Southwest Gas Mails Letter to Stockholders Highlighting Significant Value of MountainWest Acquisition

Rhea-AI Summary

Southwest Gas Holdings, Inc. (SWX) is urging stockholders to vote "FOR ALL" of its director nominees on the WHITE proxy card ahead of the Annual Meeting on May 12, 2022. The Board argues that their strategy focuses on long-term value creation, particularly through the recent acquisition of MountainWest, which is expected to enhance earnings significantly in 2022. The acquisition is framed as a unique and strategically valuable asset. The letter counters claims from Carl Icahn, who proposes to acquire shares at $82.50, suggesting that the company’s true value exceeds this offer.

Positive

- MountainWest acquisition expected to yield EPS uplift of $0.26 - $0.34 (6% - 8%) in 2022.

- Acquisition expected to deliver $240 million - $245 million in revenue for 2022 with an EBITDA margin of 68% - 72%.

- Successfully reduced expected equity portion of financing by ~50%, enhancing financial efficiency.

- S&P Global placed Southwest Gas' long-term ratings on CreditWatch Positive after financing.

Negative

- None.

News Market Reaction 1 Alert

On the day this news was published, SWX declined 1.62%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Urges Stockholders to Vote "FOR ALL" of Southwest Gas' Highly Qualified Director Nominees on the WHITE Proxy Card

LAS VEGAS, April 7, 2022 /PRNewswire/ -- Southwest Gas Holdings, Inc. (NYSE: SWX) ("Southwest Gas" or the "Company") today announced it is mailing a letter to its stockholders in connection with its upcoming Annual Meeting of Stockholders (the "Annual Meeting"), scheduled for May 12, 2022.

The Board strongly recommends that stockholders vote "FOR ALL" its director nominees on the WHITE proxy card promptly upon receipt. The proxy materials and other information regarding the Board of Directors' recommendation for the 2022 Annual Meeting can also be found at www.SWXBuildingValue.com.

Stockholders who have questions or who need help voting their shares may call the Company's proxy solicitor, Innisfree M&A Incorporated, at 1 (877) 825-8621 (toll-free from the U.S. and Canada) or +1 (412) 232-3651 (from other countries).

The full text of the letter being mailed to stockholders follows:

Vote the WHITE Proxy Card to Reap the Benefit of Your Board's Strategic Plan – Don't Let the Value of Your Investment Wind Up in Carl Icahn's Pocket

April 7, 2022

Dear Fellow Southwest Gas Stockholder,

There is a fundamental difference between your Board's approach to value creation and Carl Icahn's.

Your Board and management team have taken decisive action to deliver stockholder value by building a company of complementary businesses, optimizing each business and taking action to unlock value when the time is right. The upside of this strategy, and the value inherent in your Company, belong to you and all stockholders.

By contrast, Mr. Icahn is intent on capturing the value of Southwest Gas for himself, and no one else. He is seeking control of our Board solely to facilitate his inadequate and self-serving tender offer to acquire the outstanding shares of the Company for

The fact is that Mr. Icahn could not be more wrong in his assessment of the Board's strategy, and in his criticism of the Company's recent acquisition of MountainWest. We have consistently stated our expectation that the transaction will be accretive to earnings in 2022. As a direct result of our decision to spin-off Centuri, we were recently able to issue the full amount of equity needed to permanently finance the MountainWest acquisition in a highly efficient manner. As a result of the reduced amount of equity financing required and the higher price relative to our initial assumptions, we now expect the acquisition of MountainWest to deliver significantly more accretion to EPS in 2022 and beyond. Southwest Gas expects to achieve EPS uplift of

MOUNTAINWEST IS A UNIQUE, IMPOSSIBLE-TO-REPLICATE ASSET WITH STRATEGIC VALUE TO SOUTHWEST GAS, ACQUIRED AT AN ATTRACTIVE VALUATION

MountainWest's 2,000 miles of highly contracted, FERC-regulated interstate natural gas pipelines in the Rocky Mountain region make it a unique and structurally advantaged asset that could not be replicated today. MountainWest also allows for the delivery of natural gas to support the ongoing deployment of intermittent renewable generation.

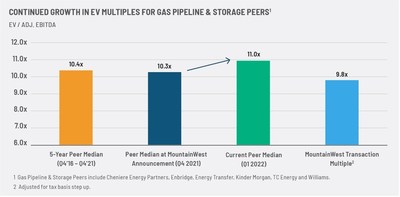

In MountainWest, the Board identified an asset that was undervalued and well-aligned with Southwest Gas' long-term value creation goals. The fact that MountainWest was not managed as a core asset under prior ownership also presented an opportunity for us to unlock further value through focused management as a core strategic component of Southwest Gas. We paid a fair price for MountainWest, below historical trading multiples and recent transaction multiples – and trading multiples have only continued to expand since the acquisition, highlighting the attractive price for our purchase of such a unique asset.

MountainWest provides a number of compelling financial and strategic benefits to Southwest Gas and our stockholders, including:

- Broadening the Company's flexibility to source and allocate growth capital;

- Generating

90% contracted revenue with over70% of revenue backed by investment grade customers; - Providing improved rate base and regulatory diversification, as well as strong, stable cash flows;

- Reducing Southwest Gas' reliance on capital markets for the significant capital investment required by continued LDC growth; and

- Providing scale and stability to further allow for the planned spin-off of Centuri.

We are on track with the integration of MountainWest and are already benefiting from strong operating cash flows from the acquisition. We expect MountainWest revenues will be

Moreover, Mr. Icahn's claims that (i) Southwest Gas is an outlier in now owning an attractive and adjacent FERC-regulated business and (ii) all industry participants are pursuing divestiture strategies to be only regulated utilities are factually incorrect. The fact is that many utilities own assets – whether pipeline, storage, renewables or otherwise – including highly respected utilities such as Atmos, Sempra and Southern Company. Furthermore, while some electric utilities have divested gas businesses, Southwest Gas is a gas utility, and owning a gas pipeline business is a compelling and natural fit for us that provides many exciting benefits.

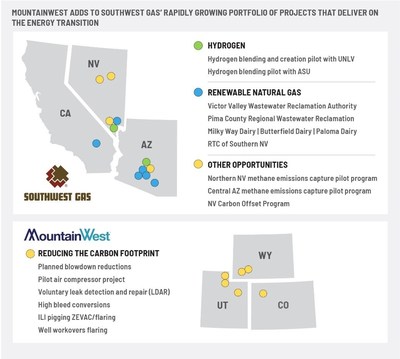

MountainWest also provides a significant opportunity to benefit from investment in the energy transition. Your Board and management team are committed to positioning Southwest Gas as a leader in the evolving energy landscape. MountainWest positions Southwest Gas to explore and deliver on numerous attractive opportunities in renewable natural gas, responsibly sourced natural gas, hydrogen and CO2 transportation.

We have identified numerous opportunities to enhance the value of the MountainWest assets and to foster company growth, including several gas-to-conversion projects within our service area with potential in-service dates of late 2023 to late 2024. One of these projects has already been contracted, and we have continued to advance others through development since the completion of the acquisition of MountainWest. In addition, we are evaluating a potential expansion of the Overthrust Pipeline with an estimated in-service date of late 2025.

Your Board and management team have the plan and skills to grow Southwest Gas through the energy transition. Mr. Icahn does not.

DRIVING VALUE THROUGH STRONG AND STABLE REGULATED EARNINGS AND THE ANNOUNCED SEPARATION OF CENTURI

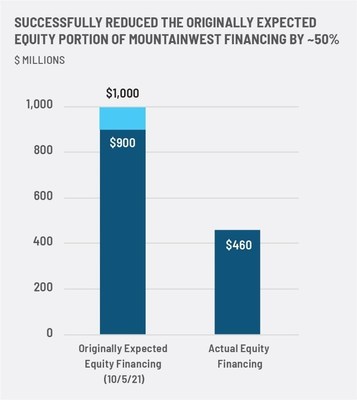

As a direct result of our decision to separate Centuri via a spin-off that is expected to be tax free, we were able to issue the full amount of equity needed to permanently finance the MountainWest acquisition in a highly efficient manner. Following discussions with credit rating agencies, we were able to successfully reduce the originally expected equity portion of the MountainWest financing by ~

This successful equity offering:

- Was multiple times oversubscribed;

- Broadly distributed new equity to 100+ new and current stockholders; and

- Was executed in one day with minimal, if any, impact on our market price.

There is no basis for Mr. Icahn's claim that stockholders have been diluted by "more than

We are baffled that Mr. Icahn continues to push a false narrative about voting rights attached to the newly issued shares. Time and time again we have stated that the equity offering was completed well after the March 21, 2022 record date had passed. As such, none of the shares issued in the financing will have voting rights at the Annual Meeting.

It is also worth reiterating that Mr. Icahn falsely claimed that he made a bona fide offer to purchase all of the equity to finance the MountainWest transaction at

Mr. Icahn also failed to mention it would be illegal for Mr. Icahn to buy shares of Southwest Gas in a financing in light of his pending tender offer.

As a result of the reduced amount of equity financing required and the higher price relative to our initial assumptions, we now expect to deliver significantly more accretion to EPS in 2022 and beyond. In fact, one research analyst published the following comments in a recent report with an increased share price target for Southwest Gas:

"As a result of the reduced equity needs we are raising our '22E by

PROTECT THE VALUE OF YOUR SOUTHWEST GAS INVESTMENT:

VOTE THE WHITE PROXY CARD TODAY

Your Board is driving results through strategic value creation opportunities and will continue to take the actions that are in the best interest of Southwest Gas and ALL of its stockholders.

When you cut through the noise surrounding Carl Icahn's proxy fight, the issue is simple:

- Mr. Icahn said he is nominating 10 candidates in support of his efforts to take control of the Company for

$82.50 per share.

- Your Board believes the Company is worth more than

$82 .50… and so does Mr. Icahn. In fact, Mr. Icahn says the sum of the parts is between$114 and$144 per share.

What's at stake is whether the value represented by a share in Southwest Gas should go to all stockholders, or only to Mr. Icahn.

This is a critical moment for Southwest Gas and your investment in the Company, and we urge you to protect the value of that investment by supporting your Board and management team. We are confident that our forthcoming spin-off of Centuri, the efficient equity financing of the MountainWest acquisition and the realization of our strategic plans will deliver significantly greater value than Mr. Icahn's

On behalf of your Board and the management team, thank you for your continued support.

Sincerely,

/s/ Michael J. Melarkey | /s/ Robert L. Boughner |

Michael J. Melarkey | Robert L. Boughner |

Chairman | Incoming Chairman |

YOUR VOTE IS IMPORTANT—PLEASE USE THE WHITE PROXY CARD TODAY! |

Simply follow the easy instructions on the enclosed WHITE proxy card to vote by telephone, by internet or by signing, dating and returning the WHITE proxy card in the postage-paid envelope provided. If you received this letter by email, you may also vote by pressing the WHITE "VOTE NOW" button in the accompanying email. |

Remember--please do not vote using any gold proxy card you may receive from Mr. Icahn, (even as a "protest vote"). A vote on the gold proxy card will revoke your prior vote for that account on the WHITE proxy card. If you inadvertently voted using the gold proxy card, you can always cancel that vote by voting again using the WHITE proxy card--only your latest-dated proxy counts! |

If you have questions about how to vote your shares, please call the firm assisting us with the solicitation of proxies, Innisfree M&A Incorporated, at: |

1 (877) 825-8621 (toll-free from the U.S. and Canada) |

or |

+1 (412) 232-3651 (from other locations) |

Lazard is serving as financial advisor to Southwest Gas and Morrison & Foerster LLP and Cravath, Swaine & Moore LLP are serving as legal advisors.

About Southwest Gas Holdings, Inc.

Southwest Gas Holdings, Inc., through its subsidiaries, engages in the business of purchasing, distributing and transporting natural gas, and providing comprehensive utility infrastructure services across North America. Southwest Gas Corporation, a wholly owned subsidiary, safely and reliably delivers natural gas to over two million customers in Arizona, California and Nevada. The Company's MountainWest subsidiary provides natural gas storage and interstate pipeline services within the Rocky Mountain region. Centuri Group, Inc., a wholly owned subsidiary, is a strategic infrastructure services company that partners with regulated utilities to build and maintain the energy network that powers millions of homes and businesses across the United States and Canada.

How to Find Further Information

This communication does not constitute a solicitation of any vote or approval in connection with the 2022 annual meeting of stockholders of Southwest Gas Holdings, Inc. (the "Company") (the "Annual Meeting"). In connection with the Annual Meeting, the Company has filed a definitive proxy statement with the U.S. Securities and Exchange Commission ("SEC"), which the Company has furnished to its stockholders in connection with the Annual Meeting. The Company may furnish additional materials in connection with the Annual Meeting. BEFORE MAKING ANY VOTING DECISION, WE URGE STOCKHOLDERS TO READ THE PROXY STATEMENT (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND WHITE PROXY CARD AND OTHER DOCUMENTS WHEN SUCH INFORMATION IS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY AND THE ANNUAL MEETING. The proposals for the Annual Meeting are being made solely through the definitive proxy statement. In addition, a copy of the definitive proxy statement may be obtained free of charge from www.swgasholdings.com/proxymaterials. Security holders also may obtain, free of charge, copies of the proxy statement and any other documents filed by Company with the SEC in connection with the Annual Meeting at the SEC's website at http://www.sec.gov, and at the Company's website at www.swgasholdings.com.

Important Information for Investors and Stockholders: This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. In response to the tender offer for the shares of the Company commenced by IEP Utility Holdings LLC and Icahn Enterprises Holdings L.P., the Company has filed a solicitation/recommendation statement on Schedule 14D-9 with the SEC. INVESTORS AND STOCKHOLDERS OF SOUTHWEST GAS HOLDINGS ARE URGED TO READ THE SOLICITATION/RECOMMENDATION STATEMENT AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and stockholders may obtain a free copy of these documents free of charge at the SEC's website at www.sec.gov, and at the Company's website at www.swgasholdings.com. In addition, copies of these materials may be requested from the Company's information agent, Innisfree M&A Incorporated, toll-free at (877) 825-8621.

Forward-Looking Statements: This press release contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements include, without limitation, statements regarding Southwest Gas Holdings, Inc. (the "Company") and the Company's expectations or intentions regarding the future. These forward-looking statements can often be identified by the use of words such as "will", "predict", "continue", "forecast", "expect", "believe", "anticipate", "outlook", "could", "target", "project", "intend", "plan", "seek", "estimate", "should", "may" and "assume", as well as variations of such words and similar expressions referring to the future, and include (without limitation) statements regarding expectations with respect to a separation of Centuri, the future performance of Centuri, Southwest Gas's dividend ratios and Southwest Gas's future performance. A number of important factors affecting the business and financial results of the Company could cause actual results to differ materially from those stated in the forward-looking statements. These factors include, but are not limited to, the timing and amount of rate relief, changes in rate design, customer growth rates, the effects of regulation/deregulation, tax reform and related regulatory decisions, the impacts of construction activity at Centuri, whether we will separate Centuri within the anticipated timeframe and the impact to our results of operations and financial position from the separation, the potential for, and the impact of, a credit rating downgrade, the costs to integrate MountainWest, future earnings trends, inflation, sufficiency of labor markets and similar resources, seasonal patterns, the cost and management attention of ongoing litigation that the Company is currently engaged in, the effects of the pending tender offer and proxy contest brought by Carl Icahn and his affiliates, and the impacts of stock market volatility. In addition, the Company can provide no assurance that its discussions about future operating margin, operating income, COLI earnings, interest expense, and capital expenditures of the natural gas distribution segment will occur. Likewise, the Company can provide no assurance that discussions regarding utility infrastructure services segment revenues, EBITDA as a percentage of revenue, and interest expense will transpire, nor assurance regarding acquisitions or their impacts, including management's plans or expectations related thereto, including with regard to Riggs Distler or MountainWest. Factors that could cause actual results to differ also include (without limitation) those discussed under the heading "Risk Factors" in the Company's most recent Annual Report on Form 10-K and in the Company's and Southwest Gas Corporation's current and periodic reports, including our Quarterly Reports on Form 10-Q, filed from time to time with the SEC. The statements in this press release are made as of the date of this press release, even if subsequently made available by the Company on its Web site or otherwise. The Company does not assume any obligation to update the forward-looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future developments, or otherwise.

Participants in the Solicitation: The directors and officers of the Company may be deemed to be participants in the solicitation of proxies in connection with the Annual Meeting. Information regarding the Company's directors and officers and their respective interests in the Company by security holdings or otherwise is available in its most recent Annual Report on Form 10-K filed with the SEC and the definitive Proxy Statement on Schedule 14A filed with the SEC in connection with the Annual Meeting. Additional information regarding the interests of such potential participants is included in other relevant materials filed with the SEC.

Contacts

For investor information, contact: Boyd Nelson, (702) 876-7237, boyd.nelson@swgas.com; or Innisfree M&A Incorporated, Scott Winter/Jennifer Shotwell/Jon Salzberger, (212) 750-5833.

For media information, contact: Sean Corbett, (702) 876-7219, sean.corbett@swgas.com; or Joele Frank, Wilkinson Brimmer Katcher, Dan Katcher / Tim Lynch, (212) 355-4449.

____________________ |

1 Permission to use quote neither sought nor obtained. The Company is not endorsing or adopting the contents of the report, and it is not incorporated into this letter. |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/southwest-gas-mails-letter-to-stockholders-highlighting-significant-value-of-mountainwest-acquisition-301519973.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/southwest-gas-mails-letter-to-stockholders-highlighting-significant-value-of-mountainwest-acquisition-301519973.html

SOURCE Southwest Gas Holdings, Inc.