VIZSLA SILVER AGREES TO ACQUIRE NEWLY CONSOLIDATED PAST-PRODUCING SILVER DISTRICT IN THE EMERGING SILVER-GOLD-RICH PANUCO - SAN DIMAS CORRIDOR IN MEXICO

NYSE: VZLA TSX-V: VZLA

Highlights

- Large property package at 16,962 Ha (more than 2x the area of the Company's

Panuco project (the "Panuco Project")). - While this district has seen past production dating back centuries, the La Garra-Metates District has seen minimal exploration and no drilling.

- Vizsla Silver's sampling demonstrated multi-kilo silver equivalent grades over several kilometers of strike.

- Epithermal vein systems trending N-NNW in a geological setting akin that of the Panuco Project and First Majestics Silver Corp.'s

San Dimas project ("San Dimas "). - Potential for high-grade shoots along-strike and at depth on two known vein systems with estimated strike length of 2.6 km and 1.8 km, respectively.

- Significant potential to discover new veins given the underexplored nature of the district.

- The La Garra-Metates District has been acquired for less than

3% of Vizsla Silver's market capitalization.

"Vizsla Silver has agreed to acquire another highly prospective precious metals rich district in the Sinaloa Silver Belt, marking the first time that the La Garra-Metates District has ever been in a public company." Stated Michael Konnert, President, and CEO. "The consolidation and acquisition of a vastly under-explored, past-producing district in the state of

About the La Garra-Metates District

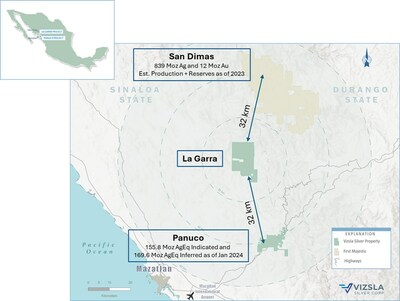

The La Garra-Metates District is located 108 kilometres northeast of the

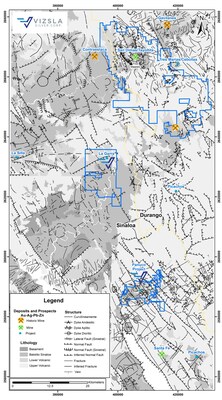

The La Garra-Metates District comprises of 16 claims (15 titled mining concessions and one application) covering 16,962 Ha in the heart of the emerging silver-gold-rich

The La Garra-Metates District area contains N-NNW-trending silver-gold-rich veins in a geological setting akin that of the Panuco Project and

In December 2023, Vizsla Silver conducted a five-day site visit and collected 37 samples on vein outcrops and underground pillars on La Garra and

Vizsla Silver plans to take advantage of its experienced team in

Sample # | Vein | Area | Sample | Ag | Au | Pb | Zn | AgEq | |

(m) | (g/t) | (g/t) | % | % | (g/t) | ||||

G566682 | El Orito | La Garra | Dump | 22 | 7.00 | 0.05 | 0.02 | 495 | |

G566683 | El Orito | La Garra | Grab | 1 | 0.01 | 0.00 | 0.00 | 1 | |

G566684 | Rosita | La Garra | 0.50 | 70 | 2.22 | 0.44 | 0.42 | 243 | |

G566686 | Rosita | La Garra | 0.30 | 76 | 1.70 | 0.16 | 0.08 | 193 | |

G566687 | Rosita | La Garra | 1.00 | 5 | 0.06 | 0.02 | 0.25 | 18 | |

G566688 | FW La Garra | La Garra | 0.30 | 25 | 0.64 | 0.07 | 0.05 | 70 | |

G566689 | FW La Garra | La Garra | 0.90 | 4 | 0.05 | 0.01 | 0.05 | 9 | |

G566691 | FW La Garra | La Garra | 0.50 | 3 | 0.03 | 0.01 | 0.05 | 7 | |

G566692 | La Garra | La Garra | 0.60 | 68 | 0.83 | 0.08 | 0.14 | 127 | |

G566693 | La Garra | La Garra | 0.75 | 11 | 0.13 | 0.01 | 0.05 | 21 | |

G566694 | La Garra | La Garra | Dump | 110 | 1.71 | 0.10 | 0.09 | 224 | |

G566696 | La Garra | Grab | 6 | 0.02 | 0.00 | 0.00 | 7 | ||

G566697 | La Garra | 1.00 | 5 | 0.02 | 0.00 | 0.00 | 6 | ||

G566698 | La Gigante | La Garra | 1.10 | 87 | 0.49 | 0.00 | 0.01 | 115 | |

G566699 | La Gigante | La Garra | 2.30 | 343 | 2.04 | 0.01 | 0.01 | 457 | |

G566700 | La Garra | 2.00 | 847 | 2.29 | 0.09 | 0.08 | 948 | ||

G566751 | La Garra | 0.90 | 1,156 | 12.30 | 0.02 | 0.04 | 1,908 | ||

G566752 | FW La Garra | La Garra | 0.70 | 52 | 0.60 | 0.45 | 0.27 | 112 | |

G566753 | La Brillosa | La Garra | 0.60 | 4 | 0.07 | 0.07 | 0.00 | 10 | |

G566754 | Nivel 4 | 1.30 | 641 | 3.08 | 0.12 | 0.17 | 814 | ||

G566756 | Grab | 402 | 2.50 | 0.02 | 0.01 | 543 | |||

G566757 | Veta La Yaqui | Dump | 627 | 10.10 | 0.39 | 0.51 | 1,295 | ||

G566758 | Veta La Yaqui | 1.30 | 36 | 0.39 | 0.01 | 0.01 | 60 | ||

G566759 | Veta La Yaqui | 2.50 | 99 | 0.52 | 0.01 | 0.03 | 128 | ||

G566760 | Veta Petra | 2.00 | 885 | 6.03 | 0.02 | 0.02 | 1,231 | ||

G566761 | Veta Petra | 1.10 | 56 | 0.55 | 0.00 | 0.00 | 89 | ||

G566762 | Veta Petra | 0.90 | 17 | 0.19 | 0.00 | 0.00 | 29 | ||

G566763 | Mina La Juanita | 0.60 | 203 | 2.40 | 0.01 | 0.01 | 351 | ||

G566764 | Mina La Juanita | 1.20 | 498 | 4.33 | 0.01 | 0.00 | 756 | ||

G566766 | Mina | 1.00 | 385 | 2.75 | 0.01 | 0.01 | 544 | ||

G566767 | Mina | 1.00 | 6 | 0.05 | 0.00 | 0.00 | 9 | ||

G566768 | Mina | 2.00 | 6 | 0.05 | 0.00 | 0.01 | 9 | ||

G566769 | Mina | 2.00 | 4 | 0.21 | 0.00 | 0.01 | 18 | ||

G566771 | Mina | 1.80 | 4 | 0.02 | 0.00 | 0.01 | 5 | ||

G566772 | 0.30 | 71 | 0.50 | 0.01 | 0.00 | 100 | |||

G566773 | Manto Gaby | 1.00 | 226 | 2.08 | 0.00 | 0.00 | 351 | ||

G566774 | 1.00 | 1 | 0.01 | 0.00 | 0.00 | 1 |

Table 1: Assays from rock samples collected on veins at La Garra.

Note: AgEq = Ag g/t x Ag rec. + ((Au g/t x Au Rec x Au price/gram)+(Pb% x Pb rec. X Pb price/t) + (Zn% x Zn rec. X Zn price/t))/Ag price/gram. Metal price assumptions are |

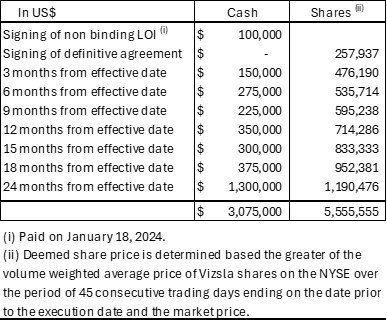

Terms of the acquisition

The Company entered into a share purchase agreement (the "Acquisition Agreement") dated March 27, 2024, with Exploradora Minera La Hacienda S.A. de C.V. and

Pursuant to the Acquisition Agreement, the Company has agreed to make cash payments in an aggregate of

The Cash Payments will be made, and the Consideration Shares will be issued over a period of 24 months from closing.

The Company is responsible for the back taxes owing on the concessions.

Royalty Agreement

Within 90 days of the closing date, the Company and the Sellers shall enter into a royalty agreement in a form satisfactory to the Parties, pursuant to which the Sellers will be granted a

Pledge Agreement

Within 90 days of the closing date, the Company shall execute and deliver to the Sellers a pledge and security agreement in a form satisfactory to the Company and the Sellers and take such other actions sufficient under applicable Laws to grant the Sellers a first priority lien on the Purchased Shares to secure the Company's obligations with regards to the acquisition costs.

Finder's fees

The finder's fees is

The Acquisition is subject to standard closing conditions, including the approval of the TSX Venture Exchange.

About the Panuco Project

The newly consolidated

The district contains intermediate to low sulfidation epithermal silver and gold deposits related to siliceous volcanism and crustal extension in the Oligocene and Miocene. Host rocks are mainly continental volcanic rocks correlated to the Tarahumara Formation.

On January 8, 2024, the Company announced an updated mineral resource estimate for

About Vizsla Silver

Vizsla Silver is a Canadian mineral exploration and development company headquartered in

Quality Assurance / Quality Control

Drill core samples were shipped to ALS Limited in

Control samples comprising certified reference samples, duplicates and blank samples were systematically inserted into the sample stream and analyzed as part of the Company's quality assurance / quality control protocol.

Qualified Person

In accordance with NI 43-101, Jesus Velador, Ph.D. MMSA QP., Vice President of Exploration, is the Qualified Person for the Company and has reviewed and approved the technical and scientific content of this news release.

Information Concerning Estimates of Mineral Resources

The scientific and technical information in this news release was prepared in accordance with NI 43-101 which differs significantly from the requirements of the

You are cautioned not to assume that any part or all of mineral resources will ever be converted into reserves. Pursuant to CIM Definition Standards, "inferred mineral resources" are that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Such geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve. However, it is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource is economically or legally mineable. Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute "reserves" by SEC standards as in place tonnage and grade without reference to unit measures.

Canadian standards, including the CIM Definition Standards and NI 43-101, differ significantly from standards in the SEC Industry Guide 7. Effective February 25, 2019, the SEC adopted new mining disclosure rules under subpart 1300 of Regulation S-K of the United States Securities Act of 1933, as amended (the "SEC Modernization Rules"), with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical property disclosure requirements included in SEC Industry Guide 7. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources". Information regarding mineral resources contained or referenced herein may not be comparable to similar information made public by companies that report according to

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain "Forward–Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward–looking information" under applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target", "plan", "forecast", "may", "would", "could", "schedule" and similar words or expressions, identify forward–looking statements or information. These forward–looking statements or information relate to, among other things: the exploration, development, and production at the Panuco Project and the potential acquisition of the La Garra Project.

Forward–looking statements and forward–looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Vizsla Silver, future growth potential for Vizsla Silver and its business, and future exploration plans are based on management's reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management's experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of silver, gold, and other metals; costs of exploration and development; the estimated costs of development of exploration projects; Vizsla Silver's ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Vizsla Silver's respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward–looking statements or forward-looking information and Vizsla Silver has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company's dependence on one mineral project; precious metals price volatility; risks associated with the conduct of the Company's mining activities in

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/vizsla-silver-agrees-to-acquire-newly-consolidated-past-producing-silver-district-in-the-emerging-silver-gold-rich-panuco--san-dimas-corridor-in-mexico-302102627.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/vizsla-silver-agrees-to-acquire-newly-consolidated-past-producing-silver-district-in-the-emerging-silver-gold-rich-panuco--san-dimas-corridor-in-mexico-302102627.html

SOURCE Vizsla Silver Corp.