Vista Gold Announces Interim Phase 2 Drilling Results at Mt Todd Including Vein Intercepts with Grade – Thicknesses Greater than 20 g Au/t - m

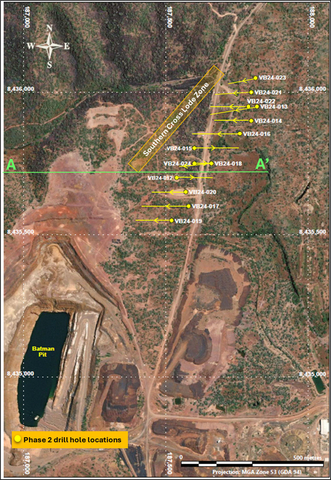

Figure 1: Plan view of the Mt Todd as-built terrain showing Phase 2 drill hole locations with respective orientation to date. (Graphic: Business Wire)

Drill Hole Highlights

VB24-014 – 9.4 meters @ 3.35 grams of gold per tonne (“g Au/t”) from 102.8 meters down hole, including

- 0.5 meters @ 50.0 g Au/t from 111.7 meters down hole (grade thickness of 25.0 g Au/t per meter (“g Au/t – m”)

VB24-015 – Returned three intervals of greater than 1 g Au/t, ranging 3 – 9 meters thick, including

- 8.0 meters at @ 1.82 g Au/t from 132.0 meters down hole, including 1.0 meter @ 12.57 g Au/t from 132.0 meters down hole (grade thickness of 12.57 g Au/t – m)

VB24-016 – Returned three intervals of greater than 1 g Au/t, ranging 6 – 22 meters thick, including

- 22.0 meters at @ 1.74 g Au/t from 146.0 meters down hole, including 2.3 meters @ 7.93 g Au/t from 150.7 meters down hole (grade thickness 18.24 g Au/t – m)

VB24-022 – Returned two intervals of greater than 1 g Au/t, with thickness up to 4 meters

- 4 meters at @ 7.18 g Au/t from 106.0 meters down hole, including 1.0 meter @ 25.89 g Au/t from 106.0 meters down hole (grade thickness of 25.89 g Au/t m)

- 3.8 meters at @ 3.25 g Au/t from 136.4 meters down hole, including 0.6 meters @ 18.13 g Au/t from 136.4 meters down hole (grade thickness of 10.88 g Au/t – m)

VB24-024 – near surface high-grade interval of 5.0 meters @ 2.18 g Au/t from 9.0 meters down hole, including

- 1.1 meters @ 6.37 g Au/t from 12.9 meters down hole (grade thickness of 7.01 g Au/t – m)

Phase 2 drilling to date has focused on the shallow portion of the SXL and approximately half of the strike length drilled is within the limits of the resource shell, with eight holes drilled (see Figures 1 and 2) in an area previously classified as waste in the 2024 Feasibility Study (as defined below). The overall objective of Phase 2 drilling is to better understand the structure and mineralization of the SXL.

Frederick H. Earnest, President and CEO, commented, “Interim results from the second phase of our Mt Todd drilling program are very encouraging and support our belief that the mineralization in the SXL zone is distinct to the Batman deposit. The SXL zone is host to more discreet and in certain zones, wider high-grade veins with thicknesses that exceed one meter, compared to the thinner, more closely spaced sheeted veins typically observed in the Batman deposit. Drilling in the SXL included several holes that intersected higher-grade mineralized veins within the limits of our resource pit. Phase 2 of the drilling program is expected to be completed by the end of this year.

“At the conclusion of the 2024 drilling program, we plan to update the Mt Todd mineral resource estimate. We will leverage the results of prior technical studies to advance evaluations of a development scenario for Mt Todd, initially targeting 150,000 to 200,000 ounces of annual gold production, with a raised cut-off grade of 0.45 to 0.50 g Au/t. We are targeting a mineral reserve grade of approximately 1 g Au/t and an initial capex of less than

“This work is expected to further de-risk the Mt Todd project and position it as a leading, shovel-ready development opportunity. We expect continued strength in the gold price and believe our strategy of advancing Mt Todd with discipline will deliver a more fully valued project.”

Figure 1 displays the plan view of the current topography at the Mt Todd project and Phase 2 drill hole locations with orientations to date. Figure 2 shows the locations of the drill holes relative to the 2024 Feasibility Study resource shell and the current pit design. Figure 3 is a cross-section view of the drill results for VB24-012, VB24-018 and VB24-024, the resource block model, resource shell, and pit design on the 8435720N cross-section as defined by the 2024 Feasibility Study. Table 1 highlights multiple vein intercepts with grades above 5 g Au/t. A total of 12 holes intercepted near-surface mineralized zones (<100 m depth) with grades ranging from 0.41 to 4.77 g Au/t.

Table 1. Summary of Phase 2 Drill Hole Program to Date – highlighting intercepts greater than 5 g Au/t.

| Hole No. | Grid Coordinates | Survey Data | Intersections | ||||||||||

| MGA94 Grid Easting | MGA94 Grid Northing | RL (m) | Azimuth (°) | Dip (°) | Depth (m) | From (m) | To (m) | Interval (m) | True Thickness (m) | Grade (g Au/t) | Sample Type | ||

| VB24-012 | 187535 |

8435697 |

139.0 |

88.7 |

-55.9 |

122.3 |

|

75.0 |

78.0 |

3.0 |

1.0 |

1.14 |

HQ ½ Core |

|

|

|

|

|

|

|

117.0 |

122.3 |

5.3 |

1.8 |

0.52 |

HQ ½ Core | |

|

|

|

|

|

|

|

|

|

|

|

|

||

| VB24-013 | 187821 |

8435944 |

143.0 |

266.7 |

-56.5 |

174.0 |

|

16.2 |

24.0 |

7.8 |

4.7 |

0.55 |

HQ ½ Core |

|

|

|

|

|

|

and |

40.0 |

49.0 |

9.0 |

5.3 |

0.65 |

HQ ½ Core | |

|

|

|

|

|

|

and |

150.0 |

154.8 |

4.8 |

2.8 |

1.66 |

HQ ½ Core | |

|

|

|

|

|

|

including |

150.0 |

151.0 |

1.0 |

0.6 |

7.59 |

HQ ½ Core | |

|

|

|

|

|

|

|

|

|

|

|

|

||

| VB24-014 | 187802 |

8435896 |

140.0 |

266.7 |

-55.6 |

139.4 |

|

102.8 |

112.2 |

9.4 |

5.8 |

3.35 |

HQ ½ Core |

|

|

|

|

|

|

including |

111.7 |

112.2 |

0.5 |

0.3 |

50.00 |

HQ ½ Core | |

|

|

|

|

|

|

|

|

|

|

|

|

||

| VB24-015 | 187597 |

8435799 |

140.0 |

87.2 |

-55.6 |

161.3 |

|

29.0 |

35.0 |

6.0 |

2.0 |

0.50 |

HQ ½ Core |

|

|

|

|

|

|

and |

46.0 |

50.0 |

4.0 |

2.3 |

0.58 |

HQ ½ Core | |

|

|

|

|

|

|

and |

56.0 |

59.0 |

3.0 |

1.7 |

4.77 |

HQ ½ Core | |

|

|

|

|

|

|

and |

67.0 |

75.0 |

8.0 |

4.6 |

0.57 |

HQ ½ Core | |

|

|

|

|

|

|

and |

83.0 |

92.0 |

9.0 |

5.2 |

1.18 |

HQ ½ Core | |

|

|

|

|

|

|

and |

121.0 |

123.3 |

2.3 |

1.3 |

2.59 |

HQ ½ Core | |

|

|

|

|

|

|

and |

132.0 |

140.0 |

8.0 |

4.7 |

1.82 |

HQ ½ Core | |

|

|

|

|

|

|

including |

132.0 |

133.0 |

1.0 |

0.6 |

12.57 |

HQ ½ Core | |

|

|

|

|

|

|

|

|

|

|

|

|

||

| VB24-016 | 187756 |

8435860 |

135.0 |

271.8 |

-56.0 |

173.7 |

|

111.0 |

120.0 |

9.0 |

5.0 |

1.01 |

HQ ½ Core |

|

|

|

|

|

|

and |

124.0 |

130.0 |

6.0 |

3.3 |

1.52 |

HQ ½ Core | |

|

|

|

|

|

|

including |

127.0 |

128.0 |

1.0 |

0.6 |

6.81 |

HQ ½ Core | |

|

|

|

|

|

|

and |

146.0 |

168.0 |

22.0 |

12.1 |

1.74 |

HQ ½ Core | |

|

|

|

|

|

|

including |

150.7 |

153.0 |

2.3 |

1.2 |

7.93 |

HQ ½ Core | |

|

|

|

|

|

|

|

|

|

|

|

|

||

| VB24-017 | 187576 |

8435601 |

137.0 |

270.2 |

-55.1 |

151.2 |

|

95.8 |

130.0 |

34.2 |

20.3 |

0.43 |

HQ ½ Core |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

| VB24-018 | 187660 |

8435746 |

137.0 |

269.7 |

-56.2 |

150.2 |

|

49.0 |

73.0 |

24.0 |

13.3 |

0.78 |

HQ ½ Core |

|

|

|

|

|

|

including |

62.0 |

64.2 |

2.2 |

1.2 |

5.96 |

HQ ½ Core | |

|

|

|

|

|

|

and |

109.0 |

126.0 |

17.0 |

9.4 |

0.72 |

HQ ½ Core | |

|

|

|

|

|

|

including |

114.0 |

126.0 |

12.0 |

6.6 |

0.90 |

HQ ½ Core | |

|

|

|

|

|

|

|

|

|

|

|

|

||

| VB24-019 | 187516 |

8435549 |

142.0 |

266.9 |

-60.1 |

141.6 |

|

29.0 |

36.6 |

7.6 |

3.8 |

0.82 |

HQ ½ Core |

|

|

|

|

|

|

and |

64.0 |

72.0 |

8.0 |

4.0 |

0.44 |

HQ ½ Core | |

|

|

|

|

|

|

and |

136.6 |

141.6 |

5.0 |

2.5 |

0.42 |

HQ ½ Core | |

|

|

|

|

|

|

|

|

|

|

|

|

||

| VB24-020 | 187568 |

8435647 |

142.0 |

267.4 |

-60.0 |

141.0 |

|

35.0 |

45.1 |

10.1 |

5.1 |

0.69 |

HQ ½ Core |

|

|

|

|

|

|

and |

67.1 |

77.0 |

9.9 |

5.0 |

0.44 |

HQ ½ Core | |

|

|

|

|

|

|

and |

96.0 |

102.4 |

6.4 |

3.3 |

2.49 |

HQ ½ Core | |

|

|

|

|

|

|

and |

121.0 |

130.0 |

9.0 |

4.6 |

0.48 |

HQ ½ Core | |

|

|

|

|

|

|

|

|

|

|

|

|

||

| VB24-021 | 187797 |

8436003 |

143.0 |

266.5 |

-59.5 |

154.7 |

|

0.0 |

4.0 |

4.0 |

2.0 |

0.81 |

HQ ½ Core |

|

|

|

|

|

|

and |

27.0 |

36.0 |

9.0 |

4.6 |

0.56 |

HQ ½ Core | |

|

|

|

|

|

|

and |

49.0 |

56.0 |

7.0 |

3.6 |

0.74 |

HQ ½ Core | |

|

|

|

|

|

|

and |

84.0 |

114.0 |

30.0 |

15.2 |

0.72 |

HQ ½ Core | |

|

|

|

|

|

|

and |

127.0 |

135.0 |

8.0 |

4.1 |

0.62 |

HQ ½ Core | |

|

|

|

|

|

|

|

|

|

|

|

|

||

| VB24-022 | 187785 |

8435950 |

142.0 |

268.4 |

-60.0 |

151.4 |

|

45.0 |

50.0 |

5.0 |

2.5 |

0.51 |

HQ ½ Core |

|

|

|

|

|

|

and |

106.0 |

110.0 |

4.0 |

2.0 |

7.18 |

HQ ½ Core | |

|

|

|

|

|

|

including |

106.0 |

107.0 |

1.0 |

0.5 |

25.89 |

HQ ½ Core | |

|

|

|

|

|

|

and |

115.0 |

125.0 |

10.0 |

4.9 |

0.85 |

HQ ½ Core | |

|

|

|

|

|

|

and |

136.4 |

140.2 |

3.8 |

2.0 |

3.25 |

HQ ½ Core | |

|

|

|

|

|

|

including |

136.4 |

137.0 |

0.6 |

0.3 |

18.13 |

HQ ½ Core | |

|

|

|

|

|

|

|

|

|

|

|

|

||

| VB24-023 | 187818 |

8436053 |

144.0 |

264.8 |

-59.1 |

155.4 |

|

5.0 |

13.9 |

8.9 |

4.6 |

0.41 |

HQ ½ Core |

|

|

|

|

|

|

and |

48.0 |

53.4 |

5.4 |

2.8 |

0.66 |

HQ ½ Core | |

|

|

|

|

|

|

and |

79.0 |

93.0 |

14.0 |

7.1 |

0.67 |

HQ ½ Core | |

|

|

|

|

|

|

and |

97.7 |

104.0 |

6.3 |

3.2 |

0.69 |

HQ ½ Core | |

|

|

|

|

|

|

|

|

|

|

|

|

||

| VB24-024 | 187596 |

8435748 |

139.0 |

88.9 |

-59.5 |

89.1 |

|

9.0 |

14.0 |

5.0 |

2.5 |

2.18 |

HQ ½ Core |

|

|

|

|

|

|

including |

12.9 |

14.0 |

1.1 |

0.6 |

6.37 |

HQ ½ Core | |

|

|

|

|

|

|

and |

20.0 |

24.0 |

4.0 |

2.0 |

0.61 |

HQ ½ Core | |

|

|

|

|

|

|

and |

38.1 |

49.0 |

10.9 |

5.6 |

0.98 |

HQ ½ Core | |

|

|

|

|

|

|

and |

74.0 |

84.2 |

10.2 |

5.2 |

0.59 |

HQ ½ Core | |

Notes: |

|

(i) |

Results are based on ore grade 50g fire assay for Au. |

(ii) |

Intersections are from diamond core drilling with half-core samples. |

(iii) |

Core sample intervals were constrained by geology, alteration or structural boundaries, intervals varied between a minimum of 0.2 meters to a maximum of 1.2 meters. |

(iv) |

Mean grades have been calculated on a 0.4g Au/t lower cut-off grade with no upper cut-off grade applied, and maximum internal waste of 4.0 meters. |

(v) |

All intersections are downhole intervals. |

(vi) |

All downhole deviations have been verified by downhole camera and or downhole gyro. |

(vii) |

Collar coordinates are given as Map Grid Australia MGA94 using a multi-band GNSS Garmin GPS 750i. |

(viii) |

The Company maintains a Quality Assurance and Quality Control procedures (QA/QC) program in accordance with the requirements and guidelines of CIM Standards of Disclosure for Mineral Projects. |

(ix) |

The independent laboratory responsible for the assays was North Australian Laboratories Pty Ltd, Pine Creek, NT. |

QA/QC Protocols and Sampling Procedure

All sampling was conducted under the supervision of the Company's geologists and the chain of custody from Mt Todd facilities to the independent sample preparation facility at North Australian Laboratories Pty Ltd. (“NAL”) in Pine Creek, NT was continuously monitored.

- The core is marked, geologically logged, geotechnically logged, photographed, and sawn into halves using diamond saws. One-half is placed into pre-numbered sample bags as per industry standards with sample lengths between a minimum of 0.2 meters to a maximum of 1.2 meters. The other half of the core is retained for future reference by the Company. The only exception to this is when a portion of the remaining core has been flagged for use in metallurgical testwork.

- Following common industry practices, blanks and standards are also placed in plastic bags for inclusion in the shipment. A reference blank or a standard is inserted at a minimum ratio of 1 in 10 and additional blank samples are added at suspected high-grade intervals. Standard reference material is sourced from Ore Research & Exploration Pty Ltd and provided in 60-gram sealed packets. When a sequence of four samples is completed, they are placed in a shipping bag and tied closed. All of these samples are kept in a secure area on-site until crated for shipping.

- Vista employees ship and transport the samples to the NAL. At the lab, the samples are pulverized and split down to 50-gram assay samples prior to assaying. The industry-standard 3 assay-ton fire assay is followed by an atomic absorption (AA) finish.

- For the purposes of this release, mineralized intervals are defined as runs of mineralization with a maximum internal waste of 4.0 meters.

- NAL is independent of Vista.

It is the opinion of the QP (as defined below) that the sample preparation methods and quality control measures employed before the dispatch of samples to an analytical or testing laboratory ensured the validity and integrity of samples taken.

Maria Vallejo, Vista’s Director of Projects and Technical Services, a Qualified Person (“QP”) as defined by Item 1300 of Regulation S-K under the Securities Exchange Act of 1934, as amended, and Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has verified the data underlying the information contained herein and has approved this press release. The information contained in this press release is provided to inform the reader of the advancement of the 2024 drilling program for the Mt Todd project.

For more information on the Company’s March 2024 feasibility study (the “2024 Feasibility Study”), including with respect to mineral resource and mineral reserve estimates, please refer to the technical report summary entitled “S-K 1300 Technical Report Summary – Mt Todd Gold Project – 50,000 tpd Feasibility Study –

About Vista Gold Corp.

Vista holds the Mt Todd gold project, an advanced development-stage gold deposit located in the low risk, Tier-1 mining friendly jurisdiction of

Vista believes that Mt Todd is an especially attractive shovel-ready development opportunity in the current environment of a strong gold market, diminishing major gold deposit discoveries, and depleting gold reserves.

The Company believes that Vista and its shareholders will be major beneficiaries of a strong gold market and rising gold prices. Vista’s strategy is to advance Mt Todd in ways that efficiently position the Project for development while exercising the discipline necessary to best realize value at the right time.

For further information about Vista or Mt Todd, please contact Pamela Solly, Vice President of Investor Relations, at (720) 981-1185 or visit the Company’s website at www.vistagold.com.

Forward Looking Statements

This news release contains forward-looking statements within the meaning of the

View source version on businesswire.com: https://www.businesswire.com/news/home/20240923441188/en/

Pamela Solly

Vice President of Investor Relations

(720) 981-1185

Source: Vista Gold Corp.