Weave Adds Buy Now, Pay Later Offering to Streamline Payments in Small Healthcare Practices

Weave (NYSE: WEAV) has launched a new Buy Now, Pay Later (BNPL) solution to enhance payment flexibility for healthcare providers and their patients. This offering, available through a partnership with Sunbit, is accessible to over 22,000 Weave customer locations in the U.S. The BNPL service boasts a 90% approval rate and quick 30-second applications, aiming to alleviate payment collection burdens for small practices. This initiative follows Weave's recent launch of an insurance verification tool, further expanding its suite of services for healthcare professionals.

- Launch of Buy Now, Pay Later solution enhances payment flexibility for 22,000+ customer locations.

- 90% approval rate and 30-second application process increase confidence in offering financing options.

- Integration with Sunbit's technology aims to drive more revenue for small healthcare practices.

- None.

Insights

Analyzing...

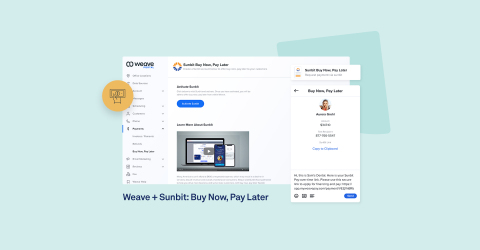

The BNPL solution will be available in Weave’s all-in-one platform, eliminating payment hurdles for patients & providers

(Photo: Business Wire)

The new solution, powered through a partnership with Sunbit, the company building financial technology for everyday expenses, is now available to all of the over 22,000 Weave customer locations across the

Buy Now, Pay Later options in healthcare are increasingly important to patients and clients. A Weave survey of pet owners recently found that one in three owners are currently delaying needed procedures due to costs. Buy Now, Pay Later options give patients and clients the flexibility they need while alleviating the burdensome task of payment collection and billing that often falls to office staff.

“There are thousands of small healthcare offices across the country who are worried about their patients’ ability to pay with the current state of the economy,” said Weave CEO

The offering integrates Sunbit’s technology and Weave’s communications platform to help offices drive more revenue by making their offerings more accessible than before. With a

“Small businesses deliver critical services to their local communities. By integrating pay over time technology, these practices enable their patients to get what they need, when they need it, instead of declining necessary care,” said Oded Vakrat, VP of Platform Partnerships, Sunbit. He continued, “I’m excited to watch this partnership unfold as exponentially more practices are able to give their patients access to the services they deserve, while simply paying over time."

The latest innovation from Weave follows close on the heels of the launch of Insurance Verification, a dental-only billing solution that automates the time-consuming process of verifying patient insurance eligibility and coverage. Learn more about Weave’s product innovations here.

About Weave

Weave is the all-in-one customer communications and engagement platform for small business. From the first phone call to the final invoice and every touchpoint in between, Weave connects the entire customer journey. Weave’s software solutions transform how local businesses attract, communicate with and engage customers to grow their business. The first

Loans are made by

View source version on businesswire.com: https://www.businesswire.com/news/home/20220727005251/en/

Director of Communications, Weave

pr@getweave.com

Source: Weave