US Foods Files Preliminary Proxy Statement and Appoints Two New Directors to Board

US Foods Holding Corp. (NYSE: USFD) has filed its preliminary proxy materials for the 2022 Annual Meeting, announcing new independent director nominees, Marla Gottschalk and Quentin Roach. Both bring extensive supply chain and financial expertise. Longtime CEO John Lederer will retire at this meeting. The Board aims to drive shareholder value through a long-range plan focusing on growth and operational efficiency, targeting ~$1.7 billion in Adjusted EBITDA by 2024. The Board's commitment to governance best practices includes the addition of six independent directors over four years and a diverse slate for the upcoming election.

- Appointment of Marla Gottschalk and Quentin Roach enhances supply chain and financial expertise on the Board.

- Projected Adjusted EBITDA of ~$1.7 billion by 2024 indicates strong growth potential.

- Past initiatives resulted in a 27% organic growth and $1 billion in new customer wins over two years.

- Departure of John Lederer raises concerns about leadership continuity.

- Ongoing proxy contest with Sachem Head may distract from strategic initiatives.

Highlights Plan to Drive Value and Governance Achievements

Sachem Head Continues to Demand Control of the Board

Total Shareholder Return –

In connection with the filing of the preliminary proxy materials, the Board disclosed its slate of director candidates for the 2022 Annual Meeting, which includes two new independent director candidates,

-

Marla Gottschalk is an accomplished executive with more than 25 years of experience in Consumer Products.Ms. Gottschalk most recently served as Chief Executive Officer ofThe Pampered Chef Ltd. , the premier direct seller of high-quality kitchen and entertaining products, from 2006 to 2013 and as President and Chief Operating Officer from 2003 to 2006. Prior toThe Pampered Chef ,Ms. Gottschalk served in a variety of senior roles atKraft Foods , including as Senior Vice President of Financial Planning and Investor Relations, Executive Vice President and General Manager of the Post Cereal division, and Vice President of Marketing and Strategy of the Kraft Cheese Division.Ms. Gottschalk is currently a member of the boards of directors of Reynolds Consumer Products,Potbelly Sandwich Works , Big Lots, Inc. and privately-heldUL, Inc. , and was previously a strategic board advisor for privately-held Ocean Spray Cranberries, Inc.Ms. Gottschalk brings strong strategic, financial and governance acumen, informed by her prior executive and board experience, and qualifies as a financial expert.

-

Quentin Roach has served as Senior Vice President and Chief Procurement Officer at Mondelez International since 2020 and brings more than two decades of global supply chain leadership experience. Prior to Mondelez,Mr. Roach served as the Chief Procurement Officer and Senior Vice President of Global Supplier Management and Workplace Enterprise Services at Merck & Co., Inc. and as the Senior Vice President and Chief Procurement Officer at Bristol Myers Squibb.Mr. Roach served in positions of increasing responsibility, including those related to supply chain management, at Bausch & Lomb,Strong Health ,Delphi Corporation andGeneral Motors Corporation .Mr. Roach has deep expertise in supplier relationship management, sourcing strategies and material procurement, as well as governance experience gained as an independent director on the board ofARMADA Supply Chain Solutions , a leading provider of supply chain management services for the foodservice industry.

As part of the Board’s refreshment process,

“US Foods has demonstrated a consistent openness to change, substantially enhancing the composition and structure of our Board over the last several years to best support our efforts to create value for shareholders,” said

Clear Plan to Drive Value Creation

- Increase market share across all target customer types;

-

Deliver

27% organic independent growth, in line with or better than peers1; -

Secure

~ in net new national customer wins over the last two years;$1 billion - Achieve the highest Gross Profit per case since IPO;

-

Reduce administrative and selling costs by

$130 million -

Reduce assortment by

15% ; and -

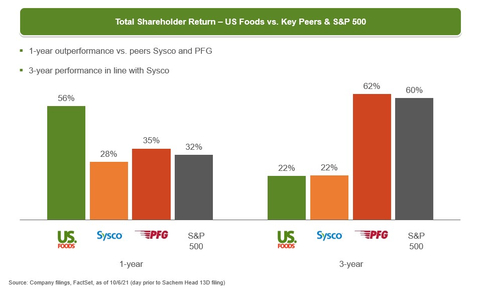

Achieve best-in-class one-year total shareholder return (TSR) of

56% as ofOctober 6, 2021 (the last day prior to Sachem Head’s Schedule 13D), beating both US Foods’ peers and the S&P 500 and showing significant improvement from previous years, as the Company has led the post-pandemic recovery (see associated graph).

Building on this momentum, the Company expects to deliver

Longstanding and Ongoing Commitment to Governance Best Practices

US Foods’ director nominees for the 2022 Annual Meeting include individuals with expertise in the foodservice and restaurant industry as well as distribution, finance, technology, governance and C-suite operating experience. In addition, US Foods’ Board has a track record of effecting change in the service of US Foods’ shareholders:

- Added six new independent directors over the last four years, reflecting an average tenure of approximately four years as of the conclusion of the 2022 Annual Meeting;

- Separated the Chairman and CEO roles;

-

Cultivated a Board with diverse directors comprising

45% of the proposed slate of candidates; - Declassified the Board, as of its 2022 Annual Meeting;

- Eliminated the previous supermajority voting requirement to amend the bylaws, as highlighted in its 2021 proxy statement;

- Adopted a majority voting standard for director elections with a director resignation policy and a plurality carveout in uncontested director elections, a change that was implemented in 2021;

- Created “Value Creation Awards” in 2021, with vesting tied to rigorous TSR growth targets over a four-year performance period; and

- Implemented a rotation of committee chairs.

Sachem Head Refused to Engage in Good Faith

-

During private engagement between October and

December 2021 , Sachem Head proposed three candidates for election to the Board:Scott Ferguson (Sachem Head’s principal),Bernardo Hees andDavid Toy . -

In

December 2021 , consistent with practice and after conducting background checks, the Board interviewed each of Sachem Head’s three original nominees. -

Following the interviews, on

December 17, 2021 ,US Foods offeredScott Ferguson a seat on the Board. The Board also offered to add a second new director with supply chain leadership experience and proposed to work with Sachem Head to identify the right candidate. Sachem Head was asking for three seats;US Foods offered two. -

After not hearing back from Sachem Head, the Board reached out again in early January to

Mr. Ferguson .Mr. Ferguson made it clear there would be no path to settlement without Bernardo Hees’ involvement and did not engage beyond that. -

On

February 14, 2022 , Sachem Head leaked a shareholder letter to the media and then proceeded to nominate seven director candidates to the 10-member Board. This shareholder letter was the first timeUS Foods heard about the four additional Sachem Head candidates. -

On

March 15, 2022 , after conducting background checks, the Board reached out again to Sachem Head and offered to interview three of the four new candidates in another genuine attempt to explore a potential amicable resolution. Two days later, Sachem Head filed its preliminary proxy materials. -

On

March 19, 2022 , on a call with US Foods’ Chairman and another independent director,Mr. Ferguson refused the Board’s offer to interview any Sachem Head nominees, and demanded that the Board give Sachem Head the majority of seats on the Board. Even though he noted twice during the call that a potential proxy contest would be a “nail biter,”Mr. Ferguson further stated that he would proceed with his proxy contest if his demands were not met.

The Board remains open to constructive engagement with the goal of enhancing value for all

About

With a promise to help its customers Make It,

Additional Information

The Company intends to file a definitive proxy statement on Schedule 14A, an accompanying WHITE proxy card and other relevant documents with the

Participants in the Solicitation

The Company, its directors and certain of its executive officers are participants in the solicitation of proxies from the Company’s shareholders in connection with matters to be considered at the Company’s 2022 annual meeting of shareholders. Information regarding the direct and indirect interests, by security holdings or otherwise, of the Company’s directors and executive officers is included in the Company’s Proxy Statement on Schedule 14A for its 2021 annual meeting of shareholders, filed with the

Forward-Looking Statements

Statements in this press release which are not historical in nature are “forward-looking statements” within the meaning of the federal securities laws. These statements often include words such as “believe,” “expect,” “project,” “anticipate,” “intend,” “plan,” “outlook,” “estimate,” “target,” “seek,” “will,” “may,” “would,” “should,” “could,” “forecast,” “mission,” “strive,” “more,” “goal,” or similar expressions and are based upon various assumptions and our experience in the industry, as well as historical trends, current conditions, and expected future developments. However, you should understand that these statements are not guarantees of performance or results and there are a number of risks, uncertainties and other factors that could cause our actual results to differ materially from those expressed in the forward-looking statements, including, among others: cost inflation/deflation and commodity volatility; competition; reliance on third party suppliers; interruption of product supply or increases in product costs; changes in our relationships with customers and group purchasing organizations; our ability to increase or maintain the highest margin portions of our business; effective integration of acquisitions; achievement of expected benefits from cost savings initiatives; fluctuations in fuel costs; economic factors affecting consumer confidence and discretionary spending; changes in consumer eating habits; our reputation in the industry; labor relations and costs; access to qualified and diverse labor; cost and pricing structures; changes in tax laws and regulations and resolution of tax disputes; governmental regulation; product recalls and product liability claims; adverse judgments or settlements resulting from litigation; disruptions of existing technologies and implementation of new technologies; cybersecurity incidents and other technology disruptions; management of retirement benefits and pension obligations; extreme weather conditions, natural disasters and other catastrophic events; risks associated with intellectual property, including potential infringement; indebtedness and restrictions under agreements governing indebtedness; potential interest rate increases; risks related to the impact of the ongoing COVID-19 outbreak on our business, suppliers, consumers, customers and employees; and potential costs associated with shareholder activism.

Non-GAAP Financial Measures

We report our financial results in accordance with

Management uses non-GAAP financial measures (a) to evaluate our historical and prospective financial performance as well as our performance relative to our competitors as they assist in highlighting trends, (b) to set internal sales targets and spending budgets, (c) to measure operational profitability and the accuracy of forecasting, (d) to assess financial discipline over operational expenditures, and (e) as an important factor in determining variable compensation for management and employees. EBITDA and Adjusted EBITDA are also used in connection with certain covenants and restricted activities under the agreements governing our indebtedness. We also believe these and similar non-GAAP financial measures are frequently used by securities analysts, investors, and other interested parties to evaluate companies in our industry.

We caution readers that our definition of Adjusted EBITDA may not be calculated in the same manner as similar measures used by other companies. The reconciliations of this non-GAAP financial measure to the most comparable GAAP financial measure is included in the schedule attached to this press release.

Non-GAAP Reconciliation (Unaudited) |

|||||||||||

|

|

For the quarter ended |

|||||||||

|

|

Consolidated |

|||||||||

($ in millions, except share and per share data) |

|

|

|

|

|

Change |

|

% |

|||

Net income (loss) available to common shareholders (GAAP) |

|

|

|

|

|

) |

|

|

|

|

NM |

Series A Preferred Stock Dividends |

|

(10 |

) |

|

(13 |

) |

|

3 |

|

|

(23.1)% |

Net income (loss) (GAAP) |

|

69 |

|

|

(10 |

) |

|

79 |

|

|

NM |

Interest expense—net |

|

55 |

|

|

60 |

|

|

(5 |

) |

|

(8.3)% |

Income tax provision (benefit) |

|

20 |

|

|

(15 |

) |

|

35 |

|

|

NM |

Depreciation expense |

|

81 |

|

|

86 |

|

|

(5 |

) |

|

(5.8)% |

Amortization expense |

|

11 |

|

|

20 |

|

|

(9 |

) |

|

(45.0)% |

EBITDA (Non-GAAP) |

|

236 |

|

|

141 |

|

|

95 |

|

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|||

Share-based compensation expense (1) |

|

12 |

|

|

11 |

|

|

1 |

|

|

|

LIFO reserve adjustments (2) |

|

15 |

|

|

16 |

|

|

(1 |

) |

|

(6.3)% |

Business transformation costs (3) |

|

5 |

|

|

14 |

|

|

(9 |

) |

|

(64.3)% |

COVID-19 bad debt benefit (4) |

|

— |

|

|

(18 |

) |

|

18 |

|

|

(100.0)% |

COVID-19 product donations and inventory adjustments (5) |

|

— |

|

|

10 |

|

|

(10 |

) |

|

(100.0)% |

COVID-19 other related expenses (6) |

|

2 |

|

|

(2 |

) |

|

4 |

|

|

(200.0)% |

Business acquisition and integration related costs and other (7) |

|

(8 |

) |

|

2 |

|

|

(10 |

) |

|

NM |

Adjusted EBITDA (Non-GAAP) |

|

262 |

|

|

174 |

|

|

88 |

|

|

|

NM - Not Meaningful

- Share-based compensation expense for expected vesting of stock awards and employee stock purchase plan.

- Represents the non-cash impact of LIFO reserve adjustments.

- Consists primarily of costs related to significant process and systems redesign across multiple functions.

- Includes the changes in the reserve for doubtful accounts expense reflecting the collection risk associated with our customer base as a result of the COVID-19 pandemic.

- Includes COVID-19 related expenses related to inventory adjustments and product donations.

- Includes COVID-19 costs that we are permitted to addback under certain agreements governing our indebtedness.

-

Includes: (i) aggregate acquisition and integration related costs of

$6 million $2 million January 1, 2022 and the 14 weeks endedJanuary 2, 2021 , respectively; (ii) favorable legal settlement recovery of$16 million January 1, 2022 ; and (iii) other gains, losses or costs that we are permitted to addback for purposes of calculating Adjusted EBITDA under certain agreements governing our indebtedness.

1 Organic independent volume growth excludes extra week in the 4th Quarter of FY 2020.

2 Assumes full run-rate synergies of

View source version on businesswire.com: https://www.businesswire.com/news/home/20220328005977/en/

INVESTOR CONTACT:

847-720-2767

Melissa.Napier@usfoods.com

212-297-0720

MEDIA CONTACT:

212-355-4449

Source:

FAQ

What is the strategic plan for US Foods following the 2022 Annual Meeting?

Who are the newly appointed directors for US Foods?

What does the retirement of John Lederer mean for US Foods?

How has US Foods performed in the past year?