Theralase(R) Release’s 2Q2024 Financial Statements

Theralase Technologies Inc. (TSXV:TLT)(OTCQB:TLTFF) has released its 2Q2024 financial statements. Key highlights include:

- Total revenue decreased 35% year-over-year

- Gross margin decreased to 33% from 47% in 2023

- Net loss reduced by 6% to $2,400,461

- The company closed three non-brokered private placements, raising approximately $2.7 million

- 72 patients have been enrolled and treated in Study II for BCG-Unresponsive NMIBC CIS

- 63% of treated patients achieved Complete Response (CR)

- 44% of CR patients maintained response for at least 12 months

- The company plans to submit for FDA Break Through Designation in 3Q2024

Theralase aims to complete Study II enrollment by end of 2024 and seeks FDA and Health Canada approval by the end of 2026.

Theralase Technologies Inc. (TSXV:TLT)(OTCQB:TLTFF) ha pubblicato il suo bilancio finanziario del 2Q2024. I punti salienti includono:

- I ricavi totali sono diminuiti del 35% rispetto all'anno precedente

- Il margine lordo è sceso al 33% rispetto al 47% del 2023

- La perdita netta è stata ridotta del 6% a $2.400.461

- L'azienda ha chiuso tre collocamenti privati non mediati, raccogliendo circa $2,7 milioni

- 72 pazienti sono stati arruolati e trattati nello Studio II per NMIBC CIS non responsivo al BCG

- Il 63% dei pazienti trattati ha raggiunto una Risposta Completa (CR)

- Il 44% dei pazienti con CR ha mantenuto la risposta per almeno 12 mesi

- L'azienda prevede di presentare domanda per la Designazione di Sviluppo Accelerato FDA nel 3Q2024

Theralase mira a completare l'arruolamento dello Studio II entro la fine del 2024 e cerca approvazione da parte della FDA e di Health Canada entro la fine del 2026.

Theralase Technologies Inc. (TSXV:TLT)(OTCQB:TLTFF) ha publicado sus estados financieros del 2Q2024. Los aspectos destacados incluyen:

- Los ingresos totales disminuyeron un 35% en comparación con el año anterior

- El margen bruto disminuyó al 33% desde el 47% en 2023

- La pérdida neta se redujo en un 6% a $2,400,461

- La empresa cerró tres colocaciones privadas no mediadas, recaudando aproximadamente $2.7 millones

- 72 pacientes han sido inscritos y tratados en el Estudio II para NMIBC CIS no responsivo a BCG

- El 63% de los pacientes tratados logró una Respuesta Completa (CR)

- El 44% de los pacientes con CR mantuvieron la respuesta durante al menos 12 meses

- La empresa planea solicitar la Designación de Desarrollo Acelerado de la FDA en el 3Q2024

Theralase tiene como objetivo completar la inscripción en el Estudio II para finales de 2024 y busca la aprobación de la FDA y Health Canada para finales de 2026.

Theralase Technologies Inc. (TSXV:TLT)(OTCQB:TLTFF)은 2024년 2분기 재무제표를 발표했습니다. 주요 하이라이트는 다음과 같습니다:

- 총 수익이 전년 대비 35% 감소했습니다

- 총 이익률이 2023년 47%에서 33%로 감소했습니다

- 순손실이 6% 감소하여 $2,400,461이 되었습니다

- 회사는 세 건의 비중개 사모펀드를 마감하고 약 $2.7 백만을 모금했습니다

- 72명의 환자가 BCG 비반응성 NMIBC CIS를 위한 II기 연구에 등록되고 치료되었습니다

- 치료받은 환자의 63%가 완전 반응(CR)을 달성했습니다

- CR 환자의 44%가 최소 12개월 동안 반응을 유지했습니다

- 회사는 2024년 3분기에 FDA 혁신 지정 신청을 계획하고 있습니다

Theralase는 2024년 말까지 II기 연구의 등록을 완료하고 2026년 말까지 FDA 및 Health Canada의 승인을 받을 계획입니다.

Theralase Technologies Inc. (TSXV:TLT)(OTCQB:TLTFF) a publié ses états financiers du 2Q2024. Les points clés comprennent :

- Les revenus totaux ont diminué de 35 % par rapport à l'année précédente

- La marge brute a chuté à 33 % contre 47 % en 2023

- La perte nette a été réduite de 6 % à 2 400 461 $

- La société a clôturé trois placements privés non intermédiés, levant environ 2,7 millions de dollars

- 72 patients ont été enrôlés et traités dans l'Etude II pour le NMIBC CIS non réactif au BCG

- 63 % des patients traités ont atteint une Réponse Complète (CR)

- 44 % des patients CR ont maintenu la réponse pendant au moins 12 mois

- La société prévoit de soumettre une demande pour la désignation de percée de la FDA au 3Q2024

Theralase vise à compléter l'inscription à l'Etude II d'ici la fin 2024 et cherche une approbation de la FDA et d’Health Canada d'ici la fin 2026.

Theralase Technologies Inc. (TSXV:TLT)(OTCQB:TLTFF) hat seine Finanzberichte für das 2Q2024 veröffentlicht. Zu den wichtigsten Punkten gehören:

- Der Gesamtumsatz sank im Jahresvergleich um 35%

- Die Bruttomarge fiel von 47% im Jahr 2023 auf 33%

- Der Nettoverlust wurde um 6% auf 2.400.461 $ verringert

- Das Unternehmen schloss drei nicht vermittelte Privatplatzierungen und sammelte etwa 2,7 Millionen $ ein

- 72 Patienten wurden im Studiensatz II für BCG-resistentes NMIBC CIS eingeschrieben und behandelt

- 63% der behandelten Patienten erreichten eine vollständige Antwort (CR)

- 44% der CR-Patienten hielten die Antwort mindestens 12 Monate lang aufrecht

- Das Unternehmen plant, im 3Q2024 einen Antrag auf FDA-Breakthrough-Designations zu stellen

Theralase plant, die Einschreibung für Studie II bis Ende 2024 abzuschließen und strebt bis Ende 2026 die Genehmigung von der FDA und Health Canada an.

- Net loss reduced by 6% year-over-year to $2,400,461

- Raised approximately $2.7 million through three non-brokered private placements

- 63% of treated patients in Study II achieved Complete Response (CR)

- 44% of CR patients maintained response for at least 12 months

- 100% of patients experienced no Serious Adverse Events related to the Study Drug or Study Device

- Plans to submit for FDA Break Through Designation in 3Q2024

- Total revenue decreased 35% year-over-year

- Gross margin decreased to 33% from 47% in 2023

- Cost of sales increased to 67% of revenue from 53% in 2023

TORONTO, ON / ACCESSWIRE / August 12, 2024 / Theralase® Technologies Inc. ("Theralase®" or the "Company") (TSXV:TLT)(OTCQB:TLTFF), a clinical stage pharmaceutical company dedicated to the research and development of light and/or radiation activated small molecules for the safe and effective destruction of various cancers, bacteria and viruses has released the Company's unaudited condensed consolidated interim financial statements for the six-month period ended June 30, 2024. ("Financial Statements").

Theralase® will be hosting a conference call on Wednesday August 21st, 2024 at 11:00 am ET, which will include a presentation of the financial and operational results for the six-month period ended June 30, 2024. Questions are welcome. To ensure Theralase® has time to review and properly address them during the call, please send them in advance to mperraton@theralase.com.

Zoom Meeting Link: https://us02web.zoom.us/j/89622152696

Conference Call in: 1-647-558-0588 (Canada) / 1-646-558-8656 (US) - not required for those attending by Zoom.

An archived version will be available on the website following the conference call.

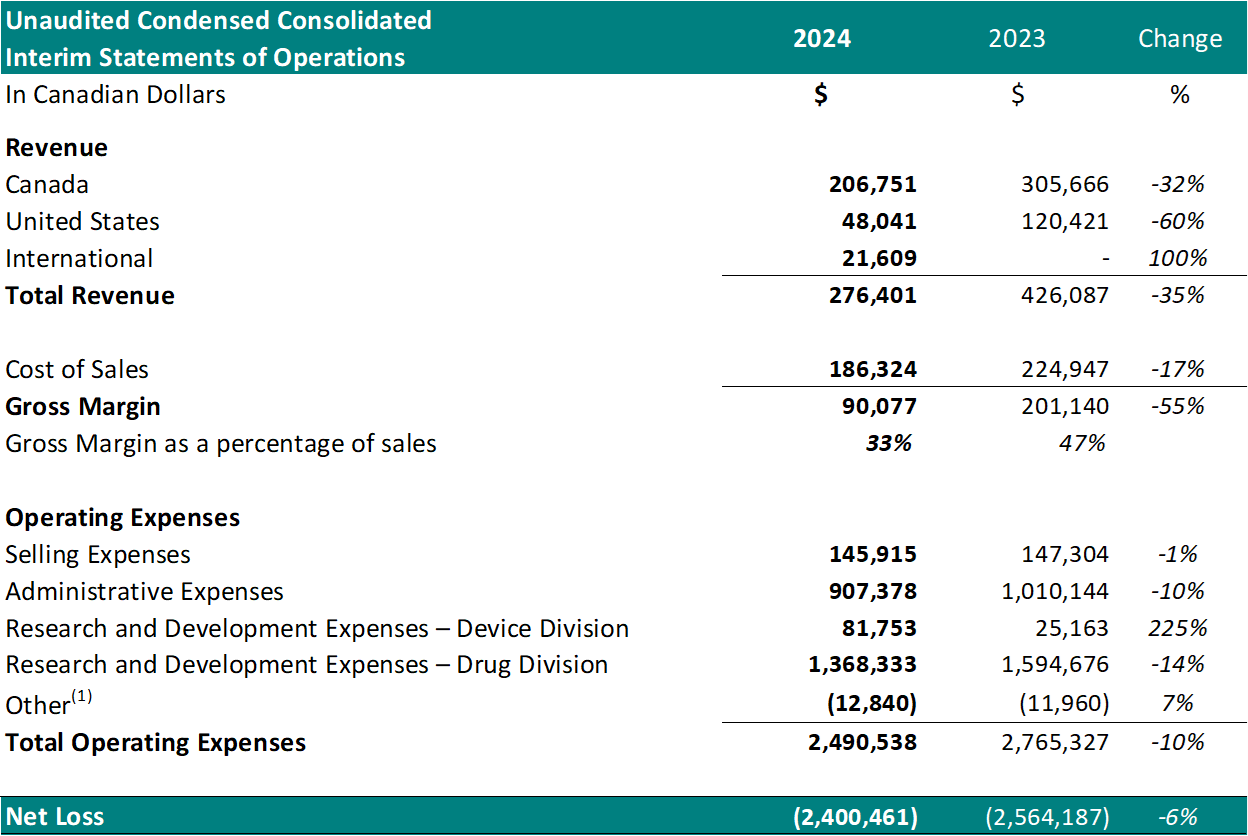

Financial Summary:

For the six-month period ended June 30th:

1 Other represents foreign exchange, interest accretion on lease liabilities and / or interest income

Financial Highlights

For the six-month period ended June 30, 2024;

Total revenue decreased

35% , year over year.Cost of sales was

$186,324 (67% of revenue) resulting in a gross margin of$90,077 (33% of revenue). In comparison, the cost of sales for the same period in 2023 was$224,947 (53% of revenue) resulting in a gross margin of$201,140 (47% of revenue). The gross margin decrease, as a percentage of sales year over year, is attributed to an increase in material costs.Selling expenses decreased to

$145,915 , from$147,304 for the same period in 2023, a1% decrease.Administrative expenses decreased to

$907,378 from$1,010,144 for the same period in 2023, a10% decrease. The decrease is a result of reduced spending on general and administrative expenses (59% ) and stock-based compensation (28% ) (due to the cumulative effect of accounting for the vesting of stock options granted in the current and previous years).Net research and development expenses for the Drug Division decreased to

$1,368,333 from$1,594,676 for the same period in 2023, a10% decrease. The decrease is primarily attributed to a decrease in costs for Study II patient enrollment and treatment.Net research and development expenses for the Device Division increased to

$81,753 from$25,163 for the same period in 2023, a225% increase. The increase is attributed to development of a new software program for the TLC-2000 Cool Laser Therapy system.Net loss was

$2,400,461 , which included$374,445 of net non-cash expenses (i.e.: amortization, stock-based compensation expense and foreign exchange gain/loss). This compared to a net loss in 2023 of$2,564,187 , a6% year-over-year reduction, which included$474,558 of net non-cash expenses. The Drug Division represented$1,938,024 of this loss (81% ). The decrease in net loss is primarily attributed to decreased spending on research and development expenses in Study II.

Operational Highlights:

Non-Brokered Private Placement:

On February 5, 2024, the Company closed a non-brokered private placement of units. On closing, the Company issued an aggregate of 6,666,670 units at a price of $CAN 0.18 per Unit for aggregate gross proceeds of approximately $CAN 1,200,000 of which 1,310,502 units were purchased by certain insiders of the Corporation, representing gross proceeds of

On April 24, 2024, the Company closed a non-brokered private placement of units. On closing, the Company issued an aggregate of 4,167,778 units at a price of

On July 8, 2024, the Company closed a non-brokered private placement of units. On closing, the Company issued an aggregate of 3,522,729 units at a price of

In 2024, the Company plans to secure funding through various equity and debt instruments to allow the Company the ability to become base shelf eligible. This will allow the Company sufficient funding to complete enrollment into Study II by year end, data lock in mid 2026 and position the Company for FDA and Health Canada approval by the end of 2026, subject to achieving FDA Priority Review."

Study II Update:

On February 8th, 2024, Dr. Michael Jewett joined the Company in the role of an independent consultant, to assist the Company in the accruement of patients into Study II. Under the terms of the consulting agreement, Dr. Jewett will be responsible for working with existing clinical study sites and helping to onboard new clinical study sites to assist Theralase® to complete enrollment and provide the primary study treatment to 75 to 100 patients in Study II, preferably by December 31, 2024.

To date, Theralase® has enrolled and treated 72 patients in Study II, who have been provided the primary Study II Procedure. The clinical study sites have screened an additional 3 patients, who they are planning to enroll and treat over the next 4 to 6 weeks, bringing the total to 75 treated patients.

Theralase® plans to add up to 5 new CSSs in 2024, as well as increase enrollment at the existing 10 Clinical Study Sites ("CSSs") to complete Study II accruement by the end of 2024 / beginning of 2025.

For the primary endpoint of Study II (Complete Response ("CR") at any point in time)

For the secondary endpoint of Study II (duration of CR)

For the tertiary endpoint of Study II (safety of Study Procedure)

Break Through Designation Update:

In 2020, the FDA granted Theralase® Fast Track Designation ("FTD") for Study II. As a Fast Track designee, Theralase® has access to early and frequent communications with the FDA to discuss Theralase®'s development plans and ensure the timely collection of clinical data to support the approval process. The accelerated communication with the FDA potentially allows, the Study Procedure, to be the first intravesical, patient-specific, light-activated, Ruthenium-based small molecule for the treatment of patients diagnosed with BCG-Unresponsive NMIBC CIS, (with or without recurrent / resected papillary Ta/T1 tumours). FTD can also lead to Break Through Designation ("BTD"), Accelerated Approval ("AA") and/or Priority Review, if certain criteria are met, which the FDA previously defined to the Company for BTD as clinical data on approximately 20 to 25 patients enrolled and provided the primary Study Procedure, who demonstrate significant safety and efficacy clinical outcomes.

To this list, the FDA has added: Post Study II Monitoring of Response and Central Pathology Laboratory Review.

The Company is currently working with the CSSs, a biostatistics organization and a regulatory organization to update the pre-BTD submission with clinical data clarifications, identified by the FDA. The Company plans to resubmit the pre-BTD submission to the FDA in 3Q2024 for FDA review of these clarifications. Once the pre-BTD submission has been accepted by the FDA, the Company plans to compile a BTD submission for review by the FDA in 3Q2024 in support of the grant of a BTD approval.

Theralase® has commenced receiving clinical data from the CSSs with a significant number of patients, who achieved CR, continuing to experience a duration of their CR beyond 450 days, with some patients demonstrating CR for up to 3 years and counting, post the primary Study Procedure.

Study II Preliminary Clinical Data:

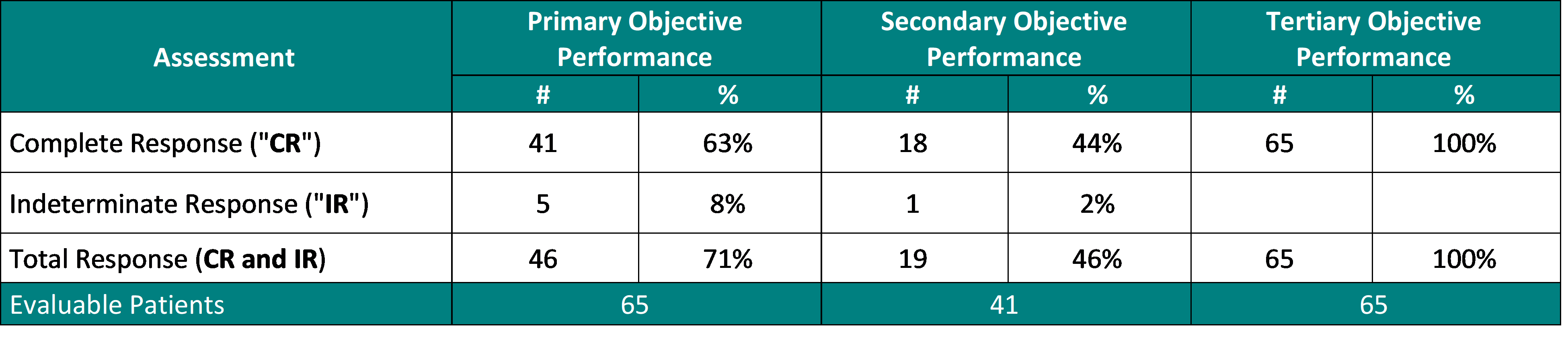

Performance to Primary, Secondary and Tertiary Objectives:

The interim clinical data above demonstrates that:

For the primary objective,

For the secondary objective,

>

For the tertiary objective, no patients have been diagnosed with a Serious Adverse Event ("SAE") directly related to the Study Drug or Study Device

Note:

For patients to be included in the statistical clinical analysis they must be enrolled in Study II, provided the primary Study Procedure and evaluated by a Principal Investigator ("PI") at the 90 days assessment visit (cystoscopy and urine cytology)

One patient passed away prior to their 90 days assessment and is therefore not included in the efficacy statistical analysis, only in the safety statistical analysis; therefore, there are 65 patients that have been statistically analyzed for efficacy.

Evaluable Patients are defined as patients who have been evaluated by a PI and thus excludes a patient's clinical data at specific assessment days, if that clinical data is pending.

7 patients have been enrolled and provided the primary Study Procedure but, have not been evaluated at their 90 day assessment; therefore, 65 patients are considered Evaluable Patients at 90 days, with 41 patients considered Evaluable Patients at 450 days.

The data analysis presented above, should be read with caution, as the clinical data is interim in its presentation, as Study II is ongoing and new clinical data collected may or may not continue to support the current trends, with clinical data still pending.

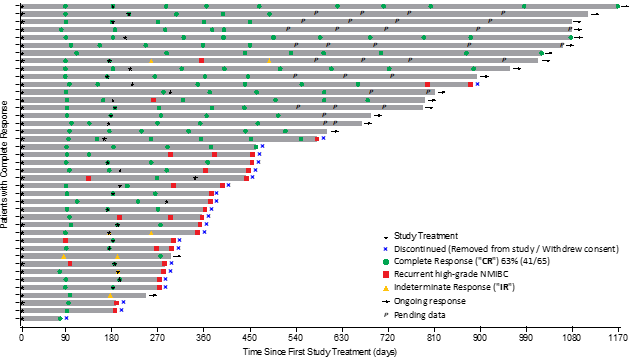

Patient Response Chart:

The Swimmer's plot below is a graphical representation of the interim clinical results (n=41) for patients who achieved a CR at any point in time and their response over 1080 days, graphically demonstrating a patient's response to a treatment over time. As can be seen in the plot, clinical data is still pending for patients, who have demonstrated an initial CR at 90 days and continue to demonstrate a duration of that response.

The Swimmer's Plot illustrates:

63% (41/65) Evaluable Patients achieved CR at any point in time, with44% (18/41) patients, who demonstrated CR, continuing to demonstrate CR at 450 days and thus achieving the primary and secondary objectives of Study II.41% (17/41) Evaluable Patients demonstrate CR beyond 450 days.

Note: This is interim clinical data and clinical data is still being collected, but all indications demonstrate that the study has achieved its primary, secondary and tertiary objectives.

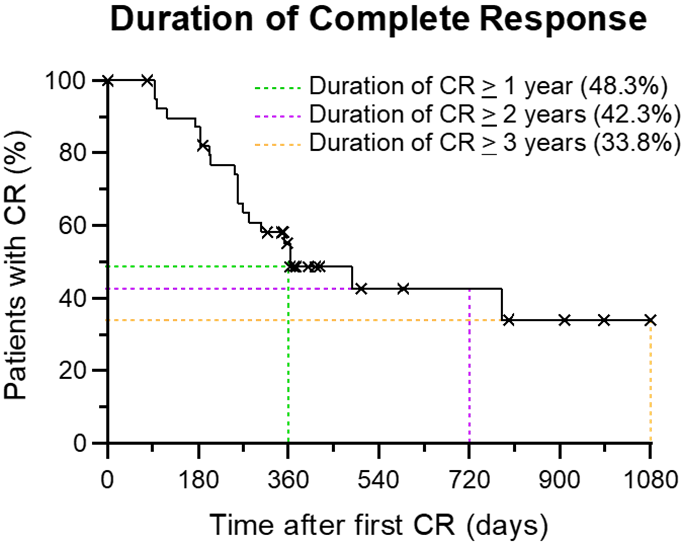

Kaplan-Meier Curve:

The Kaplan-Meier ("KM") Curve illustrates graphically, for patients who have achieved a CR, the duration of CR and probability of that CR continuing in the future.

Note: The information on the time-to-outcome event is not available for all patients in this analysis, as not all patients have been assessed at all available assessment visits. Only patients that achieved the primary objective (CR at any point in time) have been analyzed and data is plotted relative to the date at which their first CR was observed. The "X" denotes censored observations (subjects who achieved CR at their last assessment visit and are currently on-study or have been removed from study). Thus, the KM Curve estimates the risk of a patient failing to maintain a CR over time, according to currently available interim data.

In summary, the interim clinical data demonstrates that patients consenting to participate in Study II have a

If CR is obtained, then the patient has a

Serious Adverse Events

For 72 patients treated in Study II, there have been 14 Serious Adverse Events ("SAEs") reported:

3 - Grade 2 (resolved within 1, 1 and unknown days, respectively)

7 - Grade 3 (resolved within 1, 2, 3, 4, 4, 82 and unknown days, respectively)

3 - Grade 4 (resolved within 3, 6 and 8 days, respectively)

1 - Grade 5

Theralase® believes all SAEs reported to date are unrelated to the Study II Drug or Study II Device.

Note: A SAE is defined as any untoward medical occurrence that at any dose: Is serious or life-threatening, requires inpatient hospitalization or prolongation of existing hospitalization, results in persistent or significant disability/incapacity, is a congenital anomaly/birth defect or results in death.

Dr. Arkady Mandel, M.D., Ph.D., D.Sc., Chief Scientific Officer of Theralase® stated, "The interim clinical data of Study II, to date, has proven to be world-class. Study II has demonstrated an ability to destroy urothelial cell carcinoma in a patient's bladder for a Total Response ("TR") of

Roger DuMoulin-White, B.E.Sc., P.Eng., Pro.Dir., President and Chief Executive Officer of Theralase® stated, "Based on the interim clinical data accumulated to date, Study II has achieved its primary, secondary and tertiary endpoints and requires only a few additional patients enrolled and follow-up on all patients to complete the study. Theralase® expects to complete patient follow-up by mid 2026 with review by Health Canada and the FDA on a marketing approval by end of 2026. The Theralase® bladder cancer treatment has been proven clinically to be safe and effective in the treatment of BCG-Unresponsive NMIBC CIS, fulfilling an unmet need of the medical community."

About Study II:

Study II utilizes the therapeutic dose of the patented Study II Drug ("RuvidarTM" or "TLD-1433") (0.70 mg/cm2) activated by the proprietary Study II Device (TLC-3200 Medical Laser System or "TLC-3200"). Study II is focused on enrolling and treating approximately 75 to 100 BCG-Unresponsive NMIBC Carcinoma In-Situ ("CIS") patients in up to 15 Clinical Study Sites ("CSS") located in Canada and the United States.

About RuvidarTM:

RuvidarTM is a peer reviewed, patented PDC currently under investigation in Study II.

About Theralase® Technologies Inc.:

Theralase® is a clinical stage pharmaceutical company dedicated to the research and development of light activated compounds, their associated drug formulations and the light and/or radiation systems that activate them, with a primary objective of efficacy and a secondary objective of safety in the destruction of various cancers, bacteria and viruses.

Additional information is available at www.theralase.com and www.sedarplus.ca

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements:

This news release contains "forward-looking statements" within the meaning of applicable Canadian securities laws. Such statements include; but, are not limited to statements regarding the Company's proposed development plans with respect to Photo Dynamic Compounds and their drug formulations. Forward looking statements may be identified by the use of the words "may, "should", "will", "anticipates", "believes", "plans", "expects", "estimate", "potential for" and similar expressions; including, statements related to the current expectations of Company's management for future research, development and commercialization of the Company's Photo Dynamic Compounds and their drug formulations, preclinical research, clinical studies and regulatory approvals.

These statements involve significant risks, uncertainties and assumptions; including, the ability of the Company to: adequately fund and secure the requisite regulatory approvals to commercially market a treatment for bladder cancer in a timely fashion and implement its commercialization strategy. Other risks include: the ability of the Company to successfully complete its Phase II BCG-Unresponsive NMIBC CIS clinical study , access to sufficient capital to fund the Company's operations may not be available or may not be available on terms that are commercially favorable to the Company, the Company's drug formulations may not be effective against the diseases tested in its clinical studies, the Company's fails to comply with the term of license agreements with third parties and as a result loses the right to use key intellectual property in its business, the Company's ability to protect its intellectual property, the timing and success of submission, acceptance and approval of regulatory filings. Many of these factors that will determine actual results are beyond the Company's ability to control or predict.

Readers should not unduly rely on these forward- looking statements, which are not a guarantee of future performance. There can be no assurance that forward looking statements will prove to be accurate as such forward looking statements involve known and unknown risks, uncertainties and other factors which may cause actual results or future events to differ materially from the forward-looking statements.

Although the forward-looking statements contained in the press release are based upon what management currently believes to be reasonable assumptions, the Company cannot assure prospective investors that actual results, performance or achievements will be consistent with these forward-looking statements.

All forward-looking statements are made as of the date hereof and are subject to change. Except as required by law, the Company assumes no obligation to update such statements.

For investor information on the Company, please feel to reach out Investor Inquiries - Theralase Technologies.

For More Information:

1.866.THE.LASE (843-5273)

416.699.LASE (5273)

www.theralase.com

Kristina Hachey, CPA x224

Chief Financial Officer

khachey@theralase.com

SOURCE: Theralase Technologies, Inc.

View the original press release on accesswire.com

FAQ

What were Theralase Technologies' (TLTFF) financial results for Q2 2024?

How many patients have been enrolled and treated in Theralase's (TLTFF) Study II as of Q2 2024?

What percentage of patients achieved Complete Response (CR) in Theralase's (TLTFF) Study II?

When does Theralase (TLTFF) plan to submit for FDA Break Through Designation?