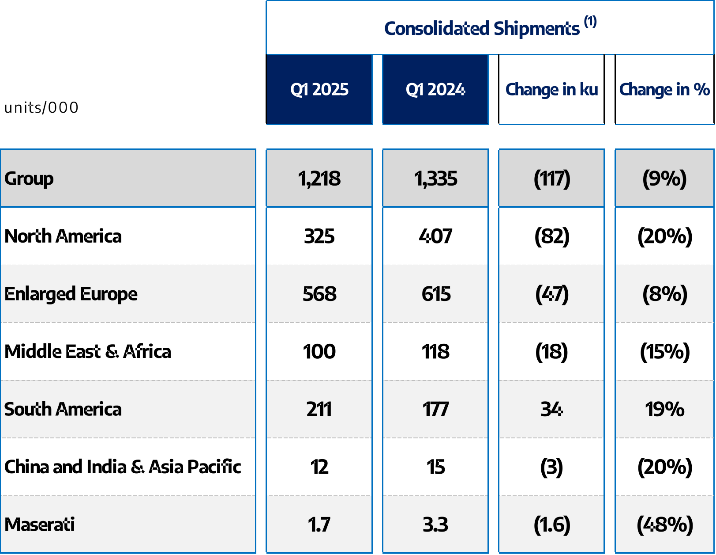

Stellantis Reports Q1 2025 Consolidated Shipment Estimates of 1.2 Million Units Globally, -9% y-o-y

Stellantis reported Q1 2025 global consolidated shipments of 1.2 million units, marking a 9% year-over-year decline. The decrease was primarily attributed to lower North American production due to extended January holiday downtime and reduced volumes in Enlarged Europe.

North American shipments fell 20% y-o-y (approximately 82,000 units), while Enlarged Europe saw an 8% decline (around 47,000 units). However, positive developments included U.S. sales growth for Jeep Compass, Grand Cherokee, and Ram 1500/2500 (>10% y-o-y), and improved EU30 market share of 17.3% (+1.9 percentage points vs Q4 2024).

The company's 'Third Engine' markets showed mixed results, with a 4% overall growth driven by South America's 19% increase, offsetting declines in Middle East & Africa, China, and India & Asia Pacific regions.

Stellantis ha riportato nel primo trimestre del 2025 spedizioni globali consolidate di 1,2 milioni di unità, segnando un declino del 9% rispetto all'anno precedente. La diminuzione è stata principalmente attribuita a una produzione ridotta in Nord America a causa di un prolungato periodo di inattività durante le festività di gennaio e a volumi inferiori in Europa allargata.

Le spedizioni in Nord America sono diminuite del 20% rispetto all'anno precedente (circa 82.000 unità), mentre l'Europa allargata ha registrato un declino dell'8% (circa 47.000 unità). Tuttavia, sviluppi positivi hanno incluso la crescita delle vendite negli Stati Uniti per Jeep Compass, Grand Cherokee e Ram 1500/2500 (>10% rispetto all'anno precedente), e un miglioramento della quota di mercato EU30 del 17,3% (+1,9 punti percentuali rispetto al quarto trimestre del 2024).

I mercati 'Third Engine' dell'azienda hanno mostrato risultati misti, con una crescita complessiva del 4% guidata da un aumento del 19% in Sud America, che ha compensato i cali nelle regioni del Medio Oriente e Africa, Cina e India e Asia Pacifico.

Stellantis reportó envíos consolidados globales de 1,2 millones de unidades en el primer trimestre de 2025, marcando un declive del 9% interanual. La disminución se atribuyó principalmente a una menor producción en América del Norte debido a un prolongado tiempo de inactividad durante las vacaciones de enero y a volúmenes reducidos en Europa ampliada.

Los envíos en América del Norte cayeron un 20% interanual (aproximadamente 82,000 unidades), mientras que Europa ampliada vio un declive del 8% (alrededor de 47,000 unidades). Sin embargo, los desarrollos positivos incluyeron el crecimiento de ventas en EE. UU. para Jeep Compass, Grand Cherokee y Ram 1500/2500 (>10% interanual), y una mejora en la cuota de mercado EU30 del 17,3% (+1,9 puntos porcentuales en comparación con el cuarto trimestre de 2024).

Los mercados 'Third Engine' de la compañía mostraron resultados mixtos, con un crecimiento general del 4% impulsado por un aumento del 19% en América del Sur, compensando las caídas en las regiones de Medio Oriente y África, China, e India y Asia-Pacífico.

스텔란티스는 2025년 1분기 전 세계 통합 출하량이 120만 대에 달하며, 전년 대비 9% 감소했다고 보고했습니다. 감소는 주로 1월의 긴 휴일로 인한 북미 생산 감소와 확대된 유럽의 물량 감소에 기인했습니다.

북미 출하량은 전년 대비 20% 감소했으며(약 82,000대), 확대된 유럽은 8% 감소했습니다(약 47,000대). 그러나 긍정적인 발전으로는 Jeep Compass, Grand Cherokee 및 Ram 1500/2500의 미국 판매 성장(전년 대비 >10%)과 2024년 4분기 대비 1.9포인트 증가한 17.3%의 EU30 시장 점유율 개선이 포함되었습니다.

회사의 '제3 엔진' 시장은 혼합된 결과를 보였으며, 남미의 19% 증가에 힘입어 전체적으로 4% 성장했습니다. 이는 중동 및 아프리카, 중국, 인도 및 아시아 태평양 지역의 감소를 상쇄했습니다.

Stellantis a rapporté des expéditions consolidées mondiales de 1,2 million d'unités au premier trimestre 2025, marquant un déclin de 9% par rapport à l'année précédente. La diminution a été principalement attribuée à une production plus faible en Amérique du Nord en raison d'une prolongation des congés de janvier et à des volumes réduits en Europe élargie.

Les expéditions en Amérique du Nord ont chuté de 20% par rapport à l'année précédente (environ 82 000 unités), tandis que l'Europe élargie a connu un déclin de 8% (environ 47 000 unités). Cependant, des développements positifs ont inclus la croissance des ventes aux États-Unis pour Jeep Compass, Grand Cherokee et Ram 1500/2500 (>10% par rapport à l'année précédente), ainsi qu'une amélioration de la part de marché EU30 de 17,3% (+1,9 points de pourcentage par rapport au quatrième trimestre 2024).

Les marchés 'Third Engine' de l'entreprise ont montré des résultats mitigés, avec une croissance globale de 4% tirée par une augmentation de 19% en Amérique du Sud, compensant les baisses dans les régions du Moyen-Orient et d'Afrique, de la Chine et de l'Inde et de l'Asie-Pacifique.

Stellantis berichtete über konsolidierte weltweite Auslieferungen von 1,2 Millionen Einheiten im ersten Quartal 2025, was einen Rückgang von 9% im Vergleich zum Vorjahr bedeutet. Der Rückgang wurde hauptsächlich auf eine verringerte Produktion in Nordamerika aufgrund einer verlängerten Feiertagsunterbrechung im Januar und auf reduzierte Volumina in erweitertem Europa zurückgeführt.

Die Auslieferungen in Nordamerika fielen um 20% im Vergleich zum Vorjahr (ungefähr 82.000 Einheiten), während erweitertes Europa einen Rückgang von 8% (rund 47.000 Einheiten) verzeichnete. Positives gab es jedoch in Form von Verkaufswachstum in den USA für Jeep Compass, Grand Cherokee und Ram 1500/2500 (>10% im Vergleich zum Vorjahr) sowie einer Verbesserung des Marktanteils in der EU30 von 17,3% (+1,9 Prozentpunkte im Vergleich zum 4. Quartal 2024).

Die 'Third Engine'-Märkte des Unternehmens zeigten gemischte Ergebnisse mit einem gesamt 4% Wachstum, das durch einen Anstieg von 19% in Südamerika angetrieben wurde, was Rückgänge in den Regionen Naher Osten & Afrika, China und Indien & Asien-Pazifik ausglich.

- EU30 market share increased by 1.9 percentage points to 17.3% vs Q4 2024

- South American shipments grew 19% with maintained market leadership

- Key US models (Jeep Compass, Grand Cherokee, Ram 1500/2500) showed >10% y-o-y growth

- March new retail orders reached highest level since July 2023

- Global shipments declined 9% y-o-y to 1.2 million units

- North American shipments dropped 20% y-o-y (-82,000 units)

- Enlarged Europe shipments fell 8% y-o-y (-47,000 units)

- Middle East & Africa shipments decreased 15% due to import restrictions

Insights

Stellantis' Q1 2025 shipment report reveals concerning volume trends that will likely impact revenue and profitability. The 9% year-over-year decline in global consolidated shipments represents significant headwinds in key markets, particularly the 20% drop in North America, which typically generates higher margins.

The extended holiday downtime in January and the Ram heavy-duty truck transition explain part of the North American decline, but the magnitude suggests deeper challenges. Similarly, the 8% European shipment decline reflects both product transition issues and weakening light commercial vehicle demand - the latter being particularly concerning as LCVs have historically been a profit center for the company.

While Stellantis highlights some recovery signals - including the 1.9 percentage point EU30 market share improvement versus Q4 2024 and specific model successes like Jeep Compass and Grand Cherokee in the US - these positive indicators are overshadowed by the overall volume deterioration. The company's "Third Engine" markets showed modest 4% growth, primarily from South America's 19% increase, providing some geographical diversification benefits.

The launch of new products like the Citroën C3 Aircross, Fiat Grande Panda, and updated Ram trucks should eventually support recovery, but transition gaps are clearly impacting near-term performance. Investors should watch whether these volume declines are temporary or indicative of more persistent market share erosion in key regions.

Stellantis Reports Q1 2025 Consolidated Shipment Estimates of 1.2 Million Units Globally, -

Commercial Recovery Efforts Drive Initial Rebound in EU30 Market Share vs. H2 2024, Stabilization in U.S. Retail Share

AMSTERDAM, April 11, 2025 – Stellantis N.V. today published global quarterly consolidated shipment estimates and provided commentary on related business trends. The term “shipments” describes the volume of vehicles delivered to dealers, distributors, or directly from the Company to retail and fleet customers, which drive revenue recognition.

Consolidated shipments for the three months ending March 31, 2025, were an estimated 1.2 million units, representing a

Commercial progress in the first quarter of 2025, included the launch of all new and refreshed models including the Citroën C3 Aircross, Opel Frontera, Fiat Grande Panda, Ram 2500 and 3500 heavy-duty trucks, helping to drive positive momentum in order intake, while maintaining normalized dealer inventory levels.

- In North America, Q1 shipments declined approximately 82 thousand units compared to the same period in 2024, representing a

20% y-o-y decline, mainly reflecting lower January production, a consequence of extended holiday downtime, as well as the initial ramp up of the updated 2025 Ram heavy duty trucks. Looking at U.S. sales performance, Jeep® Compass, Grand Cherokee and Ram 1500/2500 each saw volumes rise >10% y-o-y in Q1 2025. Also encouraging, March new retail orders were at the highest level since July 2023. - Enlarged Europe Q1 shipments declined approximately 47 thousand units, representing a

8% y-o-y decline, two-thirds due to transition gaps in certain A and B-segment vehicles replacing prior-generation products discontinued at the end of H1 2024, and one-third from a decline in LCV volumes. Switching over to European sales performance, Q1 2025 EU30 market share was17.3% , an increase of 1.9 percentage points compared to Q4 2024, reflecting in part the sales contributions of recent new product launches. - Across Stellantis’ “Third Engine”, shipments grew collectively 13 thousand units, representing a

4% increase driven mainly by a19% increase in South America, more than offsetting shipment declines in Middle East & Africa, China and India & Asia Pacific. Stellantis maintained its leadership in South America while benefiting from higher industry volumes, especially in Brazil and Argentina. In Middle East & Africa the15% decline in shipments was mostly driven by the impact of import restrictions in Algeria, Tunisia and Egypt.

(1) Consolidated shipments only include shipments by Company’s consolidated subsidiaries, which represent new vehicles invoiced to third party (dealers/importers or final customers).

Consolidated shipment volumes for Q1 2025 presented here are unaudited and may be adjusted. Final figures will be provided in our official revenue/shipments report. Analysts should interpret these numbers with the understanding that they are preliminary and subject to change.

(2) The “Third Engine” refers to the aggregation of the South America, Middle East & Africa and China and India & Asia Pacific segments for presentation purposes only.

# # #

About Stellantis

Stellantis N.V. (NYSE: STLA / Euronext Milan: STLAM / Euronext Paris: STLAP) is a leading global automaker, dedicated to giving its customers the freedom to choose the way the move, embracing the latest technologies and creating value for all its stakeholders. Its unique portfolio of iconic and innovative brands includes Abarth, Alfa Romeo, Chrysler, Citroën, Dodge, DS Automobiles, FIAT, Jeep®, Lancia, Maserati, Opel, Peugeot, Ram, Vauxhall, Free2move and Leasys. For more information, visit www.stellantis.com.

| @Stellantis |  | Stellantis |  | Stellantis |  | Stellantis | |

For more information, contact: investor.relations@stellantis.com communications@stellantis.com www.stellantis.com | ||||||||

Safe harbor statement

This document contains forward looking statements. Statements regarding future financial performance and the Company’s expectations as to the achievement of certain targeted metrics, including revenues, industrial free cash flows, vehicle shipments, capital investments, research and development costs and other expenses at any future date or for any future period are forward-looking statements. These statements may include terms such as “may”, “will”, “expect”, “could”, “should”, “intend”, “estimate”, “anticipate”, “believe”, “remain”, “on track”, “design”, “target”, “objective”, “goal”, “forecast”, “projection”, “outlook”, “prospects”, “plan”, or similar terms. Forward-looking statements are not guarantees of future performance. Rather, they are based on the Company’s current state of knowledge, future expectations and projections about future events and are by their nature, subject to inherent risks and uncertainties. They relate to events and depend on circumstances that may or may not occur or exist in the future and, as such, undue reliance should not be placed on them. Actual results may differ materially from those expressed in forward-looking statements as a result of a variety of factors, including: the Company’s ability to launch new products successfully and to maintain vehicle shipment volumes; changes in the global financial markets, general economic environment and changes in demand for automotive products, which is subject to cyclicality; the Company’s ability to successfully manage the industry-wide transition from internal combustion engines to full electrification; the Company’s ability to offer innovative, attractive products and to develop, manufacture and sell vehicles with advanced features including enhanced electrification, connectivity and autonomous-driving characteristics; the Company’s ability to produce or procure electric batteries with competitive performance, cost and at required volumes; the Company’s ability to successfully launch new businesses and integrate acquisitions; a significant malfunction, disruption or security breach compromising information technology systems or the electronic control systems contained in the Company’s vehicles; exchange rate fluctuations, interest rate changes, credit risk and other market risks; increases in costs, disruptions of supply or shortages of raw materials, parts, components and systems used in the Company’s vehicles; changes in local economic and political conditions; changes in trade policy, the imposition of global and regional tariffs or tariffs targeted to the automotive industry, the enactment of tax reforms or other changes in tax laws and regulations; the level of governmental economic incentives available to support the adoption of battery electric vehicles; the impact of increasingly stringent regulations regarding fuel efficiency requirements and reduced greenhouse gas and tailpipe emissions; various types of claims, lawsuits, governmental investigations and other contingencies, including product liability and warranty claims and environmental claims, investigations and lawsuits; material operating expenditures in relation to compliance with environmental, health and safety regulations; the level of competition in the automotive industry, which may increase due to consolidation and new entrants; the Company’s ability to attract and retain experienced management and employees; exposure to shortfalls in the funding of the Company’s defined benefit pension plans; the Company’s ability to provide or arrange for access to adequate financing for dealers and retail customers and associated risks related to the operations of financial services companies; the Company’s ability to access funding to execute its business plan; the Company’s ability to realize anticipated benefits from joint venture arrangements; disruptions arising from political, social and economic instability; risks associated with the Company’s relationships with employees, dealers and suppliers; the Company’s ability to maintain effective internal controls over financial reporting; developments in labor and industrial relations and developments in applicable labor laws; earthquakes or other disasters; and other risks and uncertainties. Any forward-looking statements contained in this document speak only as of the date of this document and the Company disclaims any obligation to update or revise publicly forward-looking statements. Further information concerning the Company and its businesses, including factors that could materially affect the Company’s financial results, is included in the Company’s reports and filings with the U.S. Securities and Exchange Commission and AFM.

Attachment