지했습니다.

주목할 만한 거래로는 2.57% 수익을 올리는 $13.3 백만의 증권을 매각하여 5.00% 수익을 올리는 $12.4 백만을 매입하고, BOLI 포트폴리오를 개선된 수익률로 재구성하는 것이 포함되었습니다. 은행은 대차대조표에서 $139.3 백만의 자원과 $233.4 백만의 사용 가능한 신용 한도를 가지고 강력한 유동성을 유지하고 있습니다.

Commencement Bancorp (CBWA) a annoncé un revenu net pour le quatrième trimestre 2024 de 539 000 $ (0,14 $ par action), en baisse par rapport à 959 000 $ au troisième trimestre 2024 (0,25 $ par action). Ce trimestre a inclus une restructuration stratégique du bilan avec une perte avant impôts de 944 000 $ provenant de la vente de titres.

Les points essentiels incluent : les dépôts ont augmenté de 4,2 % par rapport au trimestre précédent pour atteindre 591,9 millions de dollars, les prêts ont crû de 0,3 % à 467,3 millions de dollars et la marge d'intérêt nette s'est améliorée à 3,74 % contre 3,38 %. La banque a maintenu une forte qualité de crédit sans actifs non performants et a exécuté un swap de taux d'intérêt de 40 millions de dollars pour se couvrir contre le risque de taux.

Les transactions notables comprenaient la vente de 13,3 millions de dollars en titres générant un rendement de 2,57 % pour acheter 12,4 millions de dollars générant un rendement de 5,00 %, et la restructuration du portefeuille BOLI pour améliorer les rendements. La banque maintient une forte liquidité avec 139,3 millions de dollars en ressources au bilan et 233,4 millions de dollars en lignes de crédit disponibles.

Commencement Bancorp (CBWA) meldete einen Nettoertrag von $539.000 ($0,14 pro Aktie) für das 4. Quartal 2024, ein Rückgang von $959.000 im 3. Quartal 2024 ($0,25 pro Aktie). Im Quartal fand eine strategische Umstrukturierung der Bilanz mit einem steuerpflichtigen Verlust von $944.000 aus Wertpapierverkäufen statt.

Wichtige Highlights umfassen: Einlagen stiegen um 4,2% im Vergleich zum vorherigen Quartal auf $591,9 Millionen, Kredite wuchsen um 0,3% auf $467,3 Millionen, und die Nettozinsspanne verbesserte sich von 3,38% auf 3,74%. Die Bank hielt eine starke Kreditqualität ohne notleidende Vermögenswerte und führte einen Zinsswap über $40 Millionen durch, um sich gegen Zinsrisiken abzusichern.

Zu den bemerkenswerten Transaktionen gehörten der Verkauf von $13,3 Millionen an Wertpapieren mit einer Rendite von 2,57%, um $12,4 Millionen mit einer Rendite von 5,00% zu kaufen, und die Umstrukturierung des BOLI-Portfolios zur Verbesserung der Erträge. Die Bank hält starke Liquidität mit $139,3 Millionen an Bilanzquellen und $233,4 Millionen an verfügbaren Kreditlinien.

- Net interest margin increased 36 bps to 3.74%

- Deposits grew 11.4% annually and 4.2% quarterly

- Zero nonperforming assets in Q4 2024

- Strategic portfolio restructuring improved yields from 2.57% to 5.00%

- Strong liquidity position with $139.3 million on-balance sheet

- Net income decreased to $539,000 from $959,000 in Q3 2024

- Pre-tax loss of $944,000 on securities sale

- Classified loans increased to 1.82% from 0.43% year-over-year

- EPS declined to $0.14 from $0.25 in Q3 2024

2024 Fourth Quarter Financial Highlights:

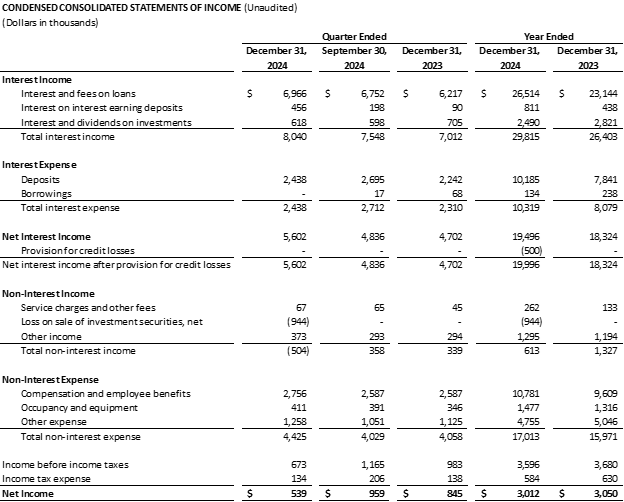

Net income was

$539,000 compared to$959,000 for the third quarter of 2024.Results include a pre-tax loss on sale of securities of

$944,000 , or$0.20 per share on an after-tax basis.Deposits increased

$23.9 million , or4.2% , from the third quarter of 2024. Annual deposit growth of11.4% .Loans receivable increased

$1.4 million , or0.3% , from the third quarter of 2024. Annual loan growth of5.6% .Net interest margin increased 36 basis points ("bps") to

3.74% from3.38% during the third quarter of 2024.Total cost of deposits decreased 26 bps to

1.67% from1.93% for the third quarter of 2024.The Bank had no nonperforming assets during the fourth quarter of 2024.

Capital ratios remained well above regulatory requirements.

Recognized as one of the top-performing companies on the OTCQX Best 50 list.

TACOMA, WA / ACCESS Newswire / January 30, 2025 / Commencement Bancorp, Inc. (OTCQX:CBWA) (the "Company", "we," or "us"), the parent company of Commencement Bank (the "Bank"), reported net income of

In December 2024, the Bank incurred a pre-tax loss of

In the fourth quarter of 2024, the Bank executed an interest rate swap with notional value of

In December 2024, the Bank initiated a restructuring of its Bank-Owned Life Insurance ("BOLI") portfolio in which

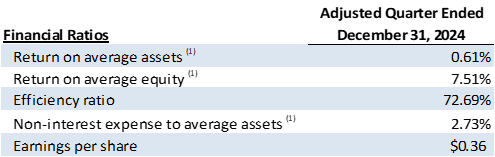

Adjusting for these fourth quarter strategic measures, the Company's quarterly adjusted ratios are as follows:

"We are very pleased with our core financial results for the fourth quarter and the full year. Due to the hard work of our bankers and our loyal client base, we were able to exceed plan for loan and deposit growth in 2024 while simultaneously improving our cost of funds and net interest margin. Excluding the costs of the balance sheet restructure in Q4, we were able to increase earnings per share by more than

"We are very proud of our team's performance in the fourth quarter. Our loan and deposit growth reflect their steadfast hard work and will be the catalyst for continued momentum, positioning us for a successful 2025. I would like to thank our dedicated bankers for their commitment to our bank and customers this past year. Despite the ongoing challenges in the market, we are very optimistic about the future of Commencement and our continued focus on our growth plan initiatives," said Nigel L. English, President and Chief Operating Officer.

Balance Sheet

Interest earning deposits increased

Investment securities available for sale decreased

Loans receivable increased

Total deposits increased

Credit Quality

The Bank had no nonperforming assets at December 31, 2024 compared to

The percentage of classified loans to loans receivable was

Liquidity

The Bank has ample liquidity with both on- and off-balance sheet sources. Total on-balance sheet liquidity of

Income Statement

Net interest income increased

Interest on cash and cash equivalents increased

Interest income on loans increased

Interest expense on deposits decreased

The Bank had no borrowings during the fourth quarter of 2024. The Bank recorded

Total non-interest income decreased

Total non-interest expense increased

###

About Commencement Bancorp, Inc.

Commencement Bancorp, Inc. is the holding company for Commencement Bank, headquartered in Tacoma, Washington. Commencement Bank was formed in 2006 to provide traditional, reliable, and sustainable banking in Pierce, King, and Thurston counties and the surrounding areas. Their team of experienced banking experts focuses on personal attention, flexible service, and building strong relationships with customers through state-of-the-art technology as well as traditional delivery systems. As a local bank, Commencement Bank is deeply committed to the community. For more information, please visit www.commencementbank.com. For information related to the trading of CBWA, please visit www.otcmarkets.com.

For further discussion, please contact the following:

John E. Manolides, Chief Executive Officer | 253-284-1802

Nigel L. English, President & Chief Operating Officer | 253-284-1801

Brandi Parker, Executive Vice President & Chief Financial Officer | 253-284-1803

Forward-Looking Statement Safe Harbor: This news release contains comments or information that constitutes forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995) that are based on current expectations that involve a number of risks and uncertainties. Forward-looking statements describe Commencement Bancorp, Inc.'s projections, estimates, plans and expectations of future results and can be identified by words such as "believe," "intend," "estimate," "likely," "anticipate," "expect," "looking forward," and other similar expressions. They are not guarantees of future performance. Actual results may differ materially from the results expressed in these forward-looking statements, which because of their forward-looking nature, are difficult to predict. Investors should not place undue reliance on any forward-looking statement, and should consider factors that might cause differences including but not limited to the degree of competition by traditional and nontraditional competitors, declines in real estate markets, an increase in unemployment or sustained high levels of unemployment; changes in interest rates; greater than expected costs to integrate acquisitions, adverse changes in local, national and international economies; changes in the Federal Reserve's actions that affect monetary and fiscal policies; changes in legislative or regulatory actions or reform, including without limitation, the Dodd-Frank Wall Street Reform and Consumer Protection Act; demand for products and services; changes to the quality of the loan portfolio and our ability to succeed in our problem-asset resolution efforts; the impact of technological advances; changes in tax laws; and other risk factors. Commencement Bancorp, Inc. undertakes no obligation to publicly update or clarify any forward-looking statement to reflect the impact of events or circumstances that may arise after the date of this release.

SOURCE: Commencement Bank

View the original press release on ACCESS Newswire