Commencement Bancorp, Inc. (CBWA) Announces First Quarter 2025 Results

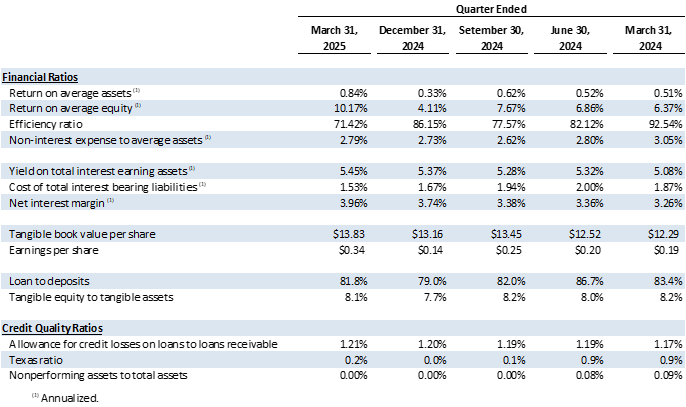

Commencement Bancorp (CBWA) reported strong Q1 2025 financial results with net income of $1.3 million ($0.34 per share), up from $539,000 in Q4 2024. Key highlights include:

- Loans receivable increased $6.7 million (5.83% annualized growth)

- Net interest margin improved 22 basis points to 3.96%

- Total cost of deposits decreased to 1.53% from 1.67%

- Zero nonperforming assets in Q1 2025

- Strong liquidity position with $121.0 million (18.8% of total assets)

The bank maintained robust credit quality with allowance for credit losses at 1.21%. Total deposits were $579.4 million, with noninterest bearing deposits representing 29.1%. The company recently relocated its headquarters to Commencement Bank Plaza in Tacoma, WA, consolidating operations to enhance efficiency.

Commencement Bancorp (CBWA) ha riportato risultati finanziari solidi nel primo trimestre 2025 con un utile netto di 1,3 milioni di dollari (0,34 dollari per azione), in aumento rispetto ai 539.000 dollari del quarto trimestre 2024. I punti salienti includono:

- Prestiti in essere aumentati di 6,7 milioni di dollari (crescita annualizzata del 5,83%)

- Margine di interesse netto migliorato di 22 punti base al 3,96%

- Costo totale dei depositi diminuito all'1,53% dall'1,67%

- Zero attività non performanti nel primo trimestre 2025

- Solida posizione di liquidità con 121,0 milioni di dollari (18,8% del totale degli attivi)

La banca ha mantenuto una qualità del credito robusta con accantonamenti per perdite su crediti all'1,21%. I depositi totali ammontavano a 579,4 milioni di dollari, con depositi senza interesse che rappresentano il 29,1%. Recentemente la società ha trasferito la sua sede al Commencement Bank Plaza a Tacoma, WA, consolidando le operazioni per migliorare l'efficienza.

Commencement Bancorp (CBWA) reportó sólidos resultados financieros en el primer trimestre de 2025 con un ingreso neto de 1,3 millones de dólares (0,34 dólares por acción), frente a los 539.000 dólares del cuarto trimestre de 2024. Los aspectos más destacados incluyen:

- Préstamos por cobrar aumentaron 6,7 millones de dólares (crecimiento anualizado del 5,83%)

- Margen de interés neto mejoró 22 puntos básicos hasta 3,96%

- Costo total de depósitos disminuyó a 1,53% desde 1,67%

- Cero activos improductivos en el primer trimestre de 2025

- Fuerte posición de liquidez con 121,0 millones de dólares (18,8% del total de activos)

El banco mantuvo una sólida calidad crediticia con provisiones para pérdidas crediticias en 1,21%. Los depósitos totales fueron de 579,4 millones de dólares, con depósitos sin intereses representando el 29,1%. La compañía trasladó recientemente su sede al Commencement Bank Plaza en Tacoma, WA, consolidando operaciones para mejorar la eficiencia.

Commencement Bancorp (CBWA)는 2025년 1분기에 순이익 130만 달러(주당 0.34달러)를 기록하며 2024년 4분기 53만 9천 달러에서 크게 증가한 강력한 실적을 발표했습니다. 주요 내용은 다음과 같습니다:

- 대출 채권 670만 달러 증가(연율 기준 5.83% 성장)

- 순이자마진 22bp 상승하여 3.96% 달성

- 총 예금 비용 1.67%에서 1.53%로 감소

- 2025년 1분기 부실 자산 없음

- 총자산의 18.8%에 해당하는 1억 2,100만 달러의 강력한 유동성 보유

은행은 1.21%의 대손충당금을 유지하며 견고한 신용 품질을 유지했습니다. 총 예금은 5억 7,940만 달러였으며, 무이자 예금이 29.1%를 차지했습니다. 회사는 최근 워싱턴주 타코마에 있는 Commencement Bank Plaza로 본사를 이전하여 운영 효율성을 강화했습니다.

Commencement Bancorp (CBWA) a publié de solides résultats financiers pour le premier trimestre 2025 avec un revenu net de 1,3 million de dollars (0,34 dollar par action), en hausse par rapport à 539 000 dollars au quatrième trimestre 2024. Les points clés incluent :

- Prêts à recevoir en hausse de 6,7 millions de dollars (croissance annualisée de 5,83%)

- Marge d'intérêt nette améliorée de 22 points de base à 3,96%

- Coût total des dépôts réduit à 1,53% contre 1,67%

- Zéro actif non performant au premier trimestre 2025

- Position de liquidité solide avec 121,0 millions de dollars (18,8% du total des actifs)

La banque a maintenu une qualité de crédit robuste avec une provision pour pertes sur créances à 1,21%. Les dépôts totaux s'élevaient à 579,4 millions de dollars, avec 29,1% de dépôts sans intérêt. La société a récemment déménagé son siège au Commencement Bank Plaza à Tacoma, WA, consolidant ses opérations pour améliorer l'efficacité.

Commencement Bancorp (CBWA) meldete starke Finanzergebnisse für das erste Quartal 2025 mit einem Nettoeinkommen von 1,3 Millionen US-Dollar (0,34 US-Dollar pro Aktie), gegenüber 539.000 US-Dollar im vierten Quartal 2024. Wichtige Highlights sind:

- Forderungskredite stiegen um 6,7 Millionen US-Dollar (annualisiertes Wachstum von 5,83%)

- Nettozinsmarge verbesserte sich um 22 Basispunkte auf 3,96%

- Gesamtkosten der Einlagen sanken von 1,67% auf 1,53%

- Keine notleidenden Vermögenswerte im ersten Quartal 2025

- Starke Liquiditätsposition mit 121,0 Millionen US-Dollar (18,8% der Gesamtaktiva)

Die Bank behielt eine robuste Kreditqualität bei, mit Rückstellungen für Kreditausfälle von 1,21%. Die Gesamteinlagen betrugen 579,4 Millionen US-Dollar, wobei 29,1% auf nicht verzinste Einlagen entfielen. Das Unternehmen verlegte kürzlich seinen Hauptsitz in die Commencement Bank Plaza in Tacoma, WA, um die Abläufe zu konsolidieren und die Effizienz zu steigern.

- Net income increased 141% quarter-over-quarter to $1.3 million

- Net interest margin improved by 22 basis points to 3.96%

- Cost of deposits decreased by 14 basis points to 1.53%

- Zero nonperforming assets maintained

- Strong loan growth with 5.83% annualized increase

- Total deposits decreased by $12.5 million (2.1%) to $579.4 million

- Classified loans increased to 2.13% from 1.82% of loans receivable

- Interest earning deposits decreased by $25.7 million

2025 First Quarter Financial Highlights:

Net income was

$1.3 million compared to$539,000 for the fourth quarter of 2024.Loans receivable increased

$6.7 million , or5.83% annualized growth rate.Net interest margin increased 22 basis points ("bps") to

3.96% from3.74% for the fourth quarter of 2024.Total cost of deposits decreased 14 bps to

1.53% from1.67% for the fourth quarter of 2024.The Bank had no nonperforming assets during the first quarter of 2025.

Headquarters was moved to 1313 Broadway, Suite 400 Tacoma, WA (Commencement Bank Plaza).

Capital ratios remained well above regulatory requirements.

TACOMA, WA / ACCESS Newswire / April 23, 2025 / Commencement Bancorp, Inc. (OTCQX:CBWA) (the "Company", "we," or "us"), the parent company of Commencement Bank (the "Bank") reported net income of

During the fourth quarter of 2024, the Bank executed two strategic measures impacting financial results. First, the Bank incurred an after-tax loss of

"The Bank's financial performance in first quarter centers around our increased operating efficiencies and reduction in cost of funds. This quarter also saw the long-awaited move to the Bank's new headquarters at 1313 Broadway in downtown Tacoma, proudly named the Commencement Bank Plaza. The new space allows the entire team to be on one floor, which has increased collaboration and efficiency, resulting in better production and engagement. We look forward to sharing our new location with shareholders, clients, and community members at our grand opening in mid-June," said John E. Manolides, Chief Executive Officer.

"We have continued to retain our deposit relationships over the course of first quarter and have done an incredible job in growing new relationships. Our team is proactive and nimble, allowing us to compete on every level regardless of the challenges. We're in a good position for continued growth," said Nigel L. English, President & Chief Operating Officer.

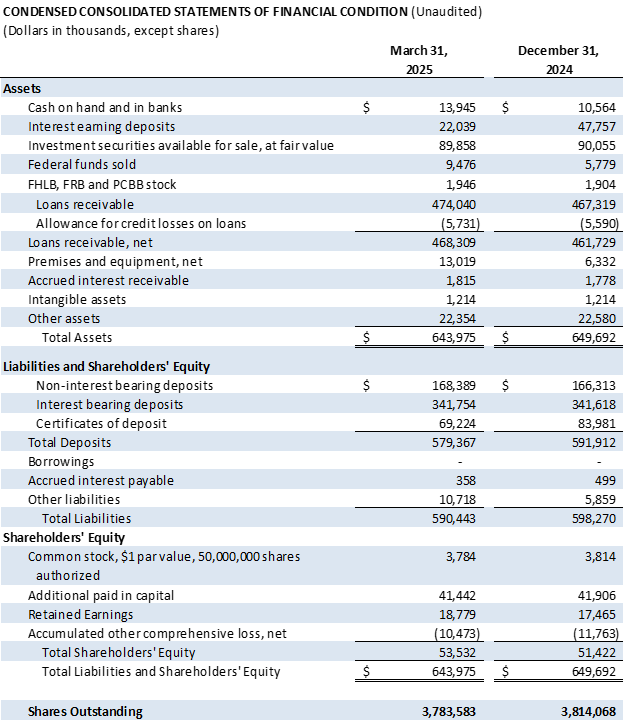

Balance Sheet

Interest earning deposits decreased

Investment securities available for sale decreased

Loans receivable increased

Total deposits decreased

Credit Quality

The Bank had no nonperforming assets at March 31, 2025 or December 31, 2024. The allowance for credit losses to loans receivable remains strong at

The percentage of classified loans to loans receivable was

Liquidity

The Bank has ample liquidity with both on- and off-balance sheet sources. Total on-balance sheet liquidity of

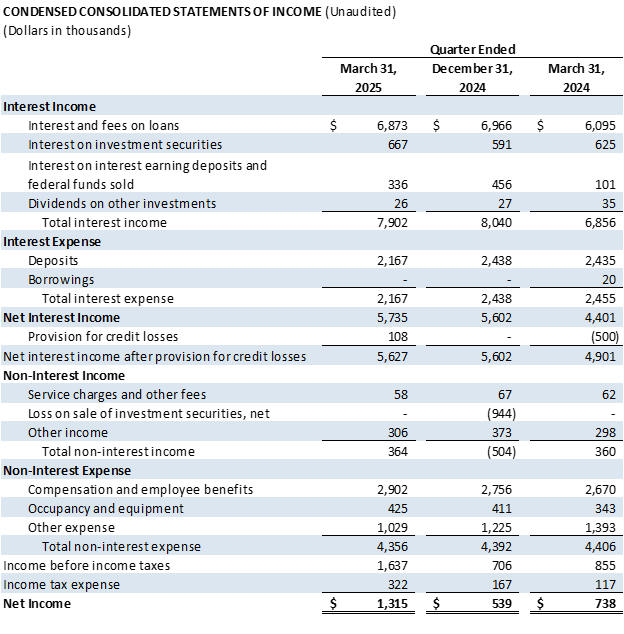

Income Statement

Net interest income increased

Interest on interest earning deposits and Federal Funds Sold decreased

Interest income on loans decreased

Interest income on investment securities increased

Interest expense on deposits decreased

Total non-interest income increased

Total non-interest expense decreased

###

About Commencement Bancorp, Inc.

Commencement Bancorp, Inc. is the holding company for Commencement Bank, headquartered in Tacoma, Washington. Commencement Bank was formed in 2006 to provide traditional, reliable, and sustainable banking in Pierce, King, and Thurston counties and the surrounding areas. Their team of experienced banking experts focuses on personal attention, flexible service, and building strong relationships with customers through state-of-the-art technology as well as traditional delivery systems. As a local bank, Commencement Bank is deeply committed to the community. For more information, please visit www.commencementbank.com. For information related to the trading of CBWA, please visit www.otcmarkets.com.

For further discussion, please contact the following:

John E. Manolides, Chief Executive Officer | 253-284-1802

Nigel L. English, President & Chief Operating Officer | 253-284-1801

Brandi Parker, Executive Vice President & Chief Financial Officer | 253-284-1803

Forward-Looking Statement Safe Harbor: This news release contains comments or information that constitutes forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995) that are based on current expectations that involve a number of risks and uncertainties. Forward-looking statements describe Commencement Bancorp, Inc.'s projections, estimates, plans and expectations of future results and can be identified by words such as "believe," "intend," "estimate," "likely," "anticipate," "expect," "looking forward," and other similar expressions. They are not guarantees of future performance. Actual results may differ materially from the results expressed in these forward-looking statements, which because of their forward-looking nature, are difficult to predict. Investors should not place undue reliance on any forward-looking statement, and should consider factors that might cause differences including but not limited to the degree of competition by traditional and nontraditional competitors, declines in real estate markets, an increase in unemployment or sustained high levels of unemployment; changes in interest rates; greater than expected costs to integrate acquisitions, adverse changes in local, national and international economies; changes in the Federal Reserve's actions that affect monetary and fiscal policies; changes in legislative or regulatory actions or reform, including without limitation, the Dodd-Frank Wall Street Reform and Consumer Protection Act; demand for products and services; changes to the quality of the loan portfolio and our ability to succeed in our problem-asset resolution efforts; the impact of technological advances; changes in tax laws; and other risk factors. Commencement Bancorp, Inc. undertakes no obligation to publicly update or clarify any forward-looking statement to reflect the impact of events or circumstances that may arise after the date of this release.

SOURCE: Commencement Bancorp, Inc.

View the original press release on ACCESS Newswire