Sarama Resources Advances Mt Venn Gold Project Acquisition

Sarama Resources has executed a binding agreement with Orbminco to acquire a majority and controlling interest in the 420km² Mt Venn Gold Project in Western Australia's Eastern Goldfields. This acquisition, combined with their recent Cosmo Project acquisition, creates a significant 1,000km² landholding in the prolific Laverton Gold District.

The Mt Venn Project, located 35km west of the Gruyere Gold Mine, captures the underexplored Jutson Rocks Greenstone Belt over ~50km strike length. Gold was first discovered there in the 1920s, with multiple gold occurrences identified since then. The project area shows potential for gold, base metals, and platinum group elements.

As consideration, Orbminco will receive 12,000,000 Chess Depository Instruments (CDIs) in Sarama. The project operates under a joint venture structure with Cazaly Resources holding a 20% interest. The transaction completion is subject to various conditions, including TSX Venture Exchange acceptance and Sarama Board approval.

Sarama Resources ha stipulato un accordo vincolante con Orbminco per acquisire una partecipazione di maggioranza e di controllo nel Mt Venn Gold Project di 420 km² situato nei Goldfields orientali dell'Australia Occidentale. Questa acquisizione, unita all'acquisto recente del Cosmo Project, crea un'importante area di 1.000 km² nel prolifico Laverton Gold District.

Il Mt Venn Project, situato a 35 km a ovest della Gruyere Gold Mine, copre la Belt di Greenstone di Jutson Rocks, poco esplorata, su una lunghezza di circa 50 km. L'oro è stato scoperto per la prima volta lì negli anni '20, con molteplici occorrenze d'oro identificate da allora. L'area del progetto mostra potenziale per oro, metalli di base e elementi del gruppo del platino.

Come corrispettivo, Orbminco riceverà 12.000.000 di Chess Depository Instruments (CDIs) in Sarama. Il progetto opera sotto una struttura di joint venture con Cazaly Resources che detiene una partecipazione del 20%. Il completamento della transazione è soggetto a varie condizioni, inclusa l'accettazione da parte della TSX Venture Exchange e l'approvazione del Consiglio di Sarama.

Sarama Resources ha ejecutado un acuerdo vinculante con Orbminco para adquirir una participación mayoritaria y de control en el Mt Venn Gold Project de 420 km² en los Goldfields Orientales de Australia Occidental. Esta adquisición, combinada con su reciente adquisición del Cosmo Project, crea una importante tenencia de tierra de 1,000 km² en el prolífico Laverton Gold District.

El Mt Venn Project, ubicado a 35 km al oeste de la Gruyere Gold Mine, abarca el poco explorado Jutson Rocks Greenstone Belt en una longitud de aproximadamente 50 km. Se descubrió oro por primera vez allí en la década de 1920, con múltiples ocurrencias de oro identificadas desde entonces. El área del proyecto muestra potencial para oro, metales básicos y elementos del grupo del platino.

Como contraprestación, Orbminco recibirá 12,000,000 de Chess Depository Instruments (CDIs) en Sarama. El proyecto opera bajo una estructura de joint venture con Cazaly Resources que posee un 20% de interés. La finalización de la transacción está sujeta a diversas condiciones, incluida la aceptación por parte de la TSX Venture Exchange y la aprobación de la Junta de Sarama.

사라마 리소스는 오르브민코와의 구속력 있는 계약을 체결하여 호주 서부의 동부 골드필드에 위치한 420km²의 몬트 벤 골드 프로젝트에서 대다수 및 지배 지분을 인수하였습니다. 이번 인수는 최근의 코스모 프로젝트 인수와 결합되어, 생산성이 높은 라버턴 골드 디스트릭트에서 1,000km²의 상당한 토지 보유를 형성합니다.

몬트 벤 프로젝트는 그루이레 골드 마인에서 서쪽으로 35km 떨어진 곳에 위치하며, 약 50km의 스트라이크 길이를 가진 탐사되지 않은 저트슨 록스 그린스톤 벨트를 포함합니다. 1920년대에 처음으로 금이 발견되었으며, 그 이후로 여러 금 발생지가 확인되었습니다. 프로젝트 지역은 금, 기초 금속 및 백금족 원소에 대한 잠재력을 보여줍니다.

대가로 오르브민코는 사라마에서 12,000,000개의 체스 예치 증서(CDIs)를 받게 됩니다. 이 프로젝트는 카잘리 리소스가 20%의 지분을 보유하는 조인트 벤처 구조 하에 운영됩니다. 거래 완료는 TSX 벤처 거래소의 수용 및 사라마 이사회의 승인을 포함한 여러 조건에 따라 달라집니다.

Sarama Resources a signé un accord contraignant avec Orbminco pour acquérir une participation majoritaire et de contrôle dans le Mt Venn Gold Project de 420 km² dans les Eastern Goldfields d'Australie-Occidentale. Cette acquisition, combinée avec leur récente acquisition du Cosmo Project, crée une superficie significative de 1 000 km² dans le prolifique Laverton Gold District.

Le projet Mt Venn, situé à 35 km à l'ouest de la Gruyere Gold Mine, couvre la ceinture de greenstone Jutson Rocks peu explorée sur une longueur d'environ 50 km. L'or a été découvert pour la première fois là-bas dans les années 1920, avec plusieurs occurrences d'or identifiées depuis lors. La zone du projet montre un potentiel pour l'or, les métaux de base et les éléments du groupe du platine.

En contrepartie, Orbminco recevra 12 000 000 d'instruments de dépôt d'échecs (CDIs) en Sarama. Le projet fonctionne sous une structure de coentreprise avec Cazaly Resources détenant une participation de 20 %. La réalisation de la transaction est soumise à diverses conditions, y compris l'acceptation par la TSX Venture Exchange et l'approbation du conseil d'administration de Sarama.

Sarama Resources hat eine verbindliche Vereinbarung mit Orbminco unterzeichnet, um eine Mehrheits- und Kontrollbeteiligung am 420 km² großen Mt Venn Gold Project in den Eastern Goldfields von Westaustralien zu erwerben. Diese Akquisition, zusammen mit ihrem kürzlichen Erwerb des Cosmo Project, schafft eine bedeutende Landfläche von 1.000 km² im produktiven Laverton Gold District.

Das Mt Venn Project, das 35 km westlich der Gruyere Gold Mine liegt, erfasst den wenig erforschten Jutson Rocks Greenstone Belt über eine Streckenlänge von etwa 50 km. Gold wurde dort erstmals in den 1920er Jahren entdeckt, und seitdem wurden mehrere Goldvorkommen identifiziert. Das Projektgebiet zeigt Potenzial für Gold, Basismetalle und Platinmetalle.

Als Gegenleistung erhält Orbminco 12.000.000 Chess Depository Instruments (CDIs) in Sarama. Das Projekt operiert unter einer Joint-Venture-Struktur, wobei Cazaly Resources eine Beteiligung von 20 % hält. Der Abschluss der Transaktion unterliegt verschiedenen Bedingungen, einschließlich der Genehmigung durch die TSX Venture Exchange und die Genehmigung des Sarama-Vorstands.

- Strategic expansion to 1,000km² land position in prolific gold district

- Project located 35km from significant Gruyere Gold Mine

- Multiple historical gold discoveries and occurrences identified

- Additional potential for base metals and platinum group elements

- Drill-ready targets already identified from previous exploration

- Project still in early exploration phase

- Requires additional capital for exploration and development

- Share dilution from issuing 12 million new CDIs

- Multiple conditions required for transaction completion

Binding Agreement Executed for Acquisition of Majority Interest(1) in Belt-Scale Gold Project

PERTH, AUSTRALIA AND VANCOUVER, BC / ACCESS Newswire / February 27, 2025 / Sarama Resources Ltd. ("Sarama" or the "Company") (ASX:SRR)(TSX-V:SWA) is pleased to advise that it has reached binding agreement (the "Agreement") with Orbminco Limited ("Orbminco") (ASX:OB1), an arm's length third party, to acquire a majority(1) and controlling interest(1) in the under-explored, belt-scale 420km² Mt Venn Project (the "Project")(2), located in the Eastern Goldfields of Western Australia.

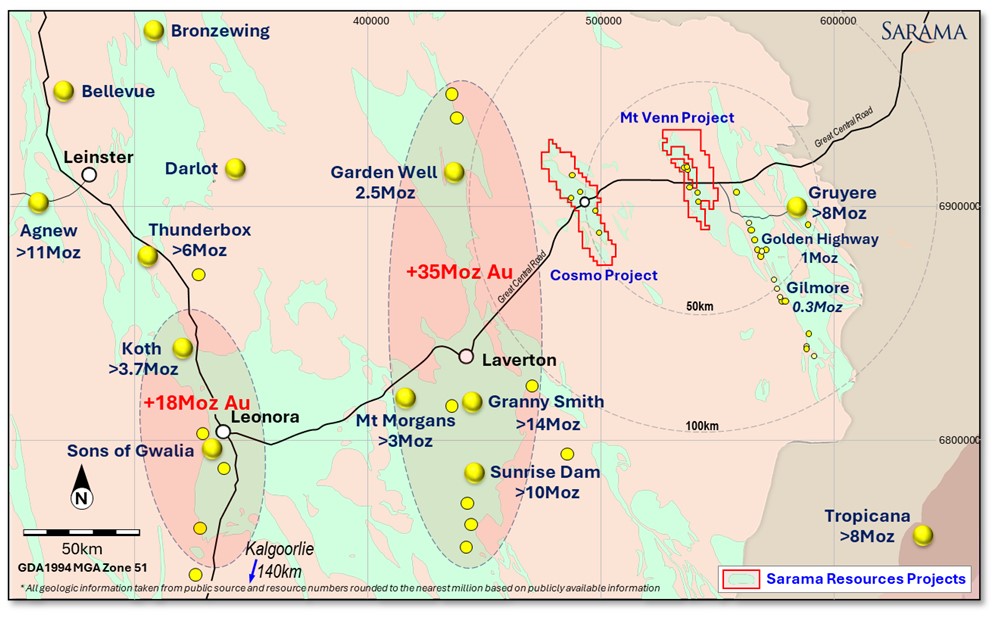

This follows Sarama's recent acquisition of a majority interest in the nearby Cosmo Project (refer Sarama news release 6 December 2024). Together the projects create a 1,000km² well-positioned and underexplored landholding in the Laverton Gold District which is known for its prolific gold endowment (refer Figure 1) and recent discoveries.

Highlights

Sarama's President, Executive Chairman, Andrew Dinning commented:

"We are very pleased to be nearing completion of the acquisition a majority interest in the Mt Venn Project and consolidating our position in the prolific Laverton Gold District of Western Australia. The addition of the Mt Venn Project will create a major 1,000km2 area-play and significantly enhances the probability of making the next big discovery in a region that continues to deliver new deposits in previously unexplored areas, including the regionally significant Gruyere Deposit just 35km east of the Mt Venn Project. Soil sampling programs at the Cosmo Project are progressing well, feeding into the process of bringing the Cosmo and Mt Venn Projects to account as expeditiously as we can."

Mt Venn Project

The Project is comprised of 3 contiguous exploration tenements covering approximately 420km² in the Eastern Goldfields of Western Australia, approximately 110km north-east of Laverton and 35km west of the regionally- significant Gruyere Gold Mine(3). The Project is readily accessible via the Great Central Road which services the regional area east of Laverton.

The Project captures the majority of the underexplored Jutson Rocks Greenstone Belt over a strike length of ~50km. Rocks within the belt feature a diverse sequence of volcanic lithologies of varying composition, together with pyroclastics and metasediments. Several internal intrusive units have been identified throughout the Project and are commonly associated with local structural features. A regionally extensive shear zone, spanning 1-3km in width, extends the entire length of the belt with subordinate splays interpreted in the southern area of the Project which provides a favourable structural setting for mineralisation.

Gold mineralisation was first discovered in the 1920's with sampling returning very high grades and prompting the commencement of small-scale mining operations in the mid 1920's. Multiple gold occurrences have since been identified throughout the Project, demonstrating the prospectivity of the system. Despite the identification of several km-scale gold-in-soil anomalies by soil geochemistry and auger drilling, many of these targets are yet to be properly tested. Encouragingly, drilling by Cazaly Resources Limited ("Cazaly") (ASX: CAZ) at the Project intersected broad, gold mineralisation over several fences in weathered and fresh rock at the Three Bears Prospect, presenting a priority target for exploration (Cazaly news release 27 February 2017: "Widespread Gold & Zinc Mineralisation Defined").

In addition to the attractiveness of the Project for gold, it is considered prospective for base metals and platinum group elements. Historical exploration work including auger geochemistry and geophysical surveys identified numerous targets for copper, nickel and zinc mineralisation. Several of these targets remain untested due to historical funding and land access constraints. Exploration in the belt to the immediate south of the Project area is noted to have intersected copper mineralisation of significant grade over a significant strike length(4).

In summary, the Project is located within a prolific gold district and has a favourable lithological and structural setting. A solid database of base-level historical exploration work by previous operators, including generation of drill-ready targets, provides a good platform for Sarama to advance the Project in conjunction with its activities at the Cosmo Project. The size and prospectivity of the landholding that Sarama will have in the Laverton Gold District upon completion of this transaction significantly enhances the chances of making an economic discovery, particularly given the infrastructure and proliferation of mines in the region which will have a favourable impact on the size threshold for finding something of economic value.

Figure 1 - Mt Venn and Cosmo Project Locations, Eastern Goldfields, Western Australia

Transaction & Joint Venture Summary

Transaction Details

Orbminco's interest in the Project is held through the participation of its

The Agreement provides for a

As consideration for the assignment of its interests in the JV, Orbminco, or its nominee, will receive 12,000,000 Chess Depository Instruments ("CDIs") in Sarama (the "Consideration Securities"). Each Consideration Security issued to Orbminco, or its nominee, in connection with the Transaction will rank equally with existing Sarama CDIs and each Consideration Security will represent a beneficial interest of 1 common share in Sarama.

Pursuant to the precursor non-binding head of agreement, Orbminco granted Sarama a right of exclusivity in return for a cash payment of A

The Transaction is an arm's length acquisition which is expected to constitute an Expedited Acquisition pursuant to TSX Venture Exchange Policy 5.3 - Acquisitions and Disposition of Non-Cash Assets. No finder's fees will be paid in connection with the completion of the Transaction.

Completion of the Transaction will be subject to the satisfaction or waiver by Sarama of the following key conditions:

receipt of TSX Venture Exchange final acceptance of the Transaction and issuance of the Consideration Securities;

receipt of Sarama Board and shareholder approval for the issue of the CDIs as consideration for the Transaction;

complete assignment of all applicable Native Title Access Agreements affecting the Project;

execution of an assignment deed/agreement by Yamarna and Cazaly for Yamarna's interest in the Project JV;

receipt of government extension/renewal notices covering new annual periods for tenements E38/3150 and E38/3581.

The Agreement contains provisions warranties and obligations for Sarama and Orbminco (or their subsidiaries) that are customary for this type of transaction.

Project Joint Venture Structure

The Project is currently in exploration phase and is operated by Yamarna as an unincorporated joint venture in which Yamarna and Cazaly hold interests of

At present, Yamarna is responsible for all costs incurred by the JV until the completion of a Pre-Feasibility Study on the Project (the "Free Carry Period"). At that point, Cazaly may elect to start contributing its pro-rata share of future JV expenditure to maintain its

Following the end of the Free Carry Period and in the event Cazaly has elected to contribute its pro rata share of Project costs, the JV participants will be subject to industry standard ‘contribute or dilute' provisions in respect of their interests. In the event a JV participant's interest falls below

The JV agreement includes customary protections for the participants associated with, but not limited to, surrender of mineral tenements, disposals of JV property and assets, material revisions to approved work programs and budgets, change of operatorship and decision to mine.

For further information, please contact:

Sarama Resources Ltd |

|

FOOTNOTES

The Project's Exploration Licences are currently held by

80% by Yamarna and20% by Cazaly, reflecting the parties' joint venture interests. The Transaction contemplates Sarama (or its nominee) being assigned Orbminco's joint venture interests and continuing under the existing joint venture agreement with Cazaly. Orbminco will transfer its interests in the Exploration Licences to Sarama (or its nominee) at completion of the transaction.The Project is comprised of the following contiguous Exploration Licences: E38/3111, E38/3150 and E38/3581 covering approximately 420km².

Gruyere Project Mineral Resources December 2023: 113.3Mt @ 1.32g/t Au for 4.8Moz Au (Measured & Indicated) and 68.6Mt @ 1.44g/t Au for 3.2Moz (Inferred) (December 2023 Quarterly Report, Gold Road Resources Limited, 29 January 2024).

Cosmo Metals Limited News Release 4 November 2022.

CAUTION REGARDING FORWARD LOOKING INFORMATION

Information in this news release that is not a statement of historical fact constitutes forward-looking information. Such forward-looking information includes, but is not limited to, statements regarding the prospectivity of the Mt Venn and Cosmo Projects, information with respect to Sarama's planned exploration activities, having or acquiring mineral interests in areas which are considered highly prospective for gold and other commodities and which remain underexplored, costs and timing of future exploration, the potential for exploration discoveries and generation of targets, the intention to gain the best commercial outcome for shareholders of the Company, timing and receipt of various approvals, consents and permits under applicable legislation and the completion of a transaction to acquire an interest in the Mt Venn Project. Actual results, performance or achievements of the Company may vary from the results suggested by such forward-looking statements due to known and unknown risks, uncertainties and other factors. Such factors include, among others, that the business of exploration for gold and other precious minerals involves a high degree of risk and is highly speculative in nature; Mineral Resources are not mineral reserves, they do not have demonstrated economic viability, and there is no certainty that they can be upgraded to mineral reserves through continued exploration; few properties that are explored are ultimately developed into producing mines; geological factors; the actual results of current and future exploration; changes in project parameters as plans continue to be evaluated, as well as those factors disclosed in the Company's publicly filed documents.

There can be no assurance that any mineralisation that is discovered will be proven to be economic, or that future required regulatory licensing or approvals will be obtained. However, the Company believes that the assumptions and expectations reflected in the forward-looking information are reasonable. Assumptions have been made regarding, among other things, the Company's ability to carry on its exploration activities, the sufficiency of funding, the timely receipt of required approvals, the price of gold and other precious metals, that the Company will not be affected by adverse political and security-related events, the ability of the Company to operate in a safe, efficient and effective manner and the ability of the Company to obtain further financing as and when required and on reasonable terms. Readers should not place undue reliance on forward-looking information. Sarama does not undertake to update any forward-looking information, except as required by applicable laws.

QUALIFIED PERSON'S STATEMENT

Scientific or technical information in this disclosure that relates to exploration is based on information compiled or approved by Paul Schmiede. Paul Schmiede is an employee of Sarama Resources Ltd and is a Fellow in good standing of the Australasian Institute of Mining and Metallurgy. Paul Schmiede has sufficient experience which is relevant to the commodity, style of mineralisation under consideration and activity which he is undertaking to qualify as a Qualified Person under National Instrument 43-101. Paul Schmiede consents to the inclusion in this news release of the information in the form and context in which it appears.

This announcement has been authorised by the Board of Sarama Resources.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Sarama Resources Ltd.

View the original press release on ACCESS Newswire