UBS reports 4Q/FY23 results and confirms financial targets, plans to propose USD 0.70 dividend per share, +27% YoY, and to reinstate share repurchases in 2H24 (Ad hoc announcement pursuant to Article 53 of the SIX Exchange Regulation Listing Rules)

4Q23 and FY23 highlights (Graphic: UBS Group AG)

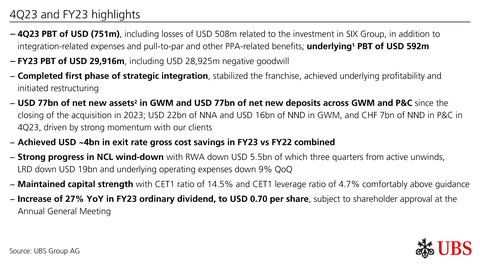

4Q23 and FY23 highlights

-

4Q23 PBT of

USD (751m) , including losses ofUSD 508m related to the investment in SIX Group, in addition to integration-related expenses and pull-to-par and other PPA-related benefits; underlying1 PBT ofUSD 592m -

FY23 PBT of

USD 29,916m , includingUSD 28,925m negative goodwill - Completed first phase of strategic integration, stabilized the franchise, achieved underlying profitability and initiated restructuring

-

USD 77bn of net new assets2 in GWM andUSD 77bn of net new deposits across GWM and P&C since the closing of the acquisition in 2023;USD 22bn of NNA andUSD 16bn of NND in GWM, andCHF 7bn of NND in P&C in 4Q23, driven by strong momentum with our clients - Achieved USD ~4bn in exit rate gross cost savings in FY23 vs FY22 combined

-

Strong progress in NCL wind-down with RWA down

USD 5.5bn of which three quarters from active unwinds, LRD downUSD 19bn and underlying operating expenses down9% QoQ -

Maintained capital strength with CET1 ratio of

14.5% and CET1 leverage ratio of4.7% comfortably above guidance -

Increase of

27% YoY in FY23 ordinary dividend, toUSD 0.70 per share, subject to shareholder approval at the Annual General Meeting

Investor update highlights

-

Re-iterating ~

15% underlying RoCET1 and <70% underlying cost/income ratio exit rate targets by end-2026; well positioned to deliver long-term growth and higher returns with ~18% reported RoCET1 in 2028 -

Targeting USD ~13bn gross cost reductions by end-2026; ~

50% of cumulative exit rate gross cost reductions expected by end-2024 - Cost savings to provide necessary capacity for reinvestment to reinforce the resilience of our combined infrastructure as we absorb Credit Suisse and to drive sustainable growth

-

Ambition to surpass

USD 5trn of invested assets in GWM by 2028, with USD ~100bn of NNA per annum through 2025, building to USD ~200bn per annum by 2028 -

NCL actively run down; underlying operating expenses expected to be USD <1bn and underlying loss before tax expected to be USD ~1bn by end-2026; RWA expected to be around

5% of Group RWA -

Optimizing financial resources to enable sustainable growth and higher returns; USD ~510bn of RWA expected by end-2026; expecting USD ~45bn of RWA reductions in NCL and USD ~15bn of business-led RWA reductions in core divisions from actions to improve capital efficiency;

Basel 3 finalization and migrating Credit Suisse’s portfolios to UBS risk models are expected to increase RWAs in the core divisions byUSD 25bn -

Expecting up to

USD 1bn of funding cost saves by 2026 relative to 2023 levels as a result of lower funding needs, diversified and more stable funding sources, and disciplined deposit pricing - Merger of UBS AG and Credit Suisse AG planned to be completed by the end of 2Q24 and merger of UBS Switzerland AG and Credit Suisse (Schweiz) AG entities planned before the end of 3Q24, which is a critical step in enabling us to unlock the next phase of the cost, capital and funding synergies we expect to realize in 2025 and 2026

-

Delivering attractive capital returns; planning to reinstate share repurchases after completion of UBS AG and Credit Suisse AG merger, with up to

USD 1bn in 2024, committed to progressive dividends and accruing for a mid-teen percentage increase in the dividend per share for 2024; ambition for FY26 share repurchases to exceed FY22 levels

“2023 was a defining year in UBS’s history with the acquisition of Credit Suisse. Thanks to the exceptional efforts of all of our colleagues, we stabilized the franchise and have made tremendous progress in the integration. In addition, clients entrusted us with

Information in this news release is presented for UBS Group AG on a consolidated basis unless otherwise specified. |

1 Underlying results exclude items of profit or loss that management believes are not representative of the underlying performance. Underlying results are a non-GAAP financial measure and alternative performance measure (APM). Refer to “Group Performance” and “Appendix-Alternative Performance Measures” in the financial report for the fourth quarter of and full year 2023 for a reconciliation of underlying to reported results and definitions of the APMs. |

2 Net new assets includes net new money, dividends and interest |

4Q23 and FY23 Group performance

Delivered on integration priorities in 2023

In 2023 we made strong progress following the announcement of the Credit Suisse acquisition, with closing completed in three months, the repayment of the Public Liquidity Backstop and Emergency Liquidity Assistance Plus, the return of the Loss Protection Agreement, the decision to integrate CS (Schweiz) AG and the definition of the NCL perimeter.

Strong momentum with our clients was evidenced by

The Group achieved USD ~4bn in exit rate gross cost savings vs. FY22 combined and we are on track to realize USD ~13bn in exit rate cumulative gross cost saves by end-2026.

Achieved underlying profitability following closing of the acquisition

4Q23 PBT of

FY23 PBT was

Maintained a balance sheet for all seasons

Capital strength is a key pillar of our strategy and we remain committed to maintaining a balance sheet for all seasons. The year-end CET1 capital ratio was

For 2023, the Board of Directors intends to propose a dividend to UBS Group AG shareholders of

Investor update confirms financial targets

Targeting ~

Based on our execution of the integration to date and the completion of our business planning process, we have confirmed our performance targets and capital guidance for the Group. We have also set ambitions for each of the business divisions that collectively are the building blocks towards achieving our targets.

We aim to deliver an underlying return on CET1 capital of ~

Sustainable growth and long-term value creation

Throughout 2024 we will deliver on our priorities while creating long-term sustainable value.

Building on our unrivaled global scale and footprint, GWM aims to surpass

Our consistent investments to improve the client experience and increase efficiency for our combined franchise in

In AM, we expect our improved strategic positioning and product offering, in addition to the realization of cost synergies, to help achieve our ambition of <

Our focus in the IB remains on increasing client relevance while maintaining capital discipline. The IB aims to achieve a ~

Expecting completion of UBS AG and Credit Suisse AG merger by end of 2Q24

In December 2023, the Board of Directors of UBS Group AG approved the merger of UBS AG and Credit Suisse AG, and both entities entered into a definitive merger agreement. The completion of the merger is subject to regulatory approvals and is expected to occur by the end of 2Q24. We also expect to transition to a single US intermediate holding company in 2Q24 and complete the planned merger of UBS Switzerland AG and Credit Suisse (Schweiz) AG in 3Q24.

Completing the mergers of our significant legal entities is a critical step in enabling us to unlock the next phase of the cost, capital and funding synergies we expect to realize in 2025 and 2026. These significant legal-entity mergers are a pre-requisite for the first wave of client migrations and will allow us to begin streamlining and decommissioning legacy Credit Suisse platforms in the second half of 2024.

Targeting USD ~13bn gross cost reductions to achieve <

We expect the execution of our integration plans and the run-down of NCL to result in USD ~13bn in gross cost saves by end-2026 compared to FY22 combined, with ~

Optimizing financial resources to enable efficient long-term growth and sustainably higher returns

Group RWA is expected to be USD ~510bn by end-2026, assuming constant FX rates, including reductions of USD ~45bn in NCL, with the remaining portfolio representing ~

As a result of lower funding needs, diversified and more stable funding sources, and disciplined deposit pricing, we expect to realize funding cost saves of up to

Reaffirming our capital return policy; proposing

For 2023, the Board of Directors plans to propose a dividend to UBS Group AG shareholders of

In 2023, we bought back

Our ambition is for share repurchases to exceed our pre-acquisition levels by 2026.

Outlook

Central banks are widely expected to lower short-term interest rates in 2024. The timing and magnitude of such cuts are still highly uncertain, given the ongoing debate around the pace of inflation converging with central bank targets. In addition, ongoing geopolitical tensions, including the conflicts in the

Notwithstanding the challenges mentioned above, we continue to execute on our strategy and integration plans at pace, and we will actively reduce non-core assets and costs. In the first quarter of 2024, we expect revenues to be positively influenced by seasonal factors, such as higher client activity levels compared with the fourth quarter of 2023. We also expect the Investment Bank to return to profitability, due to improving market activity, a growing banking pipeline and advanced progress on the integration. We expect NII for Personal & Corporate Banking and Global Wealth Management combined, and in US dollar terms, to be roughly flat sequentially in the first quarter, with higher rates broadly offsetting the residual effects of deposit mix shifts and the initial impact of financial resource optimization. These factors are expected to result in substantial sequential improvement in reported net profit in the first quarter, including around

Our focus remains on helping clients navigate challenging market environments to manage the inherent risks and opportunities while continuing to grow our invested assets and delivering on our financial targets.

Fourth quarter 2023 performance overview – Group

Group PBT

PBT was

Global Wealth Management (GWM) PBT

Total revenues increased

Personal & Corporate Banking (P&C) PBT

Total revenues increased

Asset Management (AM) PBT

Total revenues increased

Investment Bank (IB) PBT

Total revenues increased

Non-core and Legacy (NCL) PBT

Total revenues were

Group Items PBT

Changes to the Pension Fund of Credit Suisse in

As of 1 January 2027, the Pension Fund of Credit Suisse will align its Swiss pension scheme to that of the Pension Fund of UBS.

In accordance with International Financial Reporting Standards, the alignment and related mitigating measures led to an increase in UBS’s pension obligations in

UBS’s sustainability approach through the integration

Following the acquisition of Credit Suisse, our ambition is unchanged: to be a global leader in sustainable finance. We want to be the provider of choice for clients who wish to mobilize capital toward the achievement of the United Nations 17 Sustainable Development Goals and the orderly transition to a low-carbon economy.

We are currently evaluating the implications of the acquisition of Credit Suisse for our carbon reduction goals, given the different shape and activities of the businesses. We are conducting a robust risk analysis, assessing and re-baselining the emissions of the combined firm. An update will be provided in our 2023 Sustainability Report to be published on 28 March.

Increasing our focus on nature; first TNFD-aligned disclosures for 2024

To support our increasing focus on natural capital, we announced, through our 2024 financial disclosures, UBS will become an Early Adopter of the Taskforce on Nature-related Financial Disclosures meaning we will provide information on nature-related risks and opportunities.

UBS Asset Management became a founding member of the Nature Action 100 collaborative engagement initiative and joined the Principles for Responsible Investment’s Advisory Committee for its stewardship initiative on nature.

In addition, UBS published and discussed a white paper ‘Bloom or bust’ on how finance can help unlock the deployment of technologies at the speed and scale needed to reduce biodiversity loss by 2030, at the World Economic Forum (WEF) Annual Meeting in January.

UBS’s membership in the Dow Jones Sustainability Index reconfirmed

In December 2023, S&P Dow Jones Indices, the world’s leading index provider, announced the results of the annual Dow Jones Sustainability Indices rebalancing and reconstitution. As of year-end, UBS is ranked in the top ten of 669 companies in its industry group.

Using quantum computing to accelerate progress towards achieving UN SDGs

UBS is partnering with the Geneva Science and Diplomacy Anticipator Foundation (GESDA), CERN, the Swiss Federal Department of Foreign Affairs, and Swiss higher-education institutions ETH Zurich and EPFL to create the Open Quantum Institute (OQI), which was officially launched in October 2023.

In its projects, the OQI endeavors to maximize the potential of quantum computing to accelerate progress towards achieving the SDGs and solving some of the world’s most pressing issues in fields such as health, energy, climate action, clean water and food security. As a lead partner to the OQI, UBS intends to provide funding of up to

Joining the Bill & Melinda Gates Foundation and others to help eliminate NTD

As announced in December 2023, UBS Optimus Foundation is proud to join the Bill & Melinda Gates Foundation and others in the fight to eliminate neglected tropical disease (NTD) by pledging match funding of up to

Selected financial information of our business divisions and Group Items |

|||||||

|

For the quarter ended 31.12.23 |

||||||

USD m |

Global Wealth Management |

Personal & Corporate Banking |

Asset Management |

Investment Bank |

Non-core and Legacy |

Group Items |

Total |

Total revenues as reported |

5,444 |

2,431 |

805 |

2,139 |

162 |

(126) |

10,855 |

of which: accretion of PPA adjustments on financial instruments and other effects |

284 |

414 |

|

277 |

|

(32) |

944 |

of which: losses related to investment in SIX Group |

(190) |

(317) |

|

|

|

|

(508) |

Total revenues (underlying) |

5,351 |

2,334 |

805 |

1,861 |

162 |

(94) |

10,419 |

Credit loss expense / (release) |

(7) |

83 |

(1) |

48 |

15 |

(2) |

136 |

Operating expenses as reported |

5,070 |

1,560 |

691 |

2,260 |

1,873 |

17 |

11,470 |

of which: integration-related expenses |

490 |

188 |

66 |

166 |

749 |

93 |

1,751 |

of which: acquisition-related costs |

|

|

|

|

|

(1) |

(1) |

of which: amortization from newly recognized intangibles resulting from the acquisition of the Credit Suisse Group |

|

29 |

|

|

|

|

29 |

Operating expenses (underlying) |

4,580 |

1,343 |

625 |

2,094 |

1,124 |

(75) |

9,690 |

Operating profit / (loss) before tax as reported |

381 |

788 |

115 |

(169) |

(1,726) |

(140) |

(751) |

Operating profit / (loss) before tax (underlying) |

778 |

908 |

180 |

(280) |

(977) |

(17) |

592 |

|

|||||||

|

For the quarter ended 30.9.23 revised1 |

||||||

USD m |

Global Wealth Management |

Personal & Corporate Banking |

Asset Management |

Investment Bank |

Non-core and Legacy |

Group Items |

Total |

Total revenues as reported |

5,810 |

2,871 |

755 |

2,151 |

350 |

(242) |

11,695 |

of which: accretion of PPA adjustments on financial instruments and other effects |

318 |

446 |

|

251 |

|

(57) |

958 |

Total revenues (underlying) |

5,492 |

2,426 |

755 |

1,900 |

350 |

(186) |

10,737 |

Credit loss expense / (release) |

2 |

168 |

0 |

4 |

59 |

6 |

239 |

Operating expenses as reported |

4,801 |

1,579 |

724 |

2,377 |

2,152 |

7 |

11,640 |

of which: integration-related expenses |

431 |

166 |

125 |

365 |

918 |

(2) |

2,003 |

of which: acquisition-related costs |

|

|

|

|

|

26 |

26 |

of which: amortization from newly recognized intangibles resulting from the acquisition of the Credit Suisse Group |

|

28 |

|

|

|

|

28 |

Operating expenses (underlying) |

4,370 |

1,385 |

599 |

2,012 |

1,234 |

(17) |

9,583 |

Operating profit / (loss) before tax as reported |

1,007 |

1,124 |

31 |

(230) |

(1,861) |

(255) |

(184) |

Operating profit / (loss) before tax (underlying) |

1,119 |

872 |

156 |

(116) |

(943) |

(174) |

914 |

|

|||||||

|

For the quarter ended 31.12.22 |

||||||

USD m |

Global Wealth Management |

Personal & Corporate Banking |

Asset Management |

Investment Bank |

Non-core and Legacy |

Group Items |

Total |

Total revenues as reported |

4,601 |

1,130 |

495 |

1,682 |

53 |

67 |

8,029 |

of which: gain from sales of real estate |

|

|

|

|

|

68 |

68 |

Total revenues (underlying) |

4,601 |

1,130 |

495 |

1,682 |

53 |

(1) |

7,961 |

Credit loss expense / (release) |

3 |

(4) |

0 |

8 |

0 |

0 |

7 |

Operating expenses as reported |

3,540 |

605 |

372 |

1,563 |

21 |

(15) |

6,085 |

Operating profit / (loss) before tax as reported |

1,058 |

529 |

124 |

112 |

33 |

81 |

1,937 |

Operating profit / (loss) before tax (underlying) |

1,058 |

529 |

124 |

112 |

33 |

13 |

1,869 |

1 Comparative-period information has been revised. Refer to “Accounting for the acquisition of the Credit Suisse Group” in the “Consolidated financial information” section of the UBS Group fourth quarter 2023 report for more information. |

|||||||

Selected financial information of our business divisions and Group Items |

||||||||

|

For the year ended 31.12.23 |

|||||||

USD m |

Global Wealth Management |

Personal & Corporate Banking |

Asset Management |

Investment Bank |

Non-core and Legacy |

Group Items |

Negative goodwill |

Total |

Total revenues as reported |

21,190 |

8,436 |

2,639 |

8,661 |

741 |

(833) |

|

40,834 |

of which: accretion of PPA adjustments on financial instruments and other effects |

719 |

1,013 |

|

583 |

|

(35) |

|

2,280 |

of which: losses related to investment in SIX Group |

(190) |

(317) |

|

|

|

|

|

(508) |

Total revenues (underlying) |

20,661 |

7,741 |

2,639 |

8,078 |

741 |

(798) |

|

39,062 |

Negative goodwill |

|

|

|

|

|

|

28,925 |

28,925 |

Credit loss expense / (release) |

147 |

501 |

0 |

190 |

193 |

6 |

|

1,037 |

Operating expenses as reported |

17,454 |

4,787 |

2,321 |

8,515 |

5,290 |

440 |

|

38,806 |

of which: integration-related expenses |

988 |

383 |

205 |

692 |

1,772 |

438 |

|

4,478 |

of which: acquisition-related costs |

|

|

|

|

|

202 |

|

202 |

of which: amortization from newly recognized intangibles resulting from the acquisition of the Credit Suisse Group |

|

65 |

|

|

|

|

|

65 |

Operating expenses (underlying) |

16,466 |

4,338 |

2,116 |

7,823 |

3,518 |

(200) |

|

34,061 |

Operating profit / (loss) before tax as reported |

3,589 |

3,148 |

318 |

(44) |

(4,741) |

(1,279) |

28,925 |

29,916 |

Operating profit / (loss) before tax (underlying) |

4,048 |

2,902 |

522 |

64 |

(2,969) |

(603) |

|

3,963 |

|

||||||||

|

For the year ended 31.12.22 |

|||||||

USD m |

Global Wealth Management |

Personal & Corporate Banking |

Asset Management |

Investment Bank |

Non-core and Legacy |

Group Items |

|

Total |

Total revenues as reported |

18,967 |

4,302 |

2,961 |

8,717 |

237 |

(622) |

|

34,563 |

of which: net gain from disposals |

|

|

848 |

|

|

|

|

848 |

of which: gains from sales of subsidiary and business |

219 |

|

|

|

|

|

|

219 |

of which: losses in the first quarter of 2022 from transactions with Russian counterparties |

|

|

|

(93) |

|

|

|

(93) |

of which: litigation settlement |

|

|

|

|

62 |

|

|

62 |

of which: gain from sales of real estate |

|

|

|

|

|

68 |

|

68 |

Total revenues (underlying) |

18,748 |

4,302 |

2,114 |

8,810 |

175 |

(690) |

|

33,459 |

Credit loss expense / (release) |

0 |

39 |

0 |

(12) |

2 |

1 |

|

29 |

Operating expenses as reported |

13,989 |

2,452 |

1,564 |

6,832 |

104 |

(12) |

|

24,930 |

Operating profit / (loss) before tax as reported |

4,977 |

1,812 |

1,397 |

1,897 |

131 |

(611) |

|

9,604 |

Operating profit / (loss) before tax (underlying) |

4,758 |

1,812 |

550 |

1,990 |

69 |

(679) |

|

8,500 |

Our key figures |

|

|

|

|

|

|

|

|

|

As of or for the quarter ended |

|

As of or for the year ended |

|||

USD m, except where indicated |

|

31.12.23 |

30.9.231 |

31.12.22 |

|

31.12.23 |

31.12.22 |

Group results |

|

|

|

|

|

|

|

Total revenues |

|

10,855 |

11,695 |

8,029 |

|

40,834 |

34,563 |

Negative goodwill |

|

|

|

|

|

28,925 |

|

Credit loss expense / (release) |

|

136 |

239 |

7 |

|

1,037 |

29 |

Operating expenses |

|

11,470 |

11,640 |

6,085 |

|

38,806 |

24,930 |

Operating profit / (loss) before tax |

|

(751) |

(184) |

1,937 |

|

29,916 |

9,604 |

Net profit / (loss) attributable to shareholders |

|

(279) |

(715) |

1,653 |

|

29,027 |

7,630 |

Diluted earnings per share (USD)2 |

|

(0.09) |

(0.22) |

0.50 |

|

8.81 |

2.25 |

Profitability and growth3,4,5 |

|

|

|

|

|

|

|

Return on equity (%) |

|

(1.3) |

(3.3) |

11.7 |

|

38.6 |

13.3 |

Return on tangible equity (%) |

|

(1.4) |

(3.6) |

13.2 |

|

42.6 |

14.9 |

Underlying return on tangible equity (%) |

|

4.7 |

1.5 |

12.7 |

|

4.0 |

12.8 |

Return on common equity tier 1 capital (%) |

|

(1.4) |

(3.6) |

14.7 |

|

43.7 |

17.0 |

Underlying return on common equity tier 1 capital (%) |

|

4.7 |

1.4 |

14.1 |

|

4.1 |

14.6 |

Return on leverage ratio denominator, gross (%) |

|

2.6 |

2.8 |

3.2 |

|

2.9 |

3.3 |

Cost / income ratio (%)6 |

|

105.7 |

99.5 |

75.8 |

|

95.0 |

72.1 |

Underlying cost / income ratio (%)6 |

|

93.0 |

89.3 |

76.4 |

|

87.2 |

74.5 |

Effective tax rate (%) |

|

n.m.7 |

n.m.7 |

14.5 |

|

2.9 |

20.2 |

Net profit growth (%) |

|

n.m. |

n.m. |

22.6 |

|

280.4 |

2.3 |

Resources3 |

|

|

|

|

|

|

|

Total assets |

|

1,717,569 |

1,644,329 |

1,104,364 |

|

1,717,569 |

1,104,364 |

Equity attributable to shareholders |

|

87,285 |

84,926 |

56,876 |

|

87,285 |

56,876 |

Common equity tier 1 capital8 |

|

79,263 |

78,587 |

45,457 |

|

79,263 |

45,457 |

Risk-weighted assets8 |

|

546,505 |

546,491 |

319,585 |

|

546,505 |

319,585 |

Common equity tier 1 capital ratio (%)8 |

|

14.5 |

14.4 |

14.2 |

|

14.5 |

14.2 |

Going concern capital ratio (%)8 |

|

17.0 |

16.8 |

18.2 |

|

17.0 |

18.2 |

Total loss-absorbing capacity ratio (%)8 |

|

36.6 |

35.7 |

33.0 |

|

36.6 |

33.0 |

Leverage ratio denominator8 |

|

1,695,403 |

1,615,817 |

1,028,461 |

|

1,695,403 |

1,028,461 |

Common equity tier 1 leverage ratio (%)8 |

|

4.7 |

4.9 |

4.4 |

|

4.7 |

4.4 |

Liquidity coverage ratio (%)9 |

|

215.7 |

196.5 |

163.7 |

|

215.7 |

163.7 |

Net stable funding ratio (%) |

|

124.1 |

120.7 |

119.8 |

|

124.1 |

119.8 |

Other |

|

|

|

|

|

|

|

Invested assets (USD bn)4,10,11 |

|

5,714 |

5,373 |

3,981 |

|

5,714 |

3,981 |

Personnel (full-time equivalents) |

|

112,842 |

115,981 |

72,597 |

|

112,842 |

72,597 |

Market capitalization2,12 |

|

107,355 |

85,768 |

65,608 |

|

107,355 |

65,608 |

Total book value per share (USD)2 |

|

27.20 |

26.27 |

18.30 |

|

27.20 |

18.30 |

Tangible book value per share (USD)2 |

|

24.86 |

23.96 |

16.28 |

|

24.86 |

16.28 |

1 Comparative-period information has been revised. Refer to “Accounting for the acquisition of the Credit Suisse Group” in the “Consolidated financial information” section of the UBS Group fourth quarter 2023 report for more information. 2 Refer to the “Share information and earnings per share” section of the UBS Group fourth quarter 2023 report for more information. 3 Refer to the “Recent developments” section of the UBS Group fourth quarter 2023 report for more information about the updated targets, guidance and ambitions. 4 Refer to “Alternative performance measures” in the appendix to the UBS Group fourth quarter 2023 report for the definition and calculation method. 5 Profit or loss information for each of the fourth quarter of 2023 and the third quarter of 2023 is presented on a consolidated basis, including for each quarter Credit Suisse data for three months, and for the purpose of the calculation of return measures, has been annualized multiplying such by four. Profit or loss information for 2023 includes seven months (June to December 2023, inclusive) of Credit Suisse data for the year-to-date return measure. 6 Negative goodwill is not used in the calculation as it is presented in a separate reporting line and is not part of total revenues. 7 The effective tax rate for the fourth and third quarters of 2023 is not a meaningful measure, due to the distortive effect of current unbenefited tax losses at the former Credit Suisse entities. 8 Based on the Swiss systemically relevant bank framework as of 1 January 2020. Refer to the “Capital management” section of the UBS Group fourth quarter 2023 report for more information. 9 The disclosed ratios represent quarterly averages for the quarters presented and are calculated based on an average of 63 data points in the fourth quarter of 2023, 63 data points in the third quarter of 2023 and 63 data points in the fourth quarter of 2022. Refer to the “Liquidity and funding management” section of the UBS Group fourth quarter 2023 report for more information. 10 Consists of invested assets for Global Wealth Management, Asset Management and Personal & Corporate Banking. Refer to “Note 31 Invested assets and net new money” in the “Consolidated financial statements” section of the Annual Report 2022 for more information. 11 Starting with the second quarter of 2023, invested assets include invested assets from associates in the Asset Management business division, to better reflect the business strategy. Comparative figures have been restated to reflect this change. 12 In the second quarter of 2023, the calculation of market capitalization was amended to reflect total shares issued multiplied by the share price at the end of the period. The calculation was previously based on total shares outstanding multiplied by the share price at the end of the period. Market capitalization has been increased by |

|||||||

Income statement |

|

|

|

|

|

|

|

|

|

|

|

|

For the quarter ended |

|

% change from |

|

For the year ended |

||||

USD m |

|

31.12.23 |

30.9.231 |

31.12.22 |

|

3Q23 |

4Q22 |

|

31.12.23 |

31.12.22 |

Net interest income |

|

2,095 |

2,107 |

1,589 |

|

(1) |

32 |

|

7,297 |

6,621 |

Other net income from financial instruments measured at fair value through profit or loss |

|

3,158 |

3,226 |

1,876 |

|

(2) |

68 |

|

11,583 |

7,517 |

Net fee and commission income |

|

5,780 |

6,056 |

4,359 |

|

(5) |

33 |

|

21,570 |

18,966 |

Other income |

|

(179) |

305 |

206 |

|

|

|

|

384 |

1,459 |

Total revenues |

|

10,855 |

11,695 |

8,029 |

|

(7) |

35 |

|

40,834 |

34,563 |

Negative goodwill |

|

|

|

|

|

|

|

|

28,925 |

|

Credit loss expense / (release) |

|

136 |

239 |

7 |

|

(43) |

|

|

1,037 |

29 |

|

|

|

|

|

|

|

|

|

|

|

Personnel expenses |

|

7,061 |

7,567 |

4,122 |

|

(7) |

71 |

|

24,899 |

17,680 |

General and administrative expenses |

|

2,999 |

3,124 |

1,420 |

|

(4) |

111 |

|

10,156 |

5,189 |

Depreciation, amortization and impairment of non-financial assets |

|

1,409 |

950 |

543 |

|

48 |

159 |

|

3,750 |

2,061 |

Operating expenses |

|

11,470 |

11,640 |

6,085 |

|

(1) |

88 |

|

38,806 |

24,930 |

Operating profit / (loss) before tax |

|

(751) |

(184) |

1,937 |

|

307 |

|

|

29,916 |

9,604 |

Tax expense / (benefit) |

|

(473) |

526 |

280 |

|

|

|

|

873 |

1,942 |

Net profit / (loss) |

|

(278) |

(711) |

1,657 |

|

(61) |

|

|

29,043 |

7,661 |

Net profit / (loss) attributable to non-controlling interests |

|

1 |

4 |

4 |

|

(80) |

(79) |

|

16 |

32 |

Net profit / (loss) attributable to shareholders |

|

(279) |

(715) |

1,653 |

|

(61) |

|

|

29,027 |

7,630 |

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income |

|

|

|

|

|

|

|

|

|

|

Total comprehensive income |

|

2,695 |

(2,622) |

2,208 |

|

|

22 |

|

30,035 |

3,167 |

Total comprehensive income attributable to non-controlling interests |

|

18 |

(8) |

17 |

|

|

5 |

|

22 |

18 |

Total comprehensive income attributable to shareholders |

|

2,677 |

(2,614) |

2,190 |

|

|

22 |

|

30,013 |

3,149 |

1 Comparative-period information has been revised. Refer to “Accounting for the acquisition of the Credit Suisse Group” in the “Consolidated financial information” section of the UBS Group fourth quarter 2023 report for more information. |

||||||||||

Information about results materials and the earnings call

UBS’s fourth quarter 2023 report, news release and slide presentation are available from 06:45 CET on Tuesday, 6 February 2024, at ubs.com/quarterlyreporting.

UBS will hold a presentation of its fourth quarter 2023 results on Tuesday, 6 February 2024. The results will be presented by Sergio P. Ermotti (Group Chief Executive Officer), Todd Tuckner (Group Chief Financial Officer), Sarah Mackey (Head of Investor Relations), and Marsha Askins (Group Head Communications & Branding).

Time

09:00 CET

08:00 GMT

03:00 US EST

Video webcast

The presentation for analysts can be followed live via video webcast on ubs.com/quarterlyreporting with a simultaneous slide show.

The video webcast of the results presentation remains available on ubs.com/investors.

Cautionary statement regarding forward-looking statements

This news release contains statements that constitute “forward-looking statements,” including but not limited to management’s outlook for UBS’s financial performance, statements relating to the anticipated effect of transactions and strategic initiatives on UBS’s business and future development and goals or intentions to achieve climate, sustainability and other social objectives. While these forward-looking statements represent UBS’s judgments, expectations and objectives concerning the matters described, a number of risks, uncertainties and other important factors could cause actual developments and results to differ materially from UBS’s expectations. In particular, terrorist activity and conflicts in the

Rounding

Numbers presented throughout this news release may not add up precisely to the totals provided in the tables and text. Percentages and percent changes disclosed in text and tables are calculated on the basis of unrounded figures. Absolute changes between reporting periods disclosed in the text, which can be derived from numbers presented in related tables, are calculated on a rounded basis.

Tables

Within tables, blank fields generally indicate non-applicability or that presentation of any content would not be meaningful, or that information is not available as of the relevant date or for the relevant period. Zero values generally indicate that the respective figure is zero on an actual or rounded basis. Values that are zero on a rounded basis can be either negative or positive on an actual basis.

Websites

In this news release, any website addresses are provided solely for information and are not intended to be active links. UBS is not incorporating the contents of any such websites into this report.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240205403311/en/

UBS Group AG, Credit Suisse AG and UBS AG

Investor contact

Media contact

APAC: +852-297-1 82 00

ubs.com

Source: UBS Group AG