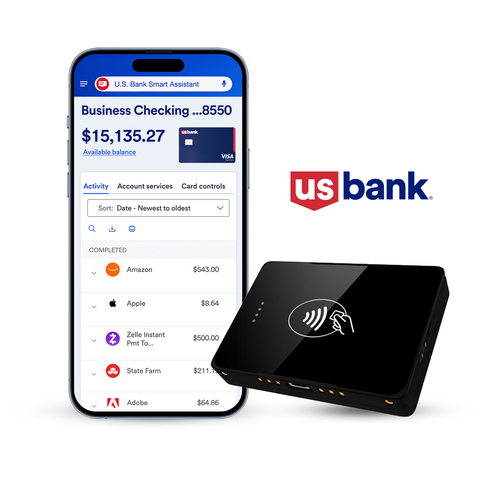

U.S. Bank Introduces All-in-One Business Checking Plus Payments Acceptance to Help Business Owners Save Time and Money

U.S. Bank (USB) has unveiled its new Business Essentials product, an innovative all-in-one business checking solution that combines payment acceptance capabilities with premium banking features. The account offers zero monthly maintenance fees and includes:

- Free same-day access to card payment funds

- Unlimited digital transactions

- Complimentary mobile card reader

- Fraud prevention tools

- Integrated digital dashboard

- Accounting software integration

This launch responds to market demand, as revealed by U.S. Bank's national survey where 80% of small business owners expressed preference for bundled digital banking and payment services. The bank currently serves over 1.4 million small business clients with comprehensive banking, payments, and digital solutions.

U.S. Bank (USB) ha presentato il suo nuovo prodotto Business Essentials, una soluzione innovativa di conto corrente aziendale tutto-in-uno che combina le capacità di accettazione dei pagamenti con funzionalità bancarie premium. Il conto offre zero spese di gestione mensili e include:

- Accesso gratuito ai fondi dei pagamenti con carta lo stesso giorno

- Transazioni digitali illimitate

- lettore di carte mobile gratuito

- Strumenti di prevenzione delle frodi

- Dashboard digitale integrata

- Integrazione con software di contabilità

Questa iniziativa risponde alla domanda di mercato, come rivelato dal sondaggio nazionale di U.S. Bank, dove l'80% dei proprietari di piccole imprese ha espresso preferenza per servizi bancari digitali e di pagamento combinati. La banca attualmente serve oltre 1,4 milioni di clienti di piccole imprese con soluzioni bancarie, di pagamento e digitali complete.

U.S. Bank (USB) ha presentado su nuevo producto Business Essentials, una solución innovadora de cuenta corriente empresarial todo en uno que combina capacidades de aceptación de pagos con características bancarias premium. La cuenta ofrece cero tarifas de mantenimiento mensual e incluye:

- Acceso gratuito a fondos de pagos con tarjeta el mismo día

- Transacciones digitales ilimitadas

- Lector de tarjetas móvil gratuito

- Herramientas de prevención de fraudes

- Tablero digital integrado

- Integración con software de contabilidad

Este lanzamiento responde a la demanda del mercado, como revela la encuesta nacional de U.S. Bank, donde el 80% de los propietarios de pequeñas empresas expresó preferencia por servicios bancarios digitales y de pago agrupados. Actualmente, el banco atiende a más de 1.4 millones de clientes de pequeñas empresas con soluciones bancarias, de pagos y digitales integrales.

U.S. Bank (USB)는 결제 수용 기능과 프리미엄 뱅킹 기능을 결합한 혁신적인 올인원 비즈니스 체크 솔루션인 Business Essentials 제품을 발표했습니다. 이 계좌는 월 유지비가 0원이며 다음과 같은 혜택을 포함합니다:

- 카드 결제 자금에 대한 무료 당일 접근

- 무제한 디지털 거래

- 무료 모바일 카드 리더기

- 사기 방지 도구

- 통합 디지털 대시보드

- 회계 소프트웨어 통합

이번 출시 는 U.S. Bank의 전국 설문 조사에서 80%의 소기업 소유자가 번들된 디지털 뱅킹 및 결제 서비스에 대한 선호를 나타낸 시장 수요에 대한 응답입니다. 이 은행은 현재 140만 개 이상의 소기업 고객에게 종합적인 뱅킹, 결제 및 디지털 솔루션을 제공하고 있습니다.

U.S. Bank (USB) a dévoilé son nouveau produit Business Essentials, une solution innovante de compte courant professionnel tout-en-un qui combine des capacités d'acceptation de paiements avec des fonctionnalités bancaires premium. Le compte propose aucune frais de maintenance mensuel et comprend :

- Accès gratuit aux fonds de paiement par carte le jour même

- Transactions numériques illimitées

- Lecteur de carte mobile gratuit

- Outils de prévention des fraudes

- Tableau de bord numérique intégré

- Intégration avec des logiciels de comptabilité

Ce lancement répond à la demande du marché, comme le révèle l'enquête nationale de U.S. Bank où 80% des propriétaires de petites entreprises ont exprimé une préférence pour des services bancaires et de paiement numériques regroupés. La banque sert actuellement plus de 1,4 million de clients de petites entreprises avec des solutions bancaires, de paiement et numériques complètes.

U.S. Bank (USB) hat sein neues Produkt Business Essentials vorgestellt, eine innovative All-in-One Geschäftskontenlösung, die Zahlungsakzeptanzfunktionen mit Premium-Banking-Features kombiniert. Das Konto bietet keine monatlichen Kontoführungsgebühren und umfasst:

- Kostenlosen Zugriff auf Kartenzahlungsfonds am selben Tag

- Unbegrenzte digitale Transaktionen

- Kostenloses mobiles Kartenlesegerät

- Betrugspräventionstools

- Integriertes digitales Dashboard

- Integration mit Buchhaltungssoftware

Diese Einführung reagiert auf die Marktnachfrage, wie eine nationale Umfrage von U.S. Bank zeigt, in der 80% der Kleinunternehmer eine Vorliebe für gebündelte digitale Bank- und Zahlungsdienste äußerten. Die Bank betreut derzeit über 1,4 Millionen Kleinunternehmer mit umfassenden Bank-, Zahlungs- und digitalen Lösungen.

- Zero monthly maintenance fees reduces operating costs for businesses

- Free same-day access to card payment funds improves cash flow management

- Unlimited digital transactions without additional fees

- Complimentary mobile card reader included for new customers

- Integration with accounting software streamlines business operations

- Same-day funding speeds may vary between weekdays and weekends

- Additional service fees may apply for certain transactions

- Free card reader to one per new account

Insights

U.S. Bank's new Business Essentials product represents a strategic evolution in their small business banking approach. This all-in-one solution combines checking with payments processing - a direct response to their research showing

The elimination of monthly maintenance fees while providing same-day funding access is particularly significant. This addresses a critical pain point for small businesses: cash flow management. By offering zero-delay access to card payment proceeds, U.S. Bank helps business owners reduce working capital constraints that typically force them to wait 1-3 days to access their funds.

What's notable is the revenue model shift. While foregoing monthly maintenance fees might seem like revenue sacrifice, U.S. Bank is likely betting on three compensating factors: 1) increased payment processing volume generating interchange revenue, 2) enhanced customer acquisition in the competitive small business segment, and 3) reduced customer churn through deeper integration of banking and operations.

The bundling approach also serves as a defensive move against both traditional competitors and fintech challengers that have been targeting small business customers with specialized solutions. By creating a unified dashboard that integrates with accounting systems, U.S. Bank elevates its value proposition beyond basic banking services.

With 1.4 million small business clients already in their ecosystem, even modest adoption rates could generate meaningful transaction volume growth. The key question is whether operational efficiencies and incremental payment processing revenue will offset the eliminated monthly fees in the near term.

Best-in-class checking account includes card payment acceptance capabilities and zero-cost same-day funding – with no monthly maintenance fee

- Premier checking account with no monthly maintenance fee

- Card payment acceptance with free same-day access to funds, every day of the weeki

- Unlimited digital transactionsiii

- Free mobile card readerii

- Fraud prevention tools

- Simplified money movement within one digital dashboard

- Ability to integrate a business’s accounting and budget management software

- Single application and streamlined onboarding experience

“With Business Essentials, we are making it easier for small business owners to manage their business,” said Shruti Patel, chief product officer for the business banking segment at

“This product exemplifies how the breadth of business offerings under the

For more information on Business Essentials and all the ways

Editor’s Note: The content of this press release is accurate as of publication on April 14 and may have changed. For the latest product information, refer to the

Disclosures:

i Sales are processed daily and deposited into the associated checking account. Funding speeds will vary between weekdays and weekends and are dependent on batch settlement times. Batches will be processed every day, including weekends. Changing the account that your funds are deposited into may impact your funding speeds. Fee to retain daily funding and deposit applies when the associated checking account is a non-

ii One free Ingenico Moby/5500 card reader is included and is only available for customers applying for a new

iii Digital transactions include electronic deposits, electronic withdrawals, ATM transactions, Elavon payment processing credits and chargebacks, electronic transfers, ACH, debit card purchases. Certain transactions may have additional service fees. Refer to

iv

For additional information call 855-955-2760 or visit your local branch for a copy of Business Essentials Pricing Information disclosure or refer to Your Deposit Account Agreement (YDAA).

Deposit products are offered by

About

U.S. Bancorp, with more than 70,000 employees and

View source version on businesswire.com: https://www.businesswire.com/news/home/20250414302442/en/

Media Contact:

Rick Rothacker,

richard.rothacker@usbank.com

Source: U.S. Bancorp