Vox Completes Acquisition of Strategic Australian Royalty Portfolio

Rhea-AI Summary

Vox Royalty Corp. has completed the acquisition of a portfolio of four Australian royalties at various development stages and a production-linked milestone payment, for A$4.7 million. This acquisition includes significant assets such as Castle Hill, Kunanalling, Halls Creek, and Broken Hill, operated by prominent Australian producers like Evolution Mining. The transaction is expected to provide meaningful revenue from early 2026, primarily from gold and copper assets. Vox’s portfolio now includes over 50 Australian assets, benefiting from high AUD-denominated gold and copper prices. This acquisition also increases Vox’s exposure to critical metals like cobalt and rare earth metals and strengthens its asset base in stable jurisdictions.

Positive

- Completed acquisition of four royalties and a milestone payment for A$4.7 million.

- Significant revenue expected from Castle Hill gold project starting early 2026.

- Portfolio includes assets operated by Evolution Mining, a major producer.

- Increased exposure to high-demand metals like copper, cobalt, and rare earth metals.

- Portfolio now includes over 50 Australian assets, benefiting from high AUD gold and copper prices.

- Strengthened asset base in low-risk jurisdictions, with 80% of assets in Australia, Canada, and USA.

Negative

- Revenue potential reliant on future developments, with meaningful income not expected until 2026.

- Significant investment of A$4.7 million without immediate revenue return.

- Dependence on high gold and copper prices to realize expected returns.

- Exposure to development and exploration risks associated with early-stage projects.

News Market Reaction 1 Alert

On the day this news was published, VOXR gained 3.98%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

TORONTO, ON / ACCESSWIRE / May 14, 2024 / Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) ("Vox" or the "Company"), a returns focused mining royalty company, is pleased to announce that it has completed the acquisition of an advanced portfolio of four Australian royalties at various stages of development including: construction, development and exploration and the rights to one production-linked milestone payment (the "Portfolio"), from a private Australian group for cash consideration of A

Spencer Cole, Chief Investment Officer of Vox stated: "We are excited to complete this Australian royalty portfolio investment and we expect meaningful revenue from Castle Hill from early 2026 onwards. Of note, this transaction increases our large-cap operator portfolio weighting to over

Transaction Highlights

- Addition of four Australian royalties and the rights to one gold production-linked milestone payment in Western Australia and New South Wales, heavily weighted to gold and copper;

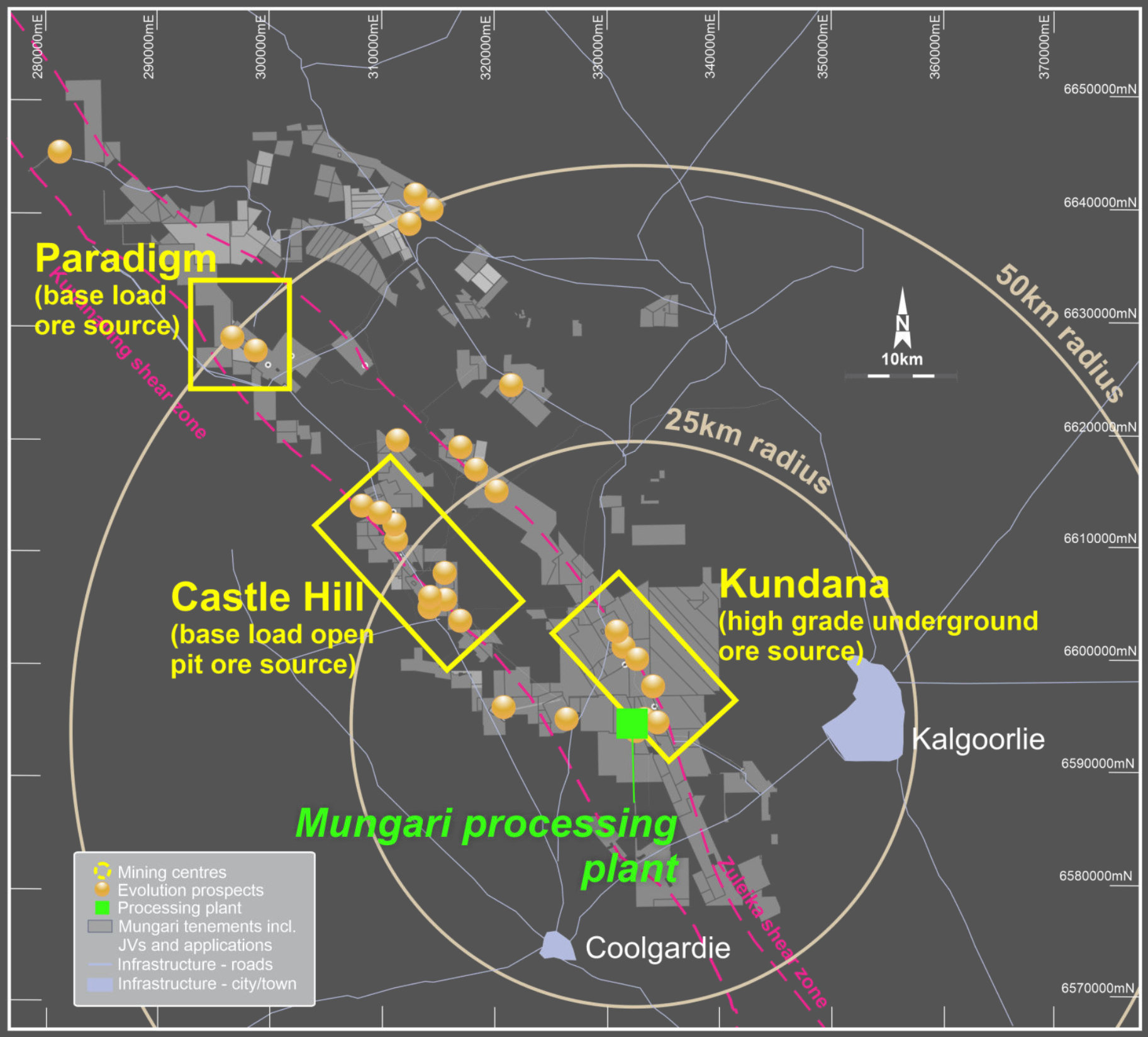

- Near-term revenue potential from early 2026 onwards from the construction-stage Castle Hill gold project in Western Australia ("Castle Hill"), operated by Evolution Mining Ltd ("Evolution"), which is a key part of the A

$250M Mungari Mine Life Extension project and mill expansion to 4.2Mtpa ("Mungari 4.2 Project") announced by Evolution on 5 June 2023; - Further production potential from the past-producing Kunanalling gold project, which is located less than 15km from the Mungari Mill and also part of Evolution's integrated Mungari 4.2 Project;

- Provides critical metals exposure to copper, cobalt and rare earth metals exposure across the Halls Creek and Broken Hill exploration projects; and

- Strengthens Vox's proportion of royalty assets located in lower risk political jurisdictions of Australia, Canada and USA, now totalling more than

80% of all royalty assets.

Portfolio Overview

Asset | Operator | Primary | Stage | Royalty |

| Castle Hill (royalty) | Evolution Mining Ltd (ASX) | Gold | Construction | A |

| Castle Hill (milestone payment) | Evolution Mining Ltd (ASX) | Gold | Construction | A |

| Kunanalling | Evolution Mining Ltd (ASX) | Gold | Development | (payable >75Koz* gold from Castle Hill royalty tenure) |

| Halls Creek / Mt Angelo North | AuKing Mining Ltd (ASX, Operator) Cazaly Resources Ltd (ASX, JV partner) | Copper, Zinc | Exploration (2023 Scoping Study) | |

| Broken Hill | Castillo Copper Ltd (ASX) | Copper, Cobalt, Rare Earths | Exploration (2022 resource) |

*: Castle Hill royalty production cap and milestone hurdle have been reduced by 13,085oz from historical production in 2013

Key Assets

Castle Hill - A

The Castle Hill gold project is located approximately 50 kilometres northwest of Kalgoorlie in the heart of the Western Australia goldfields and covers a substantial portion of the Kunanalling Shear Zone, one of the dominant corridors of mineralisation at Mungari. The project was historically explored by Cazaly Resources Limited ("Cazaly"), who sold the royalty tenure to Phoenix Gold Ltd ("Phoenix") in June 2010 for upfront consideration, royalties and contingent production-linked payments.

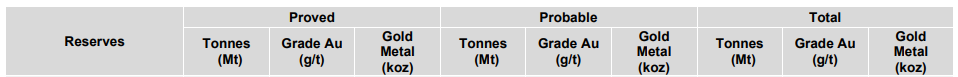

The 14.8Mt resource at Castle Hill is amenable to conventional open pit mining and both milling and heap leach processing; and is located in close proximity to the Mungari processing plant. In 2013 Phoenix conducted mining at Castle Hill, producing 13,085 ounces via the Paddington mill. In January 2015 a Joint Mining Study was commissioned by Norton Gold Fields ("Norton") and Phoenix to process high grade Castle Hill ore at Norton's nearby Paddington mill. In 2015 Phoenix was acquired by Evolution for approximately A

(Source: Evolution Mining Mungari Site Visit Presentation, August 8, 2023)

(https://evolutionmining.com.au/wp-content/uploads/2023/08/2588272_Mungari-Site-Visit-Presentation.pdf)

The Castle Hill royalty applies to a number of tenements and gold deposits, including the Castle Hill, Mick Adam and Wadi deposits which Vox management estimates covers the majority (

Table 1: Castle Hill Mineral Reserves (December 2022)

(Source: Evolution Mining Mungari Expansion Project announcement, June 2023)

(https://evolutionmining.com.au/wp-content/uploads/2023/06/2561151_Mungari-minelife-extended-to-15-years.pdf)

Kunanalling -

The Kunanalling gold project is located directly adjacent to the Castle Hill project tenure and covers the southern strike extent of the Kunanalling Shear Zone. Vox management estimates that the Kunanalling royalty tenure covers the majority (

Table 2: Kunanalling Mineral Resources (December 2015)

(Source: Evolution Mining Mineral Resources & Reserves Statement, December 2015)

In the September 2011 Quarter, Phoenix completed a feasibility study for the Catherwood gold deposit, which contemplated the mining and treatment of 314,000t of ore at 2.7g/t Au for 27,000oz gold mined and 25,300oz gold recovered via a nearby gold processing plant.

Halls Creek / Mt Angelo North -

The Halls Creek Copper Project is located 25km southwest of Halls Creek in Western Australia's Kimberley region. The project area is underlain by metamorphosed rocks of the Halls Creek Mobile Zone, which are highly prospective for a range of commodities including gold, silver, copper, nickel, lead and zinc.

The Mount Angelo North deposit is a Volcanogenic Massive Sulphide copper deposit located on royalty-linked mining lease M80/247 with a JORC Code 2012 compliant indicated resource of: 1.0Mt @

- 57m @

5.0% Cu - 43m @

2.1% Cu - 13m @

3.4% Cu

On 1 June 2023, JV partner AuKing Mining Ltd (ASX) announced the results of a positive Scoping Study for the Koongie Park copper/zinc project, which included potential development of the Mt Angelo North deposit. Further information can be found at Cazaly's website here: https://cazalyresources.com.au/projects/halls-creek-western-australia/.

Broken Hill -

The Broken Hill East Project consists of two tenements covering 684.3km2 (EL8434 and EL8435). Since acquiring EL8434 and EL8435 in late 2020, Castillo Copper's strategic intent for the Broken Hill Project is to extend known mineralisation across the project area and enhance the confidence and grade of the June 2022 released Maiden Mineral Resource Estimate (MRE).

The maiden Inferred MRE dated 1 June 2022, compliant with JORC (2012) standards, indicates 64Mt @ 318 ppm Co for 21,556t contained cobalt metal at relatively shallow depths (2-80m). In addition, the global MRE includes 44,260t of Inferred contained copper (63Mt @ 700ppm).

A primarily cobalt-focused drilling campaign, consisting of twelve reverse circulation (RC) boreholes and one diamond drillhole began in October 2022, targeting the Fence Gossan, Reef Tank and Tors Tank Prospects within EL 8434. The results of assays from 7 drillholes in the Fence Gossan and Tors Tank Prospects, along with a geochemical auger survey consisting of 209 stations conducted across Fence Gossan, revealed a noteworthy discovery of shallow clay-hosted Rare Earth Elements (REE).

Although the cobalt assays were in line with expectations, this newfound discovery prompted the Board to shift its strategic focus towards gaining a deeper understanding of the extent of REE mineralisation throughout the broader project area. To assess the feasibility of extracting REE from shallow clay deposits, metallurgical test work was conducted by ALS Perth and ANSTO.

Further information on the Broken Hill project can be found here: https://castillocopper.com/projects/broken-hill/

Qualified Person

Timothy J. Strong, MIMMM, of Kangari Consulting LLC and a "Qualified Person" under NI 43-101, has reviewed and approved the scientific and technical disclosure contained in this press release.

About Vox

Vox is a returns focused mining royalty company with a portfolio of over 60 royalties and streams spanning seven jurisdictions. The Company was established in 2014 and has since built unique intellectual property, a technically focused transactional team and a global sourcing network which has allowed Vox to target the highest returns on royalty acquisitions in the mining royalty sector. Since the beginning of 2020, Vox has announced over 25 separate transactions to acquire over 60 royalties.

Further information on Vox can be found at www.voxroyalty.com.

For further information contact:

Spencer Cole | Kyle Floyd |

Chief Investment Officer | Chief Executive Officer |

spencer@voxroyalty.com | info@voxroyalty.com |

Cautionary Statements to U.S. Securityholders

This press release and the documents incorporated by reference herein, as applicable, have been prepared in accordance with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current standards of the U.S. securities laws. In particular, and without limiting the generality of the foregoing, the terms "mineral reserve", "proven mineral reserve", "probable mineral reserve", "inferred mineral resources,", "indicated mineral resources," "measured mineral resources" and "mineral resources" used or referenced herein and the documents incorporated by reference herein, as applicable, are Canadian mineral disclosure terms as defined in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the "CIM Definition Standards"). In addition to NI 43-101, a number of resource and reserve estimates have been prepared in accordance with the JORC Code (as such term is defined in NI 43-101), which differ from the requirements of NI 43-101 and U.S. securities laws but is defined in NI 43-101 as an "acceptable foreign code". Readers are cautioned that a qualified person has not carried out independent work to validate any NI 43-101 or JORC Code resource and reserve estimates referenced herein.

For U.S. reporting purposes, the U.S. Securities and Exchange Commission (the "SEC") has adopted amendments to its disclosure rules (the "SEC Modernization Rules") to modernize the mining property disclosure requirements for issuers whose securities are registered with the SEC under the U.S. Securities Exchange Act of 1934, as amended, which became effective February 25, 2019. The SEC Modernization Rules more closely align the SEC's disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including NI 43-101, and replace the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7. Issuers were required to comply with the SEC Modernization Rules in their first fiscal year beginning on or after January 1, 2021. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information contained or incorporated by reference herein may not be comparable to similar information disclosed by companies domiciled in the U.S. subject to U.S. federal securities laws and the rules and regulations thereunder.

As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources." In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be "substantially similar" to the corresponding CIM Definition Standards that are required under NI 43-101. While the SEC will now recognize "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", U.S. investors should not assume that all or any part of the mineralization in these categories will be converted into a higher category of mineral resources or into mineral reserves without further work and analysis. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that all or any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable without further work and analysis. Further, "inferred mineral resources" have a greater amount of uncertainty and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of inferred mineral resources will be upgraded to a higher category without further work and analysis. Under Canadian securities laws, estimates of "inferred mineral resources" may not form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms are "substantially similar" to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules or under the prior standards of SEC Industry Guide 7.

Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information

This press release contains "forward-looking statements", within the meaning of the U.S. Securities Act of 1933, as amended, the U.S. Securities Exchange Act of 1934, as amended, the Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate" "plans", "estimates" or "intends" or stating that certain actions, events or results " may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be "forward-looking statements". Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements.

The forward-looking statements and information in this press release include, but are not limited to, summaries of operator disclosure provided by management and the potential impact on the Company of such operator disclosure, statements regarding expectations for the timing of commencement of development, construction at and/or resource production from various mining projects, expectations regarding the size, quality and exploitability of the resources at various mining projects, future operations and work programs of Vox's mining operator partners, the recovery rate from identified mineral resources and reserves, the receipt of expected and potential royalty payments derived from various royalty assets of Vox, anticipated future cash flows and future financial reporting by Vox, and requirements for and operator ability to receive regulatory approvals. In addition, any statements relating to reserves and resources, as well as statements regarding management expectations, are forward-looking statements, as they involve implied assessment based on certain estimates and assumptions, and no assurance can be given that the estimates and assumptions are accurate and that such reserves and resources will be recoverable by the mining operators or realized as royalty or streaming revenue by Vox.

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements, including but not limited to: the impact of general business and economic conditions; the absence of control over mining operations from which Vox will purchase precious metals or from which it will receive royalty or stream payments, and risks related to those mining operations, including risks related to international operations, government and environmental regulation, delays in mine construction and operations, actual results of mining and current exploration activities, conclusions of economic evaluations and changes in project parameters as plans are refined; problems related to the ability to market precious metals or other metals; industry conditions, including commodity price fluctuations, interest and exchange rate fluctuations; interpretation by government entities of tax laws or the implementation of new tax laws; the volatility of the stock market; competition; risks related to Vox's dividend policy; epidemics, pandemics or other public health crises, including the global outbreak of the novel coronavirus, geopolitical events and other uncertainties, such as the conflict in Ukraine and Israel, as well as those factors discussed in the section entitled "Risk Factors" in Vox's annual information form for the financial year ended December 31, 2023 available at www.sedarplus.ca and the SEC's website at www.sec.gov (as part of Vox's Form 40-F).

Should one or more of these risks, uncertainties or other factors materialize, or should assumptions underlying the forward-looking information or statement prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Vox cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

Vox has assumed that the material factors referred to in the previous paragraph will not cause such forward looking statements and information to differ materially from actual results or events. However, the list of these factors is not exhaustive and is subject to change and there can be no assurance that such assumptions will reflect the actual outcome of such items or factors. The forward-looking information contained in this press release represents the expectations of Vox as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While Vox may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

None of the TSX, its Regulation Services Provider (as that term is defined in policies of the TSX) or The Nasdaq Stock Market LLC accepts responsibility for the adequacy or accuracy of this press release.

Technical and Third-Party Information

Except where otherwise stated, the disclosure in this press release is based on information publicly disclosed by project operators based on the information/data available in the public domain as at the date hereof and none of this information has been independently verified by Vox. Specifically, as a royalty investor, Vox has limited, if any, acc ess to the royalty operations. Although Vox does not have any knowledge that such information may not be accurate, there can be no assurance that such information from the project operators is complete or accurate. Some information publicly reported by the project operators may relate to a larger property than the area covered by Vox's royalty interests. Vox's royalty interests often cover less than

References & Notes:

- Castle Hill mineral resource & reserve estimate - Evolution Mining Mungari Expansion Project announcement, June 2023: https://evolutionmining.com.au/wp-content/uploads/2023/06/2561151_Mungari-minelife-extended-to-15-years.pdf

- Mt Angelo North Mineral Resource, published on 31st January 2022:

https://aukingmining.com/site/pdf/5d1ae1e3-d731-47d9-99bf-9beb536ee4b0/Positive-Scoping-Study-results-for-Koongie-Park-copper-proje.pdf - Broken Hill - Maiden Mineral Resource estimate dated 1 June 2022:

https://wcsecure.weblink.com.au/pdf/CCZ/02527247.pdf

SOURCE: Vox Royalty Corp.

View the original press release on accesswire.com