TrueCar Releases Analysis of October Industry Sales

Rhea-AI Summary

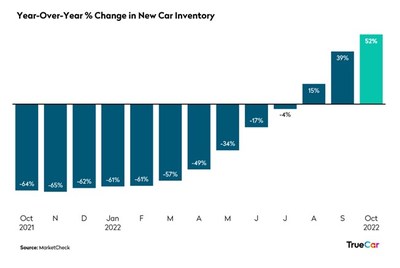

TrueCar forecasts total new vehicle industry sales for October 2022 at 1,165,658 units, a 15% increase from last year, and an estimated 14.6 million annualized sales rate, up 13% year-over-year. Excluding fleet sales, retail deliveries are expected to reach 995,808 units, up 9% but down 2% from September. Average transaction prices for new vehicles are projected to increase 3% year-over-year. Increased interest rates and pricing are cited as factors influencing affordability in the sales environment.

Positive

- Total new vehicle sales expected to rise 15% year-over-year.

- Projected retail vehicle deliveries to be 995,808 units, up 9% from last year.

- Total annualized sales rate expected to reach 14.6 million, a 13% increase.

Negative

- Retail deliveries expected to decline by 2% compared to September.

- Increased average interest rates for new vehicles at 6.3%, up from 6% in September.

News Market Reaction 1 Alert

On the day this news was published, TRUE gained 2.01%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Industry sales this month up

SANTA MONICA, Calif., Oct. 28, 2022 /PRNewswire/ -- TrueCar, Inc. (NASDAQ: TRUE), the easiest, most efficient and transparent online destination for buying and selling new and used vehicles, expects total new vehicle industry sales to reach 1,165,658 units in October 2022, up

"The sales pace has improved from a year ago though we expect it to be on par with the prior month when adjusting for selling days. With the backdrop of increased interest rates and sustained elevated pricing, the limiting factor for sales may be shifting from inventory to affordability," said Zack Krelle, Industry Analyst at TrueCar. "We are keeping a close eye on counter-measures to tackle affordability concerns."

"In October we're seeing Honda, Nissan and General Motors continuing to gain traction in sales, with last month's indication of positive growth materializing into this month," said Justin Colon, Vice President of OEM Solutions at TrueCar. "GM's huge push into electric vehicles is building momentum while the Malibu is currently positioned to capture sales as an affordability outlet."

Additional October Industry Insights (from TrueCar):

- Total sales for October 2022 are expected to be up

15% from a year ago and about even with September 2022 when adjusted for the same number of selling days. - Fleet sales for October 2022 are expected to be up

64% from a year ago and up11% from September 2022 when adjusted for the same number of selling days. - Average transaction price for new vehicles is projected to be up

3% from a year ago and slightly down from September 2022. - Total SAAR is expected to be up

13% from a year ago at 14.6 million units. - Used vehicle sales for October 2022 are expected to reach almost 3 million, down

13% from a year ago and even with September 2022. - The average interest rate on new vehicles is

6.3% compared to September 2022 at6% and the average interest rate on used vehicles is about9% . - The average loan term on a new vehicle for October 2022 is about 70 months and the average loan term on a used vehicle is about 71 months.

Total Unit Sales | |||||||

Manufacturer | Oct 2022 Forecast | Oct 2021 Actual | Sep 2022 Actual | YoY % Change | YoY % Change | MoM % Change | MoM % Change |

BMW | 28,411 | 28,231 | 27,332 | 0.6 % | 4.5 % | 3.9 % | 0.0 % |

Daimler | 28,712 | 20,081 | 30,241 | 43.0 % | 48.5 % | -5.1 % | -8.7 % |

Ford | 149,677 | 174,464 | 141,633 | -14.2 % | -10.9 % | 5.7 % | 1.6 % |

GM | 203,007 | 133,168 | 186,532 | 52.4 % | 58.3 % | 8.8 % | 4.6 % |

Honda | 85,813 | 97,083 | 79,354 | -11.6 % | -8.2 % | 8.1 % | 4.0 % |

Hyundai | 64,976 | 62,061 | 64,372 | 4.7 % | 8.7 % | 0.9 % | -2.9 % |

Kia | 57,761 | 52,067 | 56,270 | 10.9 % | 15.2 % | 2.7 % | -1.3 % |

Nissan | 63,551 | 59,859 | 53,400 | 6.2 % | 10.3 % | 19.0 % | 14.4 % |

Stellantis | 113,589 | 131,496 | 122,567 | -13.6 % | -10.3 % | -7.3 % | -10.9 % |

Subaru | 46,539 | 36,817 | 45,658 | 26.4 % | 31.3 % | 1.9 % | -2.0 % |

Tesla | 45,895 | 27,137 | 44,576 | 69.1 % | 75.6 % | 3.0 % | -1.0 % |

Toyota | 185,184 | 146,670 | 175,577 | 26.3 % | 31.1 % | 5.5 % | 1.4 % |

Volkswagen Group | 45,341 | 44,809 | 49,427 | 1.2 % | 5.1 % | -8.3 % | -11.8 % |

Industry | 1,165,658 | 1,057,164 | 1,123,504 | 10.3 % | 14.5 % | 3.8 % | -0.2 % |

Retail Unit Sales | |||||||

Manufacturer | Oct 2022 Forecast | Oct 2021 Actual | Sep 2022 Actual | YoY % Change | YoY % Change | MoM % Change | MoM % Change |

BMW | 26,561 | 26,679 | 25,054 | -0.4 % | 3.4 % | 6.0 % | 1.9 % |

Daimler | 26,782 | 18,319 | 28,157 | 46.2 % | 51.8 % | -4.9 % | -8.5 % |

Ford | 106,520 | 135,673 | 106,161 | -21.5 % | -18.5 % | 0.3 % | -3.5 % |

GM | 160,302 | 120,124 | 154,434 | 33.4 % | 38.6 % | 3.8 % | -0.2 % |

Honda | 83,730 | 96,584 | 77,119 | -13.3 % | -10.0 % | 8.6 % | 4.4 % |

Hyundai | 63,407 | 61,257 | 63,665 | 3.5 % | 7.5 % | -0.4 % | -4.2 % |

Kia | 55,798 | 48,874 | 54,393 | 14.2 % | 18.6 % | 2.6 % | -1.4 % |

Nissan | 55,590 | 53,227 | 43,668 | 4.4 % | 8.5 % | 27.3 % | 22.4 % |

Stellantis | 83,742 | 105,427 | 97,743 | -20.6 % | -17.5 % | -14.3 % | -17.6 % |

Subaru | 45,538 | 36,074 | 44,469 | 26.2 % | 31.1 % | 2.4 % | -1.5 % |

Tesla | 39,485 | 26,878 | 37,348 | 46.9 % | 52.6 % | 5.7 % | 1.7 % |

Toyota | 166,442 | 137,503 | 157,414 | 21.0 % | 25.7 % | 5.7 % | 1.7 % |

Volkswagen Group | 40,506 | 44,058 | 45,190 | -8.1 % | -4.5 % | -10.4 % | -13.8 % |

Industry | 995,808 | 951,356 | 976,052 | 4.7 % | 8.7 % | 2.0 % | -1.9 % |

Fleet Unit Sales | |||||||

Manufacturer | Oct 2022 Forecast | Oct 2021 Actual | Sep 2022 Actual | YoY % Change | YoY % Change | MoM % Change | MoM % Change |

BMW | 1,850 | 1,552 | 2,278 | 19.2 % | 23.8 % | -18.8 % | -21.9 % |

Daimler | 1,930 | 1,762 | 2,084 | 9.6 % | 13.8 % | -7.4 % | -11.0 % |

Ford | 43,157 | 38,791 | 35,472 | 11.3 % | 15.5 % | 21.7 % | 17.0 % |

GM | 42,705 | 13,044 | 32,098 | 227.4 % | 240.0 % | 33.0 % | 27.9 % |

Honda | 2,083 | 499 | 2,235 | 317.5 % | 333.6 % | -6.8 % | -10.4 % |

Hyundai | 1,569 | 804 | 707 | 95.1 % | 102.6 % | 121.8 % | 113.3 % |

Kia | 1,963 | 3,193 | 1,877 | -38.5 % | -36.2 % | 4.6 % | 0.6 % |

Nissan | 7,961 | 6,632 | 9,732 | 20.0 % | 24.7 % | -18.2 % | -21.3 % |

Stellantis | 29,847 | 26,069 | 24,824 | 14.5 % | 18.9 % | 20.2 % | 15.6 % |

Subaru | 1,001 | 743 | 1,189 | 34.7 % | 39.9 % | -15.8 % | -19.0 % |

Tesla | 6,410 | 259 | 7,228 | 2376.9 % | 2472.1 % | -11.3 % | -14.7 % |

Toyota | 18,742 | 9,167 | 18,163 | 104.4 % | 112.3 % | 3.2 % | -0.8 % |

Volkswagen Group | 4,835 | 751 | 4,237 | 543.9 % | 568.7 % | 14.1 % | 9.7 % |

Industry | 166,917 | 105,610 | 144,519 | 58.1 % | 64.1 % | 15.5 % | 11.1 % |

Fleet Penetration | |||||

Manufacturer | Oct 2022 Forecast | Oct 2021 Actual | Sep 2022 Actual | YoY % Change | MoM % Change |

BMW | 6.5 % | 5.5 % | 8.3 % | 18.4 % | -21.9 % |

Daimler | 6.7 % | 8.8 % | 6.9 % | -23.4 % | -2.5 % |

Ford | 28.8 % | 22.2 % | 25.0 % | 29.7 % | 15.1 % |

GM | 21.0 % | 9.8 % | 17.2 % | 114.8 % | 22.2 % |

Honda | 2.4 % | 0.5 % | 2.8 % | 372.4 % | -13.8 % |

Hyundai | 2.4 % | 1.3 % | 1.1 % | 86.3 % | 119.7 % |

Kia | 3.4 % | 6.1 % | 3.3 % | -44.6 % | 1.9 % |

Nissan | 12.5 % | 11.1 % | 18.2 % | 13.1 % | -31.3 % |

Stellantis | 26.3 % | 19.8 % | 20.3 % | 32.5 % | 29.7 % |

Subaru | 2.2 % | 2.0 % | 2.6 % | 6.6 % | -17.4 % |

Tesla | 14.0 % | 1.0 % | 16.2 % | 1364.5 % | -13.9 % |

Toyota | 10.1 % | 6.3 % | 10.3 % | 61.9 % | -2.2 % |

Volkswagen Group | 10.7 % | 1.7 % | 8.6 % | 536.4 % | 24.4 % |

Industry | 14.3 % | 10.0 % | 12.9 % | 43.3 % | 11.3 % |

Total Market Share | |||

Manufacturer | Oct 2022 Forecast | Oct 2021 Actual | Sep 2022 Actual |

BMW | 2.4 % | 2.7 % | 2.4 % |

Daimler | 2.5 % | 1.9 % | 2.7 % |

Ford | 12.8 % | 16.5 % | 12.6 % |

GM | 17.4 % | 12.6 % | 16.6 % |

Honda | 7.4 % | 9.2 % | 7.1 % |

Hyundai | 5.6 % | 5.9 % | 5.7 % |

Kia | 5.0 % | 4.9 % | 5.0 % |

Nissan | 5.5 % | 5.7 % | 4.8 % |

Stellantis | 9.7 % | 12.4 % | 10.9 % |

Subaru | 4.0 % | 3.5 % | 4.1 % |

Tesla | 3.9 % | 2.6 % | 4.0 % |

Toyota | 15.9 % | 13.9 % | 15.6 % |

Volkswagen Group | 3.9 % | 4.2 % | 4.4 % |

96.0 % | 95.9 % | 95.9 % | |

Retail Market Share | |||

Manufacturer | Oct 2022 Forecast | Oct 2021 Actual | Sep 2022 Actual |

BMW | 2.7 % | 2.8 % | 2.6 % |

Daimler | 2.7 % | 1.9 % | 2.9 % |

Ford | 10.7 % | 14.3 % | 10.9 % |

GM | 16.1 % | 12.6 % | 15.8 % |

Honda | 8.4 % | 10.2 % | 7.9 % |

Hyundai | 6.4 % | 6.4 % | 6.5 % |

Kia | 5.6 % | 5.1 % | 5.6 % |

Nissan | 5.6 % | 5.6 % | 4.5 % |

Stellantis | 8.4 % | 11.1 % | 10.0 % |

Subaru | 4.6 % | 3.8 % | 4.6 % |

Tesla | 4.0 % | 2.8 % | 3.8 % |

Toyota | 16.7 % | 14.5 % | 16.1 % |

Volkswagen Group | 4.1 % | 4.6 % | 4.6 % |

95.8 % | 95.7 % | 95.8 % | |

ATP | |||||

Manufacturer | Oct 2022 Forecast | Oct 2021 Actual | Sep 2022 Actual | YOY | MOM |

BMW | 13.5 % | 1.6 % | |||

Daimler | 5.8 % | 3.8 % | |||

Ford | 5.0 % | 0.4 % | |||

GM | -3.2 % | 0.2 % | |||

Honda | 8.5 % | -0.7 % | |||

Hyundai | 3.7 % | 1.0 % | |||

Kia | 4.0 % | -1.6 % | |||

Nissan | 4.8 % | 2.1 % | |||

Stellantis | 7.0 % | 0.0 % | |||

Subaru | 0.7 % | -2.3 % | |||

Toyota | -3.0 % | -1.5 % | |||

Volkswagen Group | 3.2 % | -0.4 % | |||

Industry | 2.9 % | -0.5 % | |||

- | |||||

Revenue | |||||

Manufacturer | Oct 2022 Forecast | Oct 2021 Actual | Sep 2022 Actual | YOY | MOM |

Industry | 13.5 % | 3.2 % | |||

(Note: This industry insight is based solely on TrueCar, Inc.'s analysis of domestic industry sales trends and conditions and is not a projection of TrueCar, Inc.'s operations.)

TrueCar is a leading automotive digital marketplace that lets auto buyers and sellers connect to our nationwide network of Certified Dealers. With access to an expansive inventory provided by our Certified Dealers, we are building the industry's most personalized and efficient auto shopping experience as we seek to bring more of the process online. Consumers who visit our marketplace will find a suite of vehicle discovery tools, price ratings and market context on new, used and Certified Pre-Owned vehicles. When they are ready, shoppers in TrueCar's marketplace can connect with a Certified Dealer in our network, who shares our belief that truth, transparency and fairness are the foundation of a great auto shopping experience. As part of our marketplace, TrueCar powers auto-buying programs for over 250 leading brands, including AARP, Sam's Club, Navy Federal Credit Union and American Express.

For more information, please visit www.truecar.com, and follow us on LinkedIn, Facebook or Twitter.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/truecar-releases-analysis-of-october-industry-sales-301662167.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/truecar-releases-analysis-of-october-industry-sales-301662167.html

SOURCE TrueCar.com