SILVERCORP REPORTS Q3 FISCAL 2023 ADJUSTED NET INCOME OF $11.8 MILLION, $0.07 PER SHARE, AND ISSUES FISCAL 2024 PRODUCTION, CASH COSTS, AND CAPITAL EXPENDITURE GUIDANCE

Rhea-AI Summary

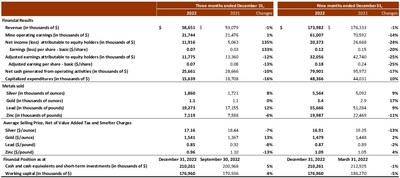

Silvercorp Metals Inc. (TSX: SVM, NYSE American: SVM) reported its Q3 Fiscal 2023 results, highlighting a net income of $11.9 million or $0.07 per share, a significant increase from $5.1 million in Q3 Fiscal 2022. Revenue reached $58.7 million, reflecting a 1% decrease year-over-year due to lower selling prices for silver, lead, and zinc. The company produced 1.9 million ounces of silver and 20.1 million pounds of lead, with cash costs per ounce of silver at negative $1.15. For Fiscal 2024, production guidance includes mining 1,100,000 to 1,170,000 tonnes of ore, projecting increases in output for key metals.

Positive

- Net income increased to $11.9 million from $5.1 million in Q3 Fiscal 2022.

- Revenue of $58.7 million despite a slight decline, indicating stable operations.

- Producing 1.9 million ounces of silver, reinforcing production capabilities.

- Cash costs per ounce of silver remain at negative $1.15, improving profitability.

Negative

- Revenue decreased by 1% compared to Q3 Fiscal 2022.

- Selling prices for silver, lead, and zinc declined by 7%, 8%, and 13%, respectively.

News Market Reaction 1 Alert

On the day this news was published, SVM gained 4.58%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

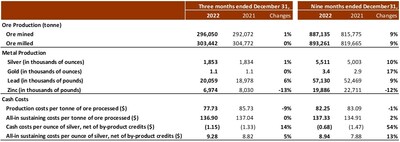

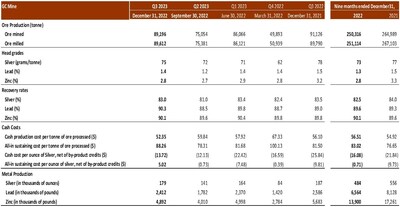

- Mined 296,050 tonnes of ore, milled 303,442 tonnes of ore, and produced approximately 1.9 million ounces of silver, 1,100 ounces of gold, 20.1 million pounds of lead, and 7.0 million pounds of zinc;

- Sold approximately 1.9 million ounces of silver, 1,100 ounces of gold, 19.3 million pounds of lead, and 7.1 million pounds of zinc, for revenue of

$58.7 million - Realized adjusted earnings attributable to equity holders of

$11.8 million $0.07 - Reported net income attributable to equity holders of

$11.9 million $0.07 - Generated cash flow from operating activities of

$25.7 million - Cash costs per ounce of silver, net of by-product credits, of negative

$1.15 - All-in sustaining costs per ounce of silver, net of by-product credits, of

$9.28 - Spent and capitalized

$1.4 million $9.0 million $2.8 million - Strong balance sheet with

$210.3 million $121.8 million December 31, 2022 .

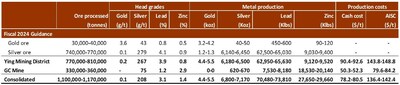

- To mine and process 1,100,000 to 1,170,000 tonnes of ores, yielding approximately 4,400 to 5,500 ounces of gold, 6.8 to 7.2 million ounces of silver, 70.5 to 73.8 million pounds of lead, and 27.7 to 29.7 million pounds of zinc.

- The guidance represents a production increase of approximately

3% to8% in ores,1% to26% in gold,3% to8% in silver,3% to8% in lead, and14% to23% in zinc compared to the expected production results in Fiscal 2023.

Net income attributable to equity holders of the Company in Q3 Fiscal 2023 was

In Q3 Fiscal 2023, the Company's consolidated financial results were mainly impacted by i) increases of

Revenue in Q3 Fiscal 2023 was

Income from mine operations in Q3 Fiscal 2023 was

Cash flow provided by operating activities in Q3 Fiscal 2023 was

The Company ended Q3 Fiscal 2023 with

Working capital as at

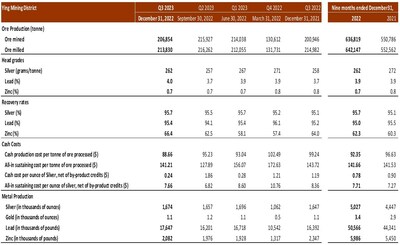

In Q3 Fiscal 2023, the Company mined 296,050 tonnes of ore, up

In Q3 Fiscal 2023, the Company produced approximately 1.9 million ounces of silver, 1,100 ounces of gold, 20.1 million pounds of lead, and 7.0 million pounds of zinc, representing increases of

In Q3 Fiscal 2023, the consolidated production costs were

In Q3 Fiscal 2023, the consolidated cash costs per ounce of silver, net of by-product credits, were negative

The consolidated all-in sustaining costs per ounce of silver, net of by-product credits, were

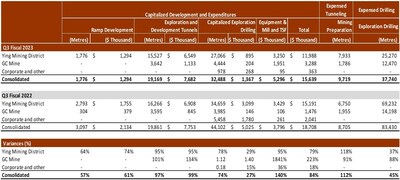

In Q3 Fiscal 2023, on a consolidated basis, a total of 70,228 metres or

In

As of

The Company spent approximately

In Fiscal 2024, the Company expects to mine and process 1,100,000 to 1,170,000 tonnes ore, yielding approximately 4,400 to 5,500 ounces of gold, 6.8 to 7.2 million ounces of silver, 70.5 to 73.8 million pounds of lead, and 27.7 to 29.7 million pounds of zinc. Fiscal 2024 production guidance represents production increases of approximately

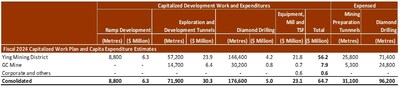

The table below summarizes the work plan and estimated capital expenditures in Fiscal 2024.

In Fiscal 2024, the Company plans to: i) complete 8,800 metres of tunnels as major access and transportation ramps at estimated capitalized expenditures of

In addition to the capitalized tunneling and drilling work, the Company also plans to complete and expense 31,100 metres of mining preparation tunnels and 96,200 metres of diamond drilling.

(a)

In Fiscal 2024, the Company plans to mine and process 770,000 to 810,000 tonnes of ore at the

The cash production cost is expected to be

In Fiscal 2024, the

In addition to the capitalized tunneling and drilling work, the

(b)

In Fiscal 2024, the Company plans to mine and process 330,000 to 360,000 tonnes of ore at the

The cash production cost is expected to be

In Fiscal 2024, the

In addition to the capitalized tunneling and drilling work, the Company also plans to complete and expense 5,300 metres of tunnels and 24,800 metres of underground drilling at the

(c) Kuanping Project

The Company plans to carry out studies to complete the environmental assessment report, water and soil protection assessment report, and preliminary safety facilities and mine design report as required for the

A conference call to discuss these results will be held tomorrow,

International Toll: 416-764-8650

Conference ID: 17900371

Participants should dial-in 10 – 15 minutes prior to the start time. A replay of the conference call and transcript will be available on the Company's website at www.silvercorp.ca.

Mr.

Silvercorp is a Canadian mining company producing silver, gold, lead, and zinc with a long history of profitability and growth potential. The Company's strategy is to create shareholder value by 1) focusing on generating free cashflow from long life mines; 2) organic growth through extensive drilling for discovery; 3) ongoing merger and acquisition efforts to unlock value; and 4) long term commitment to responsible mining and ESG. For more information, please visit our website at www.silvercorp.ca.

For further information

Vice President

Phone: (604) 669-9397

Toll Free 1(888) 224-1881

Email: investor@silvercorp.ca

Website: www.silvercorp.ca

ALTERNATIVE PERFORMANCE (NON-IFRS) MEASURES

This news release should be read in conjunction with the Company's Management Discussion & Analysis ("MD&A"), the unaudited condensed consolidated interim financial statements and related notes contains therein for the three and nine months ended

CAUTIONARY DISCLAIMER - FORWARD-LOOKING STATEMENTS

Certain of the statements and information in this news release constitute "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian and US securities laws (collectively, "forward-looking statements"). Any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects", "is expected", "anticipates", "believes", "plans", "projects", "estimates", "assumes", "intends", "strategies", "targets", "goals", "forecasts", "objectives", "budgets", "schedules", "potential" or variations thereof or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements. Forward-looking statements relate to, among other things: the price of silver and other metals; the accuracy of mineral resource and mineral reserve estimates at the Company's material properties; the sufficiency of the Company's capital to finance the Company's operations; estimates of the Company's revenues and capital expenditures; estimated production from the Company's mines in the

Actual results may vary from forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation, risks relating to: global economic and social impact of COVID-19; fluctuating commodity prices; calculation of resources, reserves and mineralization and precious and base metal recovery; interpretations and assumptions of mineral resource and mineral reserve estimates; exploration and development programs; feasibility and engineering reports; permits and licences; title to properties; property interests; joint venture partners; acquisition of commercially mineable mineral rights; financing; recent market events and conditions; economic factors affecting the Company; timing, estimated amount, capital and operating expenditures and economic returns of future production; integration of future acquisitions into the Company's existing operations; competition; operations and political conditions; regulatory environment in

This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements. Forward-looking statements are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to in the Company's Annual Information Form under the heading "Risk Factors" and in the Company's Annual Report on Form 40-F, and in the Company's other filings with Canadian and

The Company's forward-looking statements are based on the assumptions, beliefs, expectations and opinions of management as of the date of this news release, and other than as required by applicable securities laws, the Company does not assume any obligation to update forward-looking statements if circumstances or management's assumptions, beliefs, expectations or opinions should change, or changes in any other events affecting such statements. Assumptions may prove to be incorrect and actual results may differ materially from those anticipated. Consequently, guidance cannot be guaranteed. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/silvercorp-reports-q3-fiscal-2023-adjusted-net-income-of-11-8-million-0-07-per-share-and-issues-fiscal-2024-production-cash-costs-and-capital-expenditure-guidance-301743668.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/silvercorp-reports-q3-fiscal-2023-adjusted-net-income-of-11-8-million-0-07-per-share-and-issues-fiscal-2024-production-cash-costs-and-capital-expenditure-guidance-301743668.html

SOURCE