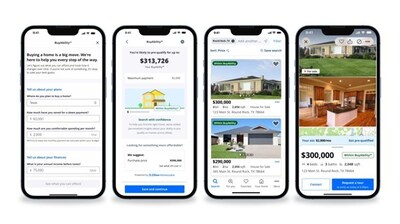

Zillow's real-time affordability tool helps shoppers quickly find homes within their budget

Rhea-AI Summary

Zillow has launched BuyAbility, a real-time affordability tool on their app that helps home shoppers instantly determine if they can afford and qualify for specific listings. The tool, powered by Zillow Home Loans, provides personalized estimates based on users' financial information and current mortgage rates. When mortgage rates shift from 7% to 6%, a median-income household's buying power increases from $380,000 to $420,000 with a 20% down payment. According to Zillow data, 79% of recent buyers prioritize staying within budget, and in September, 27.3% of listed homes were affordable for median-income households, up from 22.7% in May when rates peaked above 7%.

Positive

- Introduction of innovative real-time affordability tool enhancing user experience

- Tool potentially increases user engagement and conversion rates for Zillow Home Loans

- Expansion of services in mortgage lending segment strengthening market position

Negative

- Tool not available in New York state, limiting market reach

- Currently only available on mobile app, not desktop platform

News Market Reaction

On the day this news was published, Z gained 2.63%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

This first of its kind personalized tool will change how buyers shop for homes

BuyAbility is the tool for this moment. Homeownership can feel out of reach for aspiring first-time buyers who are daunted by today's high prices and may not feel ready to share their personal financial details with a loan officer. Volatile mortgage rates have made it difficult to know how much home they can afford, and their ability to qualify for a loan can change from day to day. BuyAbility is powered by real-time mortgage rates from Zillow Home Loans, and makes updates whenever rates move up or down, or when a prospective buyer improves their credit score, their debt-to-income ratio or saves more for their down payment.

"Mortgage rates have been on a wild ride this year," said Orphe Divounguy, a senior economist for Zillow Home Loans. "With improving inflation numbers and more balanced economic activity, mortgage rates could ease slightly heading into the new year. That will mean more affordability and more options for home shoppers. Buyers will be in a stronger position to act quickly when the right home enters their BuyAbility, bringing them one step closer to the American Dream of homeownership."

Shoppers can access BuyAbility from the Home Loans tab on the Zillow app. They enter their basic financial information, including their income, credit score, monthly debt payments, amount saved for a down payment and the amount they're comfortable spending each month. Within seconds, they get their BuyAbility: an estimate of the home price they are likely to qualify for, and a suggested budgeted maximum price based on their desired monthly payments. When they browse Zillow, listings will be clearly tagged when they are within that shopper's BuyAbility, providing instant clarity on whether they are likely to qualify for a loan on that home.

BuyAbility accounts for the one major factor that basic mortgage calculators neglect: the interplay between mortgage rates and a buyer's personal financial situation. Shoppers with higher credit scores or a lower debt-to-income ratio will qualify for a lower mortgage rate, which has a huge impact on their buying power. Assuming a

A vast majority of home buyers today are prioritizing budget above all else. Zillow data finds nearly

That significant shift shows how quickly homes can go from being unaffordable to affordable in today's market. BuyAbility gives shoppers a competitive edge by keeping them up to date on exactly what they can afford at any given time.

BuyAbility is currently available in every state but

About Zillow Group:

Zillow Group, Inc. (Nasdaq: Z and ZG) is reimagining real estate to make home a reality for more and more people. As the most visited real estate website in

Zillow Group's affiliates, subsidiaries and brands include Zillow®, Zillow Premier Agent®, Zillow Home Loans℠, Trulia®, Out East®, StreetEasy®, HotPads®, ShowingTime+℠, Spruce® and Follow Up Boss®.

All marks herein are owned by MFTB Holdco, Inc., a Zillow affiliate. Zillow Home Loans, LLC is an Equal Housing Lender, NMLS #10287 (www.nmlsconsumeraccess.org). © 2023 MFTB Holdco, Inc., a Zillow affiliate.

(ZFIN)

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/zillows-real-time-affordability-tool-helps-shoppers-quickly-find-homes-within-their-budget-302309760.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/zillows-real-time-affordability-tool-helps-shoppers-quickly-find-homes-within-their-budget-302309760.html

SOURCE Zillow Group, Inc.