Omdia Predicts Display Glass Supply to Be Constrained in 2025

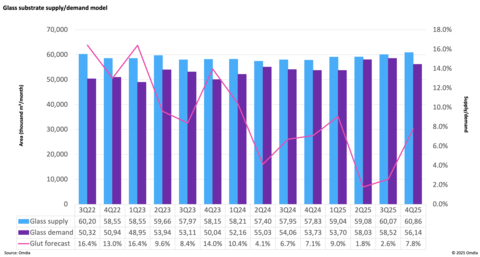

Glass supply substrate supply demand model

Glass production is an energy-intensive process requiring temperatures exceeding 1000 degrees Celsius to melt glass materials. Energy expenses account for more than

Previously, glass makers maintained over two months’ worth of inventory as a safeguard against disruptions such as glass tank failures, which can take months to recover from. However, over the past 5 years, glass makers have adjusted their production based on shipment volumes to protect profitability, reducing available inventory.

In November 2024, a fire at one of the largest glass makers exacerbated the supply shortage of FPD glass. With glass demand growth expected to exceed capacity expansion in 2025, supply constraints are expected, particularly in 2Q and 3Q25.

Meanwhile, Chinese glass makers are aggressively investing in new glass tank facilities and offering lower prices than leading global producers. This competitive push may enable them to gain market share in 2025.

“With supply/demand expected to remain extremely tight in 2025, FPD glass makers are likely to implement further price increases this year. As a result, market revenue is forecasted to grow by

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250313476488/en/

Fasiha Khan: fasiha.khan@omdia.com

Source: Omdia