More than Half of Americans Turn to Buy Now, Pay Later During Financially Stressful Times

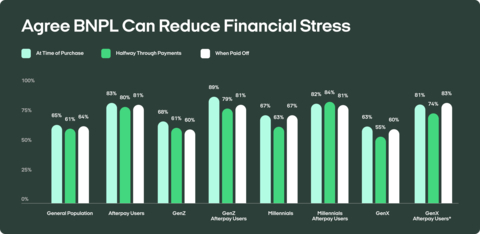

- 4 in 5 ‘Buy Now, Pay Later’ customers confirm Pay-in-Four innovation helped reduce their financial stress throughout the payment cycle

-

More than

75% of Afterpay customers say that ‘Buy Now, Pay Later’ reduces their financial stress at the time of purchase, and throughout the installments journey

DISTRIBUTED-WORK-MODEL/

(Graphic: Afterpay)

As demonstrated by the survey,

As Americans head into the summertime, many see the potential of BNPL as a solution to combat their feelings of financial insecurity for major life events. According to the survey, the highest impact areas of BNPL consideration include weddings (

Many American consumers are feeling the effects of inflation, attributing it to a heightened state of financial stress. Customers who use Afterpay’s Pay-in-4 BNPL benefit from managing their budgets with the flexibility and choice of either breaking out their purchases over four installments or paying the entire purchase off at any time – all while incurring zero costs from Afterpay if installments are paid on time. As of the first quarter of 2024,

Afterpay continues to invest in consumer protections to help customers limit their risk. Unlike a credit card, Afterpay starts customers with a low limit, pauses accounts if a customer has missed a repayment, and caps late fees. Among the BNPL brands listed in the survey, Afterpay was tied for first as the most commonly considered as well as the most trusted brand.

Methodology

Morning Consult’s Afterpay Financial Sentiment Survey (May 2024) was conducted between April 26 - 30, 2024 among 2207 adults aged 18-55 in the

About Afterpay

Afterpay is transforming the way we pay by allowing customers to buy products immediately and pay over time - enabling simple, transparent and responsible spending. We are on a mission to power an economy in which everyone wins. Afterpay is offered by thousands of the world’s favorite retailers and used by millions of active global customers. Afterpay is currently available in

View source version on businesswire.com: https://www.businesswire.com/news/home/20240626136893/en/

Source: Block, Inc.