Starco Brands Announces a $45 million Public Offering under Regulation A+

Starco Brands, Inc. (STCB) has launched a Regulation A+, Tier 2 public offering to raise $45 million. This offering allows direct investment in the company's freely tradable common stock, enhancing accessibility for investors aged 18 and older. The initiative supports Starco Brands' mission to foster close relationships with its customer base and generate capital for their innovative product lines, including Whipshots™ and Breathe®. The proceeds will enhance liquidity and fund future growth plans.

- The offering aims to raise up to $45 million, allowing public investment in Starco Brands.

- Enhances liquidity by providing approximately 45 million shares for public purchase.

- Supports the company's strategy to engage its community and customers in ownership.

- Potential shareholder dilution due to the large volume of shares being offered.

SANTA MONICA, Calif., Dec. 14, 2021 /PRNewswire/ -- Starco Brands, Inc. (STCB or the "Company") announces the launch of a Regulation A+, Tier 2, equity financing of up to

Starco Brands' mission is to create cutting edge, behavior-changing brands, and this innovative method of capital raising reflects the Company's culture of disruption by providing Starco Brands' customer base and community a chance to invest in the Company directly. Prior to this Public Offering, the Company's registered share count was very limited, making it difficult for the public to procure large volumes of its tradable stock. This offering allows the public to purchase approximately 45 million shares of common stock directly from the Company, providing capital to fund its business plan while also increasing the availability and liquidity of Starco Brands' shares in the public market.

"I've often been asked why we chose this type of public offering," comments Ross Sklar, CEO of Starco Brands. "We hold our relationship with our customers and community in high regard and strive for a deep connection where our financial interests are aligned. We believe our customers, vendors, influencers, brand evangelists and community as a whole should be entitled to own stock and participate in potential wealth creation over the long term," continued Sklar.

"We have developed an extraordinarily unique process to efficiently transform behavior changing technologies into world-class brands," said David Dreyer, EVP of Marketing for Starco Brands. "Our inventions are complemented with disruptive and leading-edge marketing programs that have proven to reach hundreds of millions of people around the world and we are just getting started," continued Dreyer.

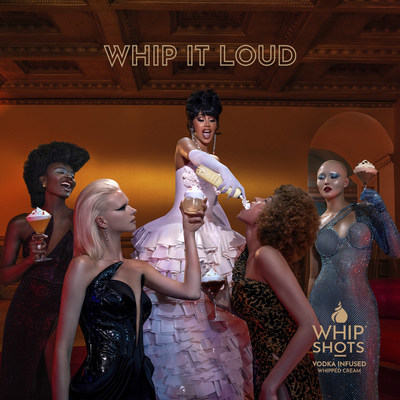

Starco Brands invents and commercializes brands across a number of consumer packaged goods categories. With one of the largest consumer product launches of 2021, the Company recently disrupted the spirits space by announcing the ground-breaking product Whipshots™, a vodka-infused whipped cream, with our partner, global artist Cardi B. Additionally, the Company pushed innovation in household goods by commercializing Breathe®, the only aerosol cleaning line to be approved by the EPA's Safer Choice program. In personal care, Starco Brands extended its Breathe® line to include the Breathe® Skin Sanitizer, a patent-pending, first ever, powered by air, spray skin sanitizer proven to kill Covid 19*. In sun care, the Company commercialized Honu™ Sunscreen, a powered by air, reef-safe spray sunscreen that has a patented ratcheting spray arm designed to spray hard to reach areas. Honu™ was named Product of the Year in 2019 by POY. In the food category, the Company commercialized Winona® Popcorn Spray, a fun and easy to use non-gmo and low-calorie popcorn seasoning spray line.

"I've been impressed with their unique ability to pair ground-breaking products with a disruptive approach to marketing to drive global awareness," said Anthony Scaramucci, CEO of the

"We helped build Mr. Sklar's private company, The Starco Group, to be one of the most diverse private label and contract manufacturers in the country. Starco Brands is positioned well to commercialize its IP and leverage the manufacturing and distribution capability of The Starco Group. This share offering further enables our mission to create power brands that truly change consumer behavior. We believe we are changing the game across a number of sectors and cannot be more thrilled about our current brands, as well as those to come," said Darin Brown, EVP and Director of Starco Brands.

About Starco Brands, Inc. (OTCQB I STCB)

Starco Brands, Inc. is a disruptive consumer packaged goods company focused on technological innovation that changes behavior for the better. Starco Brands is a public company and develops products across a variety of categories including Household Cleaning, Personal Care, OTC, Food, Beverage & Spirits and DIY Hardware. For more information about Starco Brands, please visit www.starcobrands.com.

To invest in Starco Brands visit invest.starcobrands.com.

A copy of the Company's offering circular for the Public Offering has been posted at invest.starcobrands.com/offering-circular.

Investors may also review the offering circular and other securities filings on the Security and Exchange Commission's website at sec.gov/edgar/browse/?CIK=1539850.

www.whipshots.com

www.sprayhello.com

www.bingeworthyflavor.com

www.honusunscreen.com

Cautionary Note on Forward-Looking Statements

This press release may include forward-looking information and statements within the meaning of federal securities laws. Except for historical information contained in this release, statements in this release may constitute forward-looking statements regarding assumptions, projections, expectations, targets, intentions, or beliefs about future events. Statements containing the words "may," "could," "would," "should," "believe," "expect," "anticipate," "plan," "estimate," "target," "project," "intend," and similar expressions constitute forward-looking statements. Forward-looking statements involve known and unknown risks and uncertainties, which could cause actual results to differ materially from those contained in any forward-looking statement. Forward-looking statements are based on management's current belief, as well as assumptions made by, and information currently available to, management. While the Company believes that its expectations are based upon reasonable assumptions, there can be no assurances that its goals and strategy will be realized. Numerous factors, including risks and uncertainties, may affect actual results and may cause results to differ materially from those expressed in forward-looking statements made by the Company or on its behalf. Some of these factors include, but are not limited to, risks related to the Company's liquidity, the substantial uncertainties inherent in the acceptance of existing and future products, the difficulty of commercializing and protecting new technology, the impact of competitive products and pricing, general business and economic conditions, risks associated with the expansion of our business including the implementation of any businesses we acquire, factors discussed in our public filings, including the risk factors included in the Company's most recent Annual Report on Form 10-K, Quarterly Report on Form 10-Q and other periodic reports. Except as required by applicable law, including the securities laws of the United States and the rules and regulations of the Securities and Exchange Commission, the Company is under no obligation to publicly update or revise any forward-looking statement after the date of this release whether as a result of new information, future developments or otherwise.

* 3rd party test results Breathe Skin Sanitizer Covid 19 kill test: https://sprayhello.com/pages/testing

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/starco-brands-announces-a-45-million-public-offering-under-regulation-a-301443414.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/starco-brands-announces-a-45-million-public-offering-under-regulation-a-301443414.html

SOURCE Starco Brands (STCB)

FAQ

What is the purpose of Starco Brands' public offering?

How many shares will be available in the Starco Brands public offering?

Who can participate in Starco Brands' public offering?