Adobe Forecasts Record $240.8 Billion U.S. Holiday Season Online with Black Friday Growth to Outpace Cyber Monday

Adobe forecasts a record $240.8 billion in U.S. online holiday sales for 2024, representing 8.4% growth year-over-year. Key highlights include:

- Black Friday growth expected to outpace Cyber Monday

- Mobile shopping to hit a new milestone with $128.1 billion in sales

- Strong discounts up to 30% off listed prices

- Consumers 'trading up' in categories like electronics and sporting goods

- Cyber Week to drive $40.6 billion in online spend

- Influencers converting shoppers 10 times more than social media overall

- Buy Now, Pay Later services expected to set new records

The forecast covers Nov. 1 to Dec. 31, 2024, based on Adobe Analytics data analyzing over 1 trillion visits to U.S. retail sites.

Adobe prevede un record di 240,8 miliardi di dollari nelle vendite online per le festività negli Stati Uniti nel 2024, corrispondente a una crescita del 8,4% anno su anno. Tra i principali punti salienti:

- Si prevede che la crescita del Black Friday superi quella del Cyber Monday

- Gli acquisti mobili raggiungeranno un nuovo traguardo con 128,1 miliardi di dollari in vendite

- Forti sconti fino al 30% sui prezzi di listino

- I consumatori 'trading up' in categorie come elettronica e articoli sportivi

- La Cyber Week genererà 40,6 miliardi di dollari di spese online

- Gli influencer convertiranno gli acquirenti 10 volte di più rispetto ai social media nel complesso

- Si prevede che i servizi Comprare Ora, Pagare Dopo stabiliscano nuovi record

La previsione copre il periodo dal 1° novembre al 31 dicembre 2024, basata sui dati di Adobe Analytics che analizzano oltre 1 trilione di visite ai siti di vendita al dettaglio negli Stati Uniti.

Adobe prevé un récord de 240,8 mil millones de dólares en ventas online por las festividades en EE. UU. para 2024, lo que representa un crecimiento del 8,4% interanual. Los puntos clave incluyen:

- Se espera que el crecimiento de Black Friday supere al del Cyber Monday

- Las compras móviles alcanzarán un nuevo hito con 128,1 mil millones de dólares en ventas

- Fuertes descuentos de hasta el 30% en precios listados

- Los consumidores 'trading up' en categorías como electrónica y artículos deportivos

- La Cyber Week impulsará 40,6 mil millones de dólares en gasto online

- Los influencers convertirán a los compradores 10 veces más que las redes sociales en general

- Se espera que los servicios de Comprar Ahora, Pagar Después establezcan nuevos récords

La previsión cubre del 1 de noviembre al 31 de diciembre de 2024, basada en datos de Adobe Analytics que analizan más de 1 billón de visitas a sitios minoristas en EE. UU.

어도비는 2024년 미국 온라인 홀리데이 판매가 2408억 달러에 이를 것으로 예상하며, 이는 전년 대비 8.4% 성장에 해당합니다. 주요 하이라이트는 다음과 같습니다:

- 블랙 프라이데이의 성장률이 사이버 먼데이를 초과할 것으로 예상

- 모바일 쇼핑이 1281억 달러의 판매로 새 이정표를 세울 것으로 예상

- 정가에서 최대 30% 할인 제공

- 소비자들이 전자기기 및 스포츠 용품과 같은 카테고리에서 '트레이딩 업'을 하고 있음

- 사이버 위크가 406억 달러의 온라인 소비를 촉진할 것으로 예상

- 인플루언서가 전체 소셜 미디어에 비해 10배 더 많은 구매자를 전환하고 있음

- 지금 구매하고 나중에 지불하기 서비스가 새로운 기록을 세울 것으로 예상

이 예측은 2024년 11월 1일부터 12월 31일까지를 다루며, 미국 소매 사이트에 대한 1조 이상의 방문을 분석한 어도비 분석 데이터에 기반합니다.

Adobe prévoit un record de 240,8 milliards de dollars en ventes en ligne pour les fêtes aux États-Unis en 2024, représentant une croissance de 8,4% d'une année sur l'autre. Les points clés incluent :

- La croissance du Black Friday devrait surpasser celle du Cyber Monday

- Les achats mobiles atteindront un nouveau jalon avec 128,1 milliards de dollars de ventes

- Fortes réductions allant jusqu'à 30% sur les prix affichés

- Les consommateurs 'trading up' dans des catégories comme l'électronique et les articles de sport

- La Cyber Week devrait générer 40,6 milliards de dollars de dépenses en ligne

- Les influenceurs convertiront les acheteurs 10 fois plus que les réseaux sociaux en général

- Les services Acheter maintenant, payer plus tard devraient établir de nouveaux records

La prévision couvre la période du 1er novembre au 31 décembre 2024, sur la base des données d’Adobe Analytics analysant plus d’un trillion de visites sur les sites de vente au détail aux États-Unis.

Adobe prognostiziert einen Rekord von 240,8 Milliarden Dollar bei den Online-Urlaubsverkäufen in den USA für 2024, was einem 8,4% Wachstum im Jahresvergleich entspricht. Zu den wichtigsten Ergebnissen gehören:

- Das Wachstum des Black Friday wird voraussichtlich das des Cyber Monday übertreffen

- Mobile Shopping wird mit 128,1 Milliarden Dollar Verkäufen einen neuen Meilenstein erreichen

- Starke Rabatte von bis zu 30% auf die Listenpreise

- Verbraucher 'trading up' in Kategorien wie Elektronik und Sportartikel

- Die Cyber Week wird 40,6 Milliarden Dollar an Online-Ausgaben generieren

- Influencer konvertieren Käufer 10 Mal mehr als soziale Medien insgesamt

- Jetzt kaufen, später bezahlen Dienste werden voraussichtlich neue Rekorde setzen

Die Prognose umfasst den Zeitraum vom 1. November bis 31. Dezember 2024, basierend auf Adobe Analytics-Daten, die über 1 Billion Besuche auf US-Einzelhandelsseiten analysieren.

- Record $240.8 billion in U.S. online holiday sales forecast, up 8.4% YoY

- Mobile shopping expected to reach $128.1 billion, representing 53.2% of online spend

- Cyber Week projected to drive $40.6 billion in online spend, up 7.0% YoY

- Strong discounts up to 30% off listed prices expected to drive consumer demand

- Consumers 'trading up' for more expensive goods in categories like electronics and sporting goods

- Social media influencers converting shoppers 10 times more than social media overall

- Buy Now, Pay Later services expected to set new records, driving $18.5 billion in online spend

- Persistent inflation has led shoppers to embrace cheaper goods across major e-commerce categories

- Some categories like furniture/bedding and groceries expected to see a drop in share of most expensive goods

Insights

Adobe's forecast for the 2024 holiday season is highly optimistic, projecting

- Mobile shopping reaching a record

$128.1 billion , representing53.2% of online spend - Cyber Week expected to generate

$40.6 billion in sales - Black Friday outpacing Cyber Monday in growth

- Significant discounts up to

30% off listed prices

The forecast suggests a robust holiday season for e-commerce, potentially boosting Adobe's revenue from its Experience Cloud products. Investors should monitor Adobe's ability to capitalize on this trend through its analytics and marketing solutions.

The holiday forecast reveals several key trends that could impact various sectors:

- Mobile dominance: With

53.2% of online spend expected via mobile, companies optimizing for mobile experiences may see advantages. - Discount-driven growth: Strong discounts are driving an estimated

$2-3 billion in incremental spend, highlighting price sensitivity. - "Trading up" phenomenon: Consumers are expected to purchase more expensive items in categories like sporting goods (

76% increase) and electronics (58% increase). - BNPL growth: Expected to drive

$18.5 billion in online spend, up11.4% YoY, benefiting fintech companies in this space. - Influencer impact: Converting shoppers 10 times more than social media overall, suggesting potential shifts in marketing strategies.

These trends indicate a dynamic retail landscape with opportunities across various segments, from mobile technology to fintech and influencer marketing.

-

Strong discounts—as high as

30% off listed price—will drive shoppers to “trade up” in categories such as electronics, appliances and sporting goods, contributing over$2 billion

-

The 2024 holiday season is expected to be the most mobile of all time, with a record

$128.1 billion 53.2% share over desktop, while also propelling usage of Buy Now, Pay Later services

-

Consumers will discover and research products in new ways this season, with influencers driving people to shop 10 times more compared to social media overall and generative AI-powered chat bots seeing a

100% increase in traffic to retail sites

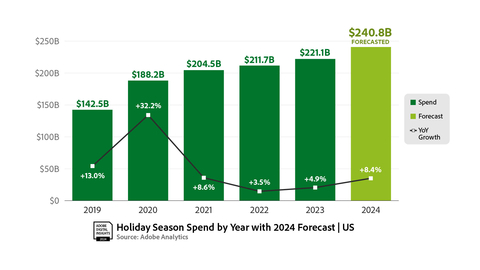

Spend by Year (Graphic: Business Wire)

Record E-commerce Spend in the

Adobe expects

Cyber Week (the 5-day period including Thanksgiving, Black Friday and Cyber Monday) is expected to drive

“The holiday shopping season has been reshaped in recent years, where consumers are making purchases earlier, driven by a stream of discounts that has allowed shoppers to manage their budgets in different ways,” says Vivek Pandya, lead analyst, Adobe Digital Insights. “These discounting patterns are driving material changes in shopping behavior, with certain consumers now trading up to goods that were previously higher-priced and propelling growth for

Price Sensitive Shoppers Enticed by Strong Discounts

Adobe anticipates major discounts this season—up to

Each season, discounting has been a reliable driver of consumer demand and e-commerce growth for retailers. The effect has been more pronounced in 2024 as consumers remain price sensitive, taking advantage of big promotional events after a period of persistent inflation. This year, Adobe’s data showed that for every

Shoppers “Trading Up” for the Holiday Season

Prior to the holiday season, months of persistent inflation had led shoppers to embrace cheaper goods across major e-commerce categories. To conduct this analysis for each category tracked by Adobe, prices were separated into four quartiles from the highest to lowest prices. Shares of units sold in the most expensive and least expensive quartiles were then tracked from April 2019 to August 2024. Adobe found the share of the cheapest goods increased significantly, up

The trend is expected to reverse for the upcoming holiday season, where share of the most expensive goods is set to increase by

Consumer Guide: Best Time to Shop

The deepest discounts are expected to hit during Cyber Week, the best time to shop for bargain hunters. And across several categories, the best deals are set to happen before the big Cyber Monday event. Thanksgiving Day (Nov. 28) will be the best day to shop for toys, appliances, furniture and sporting goods. On Black Friday (Nov. 29), shoppers will see the deepest discounts for TVs. The Saturday after (Nov. 30) will have the best deals for computers. And Cyber Monday (Dec. 2) will be the best day to shop for electronics and apparel—the two biggest categories in e-commerce by revenue share.

Notably, consumers will see deals beginning in mid-October with the Prime Day event expected to drive discounting across major

Social Influencers Driving Consumers to Shop

Across major marketing channels, paid search has remained the top driver of retail sales (

Additional Adobe Analytics Insights

-

Top sellers expected this holiday season: Top toys include Bluey Ultimate Lights and Sounds Playhouse, Slime kits, Fisher-Price Little People, MGA's Miniverse, Descendants: The Rise of Red toys and LEGO sets. Top gaming consoles include Sony PlayStation 5, Xbox Series X and Nintendo Switch OLED. Top games include Madden NFL 25, NBA 2k25,

Diablo 4, Call of Duty: Black Ops 6, Super Mario Party Jamboree, Valorant and World of Warcraft: The War Within. Other top sellers this season are expected to include iPhone 16, Google Pixel 9, Samsung Galaxy S24 Ultra, Bluetooth headphones, film/digital cameras, Oura Ring, Kindle/E-readers and Ninja Creami.

-

E-commerce categories driving growth: Over half of online spend this holiday season is expected to be driven by electronics (

$55.1 billion 8.5% YoY), apparel ($43.9 billion 5.8% YoY) and furniture/bedding ($28.4 billion 4.2% YoY). Groceries remains a high-growth category, expected to drive$20.8 billion 8.8% YoY, as well as cosmetics ($10.3 billion 7.3% YoY). Other notable growth categories this season include toys ($8.1 billion 5.8% YoY) and sporting goods ($7.2 billion 5.5% YoY).

-

Buy Now, Pay Later (BNPL): The payment method is expected to set new records this season, driving

$18.5 billion 11.4% YoY. Adobe expects BNPL to hit$9.5 billion $993 million 74% to79% (vs. desktop)—74.1% so far this year (Jan. 1 – Aug. 11, 2024). In Adobe’s survey,39% of millennials plan to use BNPL services this season, followed by38% of Gen Z. Most common reasons cited for using BNPL include freeing up cash (per22% of respondents) and the ability to purchase something they couldn’t afford otherwise (19% ).

-

Impact of Generative AI: In 2024 (Jan. 1 to Aug. 31, 2024), traffic to retail sites from generative AI-powered chat bots has doubled. Direct referrals (consumers clicking on a link to retail site) have also increased dramatically—8 times higher than in 2023. Use of generative AI tools for shopping is expected to rise this holiday season. Adobe’s survey shows that 7 in 10 consumers who have used generative AI for shopping believe it enhances their experience, and 2 in 5 plan to use it for the holidays. Additionally,

20% of respondents turn to generative AI to find the best deals, followed by quickly finding specific items online (19% ) and getting brand recommendations (15% ).

About Adobe

Adobe is changing the world through digital experiences. For more information, visit www.adobe.com.

*Per the Digital Commerce 360 Top 500 report (2024)

**Survey fielded from Sept. 2 to 9, 2024

© 2024 Adobe. All rights reserved. Adobe and the Adobe logo are either registered trademarks or trademarks of Adobe in

Disclaimer: The information and analysis in this release have been prepared by Adobe Inc. for informational purposes only and may contain statements about future events that could differ from actual results. Adobe Inc. does not warrant that the material contained herein is accurate or free of errors and has no responsibility to update or revise information presented herein. Adobe Inc. shall not be liable for any reliance upon the information provided herein.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240925007732/en/

Public relations contact

Kevin Fu

Adobe

kfu@adobe.com

Source: Adobe