Updated PEA for Falchani Highlights Robust Economics After-tax NPV8% Triples to US$5.11 Billion, IRR 32.0% and Low Opex $5,093/t LCE

VANCOUVER, British Columbia, Jan. 10, 2024 (GLOBE NEWSWIRE) -- American Lithium Corp. (“American Lithium” or the “Company”) (TSX-V:LI | NASDAQ:AMLI | Frankfurt:5LA1) is pleased to announce the results of its updated Preliminary Economic Assessment (“PEA”) for the Falchani Lithium (“Falchani”) project located in Puno, southwestern Peru. This independent, updated PEA was completed by DRA Global following the updated mineral resource estimate recently completed by Stantec Consulting Services Ltd. (“Stantec” - see news release dated December 15, 2023).

The updated PEA demonstrates that with low initial capex, the Falchani project has the potential to become a substantial, low-cost, long-life producer of high purity Lithium Carbonate (“LCE” or “Li2CO3”) with the potential to also produce Sulfate of Potash (“SOP”) and Cesium Sulfate (“CsS” or “Cs2SO4”) by-products alongside LCE. The PEA base case envisions 32 years of mining followed by 11 years of stockpile processing over the potential life of mine (“LOM”). The PEA alternative case is identical, but with added production of high purity SOP and Cesium sulfate as by-products from Years 6-43 alongside the initial expansion. All dollar figures are in US currency.

Falchani PEA Highlights (Base Case – LCE only production):

- Pre-tax Net Present Value (“NPV”)8%

$8.41 billion at$22,500 /tonne (“t”) LCE - After-tax NPV8%

$5.11 billion at$22,500 /t LCE- NPV has tripled versus 2019 PEA After-tax NPV8%

$1.5 billion at$12,000 /t LCE

- NPV has tripled versus 2019 PEA After-tax NPV8%

- Pre-tax Internal Rate of Return (“IRR”) of

40.7% - After-tax IRR of

32.0% - Pre-tax initial capital payback period 2.5 years; after-tax payback 3.0 years

- Average LOM annual pre-tax cash flow:

$1,019 million ; annual after-tax cash flow:$ 644 million - Initial Capital Costs (“Capex”) estimated at

$681 million - Total Capex LOM estimated at

$2,565 million ; Sustaining Capital estimated at$236 million - Operating cost (“Opex”) estimated at

$5,092 /t LCE - PEA mine and processing plan produces 2.64 Mt LCE LOM over 43 years

- Steady-state Ave. of 23,145 tpa LCE Phase 1; 45,084 tpa Phase 2; and 72,624 tpa Phase 3

Simon Clarke, CEO of American Lithium states, “The very large increase in NPV combined with a low initial capex and robust economics in the updated PEA for Falchani are the culmination of successful work programs at site and flow sheet optimization over the last couple of years combined with an improved lithium pricing environment. We are also extremely pleased to now include the compelling strategic and economic value proposition of adding SOP fertilizer and cesium sulfate by-products to the robust economic potential of core, high purity lithium production at Falchani. This PEA update is a major step towards completion of pre-feasibility work.

In this PEA, we showcase the existing potential for high annual production and long mine-life at Falchani, yet the deposit resource currently remains open to the north and west with the potential for further resource / mine-life expansion. The low operating cost potential at Falchani with costs of less than

Falchani PEA Highlights Alternate Case – LCE-only in Phase 1; SOP + Cs2SO4 added from Phase 2:

- Identical LCE production scenario, but with added average production of 81,556 tpa of SOP and 3,796 tpa of Cs2SO4 from Years 6-43

- Pre-tax NPV8%

$9.25 billion at$22,500 /t LCE,$1,000 /t SOP &$58,000 /t Cs2SO4 - After-tax NPV8%

$5.58 billion at$22,500 /t LCE,$1,000 /t SOP &$58,000 /t Cs2SO4 - Pre-tax Internal Rate of Return (“IRR”) of

38.5% - After-tax IRR of

29.9% - Pre-tax initial capital payback period 2.5 years; after-tax payback 3.0 years

- Average LOM pre-tax annual cash flow (excluding initial capital):

$1,227 million ; annual after-tax cash flow:$ 774 million - Initial Capital Costs (“Capex”) estimated at

$681 million - Total Capex estimated at

$3,466 million ; Sustaining Capital estimated at$260 million - Opex estimated at

$5,705 /t LCE (for all products) - Opex estimated at

$1,361 /t LCE, inclusive of SOP & Cs2SO4 credits - PEA mine plan produces 2.64 Mt LCE and 3.10 Mt SOP and 144,247 t Cs2SO4 LOM over 43 years

Mine Life & Production

- Simple drill, blast, truck and shovel open pit mining of the near-surface, high-grade (>2,700 ppm Li) resource the scalable, long-life, lithium project producing approximately 23 ktpa LCE over Years 1-5, expanding to 45 ktpa LCE production for Years 6-10 years followed by Phase 3 expansion producing ~84 ktpa for Years 11-32 when mining ceases. Rehandling of the <2,700 ppm Li stockpile allows production to continue for Years 33-43, averaging 44.8 ktpa over this period.

- Average LOM Production of approximately 61,400 tpa of

99.5% LCE for 43 years. - Targeted >2,700 ppm Li grade pit-constrained resource supports mining for 32 years and processing <2,700 ppm Li stockpile for an additional 11 years.

- LOM Strip Ratio (Waste:Ore) of 0.60:1 after accounting for processed stockpile material

- Sulfuric acid leaching using industry standard techniques and flowsheet produces high purity lithium carbonate to enable the production of battery grade LC.

- Sulfate of Potash is an important fertilizer product for specialty crops, especially those grown in Peru (ex. avocado, blueberries, grapes & coffee) with a growing global market. SOP production from Falchani has the potential to satisfy Peru’s domestic needs with additional export possibility.

- Cesium is used in high-pressure, high-temperature offshore oil and gas drilling and is used in infrared detectors, optics, photoelectrical cells, scintillation counters and spectrometers. Isotopes of cesium are atomic clocks necessary for aircraft guidance systems, global positioning satellites, and internet and cell phone applications. Cesium sulfate produced at Falchani can be further refined by third parties into desired end-products.

Table 1 – Falchani Project PEA Key Highlights

| Description | Units | Base Case | Alternate Case |

| LCE Selling Price | $/tonne | ||

| Life of Mine | years | 43 | 43 |

| Processing Rate P1 / P2 / P31 | ROM Mtpa | 1.5/3.0/6.0 | 1.5/3.0/6.0 |

| Average Throughput (LOM) | tpa | 4,946,898 | 4,946,898 |

| LCE Produced (average LOM)1 | tpa | 61,386 | 61,386 |

| P1 LCE Production (Yr 1-5 steady state) | tpa | 23,000 | 23,000 |

| P2 LCE Production (Yr 6-10 steady state) | tpa | 45,000 | 45,000 |

| P3 LCE Production (Yr 11-32 steady state) | tpa | 84,000 | 84,000 |

| P3 LCE Production (Yr 33-43 stockpile) | tpa | 44,800 | 44,800 |

| LCE Produced (total LOM)1 | tonnes | 2,639,610 | 2,639,610 |

| Unit Operating Cost (OPEX) LOM2 | $/LCE tonne | 5,092 | 1,361 |

| SOP Produced (average LOM)1 | tpa | n/a | 81,556 |

| SOP Selling Price | $/tonne | n/a | 1,000 |

| Cs2SO4 Produced (average LOM)1 | tpa | n/a | 3,796 |

| Cs2SO4 Selling Price | $/tonne | n/a | 58,000 |

| Capital Cost (CAPEX)3 P1 | $ M | 681 | 681 |

| Capital Cost (CAPEX)3 LOM | $ M | 2,565 | 3,466 |

| Sustaining Capital Costs (undiscounted) | $ M | 236 | 260 |

| Project Economics | |||

| Pre-tax: | |||

| Net Present Value (NPV) ( | U$ M | 8,411 | 9,251 |

| Internal Rate of Return (IRR) | % | 40.7 | 38.5 |

| Initial Payback Period (undiscounted) | years | 2.5 | 2.5 |

| Average Annual Cash Flow (LOM) | $ M | 1,019 | 1,227 |

| Cumulative Cash Flow (undiscounted) | $ M | 43,150 | 52,072 |

| After-tax:4 | |||

| Net Present Value (NPV) | $ M | 5,109 | 5,585 |

| Internal Rate of Return (IRR) Post-Tax | % | 32.0 | 29.9 |

| Payback Period (undiscounted) | years | 3.0 | 3.0 |

| Average Annual Cash Flow (LOM) | $ M | 644 | 774 |

| Cumulative Cash Flow (undiscounted) | $ M | 27,011 | 32,597 |

Notes:

- Production: base case is 3 phases, 1.5Mtpa, 3.0Mtpa and 6.0Mtpa throughput; alternative case is identical with production of LCE-only in Phase 1, but with SOP and Cs2SO4 co-products from Phase 2 expansion onward (Years 6-43).

- Includes all operating expenditures with credit for SOP and Cs2SO4 production as offset to Unit LCE Opex, the estimate is expected to fall within an accuracy level of ±

30% . - Includes an

11% design development allowance (DDA) on process plant capital costs. - Tax calculation is preliminary with estimates considering current applicable taxes and include: Depreciation; Workers’ Participation Tax; Mining Pension Fund; Modified Mining Royalty Tax; and Federal Income Taxes.

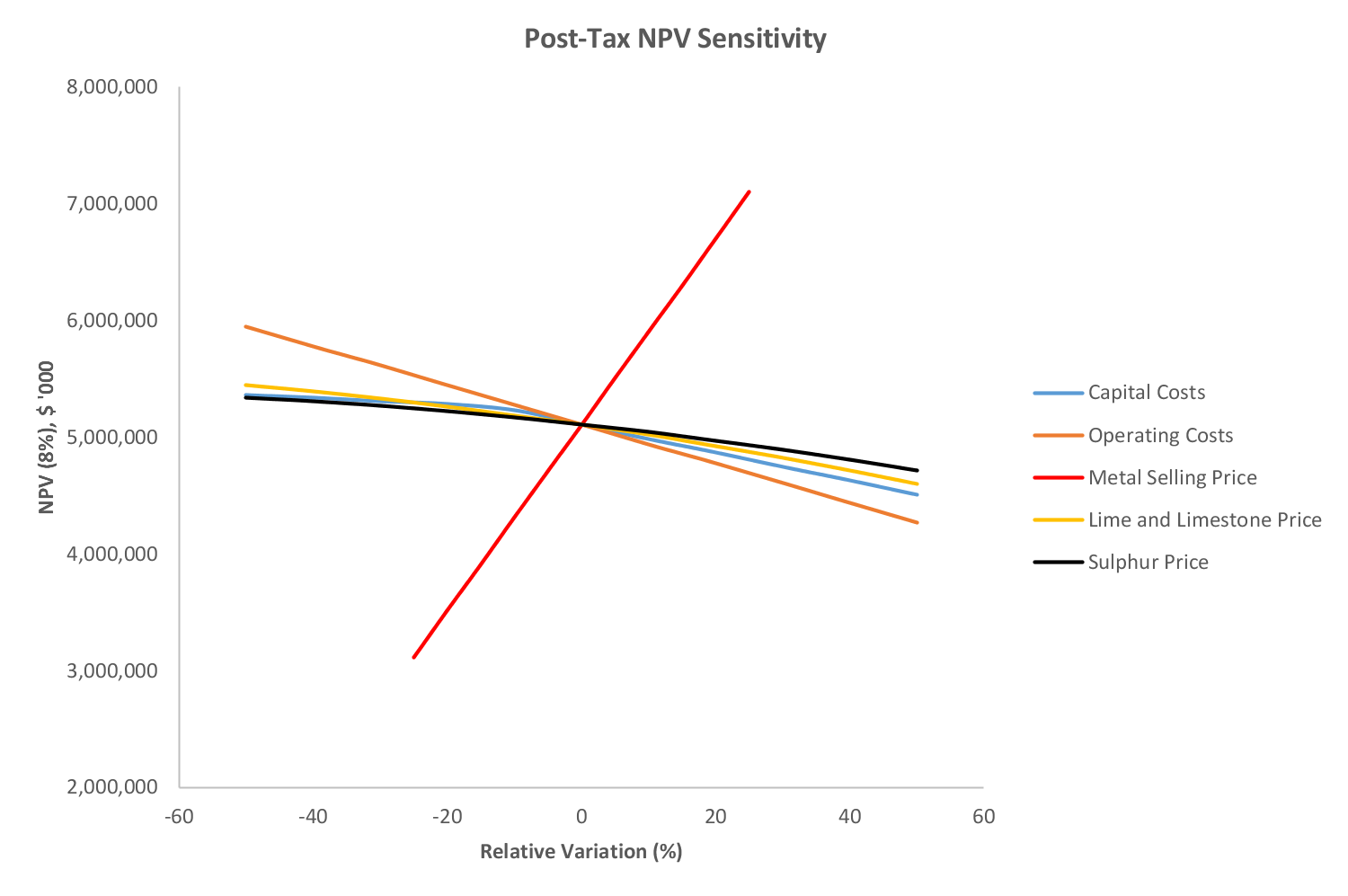

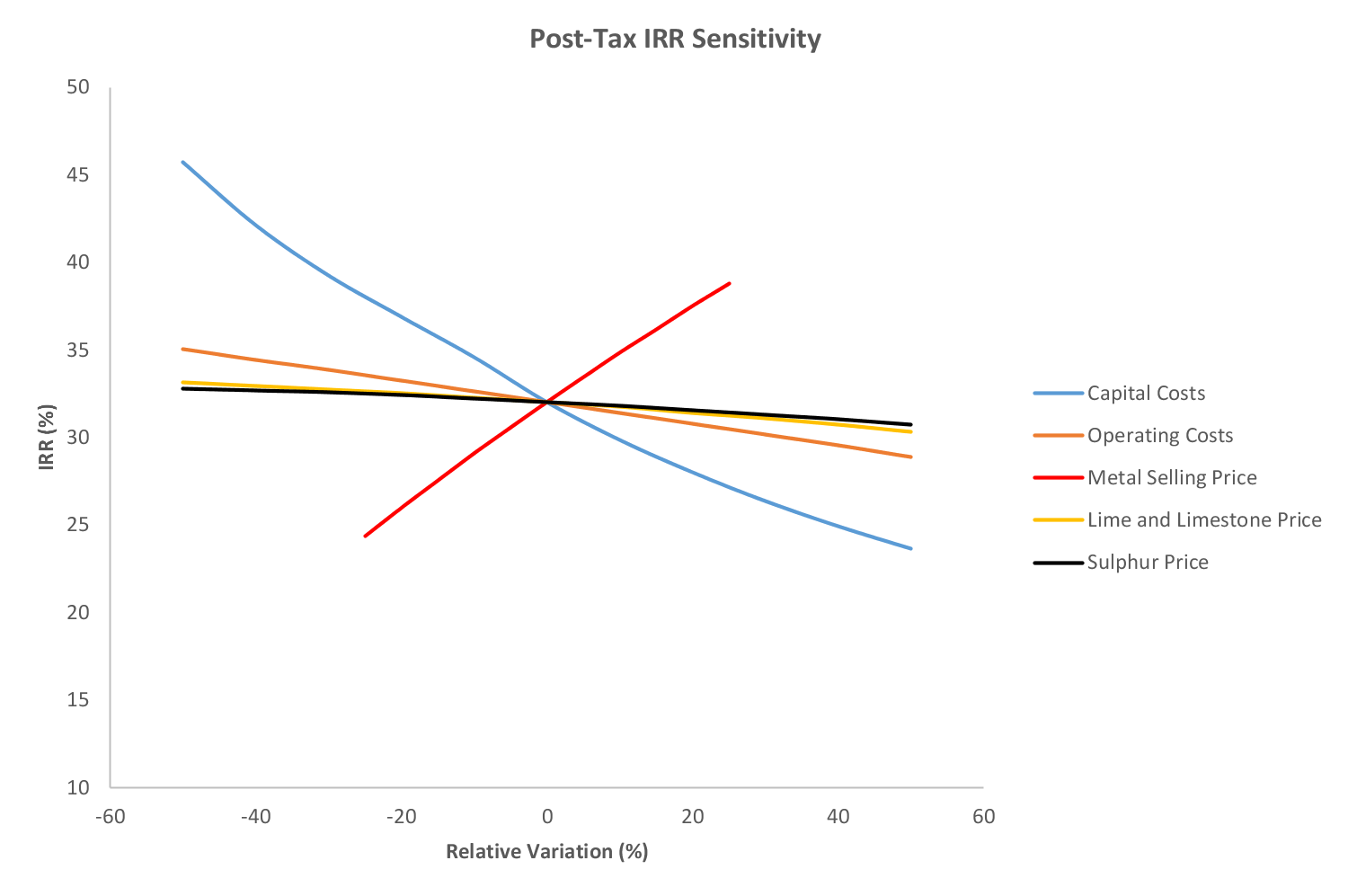

Sensitivities (Base Case)

The NPV for the project is most sensitive to LCE/metal selling price, but relatively far less sensitive to operating costs, capital costs and main reagent costs. IRR is most sensitive to capital costs and LCE/metal selling price (Figures 1 and 2, below).

Figure 1 - Base Case Post-Tax NPV8 Sensitivity Graph

Figure 2 - Base Case Post-Tax IRR Sensitivity Graph

Mining

Based on the analysis completed by DRA Global, the Falchani Project is highly amenable for development by conventional open pit, drill-blast, truck and shovel operation. The Base Case and Alternative Case have identical LOM production plans and schedules.

Table 3 – Mining/Processing Rates

| Parameter | Unit | Value |

| Production Life | Years | 43 (includes 2-year production ramp up)1 |

| Material mined | Mt | 339.7 |

| ROM head grade to leach (Years 1-32) | ppm Li | 3,382 |

| ROM head grade to leach (Years 33-43) | ppm Li | 1,841 |

| Recovered LCE | LOM Mt | 2.63 |

| Waste | LOM Mt | 127.0 |

| Total Mineralized Material throughput | LOM Mt | 212.7 |

| Strip Ratio (LOM) | (tw:to) | 0.60 |

- 2 years construction, including 1 year Capitalized pre-production mining; 2-year production ramp-up with

75% nameplate in Year 2.

Table 4 - Detailed Capital Cost Estimates:

| Capital Costs | Phase 1 | Phase 2 | Phase 3 | LOM |

| ($ millions) | ||||

| Mining (pre-strip and capital) | 10.3 | 10.3 | 20.6 | 41.2 |

| Processing plant - Direct costs | 399.9 | 359.9 | 720.5 | 1480.3 |

| Processing plant/mine – Infrastructure | 36.3 | 32.7 | 65.5 | 134.5 |

| Bulk infrastructure1 | 35.1 | 17.6 | 35.2 | 87.9 |

| Tailings2 | 29.2 | - | 127.4 | 156.6 |

| Total Direct Costs | 510.8 | 420.5 | 969.1 | 1900.4 |

| Total Indirect Costs (Process Plant)2 | 109.7 | 98.7 | 197.4 | 405.8 |

| Contingency/DDA (Process Plant) | 60.1 | 54.1 | 108.2 | 222.4 |

| Closure Costs (captured in sustaining) | - | - | - | 36.0 |

| TOTAL – Li Only Base Case | 680.6 | 573.3 | 1274.7 | 2,564.6 |

| Added Plant Capex for Cs2SO4 + SOP | - | 417 | 395 | 812 |

| Added Contingency for Cs2SO4 + SOP | - | 45.9 | 43.5 | 89.4 |

| TOTAL – Li + Cs2SO4 + SOP | 680.6 | 1,036.3 | 1713.2 | 3,466.0 |

| Sustaining Capital Costs – Li only | - | - | - | 235.6 |

| Sustaining Capital Costs – Li + Cs2SO4 + SOP | - | - | - | 259.9 |

- Tailings built in phases and included in P1 capital cost estimate and sustaining capital for remaining LOM

- Includes EPCM, spares, insurances, owners’ team.

The PEA is preliminary in nature and includes inferred resources that are considered too speculative to have the economic considerations applied to them that would enable them to be categorized as mineral reserves and there is no certainty the estimates presented in the PEA will be realized.

Qualified Persons

David Alan Thompson B-Tech, Pr Cert Eng, SACMA of DRA Projects SA Pty, an Independent Qualified Person as defined by NI 43-101, has prepared or supervised the preparation of, or has reviewed and approved the scientific and technical information pertaining to mining, mine scheduling and optimization contained in this news release.

John Joseph Riordan, BSc, CEng, FAuslMM, MIChemE, RPEQ, of DRA Pacific (Pty) Ltd., and Aveshan Naidoo MBA, BSc, PrEng, MSAIMM of DRA Projects SA Pty Ltd., Independent Qualified Persons as defined by NI 43-101, have prepared or supervised the preparation of, or have reviewed and approved the scientific and technical metallurgical information and financial modelling results contained in this news release.

Mr. Ted O’Connor, P.Geo., Executive Vice President of American Lithium, and a Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, has also reviewed and approved the scientific and technical information contained in this news release.

The PEA is preliminary in nature and includes inferred resources that are considered too speculative to have the economic considerations applied to them that would enable them to be categorized as mineral reserves and there is no certainty the estimates presented in the PEA will be realized.

In accordance with NI 43-101, the Company intends to file the completed technical report on the PEA under the Company's profile on SEDAR+ (www.sedarplus.ca) and on the Company's website within 45 days from the date of this news release.

About DRA Global Limited (ASX: DRA | JSE: DRA), as lead engineer, is a diversified global engineering, project delivery and operations management group headquartered in Perth, Australia, with an impressive track record completing over 300 unique projects worldwide spanning more than three decades. Known for its collaborative approach and extensive experience in project development and delivery, as well as turnkey operations and maintenance services, DRA Global delivers optimal solutions that are tailored to meet clients’ needs.

About American Lithium

American Lithium is actively engaged in the development of large-scale lithium projects within mining-friendly jurisdictions throughout the Americas. The Company is currently focused on enabling the shift to the new energy paradigm through the continued development of its strategically located TLC lithium project (“TLC”) in the richly mineralized Esmeralda lithium district in Nevada, as well as continuing to advance its Falchani lithium (“Falchani”) and Macusani uranium (“Macusani”) development-stage projects in southeastern Peru. All three projects, TLC, Falchani and Macusani have been through robust preliminary economic assessments, exhibit strong significant expansion potential and enjoy strong community support. Pre-feasibility is advancing well TLC and Falchani.

For more information, please contact the Company at info@americanlithiumcorp.com or visit our website at www.americanlithiumcorp.com

Follow us on Facebook, Twitter and LinkedIn.

On behalf of the Board of Directors of American Lithium Corp.

“Simon Clarke”

CEO & Director

Tel: 604 428 6128

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Cautionary Statement Regarding Forward Looking Information

This news release contains certain forward-looking information and forward-looking statements (collectively “forward-looking statements”) within the meaning of applicable securities legislation. All statements, other than statements of historical fact, are forward-looking statements. Forward-looking statements in this news release include, but are not limited to, statements regarding the business plans, expectations and objectives of American Lithium. Forward-looking statements are frequently identified by such words as "may", "will", "plan", "expect", "anticipate", "estimate", "intend", “indicate”, “scheduled”, “target”, “goal”, “potential”, “subject”, “efforts”, “option” and similar words, or the negative connotations thereof, referring to future events and results. Forward-looking statements are based on the current opinions and expectations of management and are not, and cannot be, a guarantee of future results or events. Although American Lithium believes that the current opinions and expectations reflected in such forward-looking statements are reasonable based on information available at the time, undue reliance should not be placed on forward-looking statements since American Lithium can provide no assurance that such opinions and expectations will prove to be correct. All forward-looking statements are inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including risks, uncertainties and assumptions related to: American Lithium’s ability to achieve its stated goals;, which could have a material adverse impact on many aspects of American Lithium’s businesses including but not limited to: the ability to access mineral properties for indeterminate amounts of time, the health of the employees or consultants resulting in delays or diminished capacity, social or political instability in Peru which in turn could impact American Lithium’s ability to maintain the continuity of its business operating requirements, may result in the reduced availability or failures of various local administration and critical infrastructure, reduced demand for the American Lithium’s potential products, availability of materials, global travel restrictions, and the availability of insurance and the associated costs; the ongoing ability to work cooperatively with stakeholders, including but not limited to local communities and all levels of government; the potential for delays in exploration or development activities; the interpretation of drill results, the geology, grade and continuity of mineral deposits; the possibility that any future exploration, development or mining results will not be consistent with our expectations; risks that permits will not be obtained as planned or delays in obtaining permits; mining and development risks, including risks related to accidents, equipment breakdowns, labour disputes (including work stoppages, strikes and loss of personnel) or other unanticipated difficulties with or interruptions in exploration and development; risks related to commodity price and foreign exchange rate fluctuations; risks related to foreign operations; the cyclical nature of the industry in which American Lithium operates; risks related to failure to obtain adequate financing on a timely basis and on acceptable terms or delays in obtaining governmental approvals; risks related to environmental regulation and liability; political and regulatory risks associated with mining and exploration; risks related to the uncertain global economic environment and the effects upon the global market generally, any of which could continue to negatively affect global financial markets, including the trading price of American Lithium’s shares and could negatively affect American Lithium’s ability to raise capital and may also result in additional and unknown risks or liabilities to American Lithium. Other risks and uncertainties related to prospects, properties and business strategy of American Lithium are identified in the “Risk Factors” section of American Lithium’s Management’s Discussion and Analysis filed on October 16, 2023, and in recent securities filings available at www.sedarplus.ca. Actual events or results may differ materially from those projected in the forward-looking statements. American Lithium undertakes no obligation to update forward-looking statements except as required by applicable securities laws. Investors should not place undue reliance on forward-looking statements.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/1b17cf2d-4c2a-47d2-b376-7b67940e68d2

https://www.globenewswire.com/NewsRoom/AttachmentNg/caa0c9ef-8bb8-4e1a-8b26-db5757c874b0