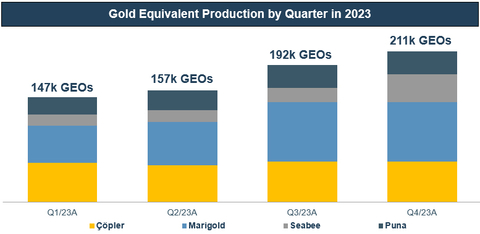

SSR Mining Delivers Strong Fourth Quarter Production and Achieves 2023 Consolidated Production Guidance

- FOURTH QUARTER PRODUCTION OF APPROXIMATELY 211,100 GOLD EQUIVALENT OUNCES, THIRD HIGHEST QUARTERLY PRODUCTION TOTAL IN COMPANY HISTORY

- FULL-YEAR PRODUCTION OF APPROXIMATELY 706,900 GOLD EQUIVALENT OUNCES MEETS GUIDANCE EXPECTATIONS

- RECORD FULL-YEAR PRODUCTION IN 2023 FROM MARIGOLD AND PUNA

- LONG-TERM PRODUCTION GUIDANCE TO BE ANNOUNCED FEBRUARY 13, 2024

- FULL-YEAR 2023 FINANCIAL RESULTS TO BE ANNOUNCED FEBRUARY 21, 2024

Gold Equivalent Production by Quarter in 2023

|

|

Three Months Ended |

|

Twelve Months Ended |

||||

|

|

December 31, |

|

December 31, |

||||

Preliminary Operating Data |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

Çöpler (1) |

|

|

|

|

|

|

|

|

Gold produced (oz) |

|

57,126 |

|

65,603 |

|

220,999 |

|

191,366 |

Gold sold (oz) |

|

59,694 |

|

59,949 |

|

225,599 |

|

192,811 |

Marigold |

|

|

|

|

|

|

|

|

Gold produced (oz) |

|

82,794 |

|

62,875 |

|

278,488 |

|

194,668 |

Gold sold (oz) |

|

81,173 |

|

62,936 |

|

275,962 |

|

195,617 |

Seabee |

|

|

|

|

|

|

|

|

Gold produced (oz) |

|

38,758 |

|

24,709 |

|

90,777 |

|

136,125 |

Gold sold (oz) |

|

32,050 |

|

23,500 |

|

83,610 |

|

133,500 |

Puna |

|

|

|

|

|

|

|

|

Silver produced ('000 oz) |

|

2,759 |

|

2,389 |

|

9,688 |

|

8,397 |

Silver sold ('000 oz) |

|

2,830 |

|

2,098 |

|

9,920 |

|

7,864 |

Consolidated (2) |

|

|

|

|

|

|

|

|

GEOs produced (oz) |

|

211,118 |

|

182,655 |

|

706,896 |

|

623,819 |

GEOs sold (oz) |

|

206,194 |

|

172,308 |

|

704,594 |

|

617,135 |

|

|

|

|

|

|

|

|

|

(1) Figures are reported on a |

||||||||

(2) Gold equivalent ounces (GEOs) are calculated by multiplying the silver ounces by the ratio of the silver price to the gold price, using the average London Bullion Market Association (“LBMA”) prices for the period. The Company does not include by-products in the gold equivalent ounce calculations. |

||||||||

In addition, SSR Mining announces February 13, 2024 as the release date for its 2024 and long-term production guidance, accompanied by updated life of mine plans and Mineral Reserves and Mineral Resources for the Company’s key operating properties. Following this announcement, SSR Mining’s senior leadership team will host a conference call to provide an overview of current operations as well as the Company’s outlook and long-term growth strategy. Investors, media and the public are invited to listen to the conference call and accompanying webcast.

-

News release containing long-term production guidance and updated Mineral Reserves and Mineral Resources: Tuesday, February 13, 2024, before markets open.

-

Conference call and webcast: Tuesday, February 13, 2024, at 9:00 am EST.

Toll-free inU.S. andCanada : +1 (800) 319-4610

All other callers: +1 (604) 638-5340

Webcast: http://ir.ssrmining.com/investors/events

-

The conference call will be archived and available on our website. Audio replay will be available for two weeks by calling:

Toll-free inU.S. andCanada : +1 (855) 669-9658, replay code 0631

All other callers: +1 (412) 317-0088, replay code 0631

The Company also announces the date for its fourth quarter and full-year 2023 consolidated financial results news release and conference call. Investors, media and the public are invited to listen to the conference call and accompanying webcast.

-

News release containing fourth quarter 2023 and full-year consolidated financial results: Wednesday, February 21, 2024, after markets close.

-

Conference call and webcast: Wednesday, February 21, 2024, at 5:00 pm EST.

Toll-free inU.S. andCanada : +1 (800) 319-4610

All other callers: +1 (604) 638-5340

Webcast: http://ir.ssrmining.com/investors/events

-

The conference call will be archived and available on our website. Audio replay will be available for two weeks by calling:

Toll-free inU.S. andCanada : +1 (855) 669-9658, replay code 0570

All other callers: +1 (412) 317-0088, replay code 0570

About SSR Mining

SSR Mining Inc. is a leading, free cash flow focused gold company with four producing operations located in the

View source version on businesswire.com: https://www.businesswire.com/news/home/20240115069067/en/

SSR Mining Contacts:

F. Edward Farid, Executive Vice President, Chief Corporate Development Officer

Alex Hunchak, Vice President, Investor Relations

SSR Mining Inc.

E-Mail: invest@ssrmining.com

Phone: +1 (888) 338-0046

To receive SSR Mining’s news releases by e-mail, please register using the SSR Mining website at www.ssrmining.com.

Source: SSR Mining Inc.